Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If the decedent was a nonresident alien and assuming there is no reciprocity, how much is the gross estate? The gross estate of a decedent

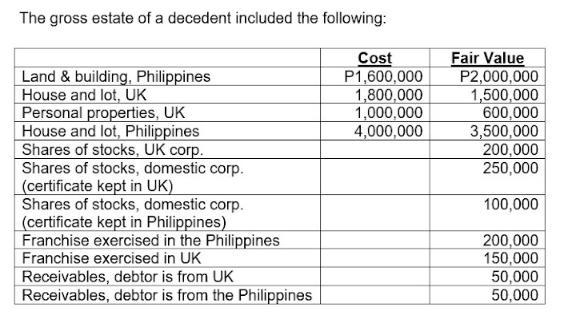

If the decedent was a nonresident alien and assuming there is no reciprocity, how much is the gross estate?

The gross estate of a decedent included the following: Land & building, Philippines House and lot, UK Personal properties, UK House and lot, Philippines Shares of stocks, UK corp. Shares of stocks, domestic corp. (certificate kept in UK) Shares of stocks, domestic corp. (certificate kept in Philippines) Franchise exercised in the Philippines Franchise exercised in UK Receivables, debtor is from UK Receivables, debtor is from the Philippines Cost P1,600,000 1,800,000 1,000,000 4,000,000 Fair Value P2,000,000 1,500,000 600,000 3,500,000 200,000 250,000 100,000 200,000 150,000 50,000 50,000

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the gross estate of the decedent we need to include all the propert...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started