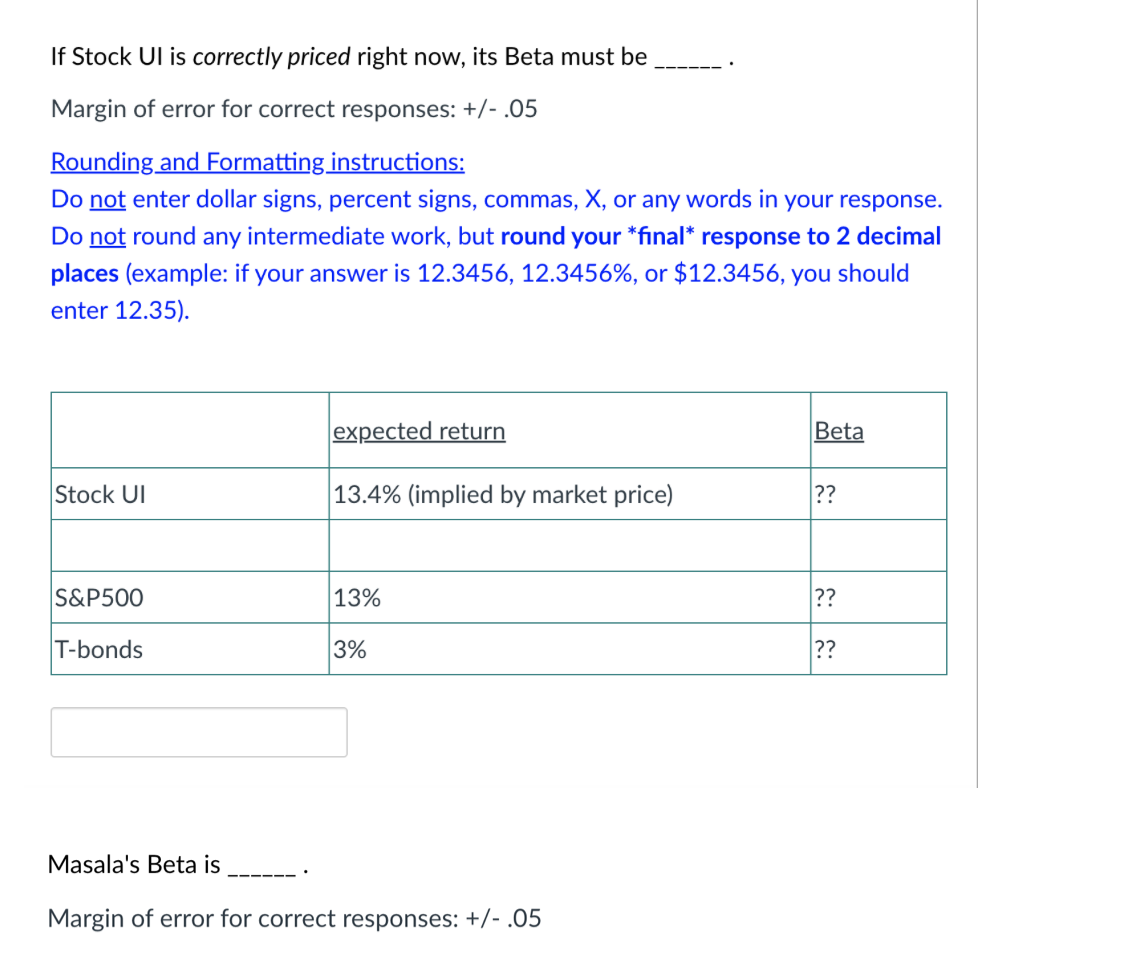

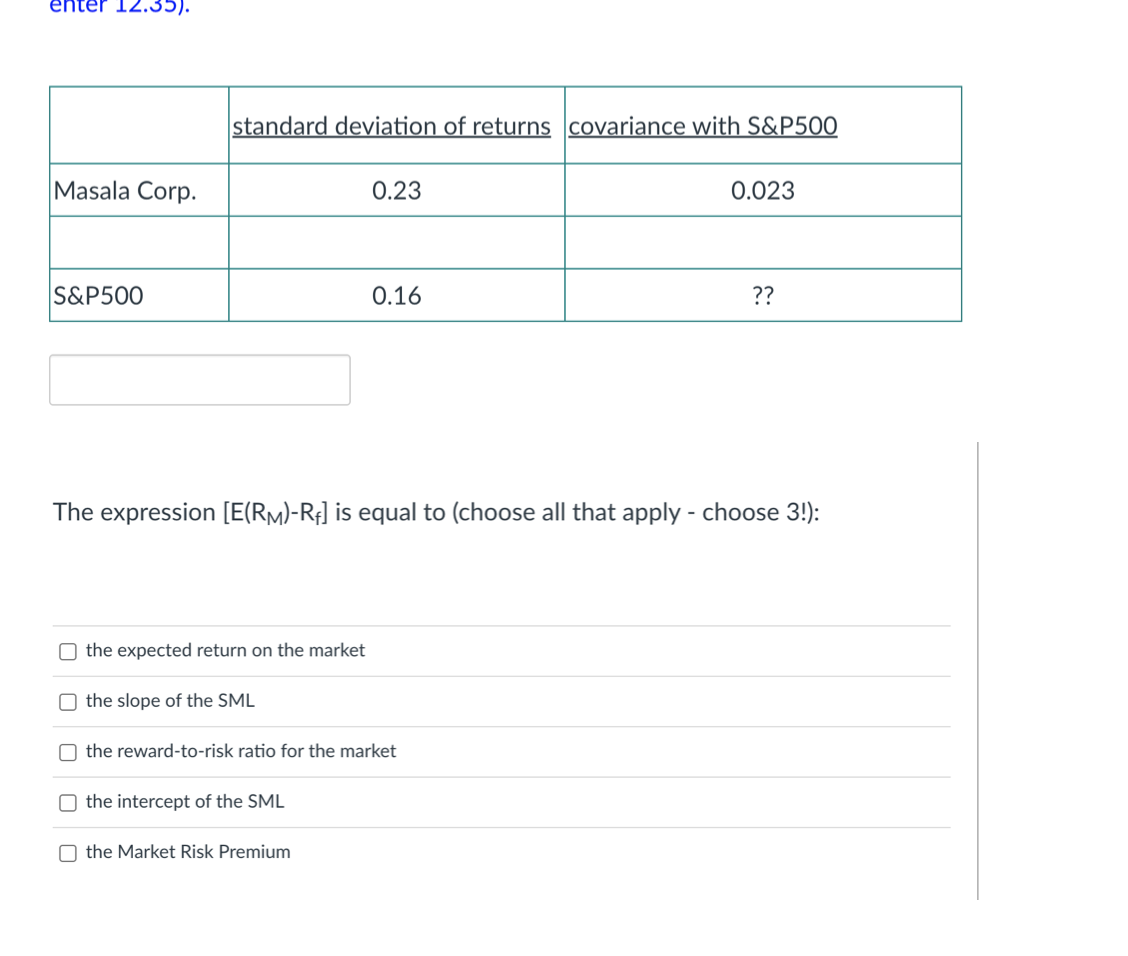

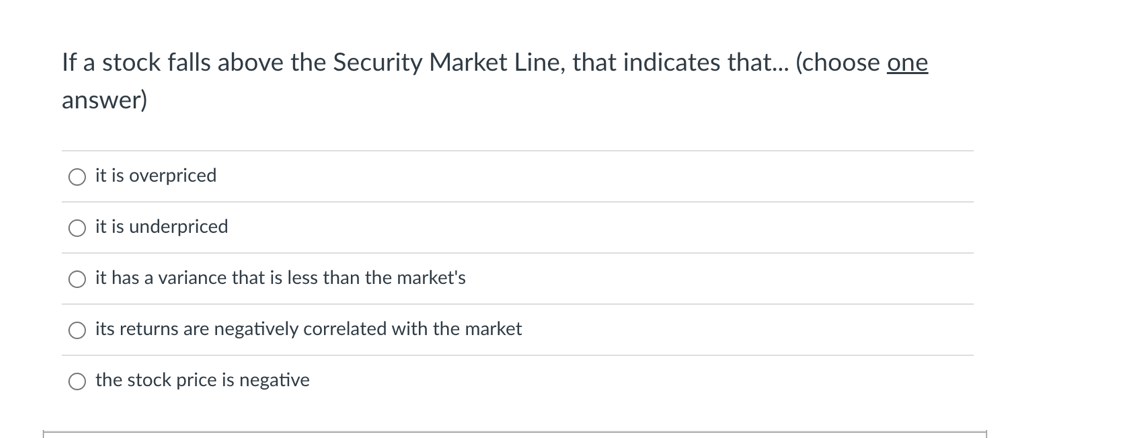

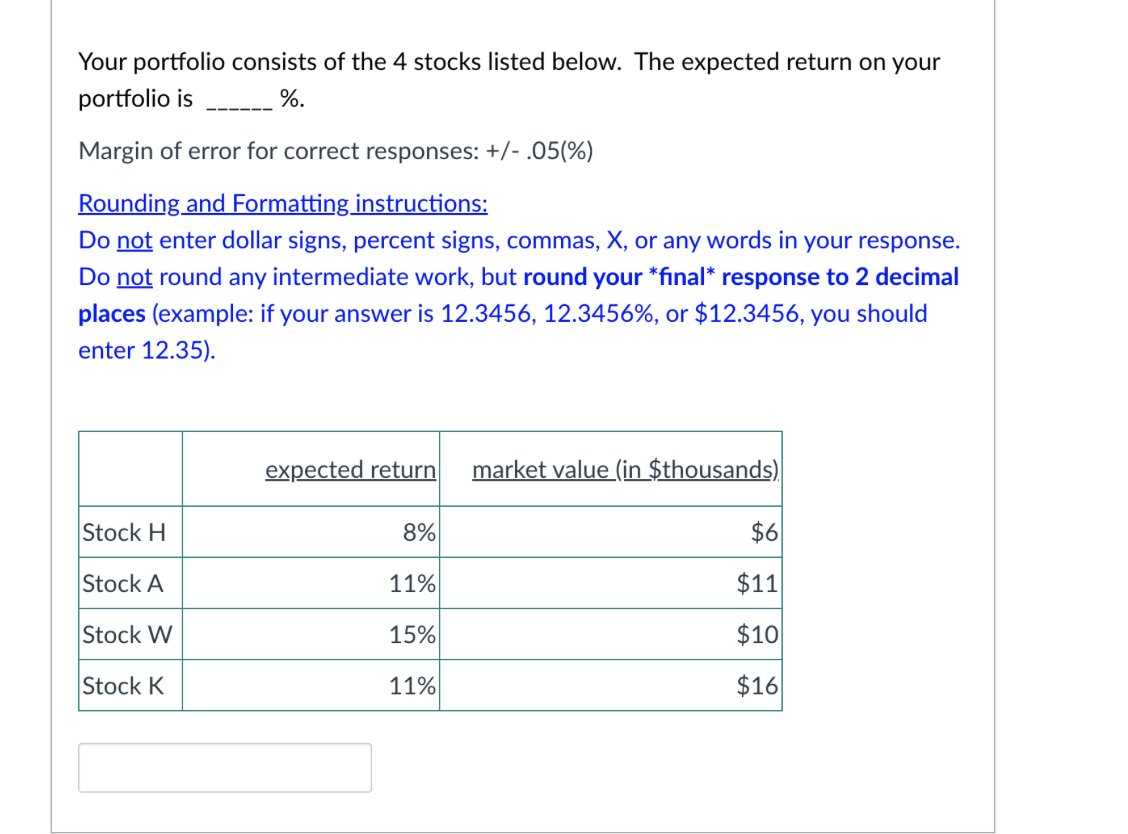

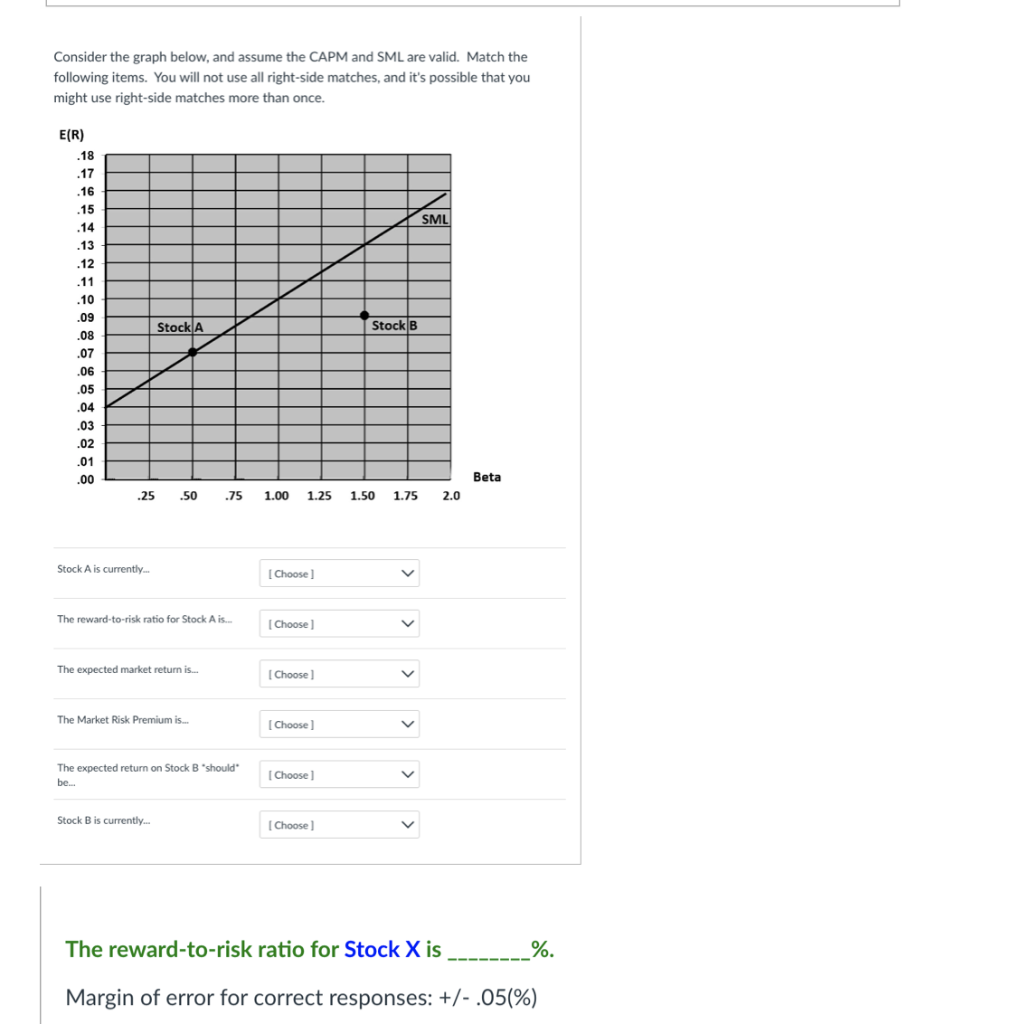

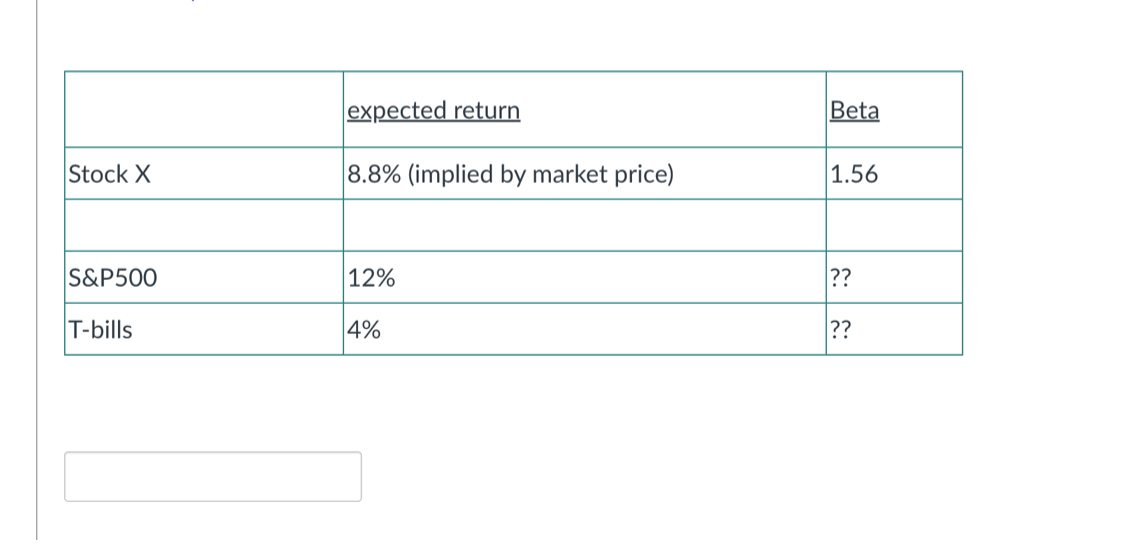

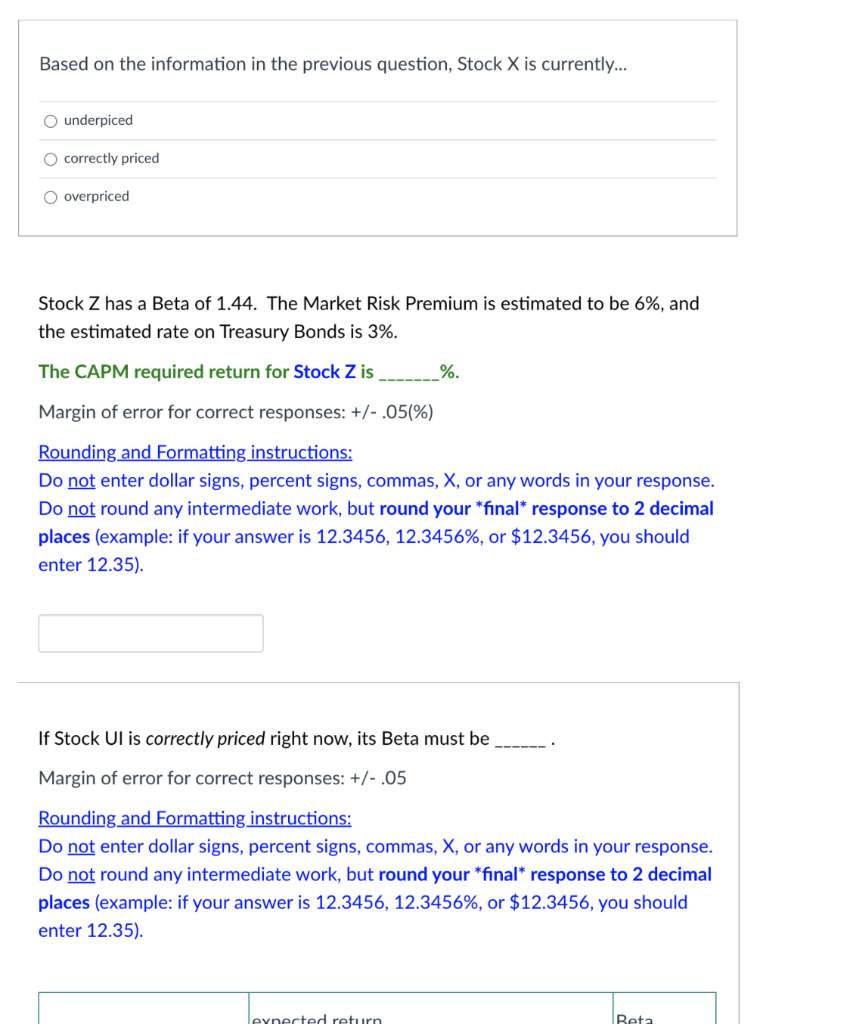

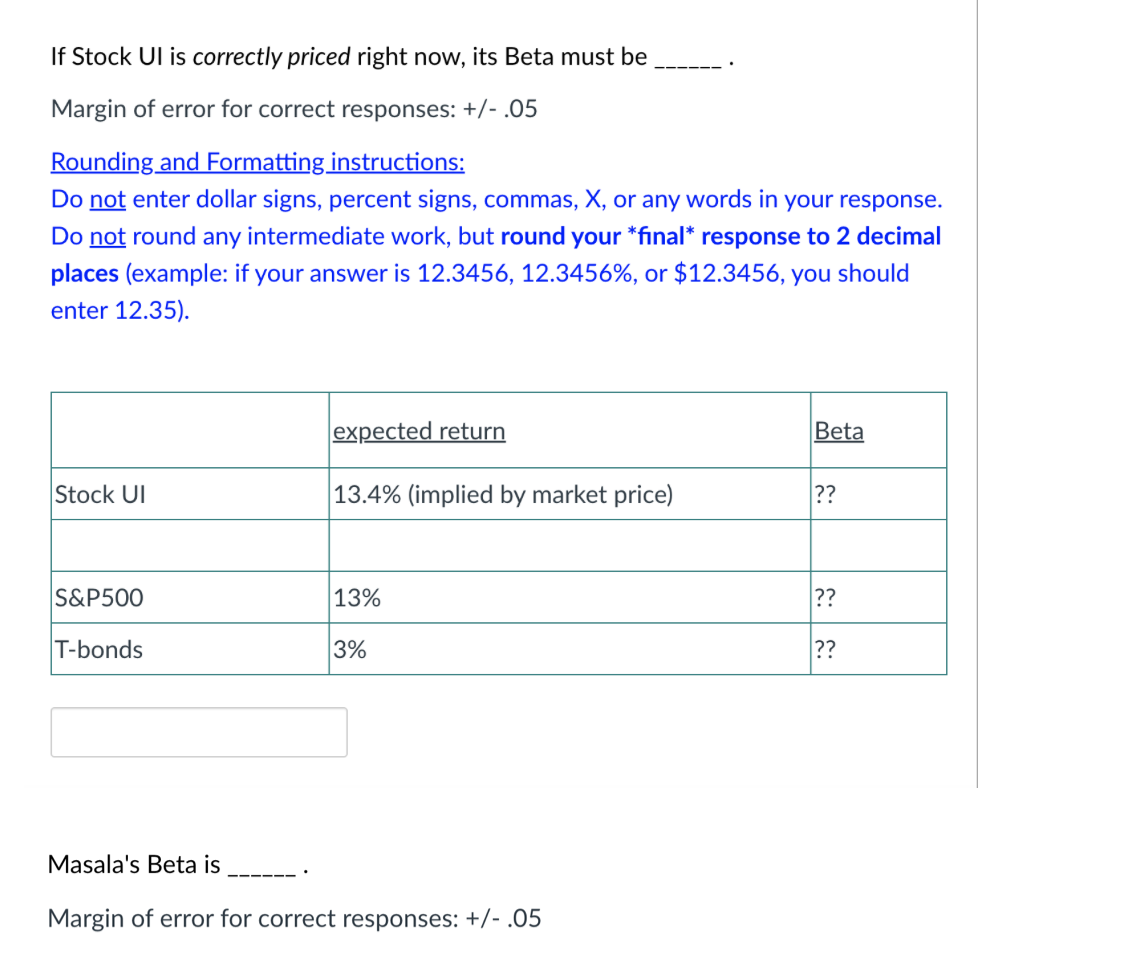

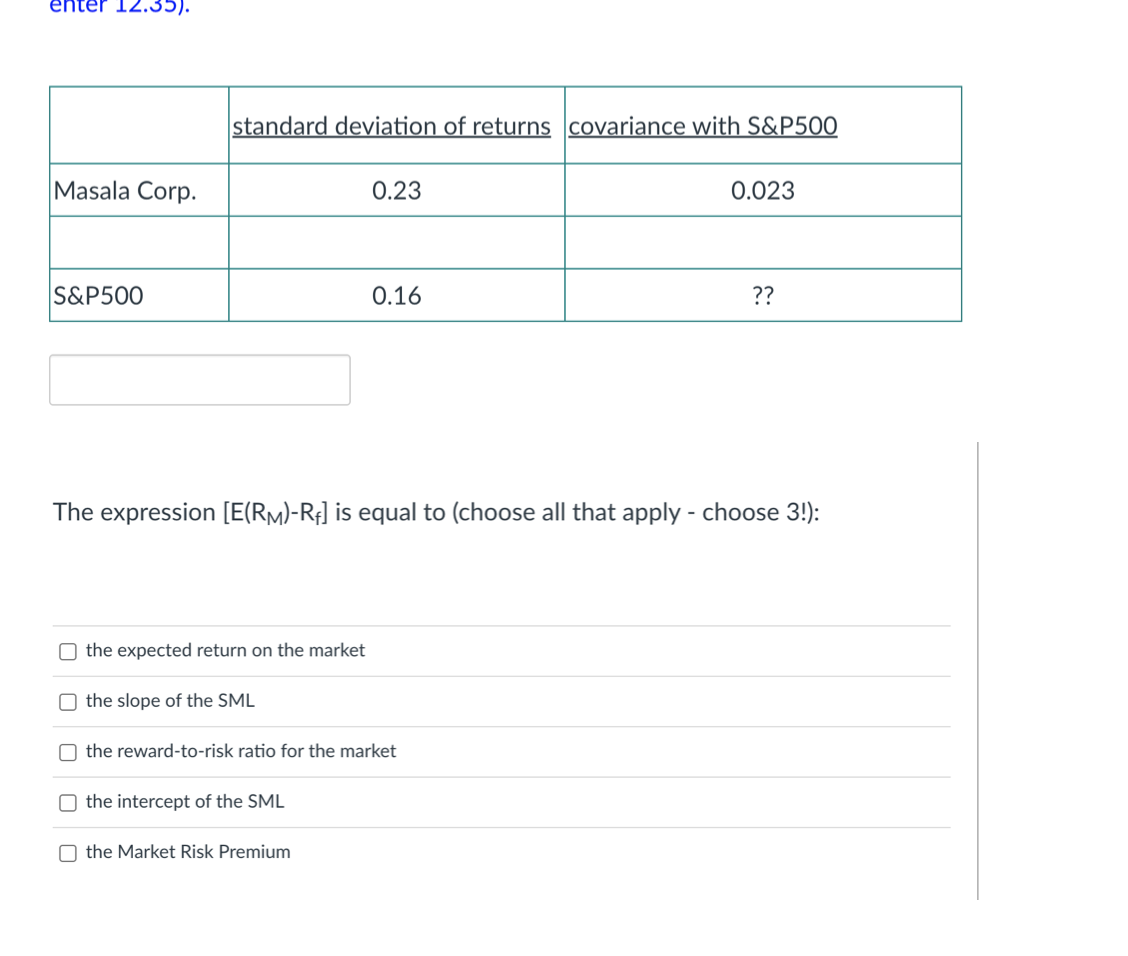

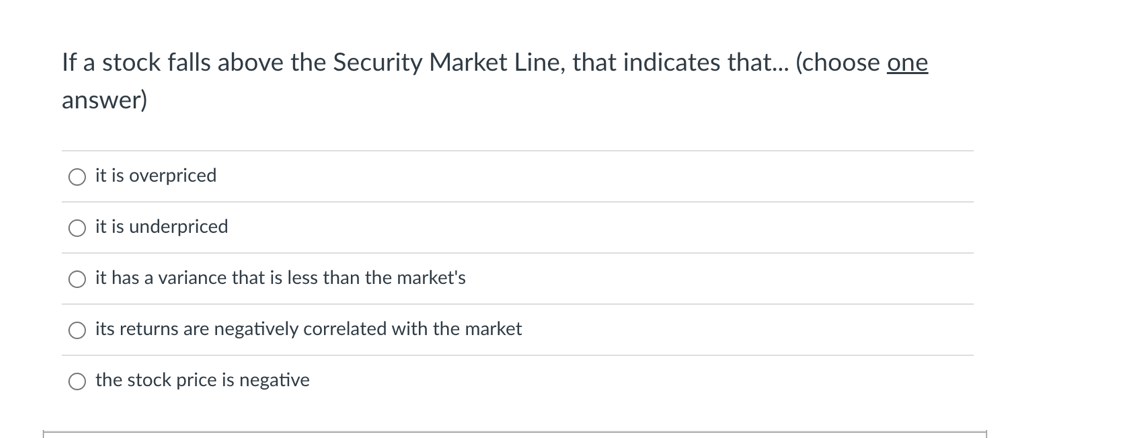

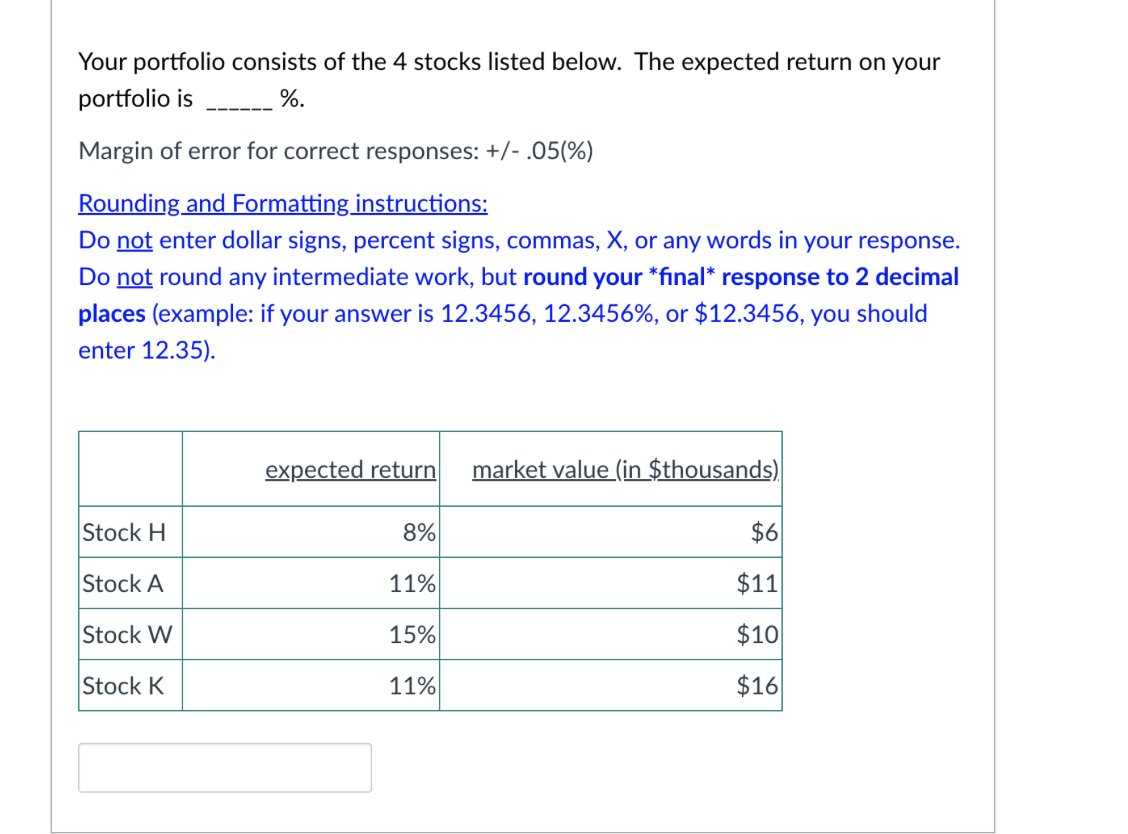

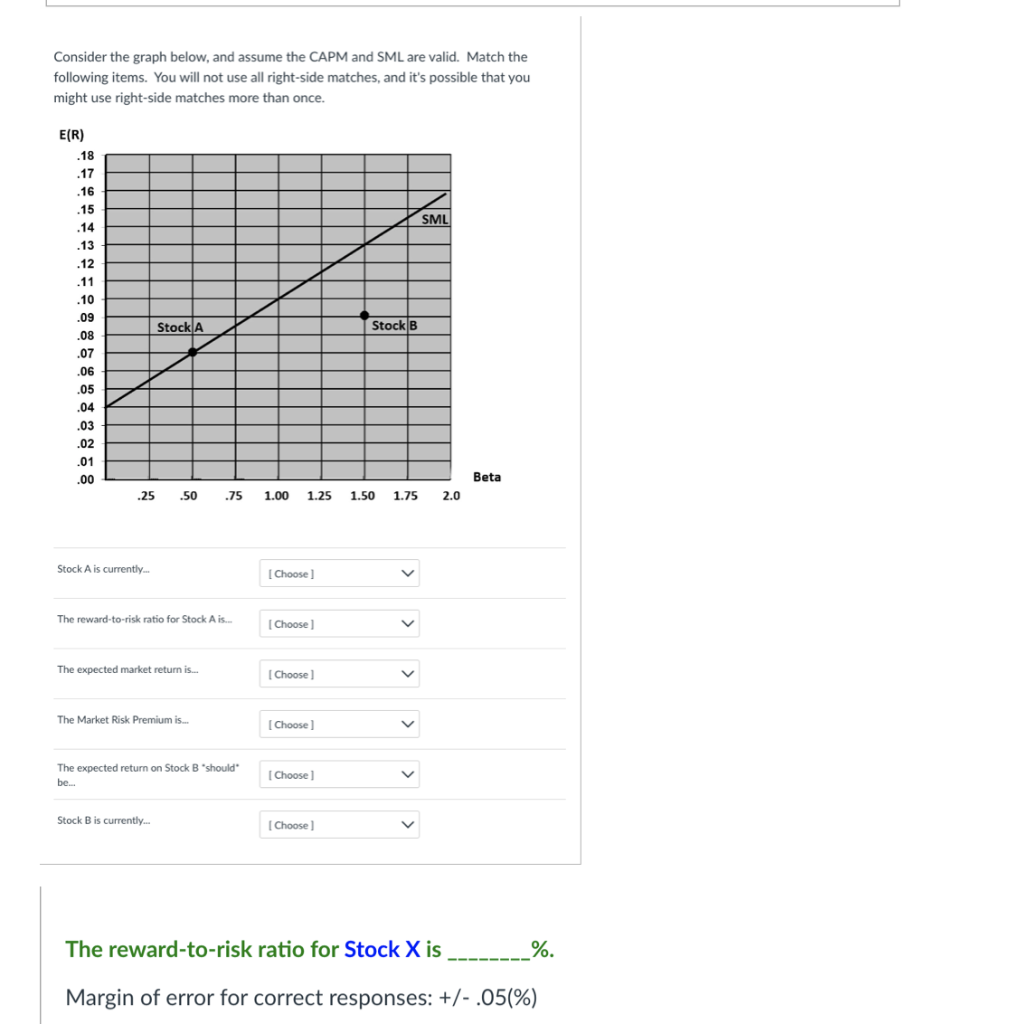

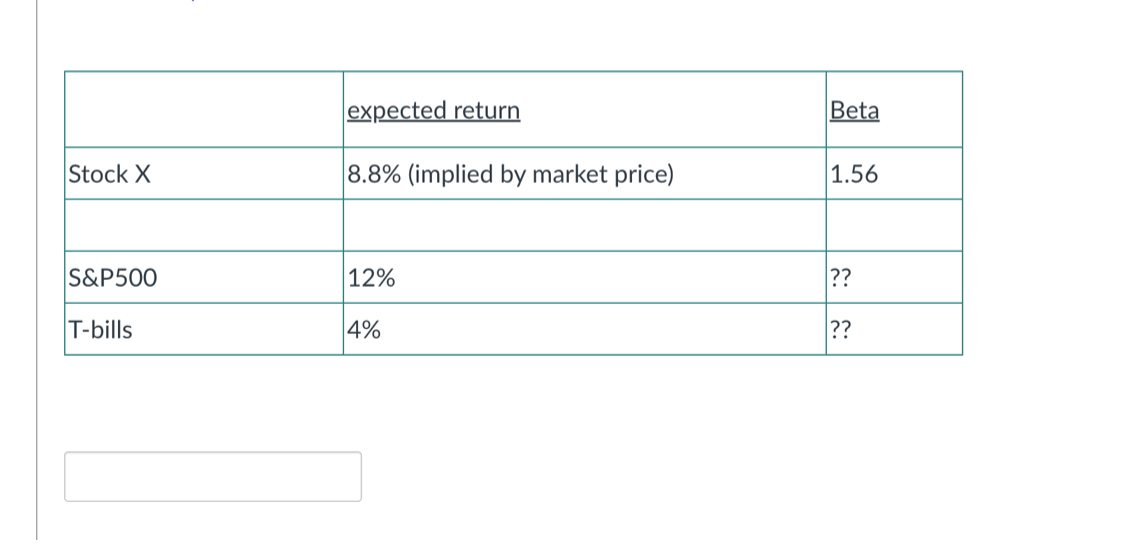

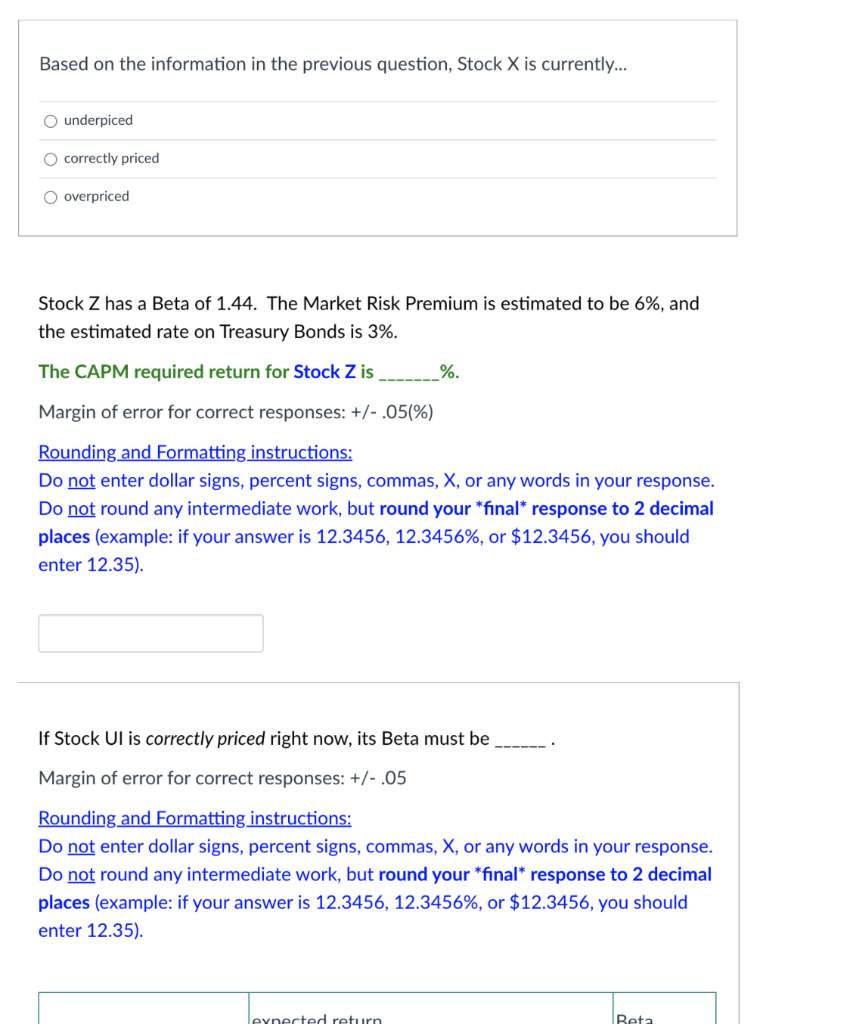

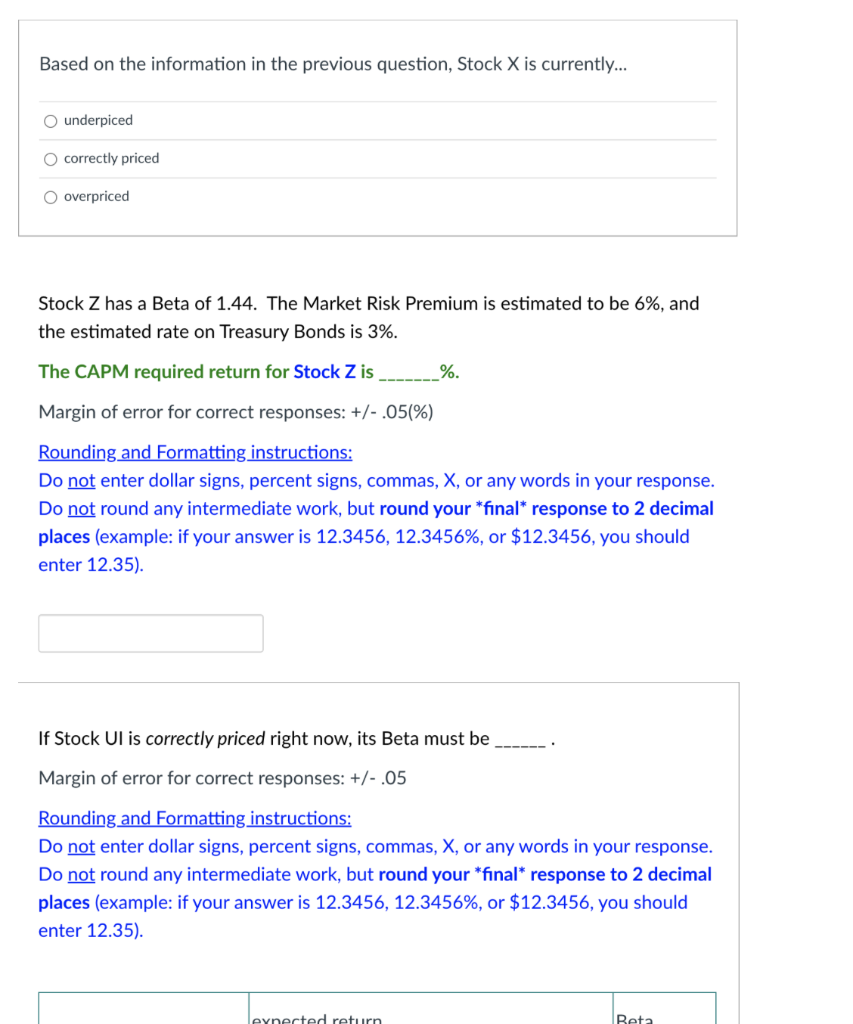

If Stock UI is correctly priced right now, its Beta must be Margin of error for correct responses: +/- .05 Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your final" response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35). Masala's