Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If the cost of goods sold is 55% of current quarters sales, calculate the cost of goods sold for the first, second, third a.

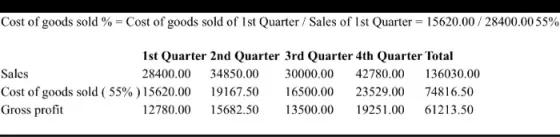

If the cost of goods sold is 55% of current quarters sales, calculate the cost of goods sold for the first, second, third a. and fourth quarters. b Calculate Gross Profit c Calculate selling expenses for each quarter to be 11% of sales d Calculate administration expense for each quarter to be 23% e Calculate net profit before taxes for each quarter fCalculate income taxes for each quarter to be 40% of TAXABLE INCOME > Calculate Net Income for each quarter. ... ended 2015 for Baker L respectively. The statement or for Baker Corporation is presented in Tate inflows as well as net profits after taxes and depreciation a Les Operating expenses Selling, general, and administrative experie Depreciation expense Toul operating expense Earnings before interest and taxes (EBIT TABLE 4.4 Boker Corporation 2015 lncome Statement (5000) Sales Leve Cut of gods will Less Imerest exper Refer to your textbook on Ch 4 4.4 Net profies before taxes are treated Lesi Tases trate-40% $1,700 1,000 $.700 $ 2.50 100 $ 330 $ 370 70 5.300 120 $ 180 10 $ 170 $1.70 Net profies after tax Less Preferred stock dividends Earnings available for common stockholders Earnings per share (EPS? Calcald by dading the rings acailable for common stockholders by dhe mbr of hates of cock ountanding $170,000 -100,000 Cost of goods sold % - Cost of goods sold of 1st Quarter / Sales of 1st Quarter = 15620.00/28400.00 55% = 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Total 34850.00 30000.00 42780.00 136030.00 19167.50 16500.00 23529.00 74816.50 12780.00 15682.50 13500.00 19251.00 61213.50 Sales 28400.00 Cost of goods sold (55%) 15620.00 Gross profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER less less less less less Particulars Sales COGS 55 of Sales Operating Expenses Selling E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started