Question

Round all amounts on the financial statements to the nearest whole dollar. Be sure you add the correct date in the heading of each financial

Round all amounts on the financial statements to the nearest whole dollar. Be sure you add the correct date in the heading of each financial statement. Your file may have additional sheets that you use for calculations. But have everything you want considered in your grade on the sheets identified above.

And this is the preliminary Trial Balance:

And this is the transaction:

- During 2023, the company decided to install a security system from Safety-Sure in their office building. The installation took place in December 2023. The cost of the equipment was $2,700 and installation by Safety-Sure cost an additional $4,000. During the installation process, Safety-Sure told Ross that updates to the buildings electrical panel were required for the security system to work properly. Ross hired an electrician to do the work. While the electrician was on-site to do the panel upgrade, Ross had the electrician repair a few outlets in the office building that were not working. The electrician was paid $2,000 for the work; $500 of that amount was for the repairs to the outlets.

What is the correct Journal entry?

A) Office Building $6,700 Cash $6,700

or

B) Equipment $2,700 Installation Expense $4,000 Repairs Expense $500 Cash $7,200

Is it A or B and why? (Or if neither, what's the correct journal entry). If it's A, what happens to the payment of $2,000 for the Electrician?

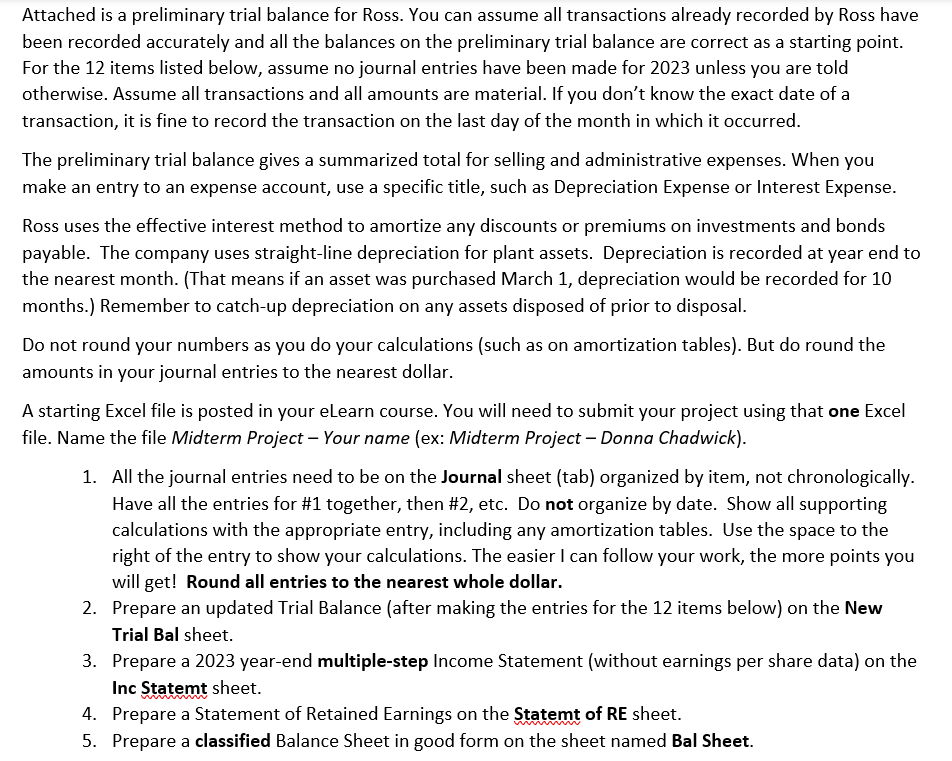

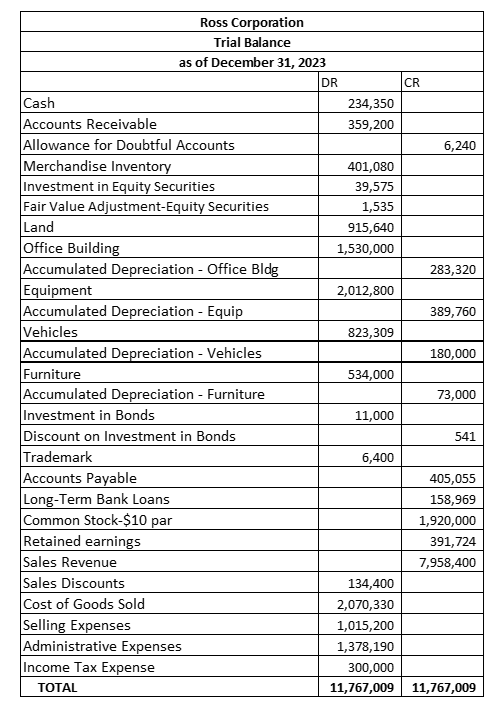

Attached is a preliminary trial balance for Ross. You can assume all transactions already recorded by Ross have been recorded accurately and all the balances on the preliminary trial balance are correct as a starting point. For the 12 items listed below, assume no journal entries have been made for 2023 unless you are told otherwise. Assume all transactions and all amounts are material. If you don't know the exact date of a transaction, it is fine to record the transaction on the last day of the month in which it occurred. The preliminary trial balance gives a summarized total for selling and administrative expenses. When you make an entry to an expense account, use a specific title, such as Depreciation Expense or Interest Expense. Ross uses the effective interest method to amortize any discounts or premiums on investments and bonds payable. The company uses straight-line depreciation for plant assets. Depreciation is recorded at year end to the nearest month. (That means if an asset was purchased March 1, depreciation would be recorded for 10 months.) Remember to catch-up depreciation on any assets disposed of prior to disposal. Do not round your numbers as you do your calculations (such as on amortization tables). But do round the amounts in your journal entries to the nearest dollar. A starting Excel file is posted in your eLearn course. You will need to submit your project using that one Excel file. Name the file Midterm Project - Your name (ex: Midterm Project - Donna Chadwick). 1. All the journal entries need to be on the Journal sheet (tab) organized by item, not chronologically. Have all the entries for #1 together, then #2, etc. Do not organize by date. Show all supporting calculations with the appropriate entry, including any amortization tables. Use the space to the right of the entry to show your calculations. The easier I can follow your work, the more points you will get! Round all entries to the nearest whole dollar. 2. Prepare an updated Trial Balance (after making the entries for the 12 items below) on the New Trial Bal sheet. 3. Prepare a 2023 year-end multiple-step Income Statement (without earnings per share data) on the Inc Statemt sheet. 4. Prepare a Statement of Retained Earnings on the Statemt of RE sheet. 5. Prepare a classified Balance Sheet in good form on the sheet named Bal Sheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Background The company decided to install a security system in its office building The costs associated with this decision are as follows Security Equ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started