Answered step by step

Verified Expert Solution

Question

1 Approved Answer

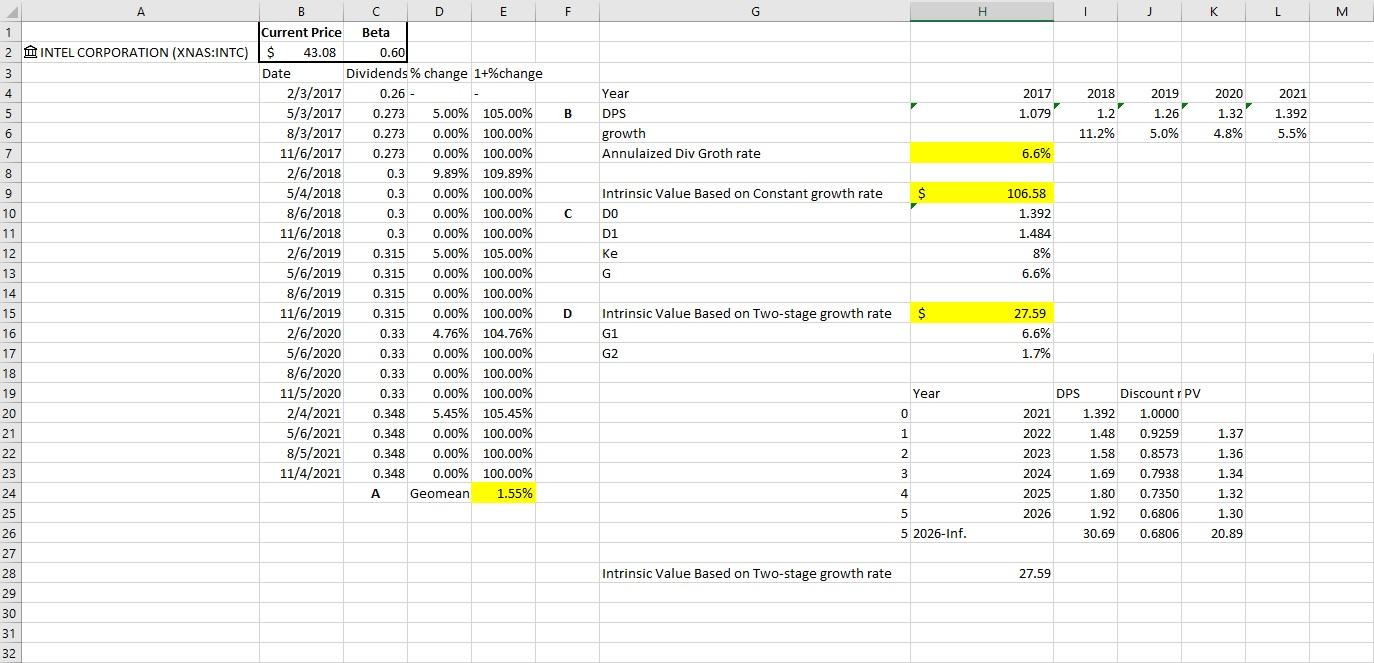

if the dividend growth rate begins declining immediately from the current level to its long-term rate over 20 years (15-year transition plus the initial five

if the dividend growth rate begins declining immediately from the current level to its long-term rate over 20 years (15-year transition plus the initial five years), what is the value of the stock according to the H-Model? What is the value using the three-stage model? Use the same assumption as in part D.

