If you could format it in a table like what i have to fill in, it would be much appreciated!

If you could format it in a table like what i have to fill in, it would be much appreciated!

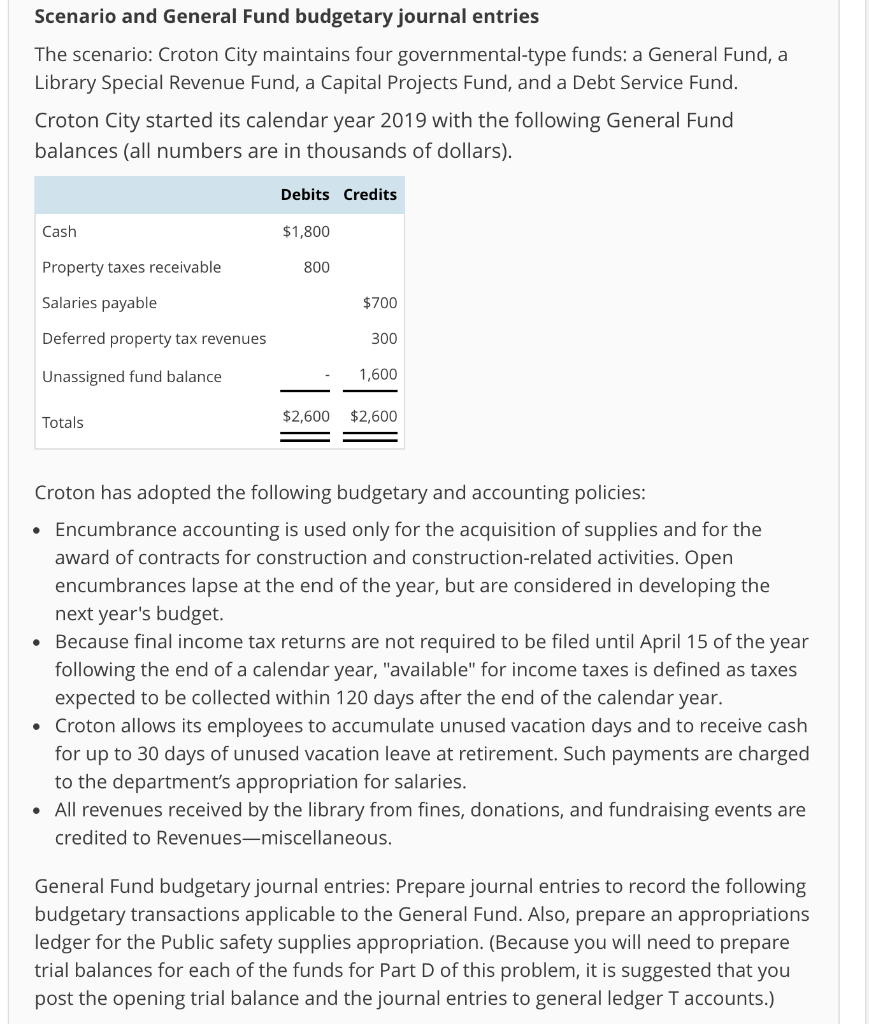

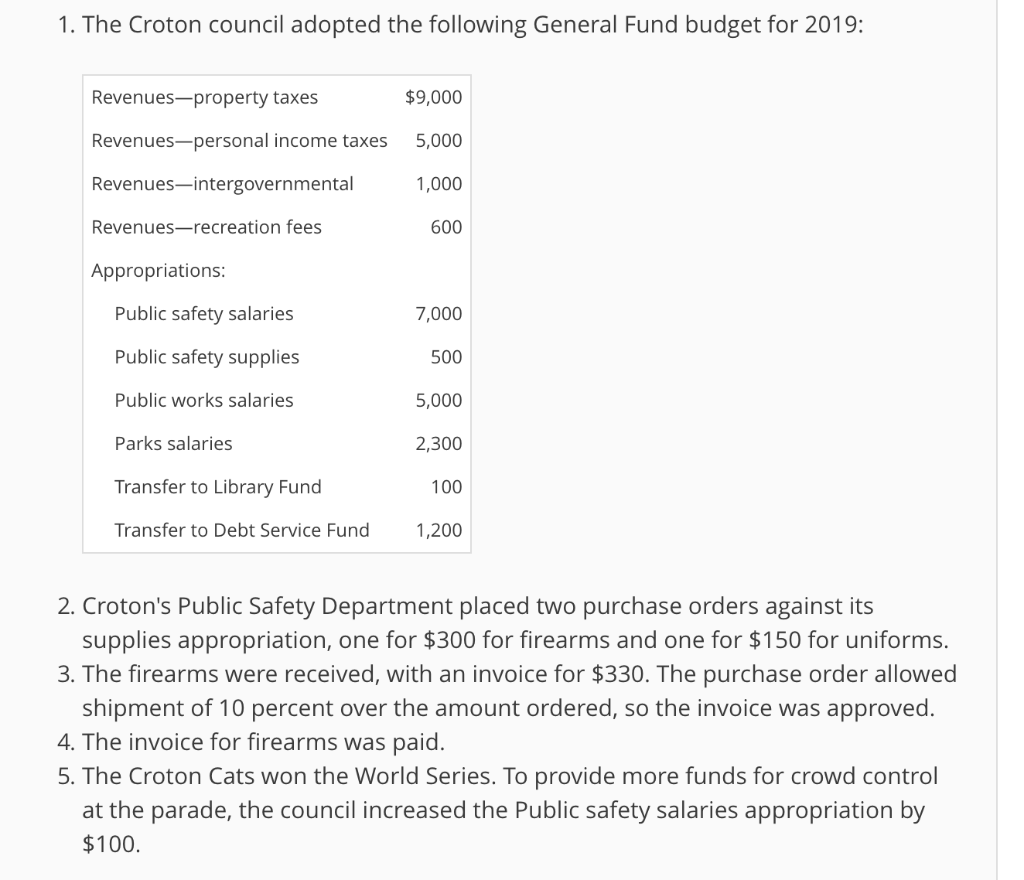

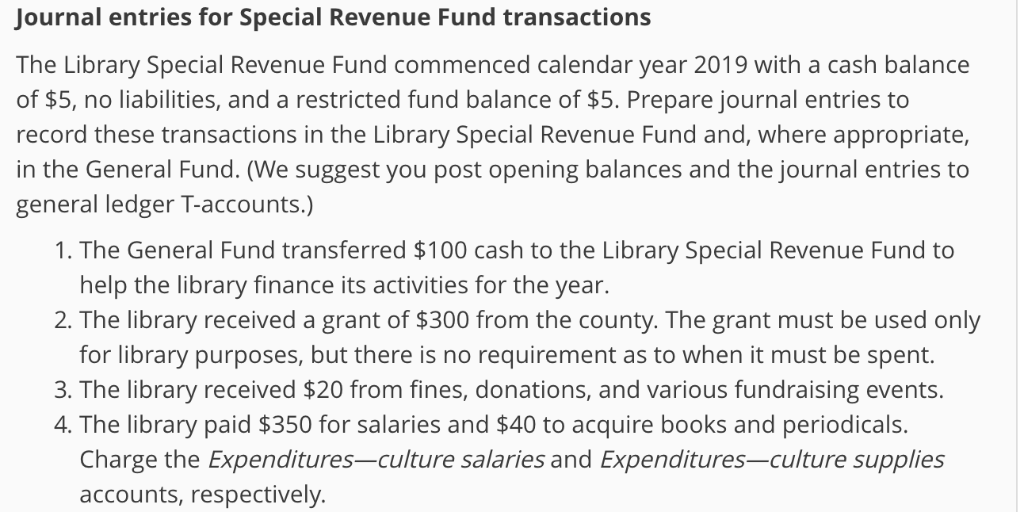

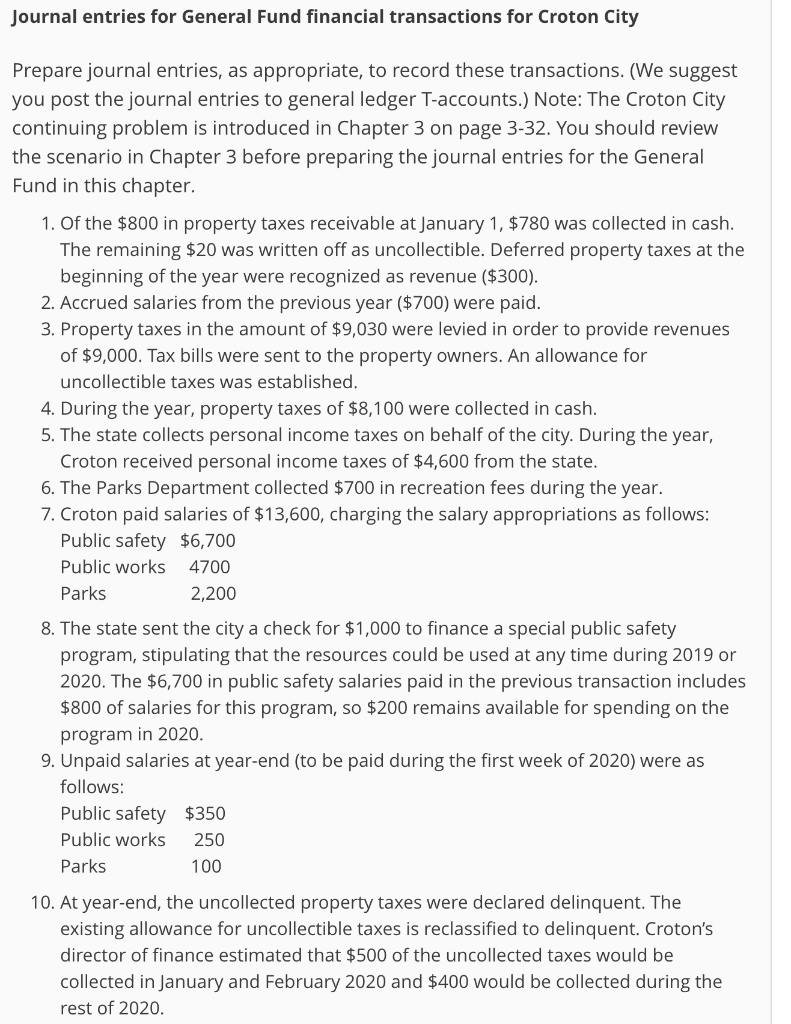

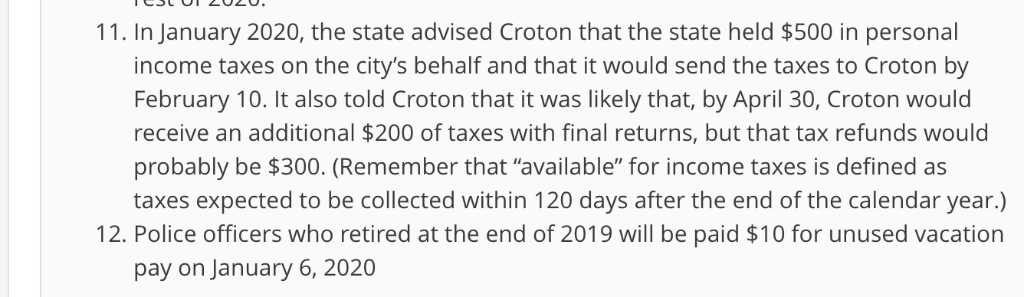

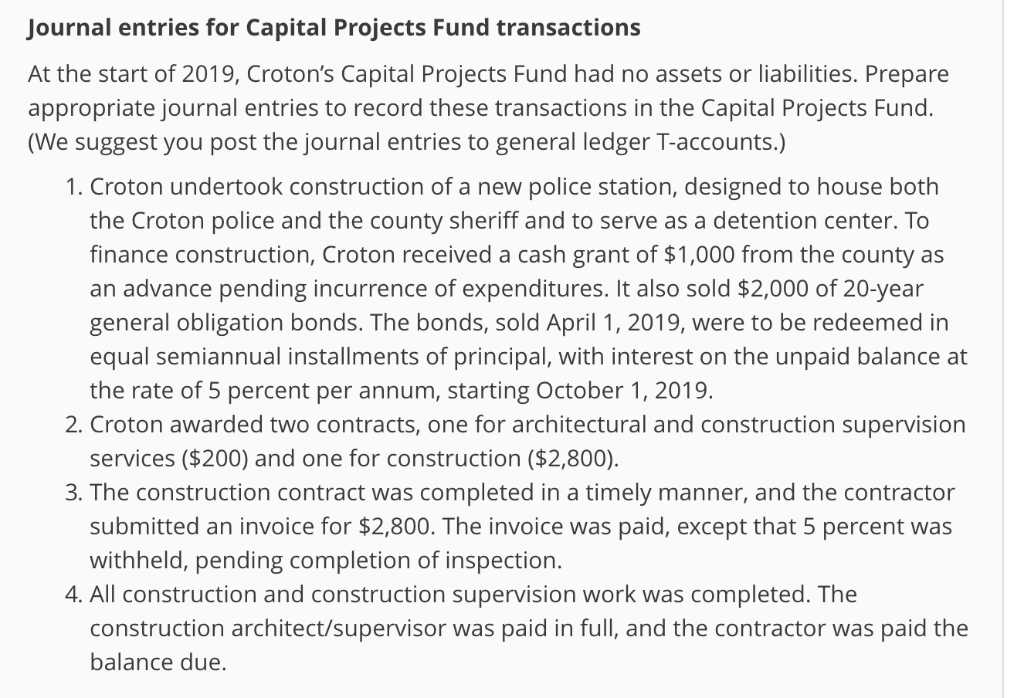

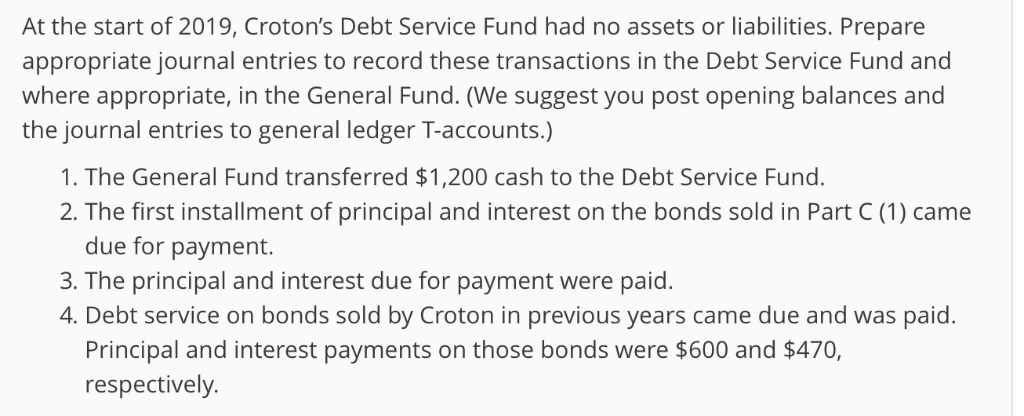

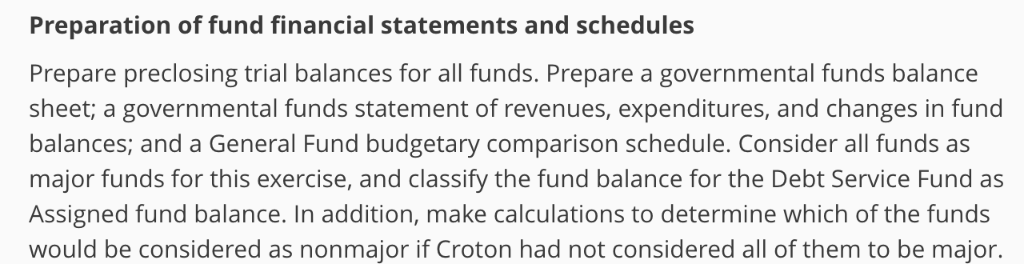

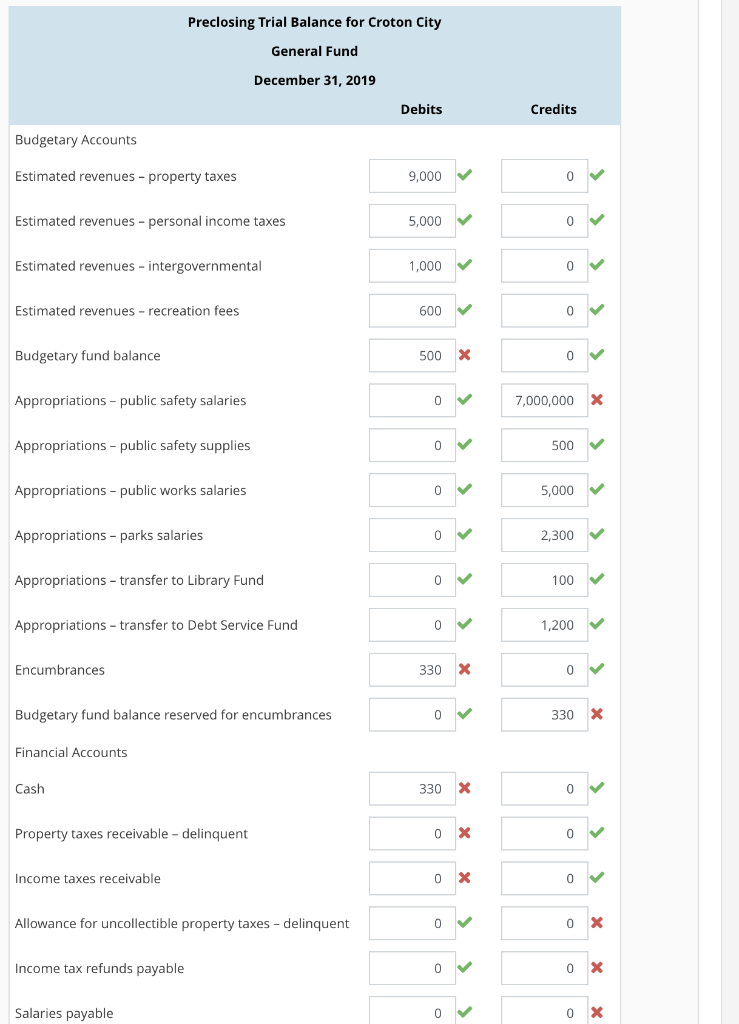

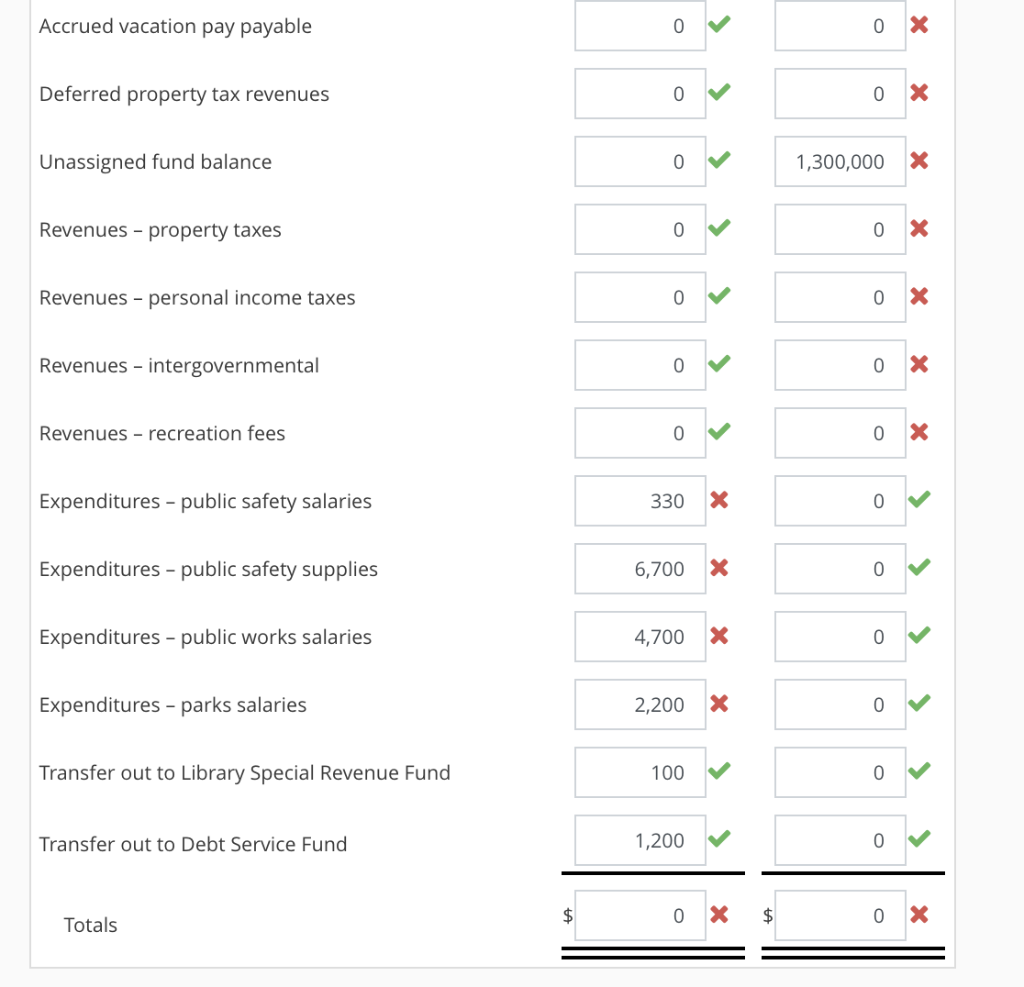

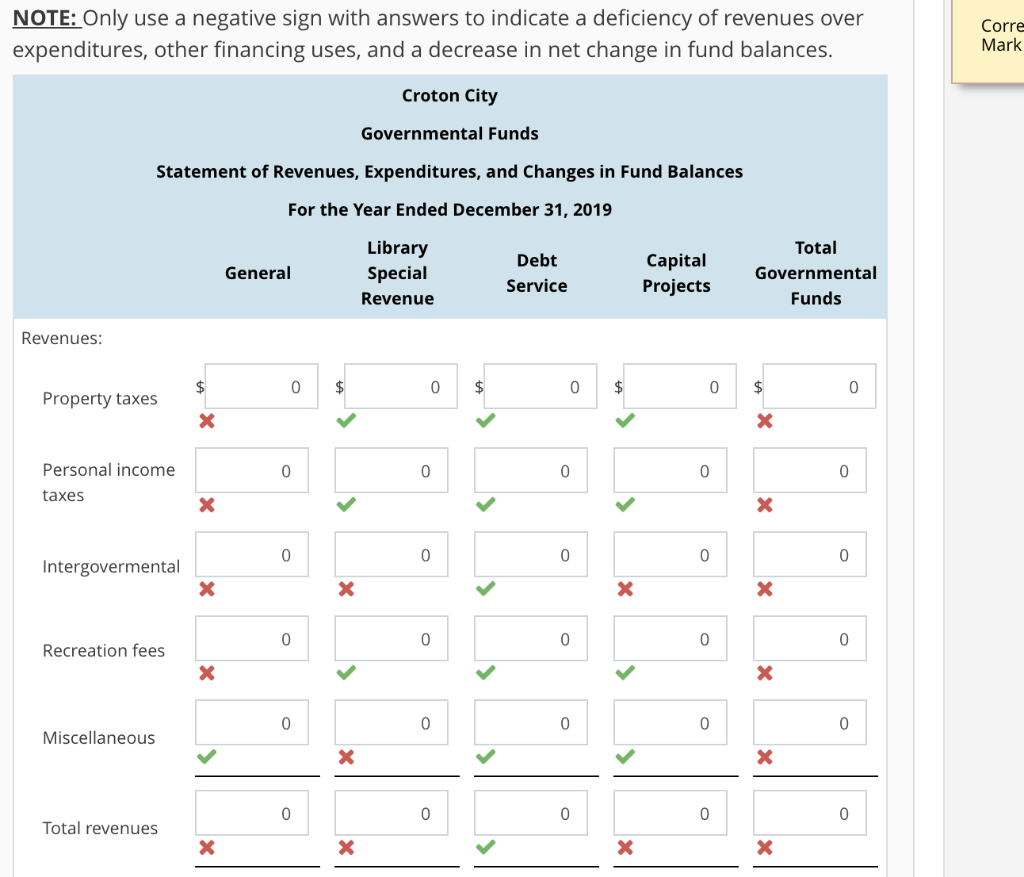

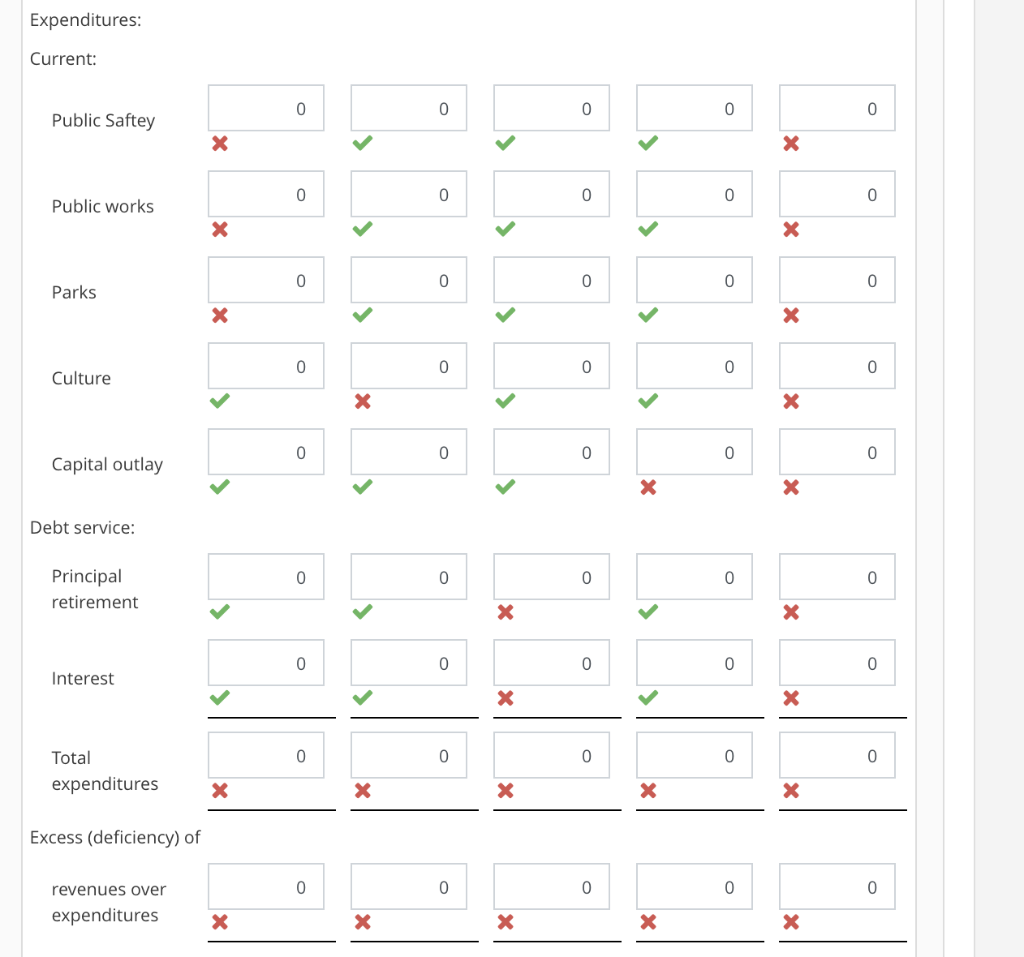

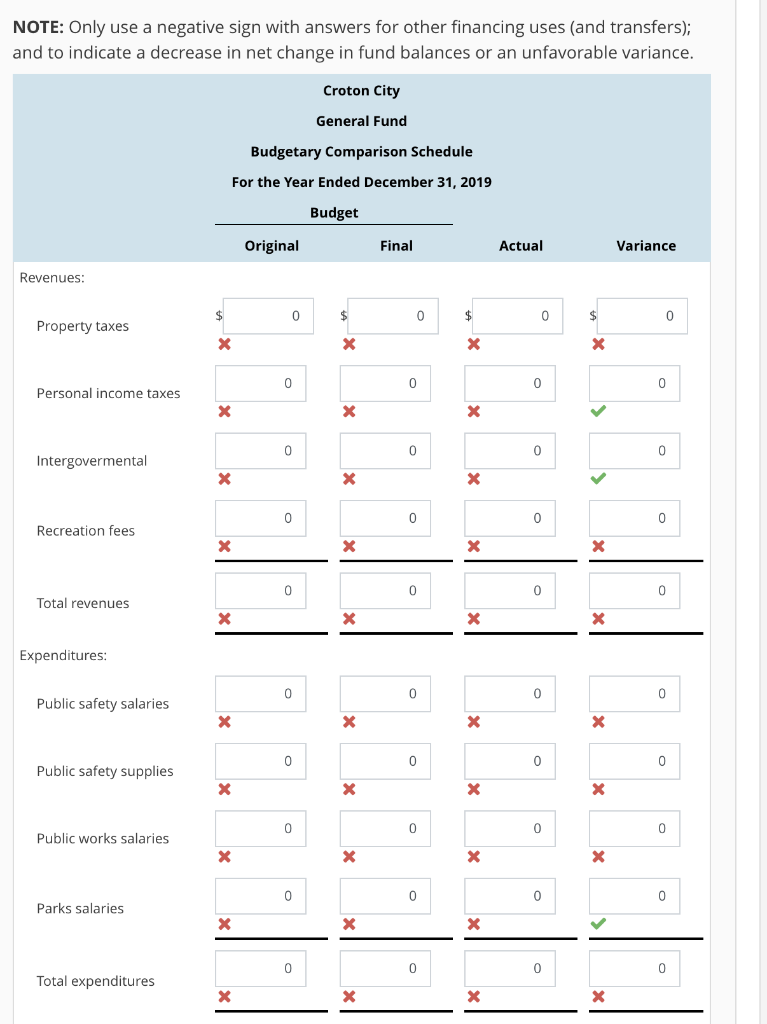

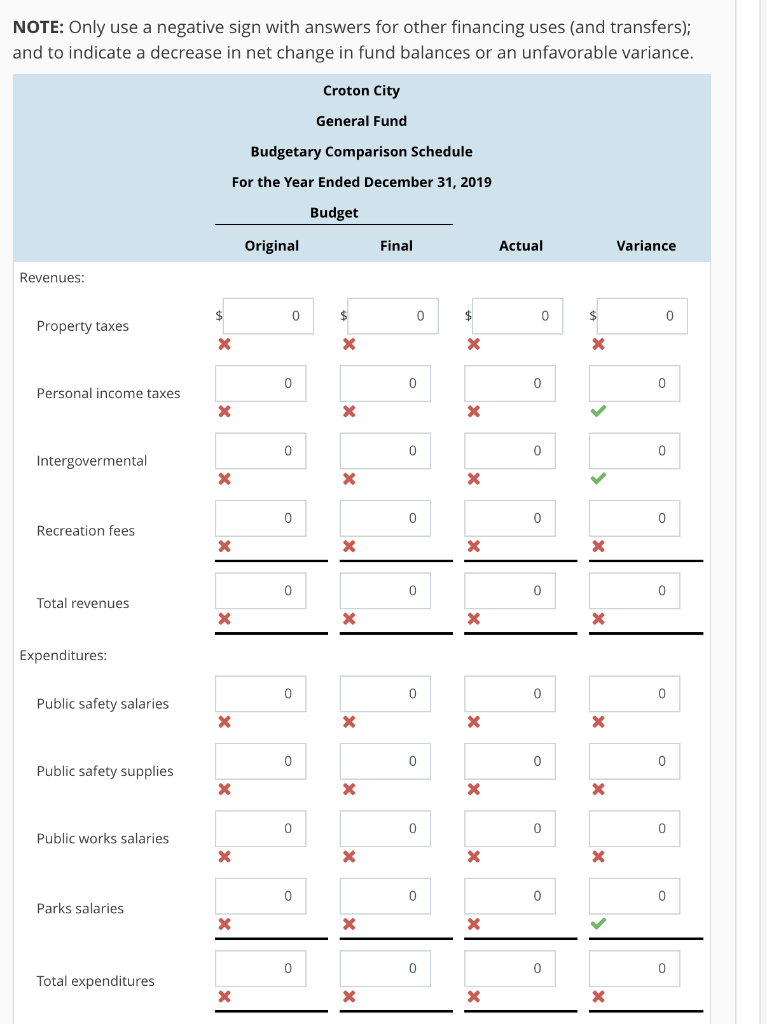

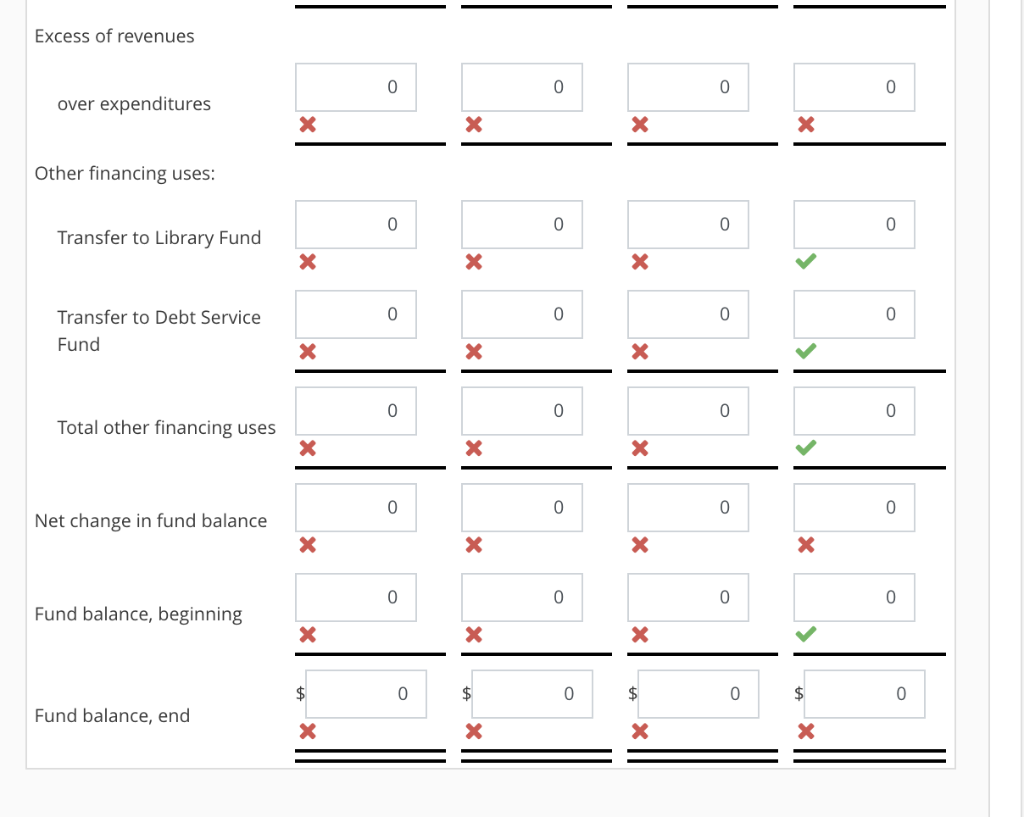

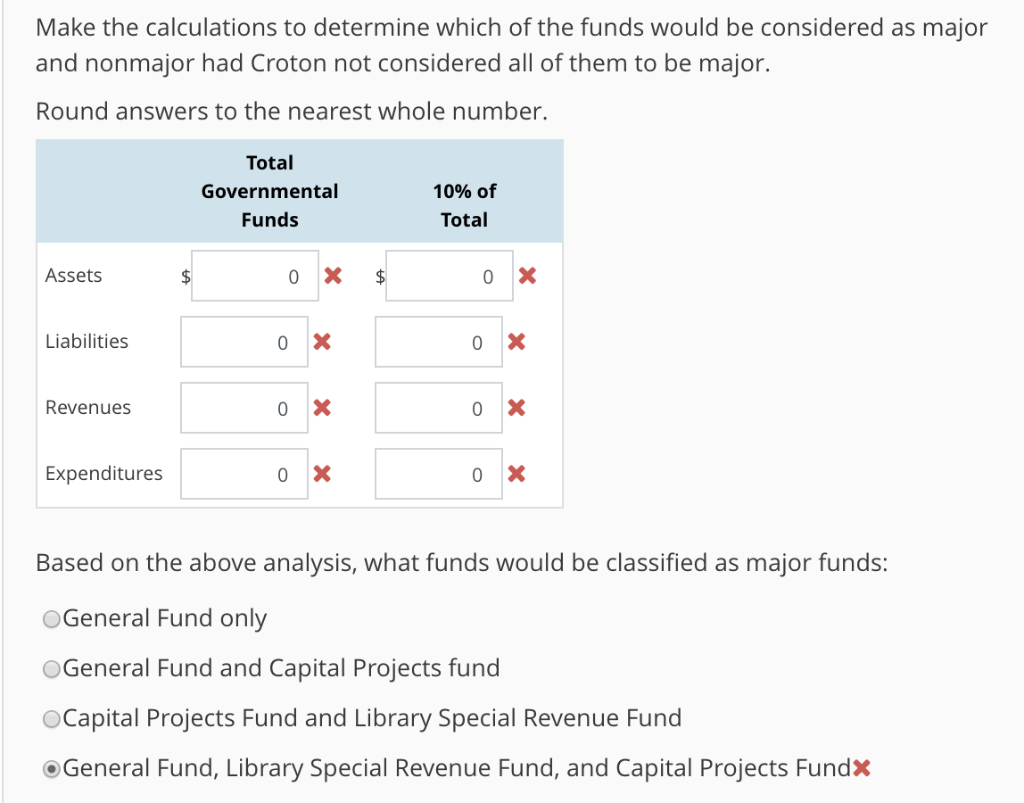

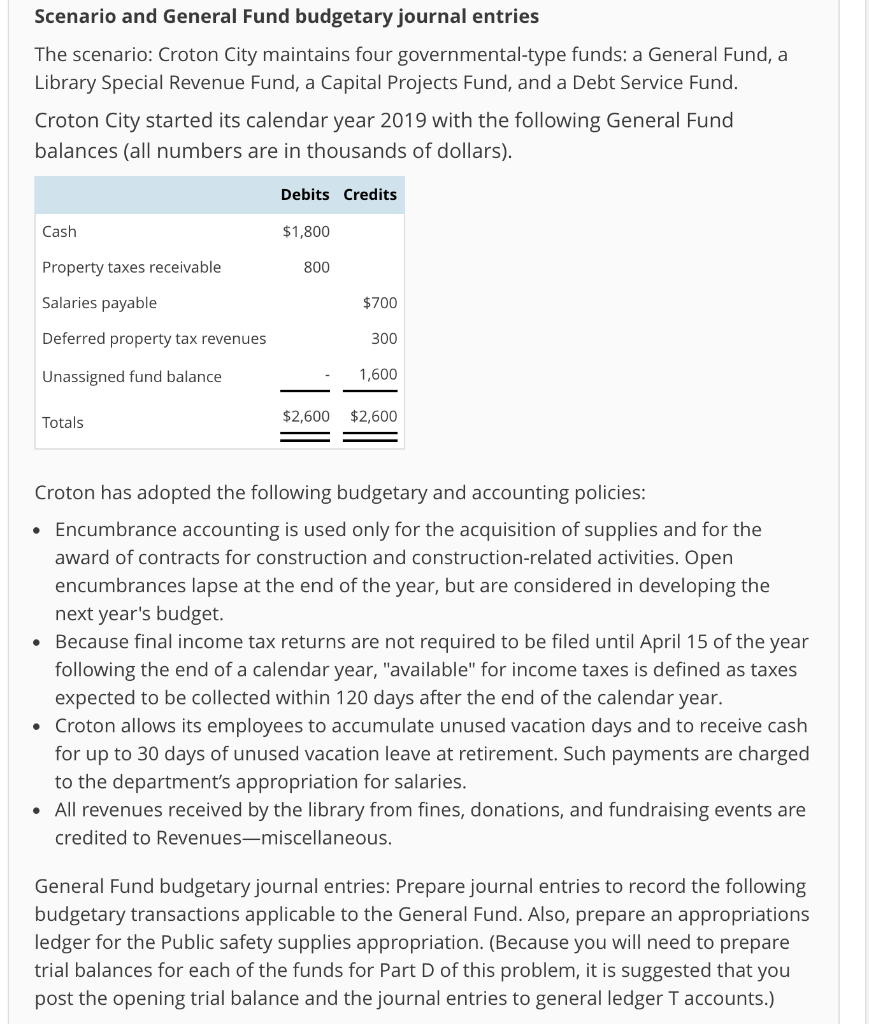

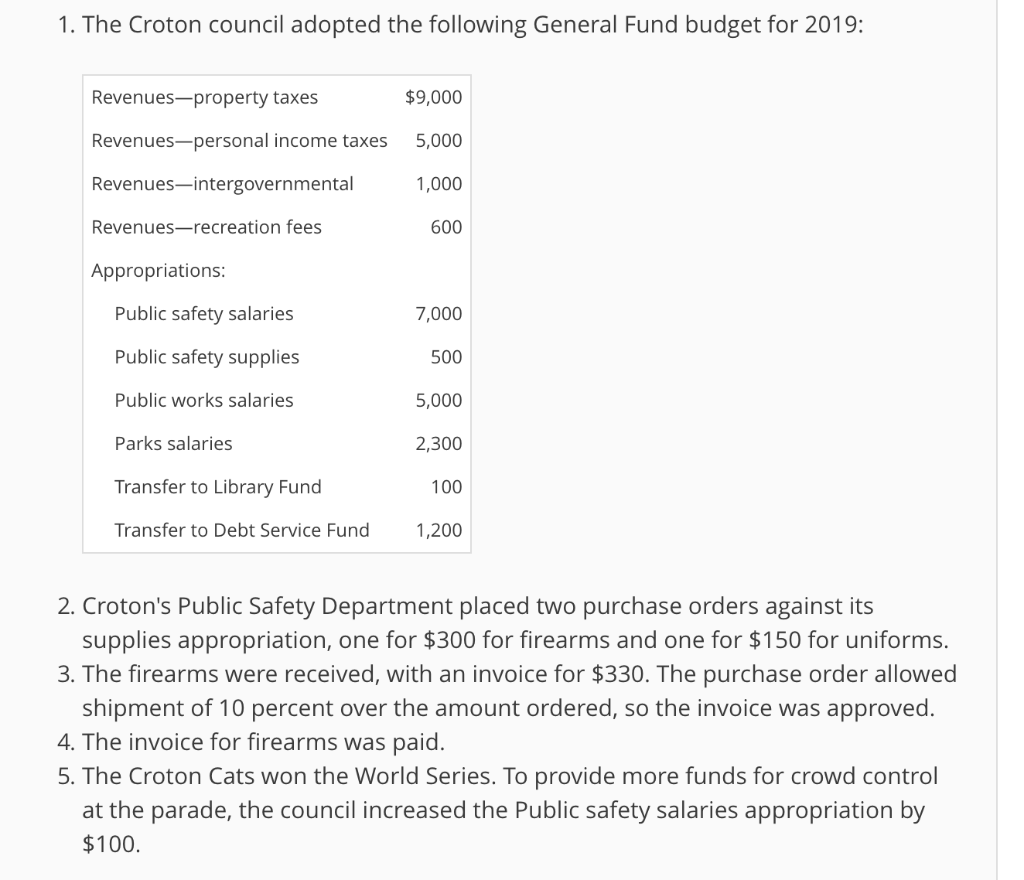

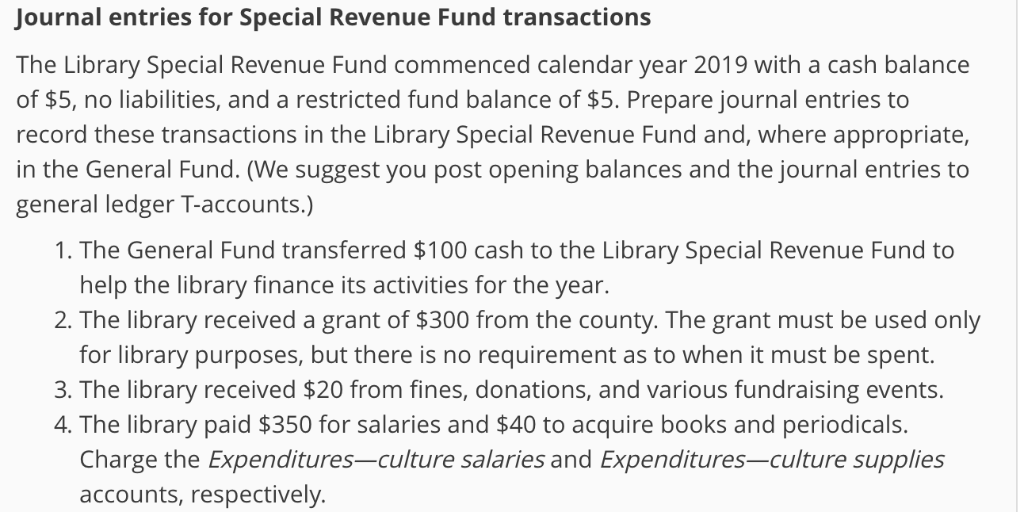

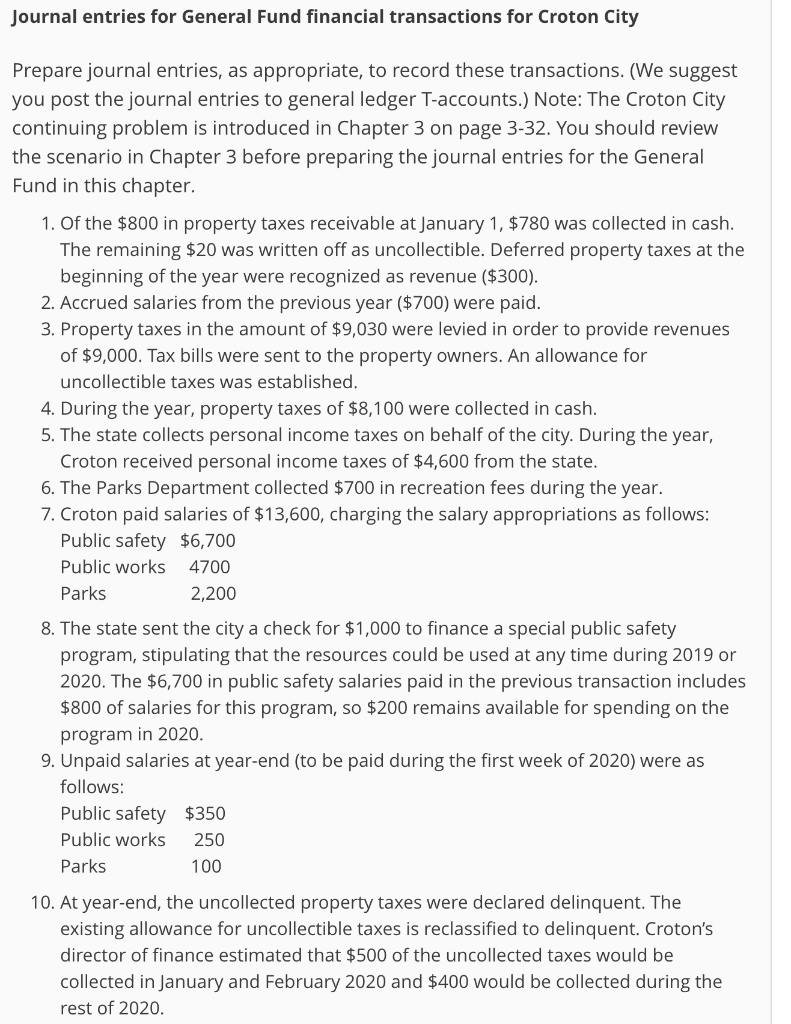

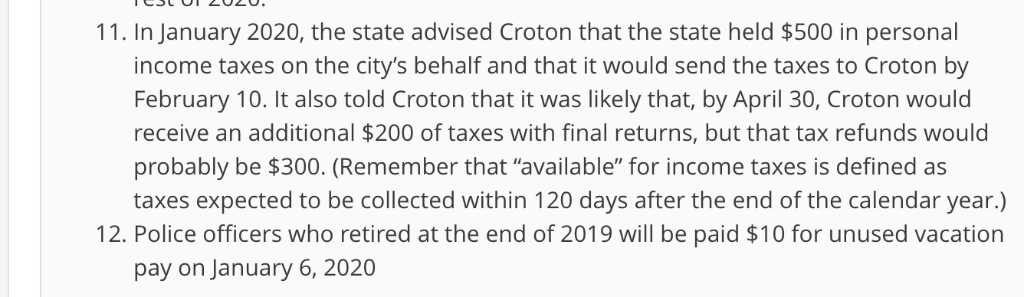

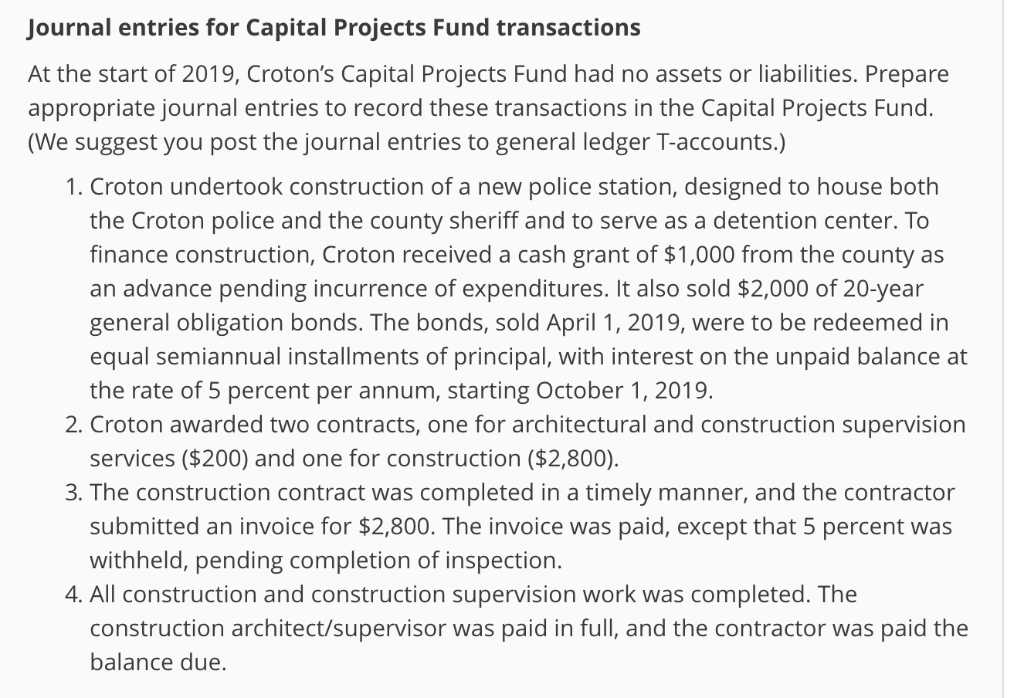

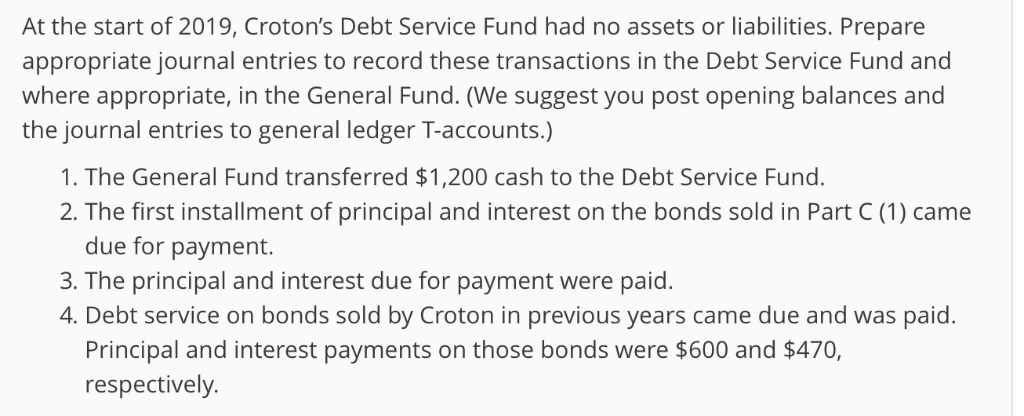

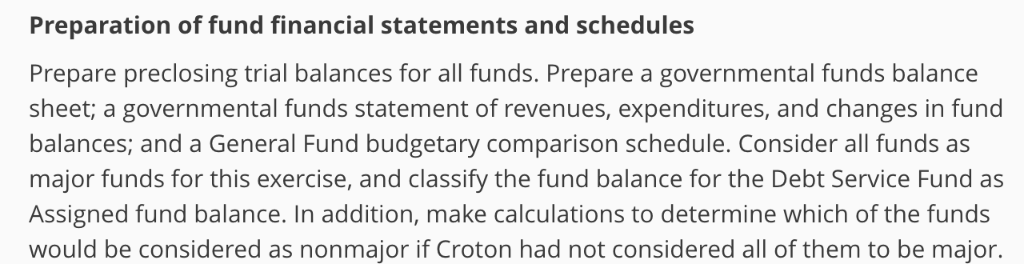

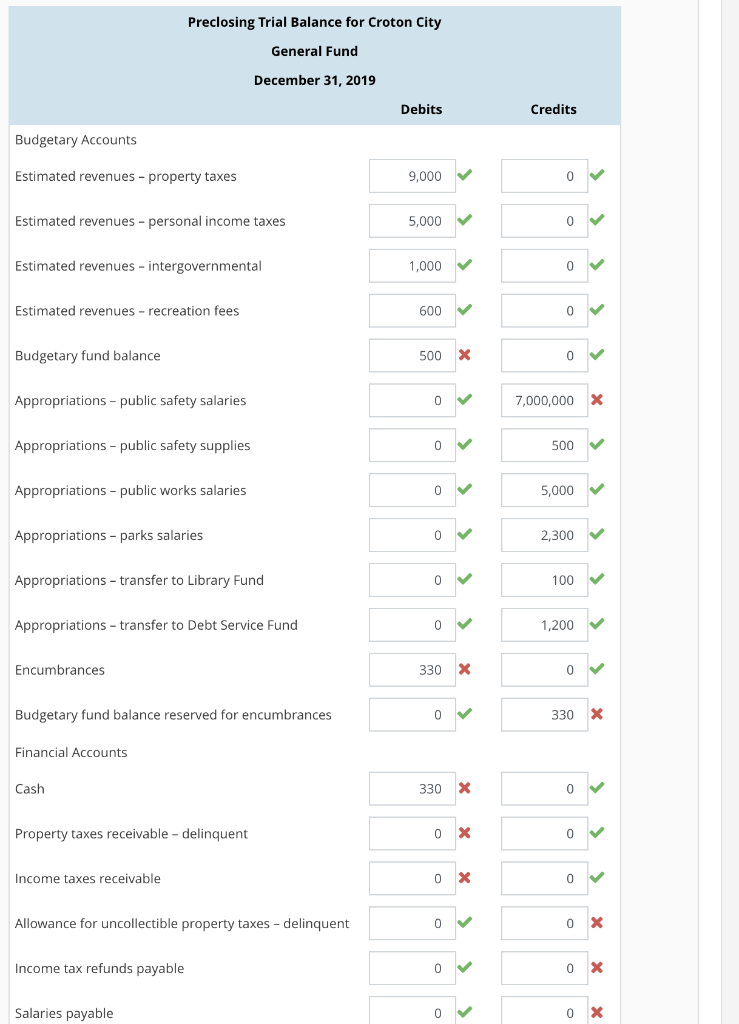

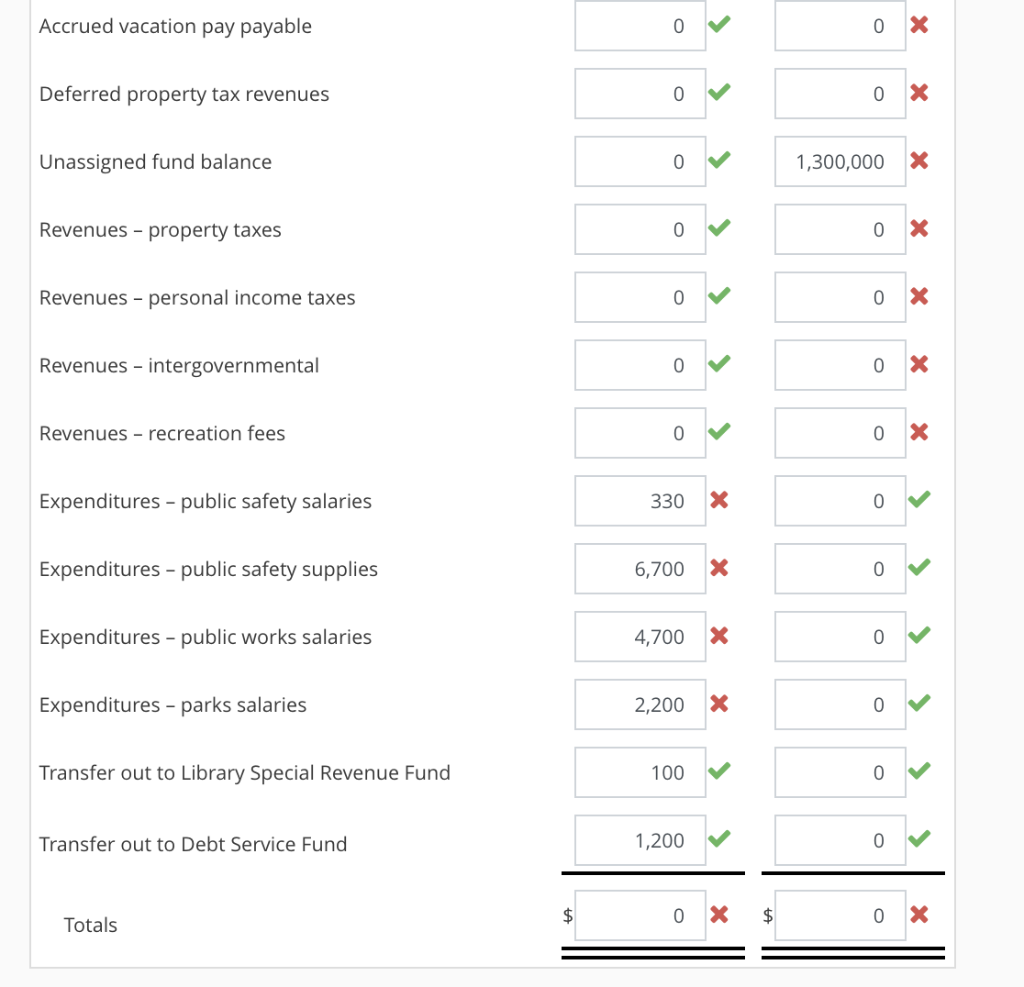

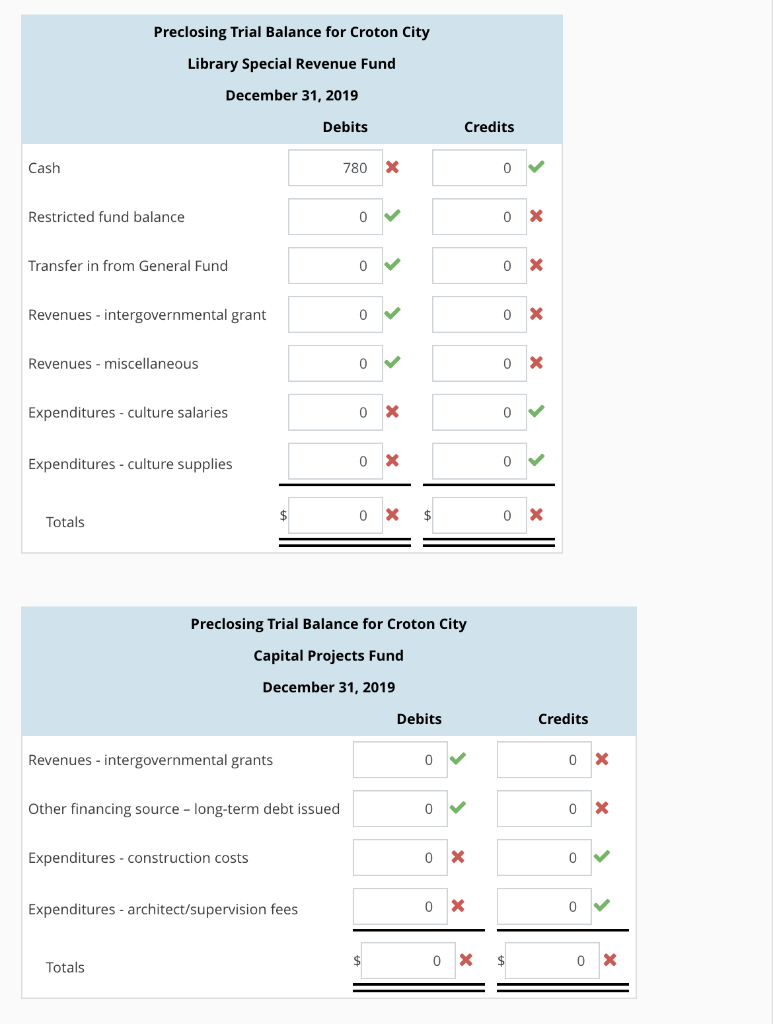

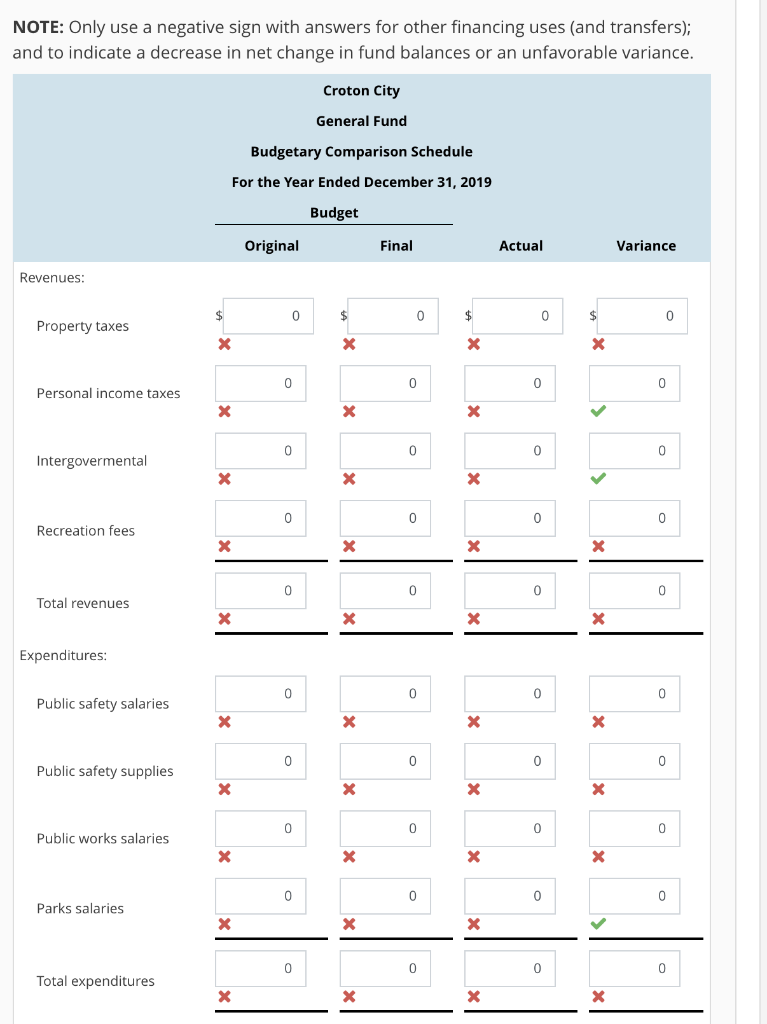

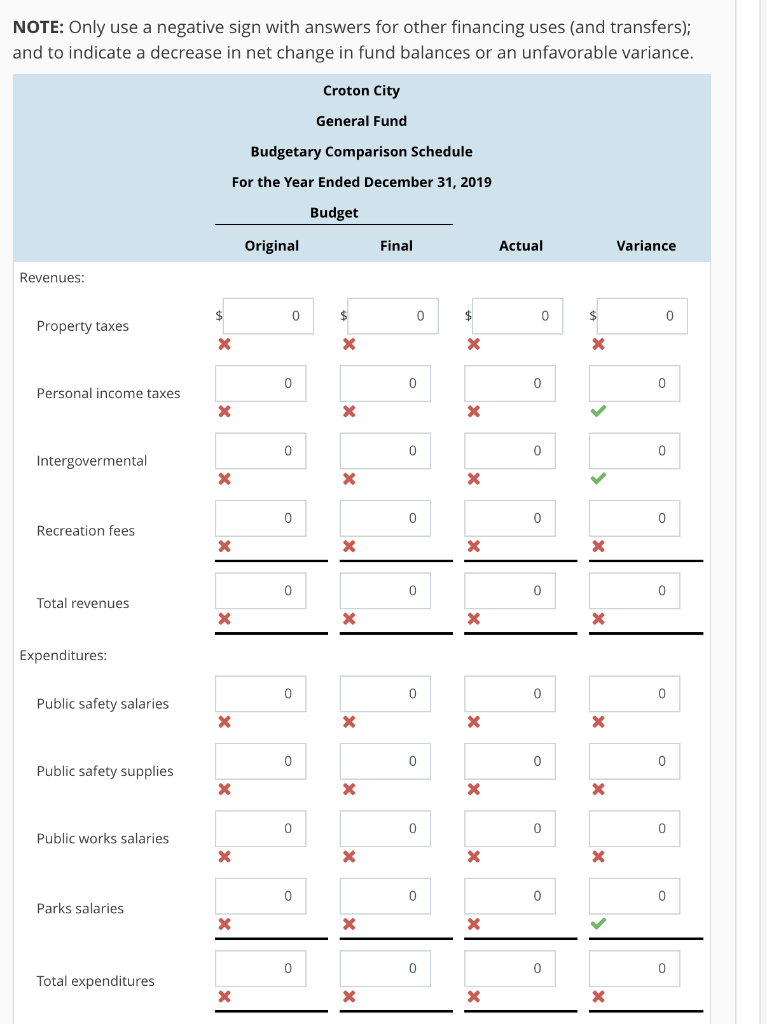

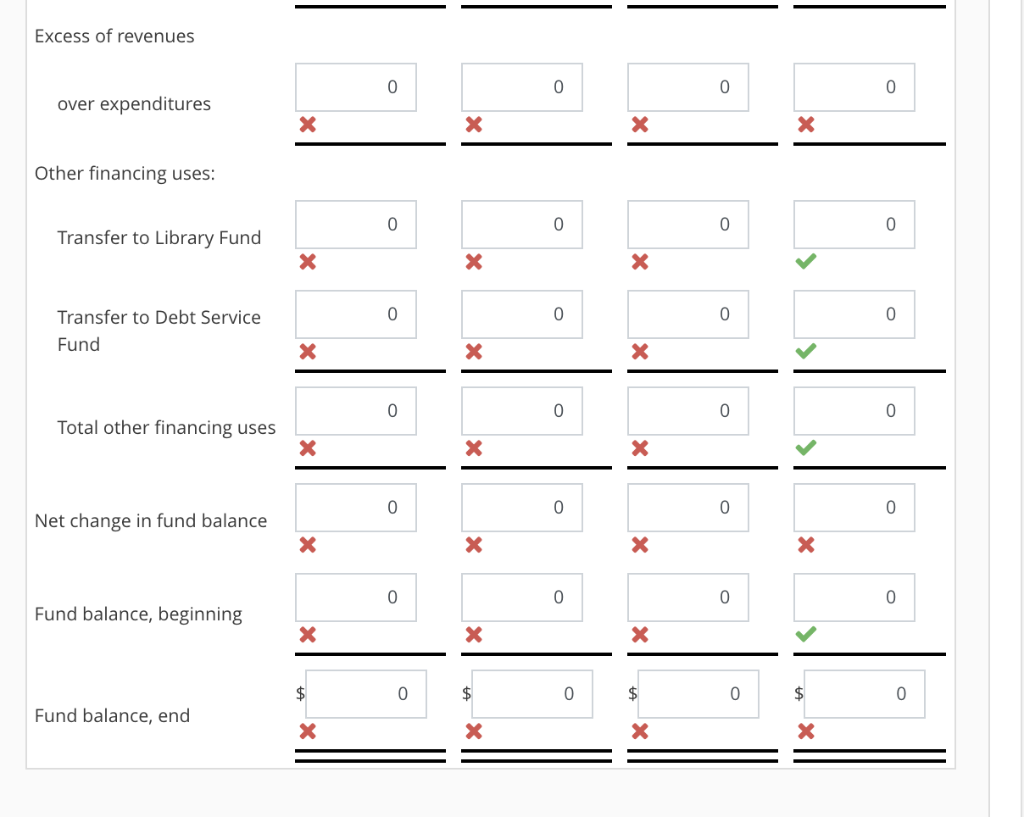

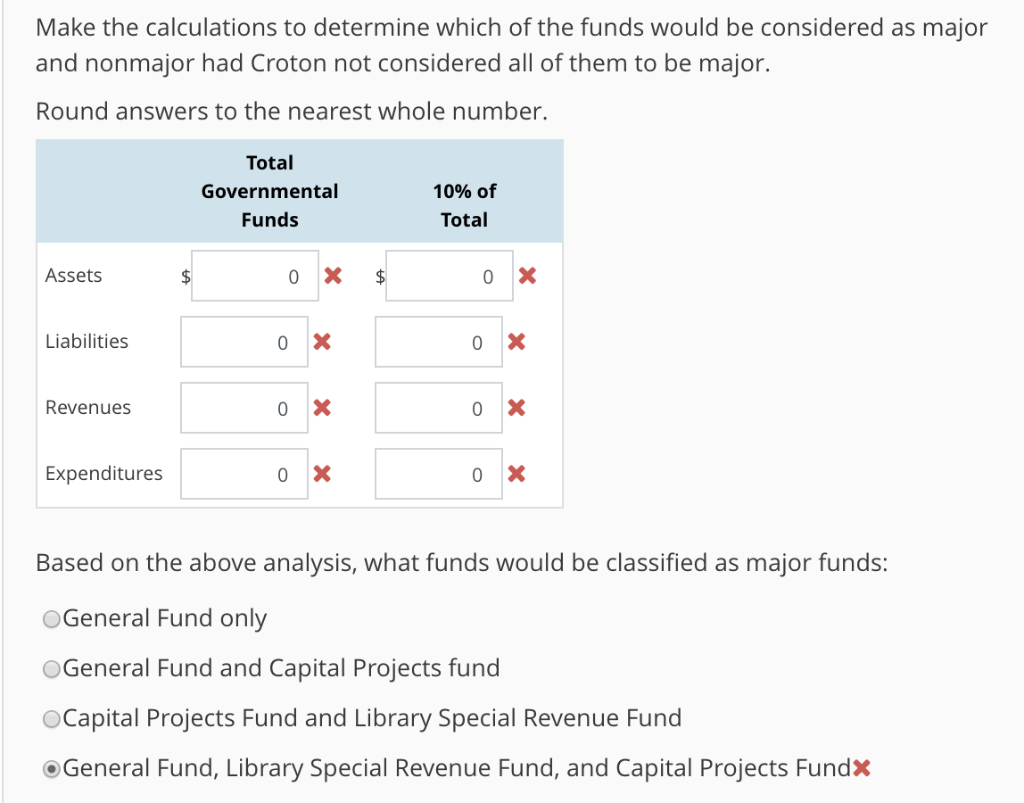

Journal entries for Special Revenue Fund transactions The Library Special Revenue Fund commenced calendar year 2019 with a cash balance of $5, no liabilities, and a restricted fund balance of $5. Prepare journal entries to record these transactions in the Library Special Revenue Fund and, where appropriate, in the General