Beta is Margin of error for correct responses: +/- .05 The expression [E(RM)Rf] is equal to (choose all that apply - choose 3!) : the expected return on the market the slope of the SML the reward-to-risk ratio for the market the intercept of the SML the Market Risk Premium If a stock falls above the Security Market Line, that indicates that... (choose one answer) it is overpriced it is underpriced it has a variance that is less than the market's its returns are negatively correlated with the market the stock price is negative Your portfolio consists of the 4 stocks listed below. The expected return on your portfolio is %. Margin of error for correct responses: +/- .05(\%) Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your final" response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35). Consider the graph below, and assume the CAPM and SML are valid. Match the following items. You will not use all right-side matches, and it's possible that you might use right-side matches more than once. Stock A is currently. The reward-to-risk ratio for Stock A is. The expected market return is.. The Market Risk Premium is... The expected return on Stock B "should" be.. Stock B is currently... The reward-to-risk ratio for Stock X is %. Margin of error for correct responses: +/- .05(\%) \begin{tabular}{|l|l|l|} \hline & expected return & Beta \\ \hline Stock X & 8.8% (implied by market price) & 1.56 \\ \hline & & \\ \hline S\&P500 & 12% & ?? \\ \hline T-bills & 4% & ?? \\ \hline \end{tabular} Based on the information in the previous question, Stock X is currently... underpiced correctly priced overpriced Stock Z has a Beta of 1.44. The Market Risk Premium is estimated to be 6%, and the estimated