Answered step by step

Verified Expert Solution

Question

1 Approved Answer

if you can do it in excel format and show your work. thnak you (for number 2 use 4 years for time maturity) typed would

if you can do it in excel format and show your work. thnak you

(for number 2 use 4 years for time maturity)

typed would be apprieciated.

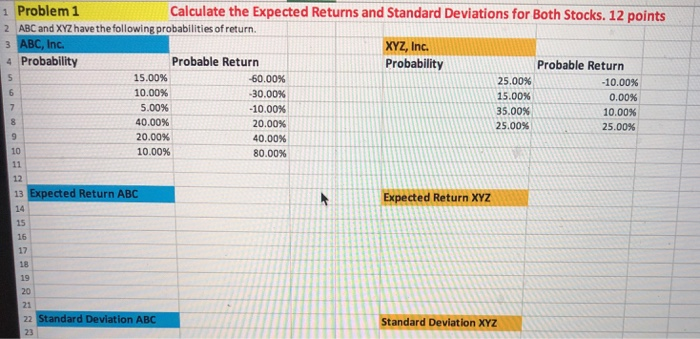

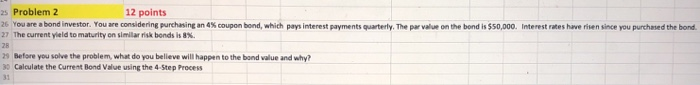

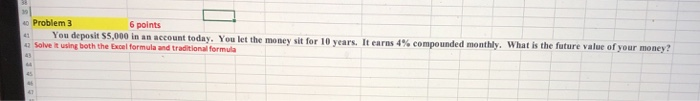

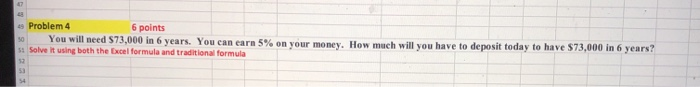

8 10 1 Problem 1 Calculate the expected Returns and Standard Deviations for Both Stocks. 12 points 2 ABC and XYZ have the following probabilities of return 3 ABC, Inc. XYZ, Inc. 4 Probability Probable Return Probability Probable Return 5 15.00% -60.00% 25.00% -10.00% 6 10.00% -30.00% 15.00% 0.00% 7 5.00% -10.00% 35.00% 10.00% 40.00% 20.00% 25.00% 25.00% 9 20.00% 40.00% 10.00% 80.00% 11 12 13 Expected Return ABC Expected Return XYZ 14 15 16 17 18 19 20 21 22 Standard Deviation ABC Standard Deviation XYZ 23 25 Problem 2 12 points 26 You are a bond investor. You are considering purchasing an 4% coupon bond, which pays interest payments quarterly. The par value on the bond is $50,000. Interest rates have risen since you purchased the bond 27 The current yield to maturity on similar risk bonds is 8%. 29 Before you solve the problem, what do you believe will happen to the band value and why? 30 Calculate the Current Bond Value using the 4-Step Process 19 40 Problem 3 6 points 41 You deposit 55,000 in an account today. You let the money sit for 10 years. It earns 4% compounded monthly. What is the future value of your money? Solve it using both the Excel formula and traditional formula 19 Problem 4 6 points You will need $73,000 in 6 years. You can earn 5% on your money. How much will you have to deposit today to have $73,000 in 6 years? 51 Solve it using both the Excel formula and traditional formula 33 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started