Fund. (We suggest you post opening balances and the journal entries to general ledger T-accounts.) 1. The General Fund transferred $100 cash to the Library Special Revenue Fund to help the library finance its activities for the year. 2. The library received a grant of $300 from the county. The grant must be used only for library purposes, but there is no requirement as to when it must be spent. 3. The library received $20 from fines, donations, and various fundraising events. 4. The library paid $350 for salaries and $40 to acquire books and periodicals. Charge the Expenditures-culture salaries and Expenditures-culture supplies accounts, respectively. 11. In January 2020, the state advised Croton that the state held $500 in personal income taxes on the city's behalf and that it would send the taxes to Croton by February 10. It also told Croton that it was likely that, by April 30, Croton would receive an additional $200 of taxes with final returns, but that tax refunds would probably be $300. (Remember that "available" for income taxes is defined as taxes expected to be collected within 120 days after the end of the calendar year.) 12. Police officers who retired at the end of 2019 wil be paid $10 for unused vacation pay on January 6, 2020 Journal entries for Special Revenue Fund transactions The Library Special Revenue Fund commenced calendar year 2019 with a cash balance of $5, no liabilities, and a restricted fund balance of $5. Prepare journal entries to record these transactions in the Library Special Revenue Fund and, where appropriate, in the General Fund. (We suggest you post opening balances and the journal entries to general ledger T-accounts.) 1. The General Fund transferred $100 cash to the Library Special Revenue Fund to help the library finance its activities for the year. 2. The library received a grant of $300 from the county. The grant must be used only for library purposes, but there is no requirement as to when it must be spent. 3. The library received $20 from fines, donations, and various fundraising events. 4. The library paid $350 for salaries and $40 to acquire books and periodicals. Charge the Expenditures-culture salaries and Expenditures-culture supplies accounts, respectively. 11. In January 2020, the state advised Croton that the state held $500 in personal income taxes on the city's behalf and that it would send the taxes to Croton by February 10. It also told Croton that it was likely that, by April 30, Croton would receive an additional $200 of taxes with final returns, but that tax refunds would probably be $300. (Remember that "available" for income taxes is defined as taxes expected to be collected within 120 days after the end of the calendar year.) 12. Police officers who retired at the end of 2019 wil be paid $10 for unused vacation pay on January 6, 2020

If you could format it in a table like what i have to fill in, it would be much appreciated!

If you could format it in a table like what i have to fill in, it would be much appreciated!