Stocks A and B are the only risky assets in a market. The mean returns of the two assets are r = 0.15 and

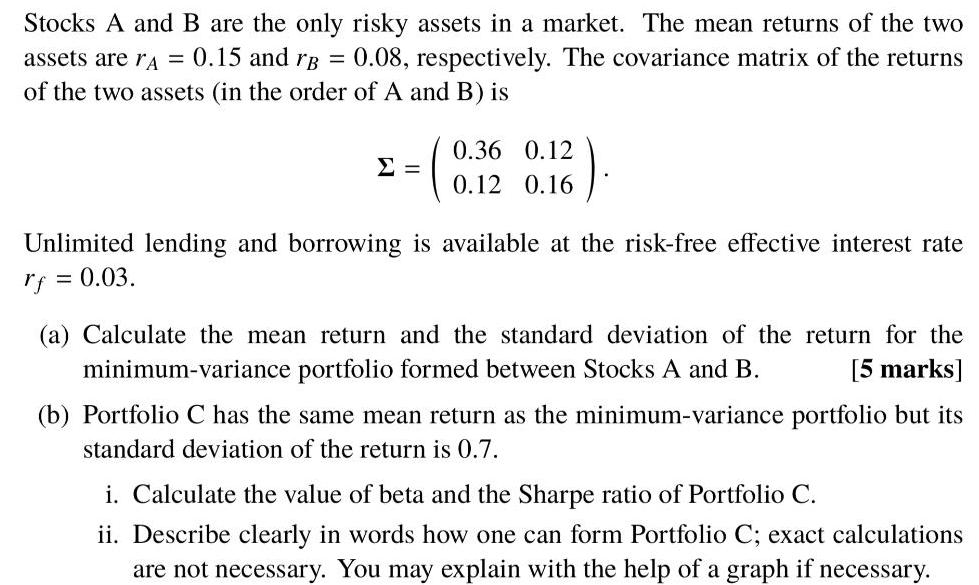

Stocks A and B are the only risky assets in a market. The mean returns of the two assets are r = 0.15 and rg = 0.08, respectively. The covariance matrix of the returns of the two assets (in the order of A and B) is = 0.36 0.12 ( ). 0.12 0.16 Unlimited lending and borrowing is available at the risk-free effective interest rate rf = 0.03. (a) Calculate the mean return and the standard deviation of the return for the minimum-variance portfolio formed between Stocks A and B. [5 marks] (b) Portfolio C has the same mean return as the minimum-variance portfolio but its standard deviation of the return is 0.7. i. Calculate the value of beta and the Sharpe ratio of Portfolio C. ii. Describe clearly in words how one can form Portfolio C; exact calculations are not necessary. You may explain with the help of a graph if necessary.

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Calcul ate the mean return and the standard deviation of the return for the minimum vari ance port... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards