Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If Yellow Hammer had reduced its DSO to 30 days in 2021and used the funds saved to down short-term debt, what would be the new

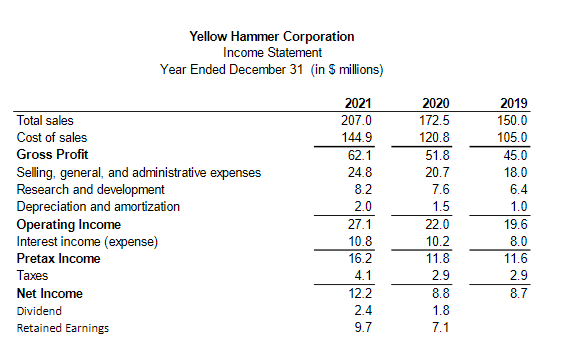

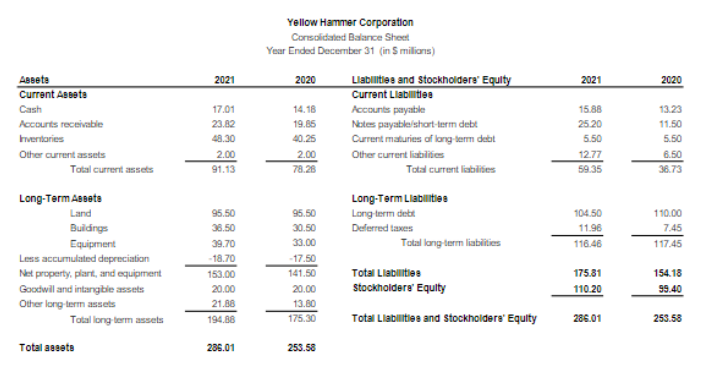

If Yellow Hammer had reduced its DSO to 30 days in 2021and used the funds saved to down short-term debt, what would be the new Debt/Cap and Debt/EBITDA ratios for 2021?

Yellow Hammer Corporation Income Statement Year Ended December 31 (in $ millions) Total sales Cost of sales Gross Profit Selling, general, and administrative expenses Research and development Depreciation and amortization Operating Income Interest income (expense) Pretax Income Taxes Net Income Dividend Retained Earnings 2021 2070 144.9 62.1 24.8 8.2 2.0 27.1 10.8 16.2 4.1 12.2 2020 172.5 120.8 51.8 20.7 7.6 1.5 22.0 10.2 11.8 2.9 8.8 1.8 7.1 2019 150.0 105.0 45.0 18.0 6.4 1.0 19.6 8.0 11.6 2.9 8.7 2.4 9 9.7 2021 2021 2020 Assets Current Assets Cash Accounts receivable Inventaries Other current assets Total current assets Yellow Hammer Corporation Consolidated Balance Sheet Year Ended December 31 (in 5 milions) 2020 Llabilities and stockholders' Equity Current Liabilities 14.18 Accounts payable 19.85 Notes payable/short-term dubt 40.25 Current maturies of long-term dett 2.00 Other current liabilities 78.26 Total current liabilities 17.01 23.82 48.30 2.00 91.13 15.88 25.20 5.50 12.77 59.35 13.20 11.50 5.50 6.50 36.73 Long-Term Liabilities Long term diebt Deferred taxes Total long term liabilities 104.50 11.96 116.46 110.00 7.45 117.45 Long-Term Assets Land Buildings Equipment Less accumulated depreciation Net property, plant, and equipment Goodwill and intarzble assets Other long-term assets Total long term assets 95.50 38.50 39.70 -18.70 153.00 20.00 21.88 194.88 95.50 30.50 33.00 -17.50 141.50 20.00 13.30 175.30 Total Liabilities Stockholdere' Equity 175.81 110.20 154.18 99.40 Total Liabilities and stockholders' Equity 286.01 253.58 Total assets 286.01 253.58Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started