Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If you analyzed the firm's solvency analysis, what is the major change of the firm's capital structure? What are the possible reason(s) that the company

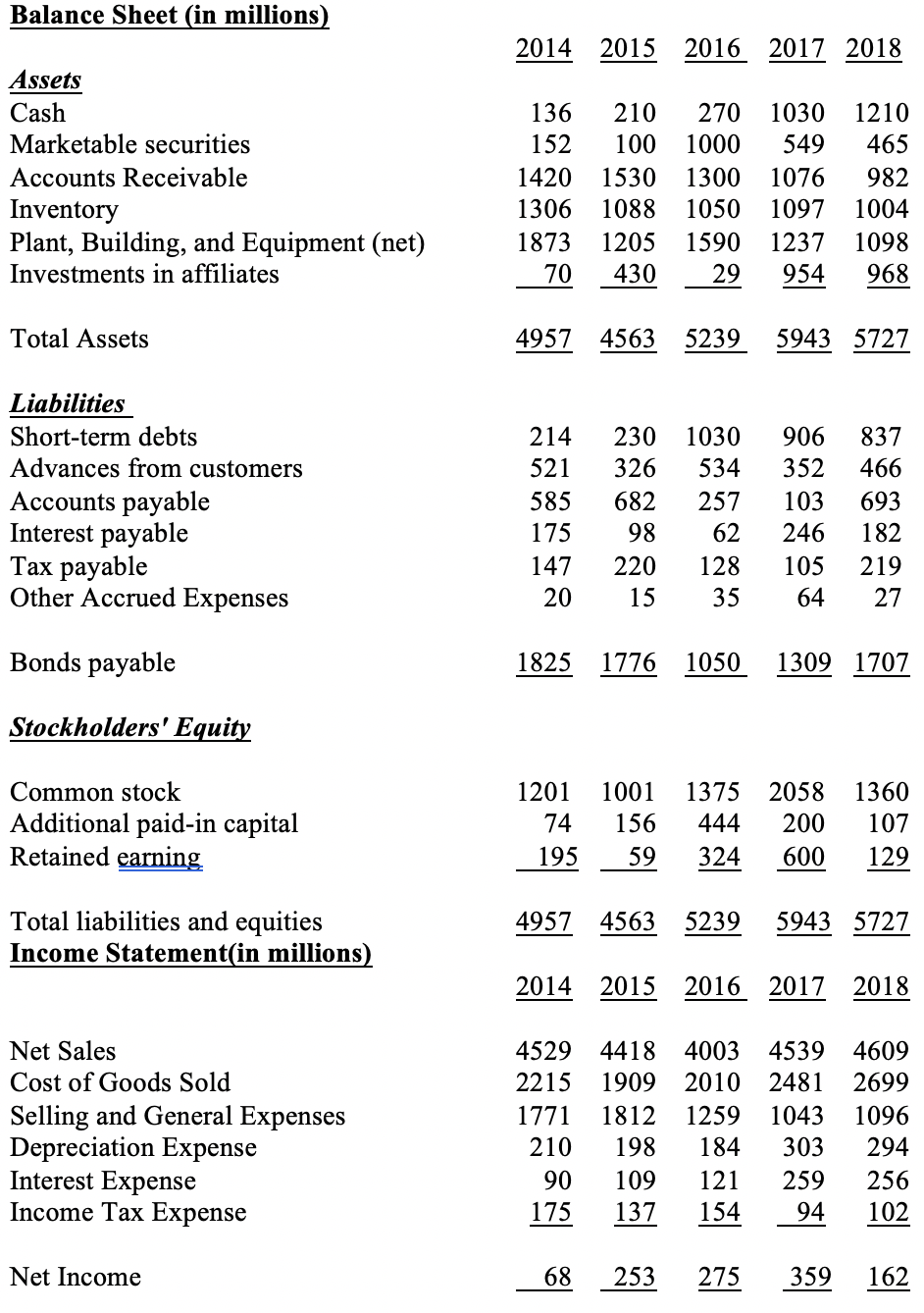

If you analyzed the firm's solvency analysis, what is the major change of the firm's capital structure? What are the possible reason(s) that the company wants to do so? Is the firm really in trouble if one applied the Return on Asset to verify the performance of the firm? Is using this rate sufficient enough to verify the performance of the firm? Why or why not? Analyze the firm's profitability by using the ratios given in the text. Is this company improving its position for the shareholders? Why or why not?

If you analyzed the firm's solvency analysis, what is the major change of the firm's capital structure? What are the possible reason(s) that the company wants to do so? Is the firm really in trouble if one applied the Return on Asset to verify the performance of the firm? Is using this rate sufficient enough to verify the performance of the firm? Why or why not? Analyze the firm's profitability by using the ratios given in the text. Is this company improving its position for the shareholders? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started