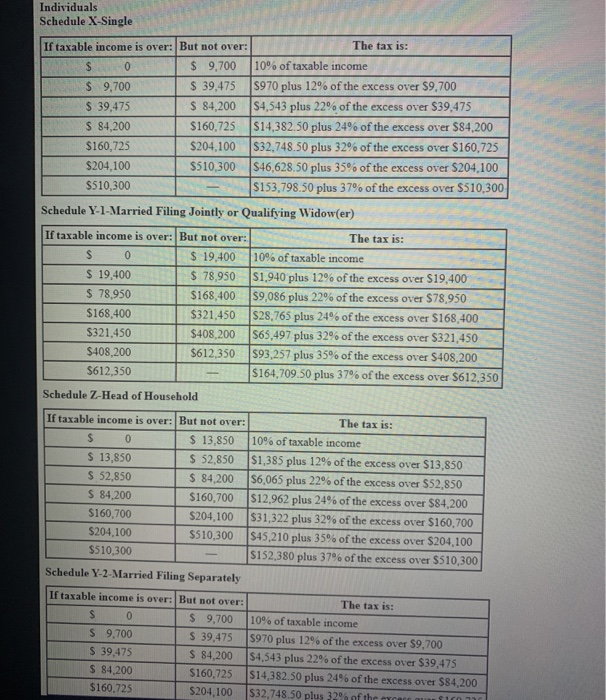

If Susie earns $600,000 in taxable income and files as head of household for year 2019, what is Susie's average tax rate? (Use tax rate schedule) Multiple Choice 30 93 percent O 3264 percent 0 3379 percent O 3579 percent None of the choices are correct Individuals Schedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 9,700 10% of taxable income $ 9,700 $ 39,475 S970 plus 12% of the excess over $9.700 $ 39,475 $ 84,200 $4,543 plus 22% of the excess over $39,475 $ 84,200 $160,725 $14,382.50 plus 24% of the excess over $84,200 $160,725 $204,100 $32,748.50 plus 32% of the excess over $160,725 $204,100 $510,300 $46,628.50 plus 35% of the excess over S204,100 $510,300 $153,798.50 plus 37% of the excess over $510,300 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,400 10% of taxable income $ 19,400 $ 78,950 $1.940 plus 12% of the excess over $19,400 $ 78,950 $168,400 $9,086 plus 22% of the excess over $78,950 $168,400 $321,450 $28,765 plus 24% of the excess over $168,400 $321,450 $408.200 $65,497 plus 32% of the excess over $321,450 $408,200 $612,350 $93,257 plus 35% of the excess over $408,200 $612,350 $164.709.50 plus 37% of the excess over $612,350 Schedule Z-Head of Household The tax is: If taxable income is over: But not over: S 0 $ 13,850 $ 13,850 $ 52,850 $ 52,850 $ 84,200 $ 84,200 $160,700 $160,700 $204,100 S204,100 $510,300 $510,300 10% of taxable income $1,385 plus 12% of the excess over $13,850 $6,065 plus 22% of the excess over 552,850 $12,962 plus 24% of the excess over $84,200 $31,322 plus 32% of the excess over $160,700 $45,210 plus 35% of the excess over $204,100 $152,380 plus 37% of the excess over $510,300 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: S 0 $ 9,700 $ 9,700 $ 39,475 $ 39,475 $ 84,200 $ 84,200 $160,725 $160.725 $204.100 The tax is: 10% of taxable income $970 plus 12% of the excess over $9,700 $4,543 plus 22% of the excess over $39,475 $14,382.50 plus 24% of the excess over $84.200 $32,748.50 plus 32% of the