Question

IF you can Answer them also by showing the calculations with Excel sheet, would be great dear please with showing the way of calculating and

IF you can Answer them also by showing the calculations with Excel sheet, would be great dear please with showing the way of calculating and the formulas

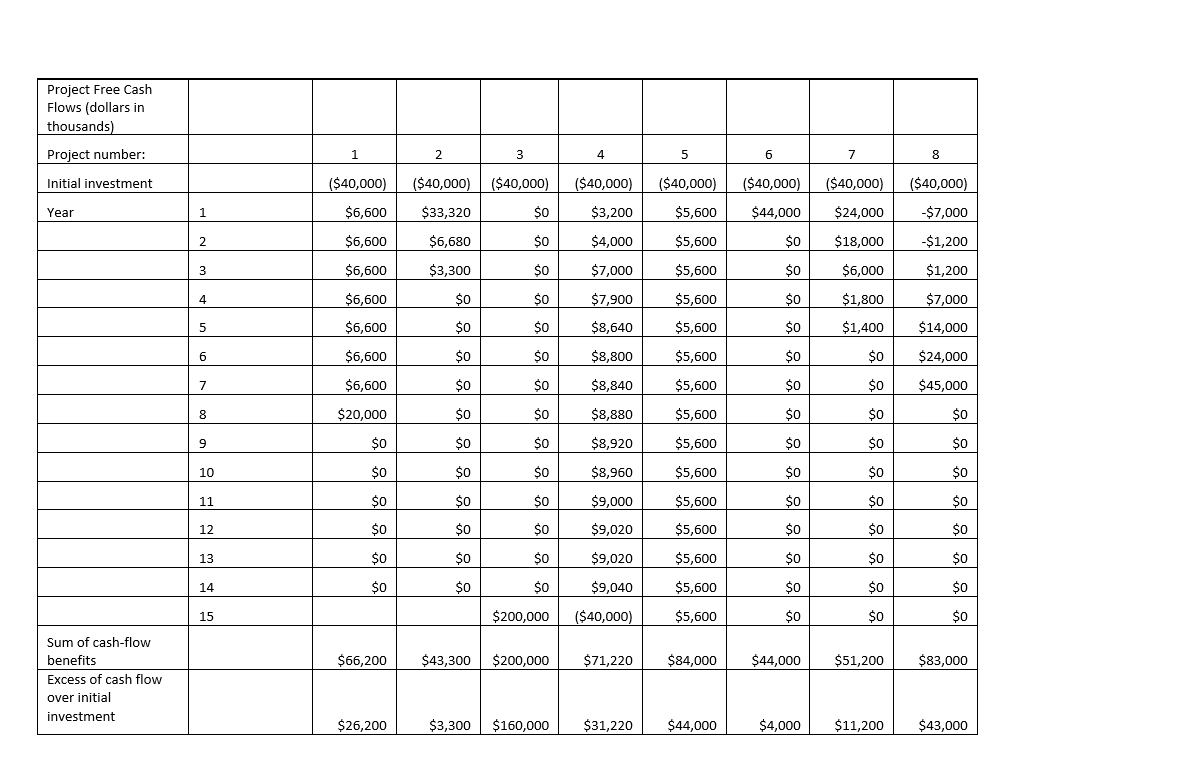

You are the capital-budgeting analyst for Dubai Holding Co. which is considering investments in the eight projects listed in the table below. The chief financial officer asked you to rank the projects and recommend the four best that the company should accept.

In this assignment, only the quantitative considerations are relevant. No other project characteristics are deciding factors in the selection, except that management has determined that projects 3 and 4 are mutually exclusive.

All the projects require the same initial investment, $40 million. Moreover, all are believed to be of the same risk class. The weighted-average cost of capital of the firm has never been estimated. In the past, analysts have simply assumed that 8 percent was an appropriate discount rate.

To stimulate your analysis, consider the following questions:

- Can you rank the projects simply by inspecting the cash flows? Show your ranking?

| rank | project | Net present value (NPV) |

| 1 | 3 | |

| 2 | 5 | |

| 3 | 8 | |

| 4 | 4 | |

| 5 | 1 | |

| 6 | 7 | |

| 7 | 6 | |

| 8 | 2 |

- Apply the 5 methods for analyzing the given 8 projects. Rank the projects and make your recommendation based on the ranking and the above given information.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started