if you can answer the question in two pages i will appreciate!

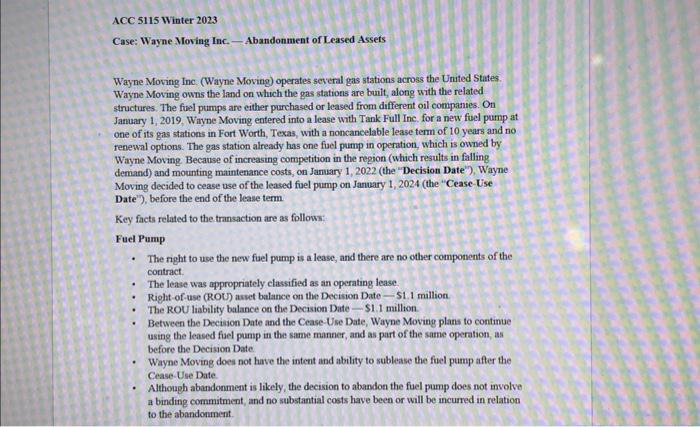

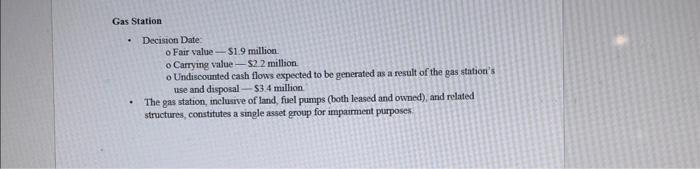

2. What is the impact of abandonment on impairment considerations related to the leased fuel pump and gas station, more specifically the following? a. Whether the abandonment decision constitutes an impairment trigger. b. Impact on current asset grouping of the ROU asset as a result of the abandonment decision. c. Relevance of ROU asset's relative significance to the asset group. d. Evaluation of whether an impaiment needs to be recorded ACC 5115 Winter 2023 Case: Wayne Moving Inc. - Abandonment of Leased Assets Wayne Moving Inc. (Wayne Moving) operates several gas stations across the United States. Wayne Moving owns the land on which the gas stations are buitt, along with the related structures. The fuel pumps are either purchased or leased from different oil companies. On January 1, 2019, Wiyne Moving entered into a lease with Tank Full Inc, for a new fuel pump at one of its gas stations in Fort Worth, Texas, with a noncancelable lease term of 10 years and no renewal options. The gas station already has one fuel pump in operation, which is owned by Wayne Moving. Because of increasing competition in the region (which results in falling demand) and mounting maintenance costs, on January 1, 2022 (the "Decision Date'), Wayne Moving decided to cease use of the leased fuel pump on January 1, 2024 (the "Cease-Use Date'), before the end of the lease term Key facts related to the transaction are as follows: Fuel Pump - The right to use the new fuel pump is a lease, and there are no other components of the contract. - The lease was appropriately classified as an operating lease. - Right-of-use (ROU) asset balance on the Decision Date - 51.1million - The ROU liability balance on the Decision Date - $1.1 million. - Between the Decision Date and the Cease-Use Date, Wayne Moving plans to continue using the leased foel pump in the same manner, and as part of the same operation, as before the Decision Date. - Wayne Moving does not have the intent and ability to sublease the fuel pump after the Cease-Use Date. - Although abandonment is likely, the decision to abandon the fuel pump does not involve a binding cormmitment, and no substantial costs have been or will be incurred in relation to the abandonment. Gas Station - Deciston Date: o Fair value - $1.9 million. o Carrying value - 52.2 million. o Undiscoruted cash flows expected to be generated as a result of the gas station's use and disposal - $3.4 million. - The gas station, inclusive of land, fuel pumps (both leased and owned), and related structures, constitutes a single asset group for imparment purposes