Answered step by step

Verified Expert Solution

Question

1 Approved Answer

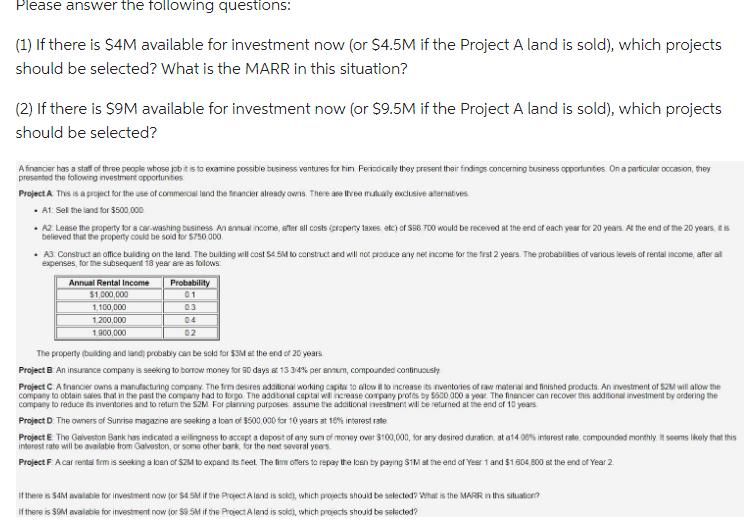

If there is S4M available for investment now (or $4.5M if the Project A land is sold), which projects should be selected? What is

If there is S4M available for investment now (or $4.5M if the Project A land is sold), which projects should be selected? What is the MARR in this situation? (2) If there is $9M available for investment now (or $9.5M if the Project A land is sold), which projects should be selected? A financier has a staff of three people whose job it is to examine possible business ventures for him Periodically they present their findings concerning business opportunities. On a particular occasion, they presented the following investment opportunities Project A This is a project for the use of commercial and the financier already owns. There are three mutualy exclusive alternatives A1: Sell the land for $500,000 A2 Lease the property for a car washing business. An annual income, after all costs property taxes etc) of S98 700 would be received at the end of each year for 20 years. At the end of the 20 years, it is believed that the property could be sold for $750.000 A3: Construct an office building on the land. The building will cost S 5M to construct and will not produce any net income for the first 2 years. The probabilities of various levels of rental income, after all expenses, for the subsequent 18 year are as follows: Annual Rental Income $1,000,000 1,100,000 1.200,000 1.900,000 Probability 01 03 04 02 The property (building and land) probably can be sold for $3M at the end of 20 years Project B An insurance company is seeking to borrow money for 90 days at 13 3/4% per annum, compounded continuously Project CA Inancier owns a manufacturing company. The firm desires additional working capita to allow it to increase its inventories of raw material and finished products. An investment of S2M will allow the company to obtain sales that in the past the company had to forgo. The additional capital well increase company profits by $500 000 a year. The financier can recover this additional investment by ordering the company to reduce s inventories and to return the S2M For planning purposes assume the additional investment will be returned at the end of 10 years Project D. The owners of Sunrise magazine are seeking a loan of $500,000 for 10 years at 18% interest rate Project E The Galveston Bank has indicated a willingness to accept a deposit of any sum of money over $100,000, for any desired duration at a1400% interest rate compounded monthly it seems likely that this interest rate will be available from Galveston, or some other bark for the next several years. Project F: A car rental firm is seeking a loan of S2M to expand its feet. The time offers to repay the loen by paying S1M at the end of Year 1 and $1 604 800 at the end of Year 2 If there is 54M available for investment now for $4 SM if the Project A land is sold), which projects should be selected? What is the MARR in this situation? If there is 39M available for investment now for $9.5M if the Project A land is sold, which projects should be selected?

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started