Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If the current market price of an 9.10% annual-pay bond that matures in one year is 97.42, what is the one-year spot rate in percent

If the current market price of an 9.10% annual-pay bond that matures in one year is 97.42, what is the one-year spot rate in percent per year to two decimal places?

Calculate the dollar duration of an annual-pay floating-rate annuity with a tenor of 49 years in an economy with a flat yield curve at 5.08%/year. Assume a par amount of 100.

Calculate the price of a one-year annual-pay 8.6% corporate bond with a default probability of 15.7% and recovery rate of 40.8% when the 1-year CMT rate is 7.1%/year. Use the par = 100 pricing convention.

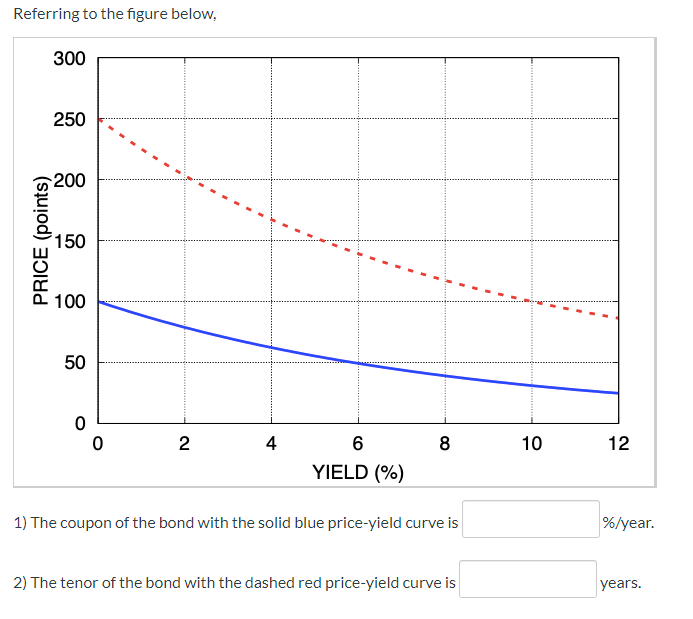

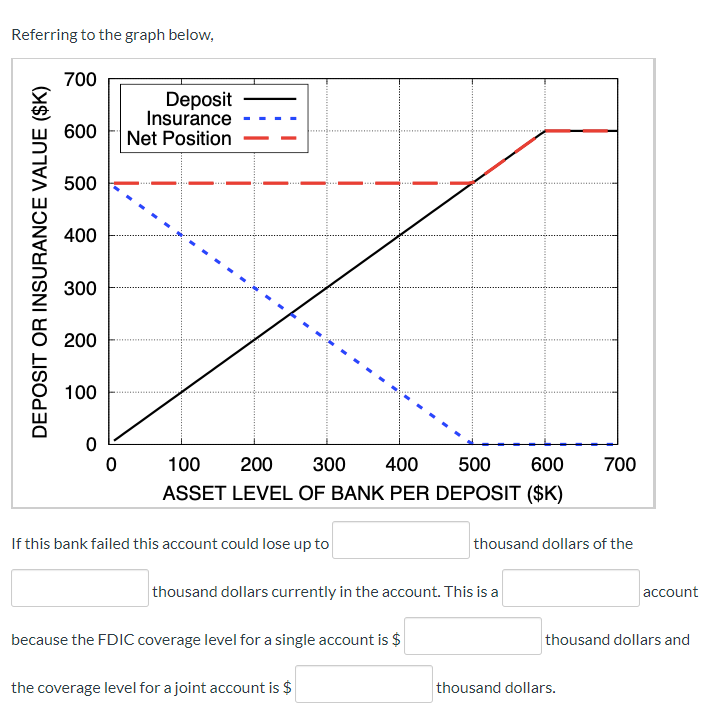

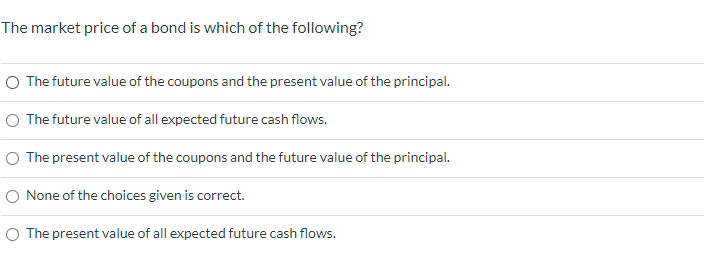

Referring to the figure below, 300 250 200 PRICE (points) 150 100 50 0 0 2 4 8 10 12 6 YIELD (%) 1) The coupon of the bond with the solid blue price-yield curve is %/year. 2) The tenor of the bond with the dashed red price-yield curve is years. Referring to the graph below, 700 Deposit Insurance Net Position 600 500 400 DEPOSIT OR INSURANCE VALUE ($K) 300 200 100 0 700 100 200 300 400 500 600 ASSET LEVEL OF BANK PER DEPOSIT ($K) If this bank failed this account could lose up to thousand dollars of the thousand dollars currently in the account. This is a account because the FDIC coverage level for a single account is $ thousand dollars and the coverage level for a joint account is $ thousand dollars. The lack of interest-rate risk of a floating-rate bond is a result of which of the following? The price of the coupon annuity cancelling the price of the principal payment. The price of the coupon annuity and the price of the principal payment always being half of the price of the floating-rate bond. The duration of the coupon annuity being of equal magnitude and opposite sign as the duration of the principal amount. The duration of the coupon annuity being of equal magnitude and same sign as the duration of the principal amount. None of the choices given is correct. The coupons you receive in an annual receiver swap are equal to: The par rate when the coupon payment is made. None of the choices given is correct. The 1-year spot rate then the swap was created. The par rate when the swap was created. The forward rate when the coupon is paid. The market price of a bond is which of the following? The future value of the coupons and the present value of the principal. The future value of all expected future cash flows. The present value of the coupons and the future value of the principal. None of the choices given is correct. The present value of all expected future cash flowsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started