rate on Treasury Bonds is 3%. The CAPM required return for Stock Z is %. Margin of error for correct responses: +/.05(%) Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your "final" response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35). If Stock UI is correctly priced right now, its Beta must be Margin of error for correct responses: +/.05 Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your final" response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35). Based on the information in the previous question, Stock X is currently... underpiced correctly priced overpriced Stock Z has a Beta of 1.44. The Market Risk Premium is estimated to be 6%, and the estimated rate on Treasury Bonds is 3%. The CAPM required return for Stock Z is %. Margin of error for correct responses: +/.05(%) Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your "final" response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35). If Stock UI is correctly priced right now, its Beta must be Margin of error for correct responses: +/.05 Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your final" response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35). If Stock UI is correctly priced right now, its Beta must be Margin of error for correct responses: +/- .05 Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your final" response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35). Masala's Beta is Margin of error for correct responses: +/- .05 The expression [E(RM)Rf] is equal to (choose all that apply - choose 3!) : the expected return on the market the slope of the SML the reward-to-risk ratio for the market the intercept of the SML the Market Risk Premium If a stock falls above the Security Market Line, that indicates that... (choose one answer) it is overpriced it is underpriced it has a variance that is less than the market's its returns are negatively correlated with the market the stock price is negative Your portfolio consists of the 4 stocks listed below. The expected return on your portfolio is %. Margin of error for correct responses: +/- .05(\%) Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your final" response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35). Consider the graph below, and assume the CAPM and SML are valid. Match the following items. You will not use all right-side matches, and it's possible that you might use right-side matches more than once. Stock A is currently. The reward-to-risk ratio for Stock A is. The expected market return is.. The Market Risk Premium is... The expected return on Stock