Answered step by step

Verified Expert Solution

Question

1 Approved Answer

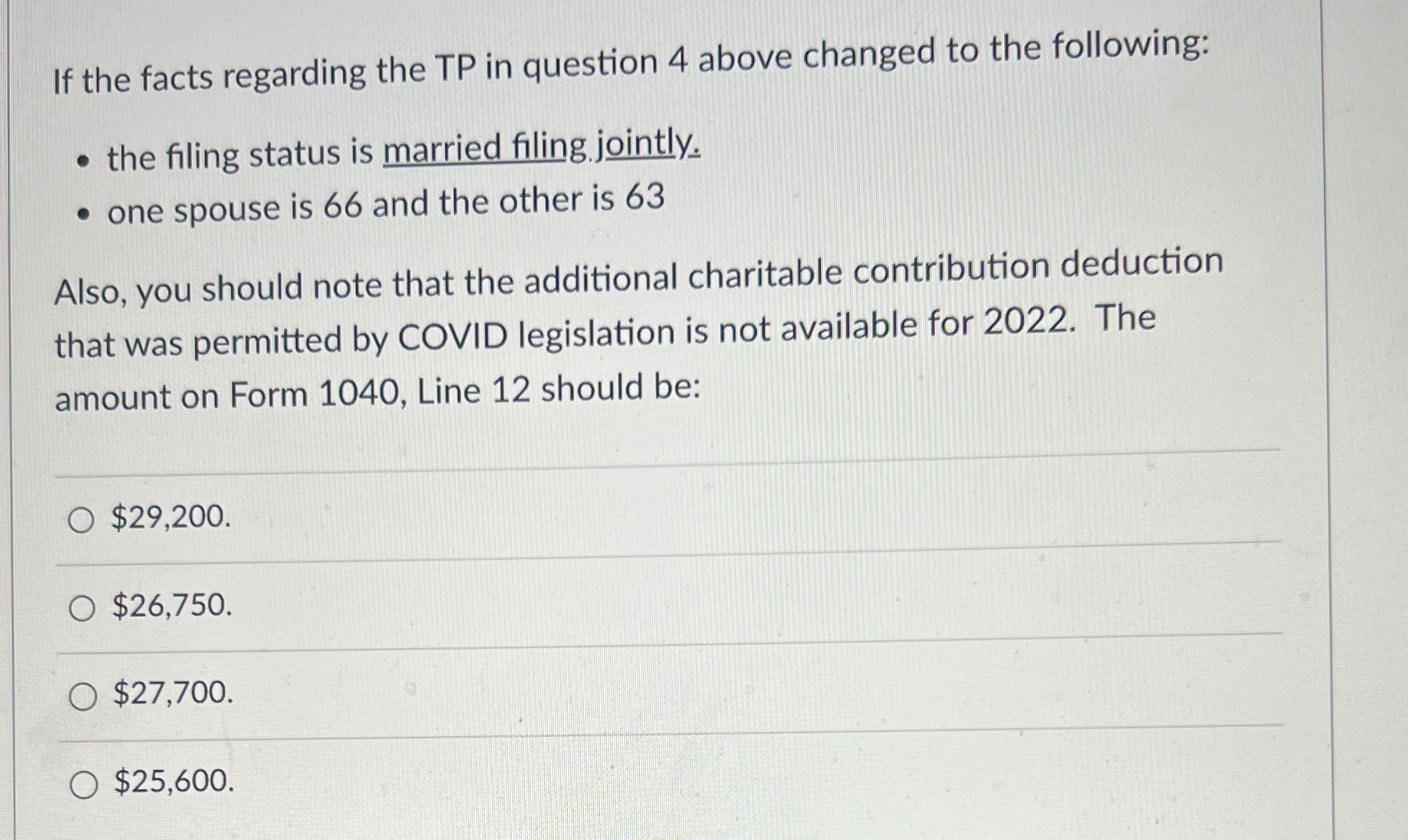

If the facts regarding the TP in question 4 above changed to the following: the filing status is married filing jointly. one spouse is

If the facts regarding the TP in question 4 above changed to the following: the filing status is married filing jointly. one spouse is 66 and the other is 63 Also, you should note that the additional charitable contribution deduction that was permitted by COVID legislation is not available for 2022. The amount on Form 1040, Line 12 should be: O $29,200. $26,750. O $27,700. $25,600.

Step by Step Solution

★★★★★

3.36 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the amount on Form 1040 Line 12 for married filing jointly with one ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started