F G H 1 J J K L M Year 2017 2020 B DPS 1.079 2018 1.2 11.2% 2019 1.26 5.0% 1.32 4.8% 2021 1.392 5.5% growth Annulaized Div Groth rate 6.6% $ 106.58 Intrinsic Value Based on Constant growth rate DO C 1.392 D1 1.484 8 8% Ke G 6.6% A B D E 1 Current Price Beta 2 INTEL CORPORATION (XNAS:INTC) $ 43.08 0.60 3 Date Dividends % change 1+%change 4 2/3/2017 0.26 - 5 5/3/2017 0.273 5.00% 105.00% 6 6. 8/3/2017 0.273 0.00% 100.00% 7 11/6/2017 0.273 0.00% 100.00% 8 2/6/2018 0.3 9.89% 109.89% 9 5/4/2018 0.3 0.00% 100.00% 10 8/6/2018 0.3 0.00% 100.00% 11 11/6/2018 0.3 0.00% 100.00% 12 2/6/2019 0.315 5.00% 105.00% 13 5/6/2019 0.315 0.00% 100.00% 14 8/6/2019 0.315 0.00% 100.00% 15 11/6/2019 0.315 0.00% 100.00% 16 2/6/2020 0.33 4.76% 104.76% 17 5/6/2020 0.33 0.00% 100.00% 18 8/6/2020 0.33 0.00% 100.00% 19 11/5/2020 0.33 0.00% 100.00% 20 2/4/2021 0.348 5.45% 105.45% 21 5/6/2021 0.348 0.00% 100.00% 22 8/5/2021 0.348 0.00% 100.00% 23 11/4/2021 0.348 0.00% 100.00% 24 A Geomean 1.55% 25 26 27 D Intrinsic Value Based on Two-stage growth rate $ G1 27.59 6.6% 1.7% G2 Year 0 1 2 DPS Discount r PV 2021 1.392 1.0000 2022 1.48 0.9259 2023 1.58 0.8573 2024 1.69 0.7938 2025 1.80 0.7350 2026 1.92 0.6806 1.37 1.36 1.34 3 1.32 4 5 5 2026-Inf. 1.30 30.69 0.6806 20.89 Intrinsic Value Based on Two-stage growth rate 27.59 28 29 30 31 32 F G H 1 J J K L M Year 2017 2020 B DPS 1.079 2018 1.2 11.2% 2019 1.26 5.0% 1.32 4.8% 2021 1.392 5.5% growth Annulaized Div Groth rate 6.6% $ 106.58 Intrinsic Value Based on Constant growth rate DO C 1.392 D1 1.484 8 8% Ke G 6.6% A B D E 1 Current Price Beta 2 INTEL CORPORATION (XNAS:INTC) $ 43.08 0.60 3 Date Dividends % change 1+%change 4 2/3/2017 0.26 - 5 5/3/2017 0.273 5.00% 105.00% 6 6. 8/3/2017 0.273 0.00% 100.00% 7 11/6/2017 0.273 0.00% 100.00% 8 2/6/2018 0.3 9.89% 109.89% 9 5/4/2018 0.3 0.00% 100.00% 10 8/6/2018 0.3 0.00% 100.00% 11 11/6/2018 0.3 0.00% 100.00% 12 2/6/2019 0.315 5.00% 105.00% 13 5/6/2019 0.315 0.00% 100.00% 14 8/6/2019 0.315 0.00% 100.00% 15 11/6/2019 0.315 0.00% 100.00% 16 2/6/2020 0.33 4.76% 104.76% 17 5/6/2020 0.33 0.00% 100.00% 18 8/6/2020 0.33 0.00% 100.00% 19 11/5/2020 0.33 0.00% 100.00% 20 2/4/2021 0.348 5.45% 105.45% 21 5/6/2021 0.348 0.00% 100.00% 22 8/5/2021 0.348 0.00% 100.00% 23 11/4/2021 0.348 0.00% 100.00% 24 A Geomean 1.55% 25 26 27 D Intrinsic Value Based on Two-stage growth rate $ G1 27.59 6.6% 1.7% G2 Year 0 1 2 DPS Discount r PV 2021 1.392 1.0000 2022 1.48 0.9259 2023 1.58 0.8573 2024 1.69 0.7938 2025 1.80 0.7350 2026 1.92 0.6806 1.37 1.36 1.34 3 1.32 4 5 5 2026-Inf. 1.30 30.69 0.6806 20.89 Intrinsic Value Based on Two-stage growth rate 27.59 28 29 30 31 32Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started