B "should" be.. Stock B is currently... The reward-to-risk ratio for Stock X is %. Margin of error for correct responses: +/- .05(\%) \begin{tabular}{|l|l|l|} \hline & expected return & Beta \\ \hline Stock X & 8.8% (implied by market price) & 1.56 \\ \hline & & \\ \hline S\&P500 & 12% & ?? \\ \hline T-bills & 4% & ?? \\ \hline \end{tabular} Based on the information in the previous question, Stock X is currently... underpiced correctly priced overpriced Stock Z has a Beta of 1.44. The Market Risk Premium is estimated to be 6%, and the estimated rate on Treasury Bonds is 3%. The CAPM required return for Stock Z is %. Margin of error for correct responses: +/.05(%) Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your "final" response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35). If Stock UI is correctly priced right now, its Beta must be Margin of error for correct responses: +/.05 Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your final" response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35). Based on the information in the previous question, Stock X is currently... underpiced correctly priced overpriced Stock Z has a Beta of 1.44. The Market Risk Premium is estimated to be 6%, and the estimated rate on Treasury Bonds is 3%. The CAPM required return for Stock Z is %. Margin of error for correct responses: +/.05(%) Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your "final" response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35). If Stock UI is correctly priced right now, its Beta must be Margin of error for correct responses: +/.05 Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your final" response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35)