If you could include the formulas that would be great:)

If you could include the formulas that would be great:)

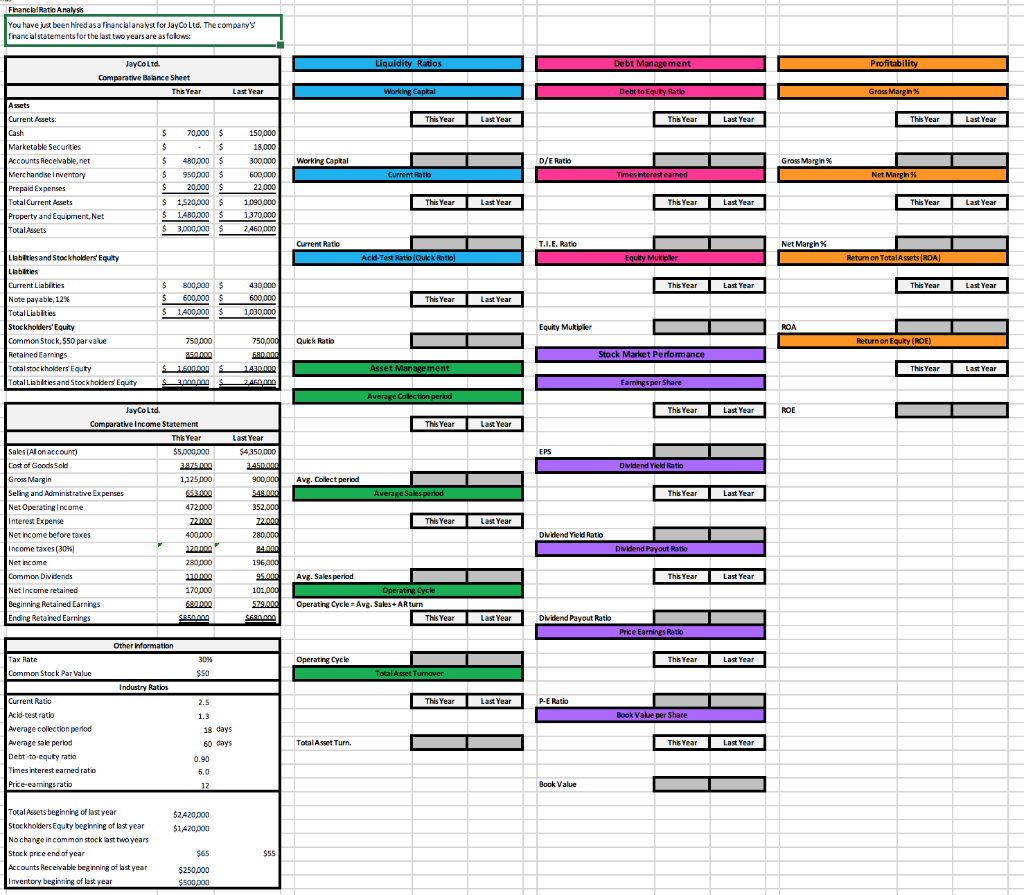

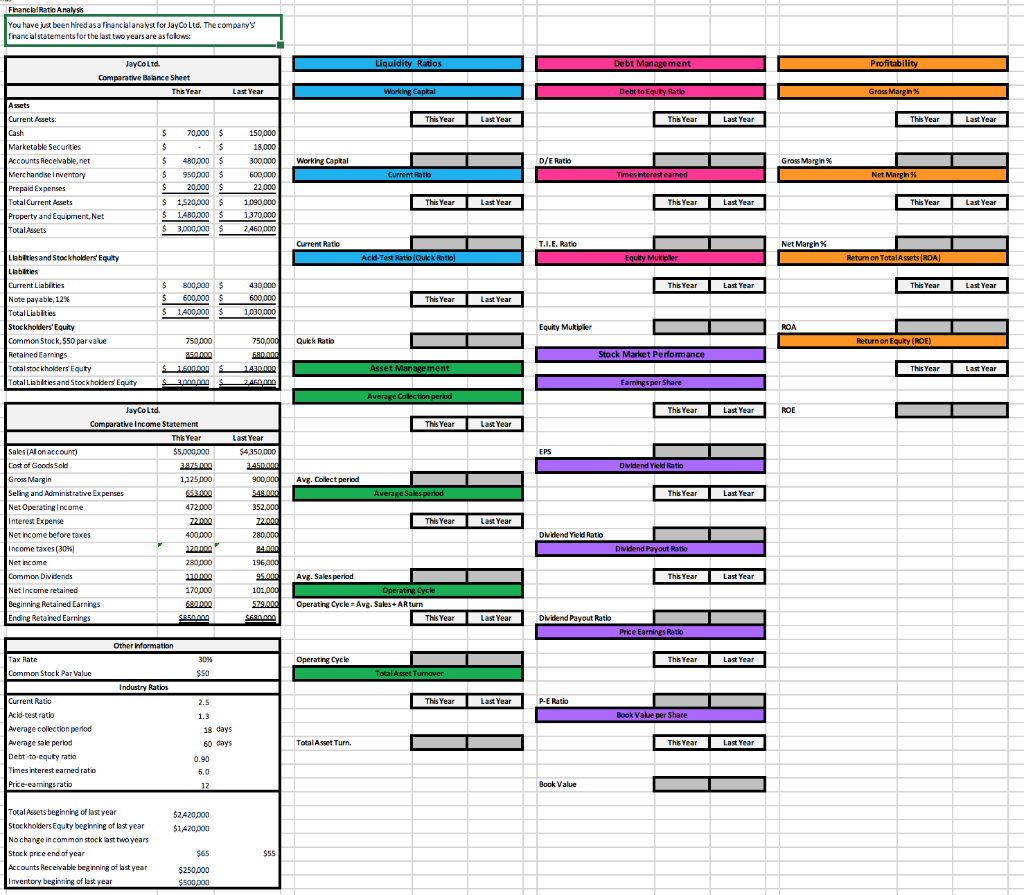

Financial Ratio Analys You have just been hired as a financial analyst for JayCo Ltd. The company's financial statements for the last two years are as folows: Liquidity Ratios Debt Management Profitability JayColtd. Comparative Balance Sheet This Year Last Year Working Capital Debt to Equity Ratio Gross Margin Assets Current Assets This Year Last Year This Year Last Year This Year Last Year Cash $ $ $ $ $ $ $ Working Capital D/E Ratio Gross Margin Current Ratio Times interesteamed Net Margin Marketable Securities Accounts Receivablenet Merchandise inventory Prepaid Expenses Total Current Assets Property and Equipment, Net Total Assets 70,000 - 480,000 950.000 20.000 1,520,000 1480000 3.000.000 $ $ 150,000 18,000 300,000 600,000 22.000 1090,000 1370000 2460.000 This Year Last Year This Year Last Year This Year $ $ $ $ Current Ratio Net Marein Acid-Test Ratio (Quick Ratio Equity Mutter Return on Total Assets RDA This Year This Year Last Year $ $ $ 800.000 $ 600,000 $ 1.400,000 $ 430,000 600,000 1,030,000 This Year Last Year Llabilities and Stockholders' Equity Liabilities Current Liabilities Note payable, 12% Total Liabities Stockholders' Equity Common Stock. $50 par value Retained Earnings Total stockholders Equity Total Liabilities and Stockholders' Equity Equity Mukipler 750,000 Quick Ratio Return an Equity (ROE) 750.000 85.000 BERAD SA Stock Market Performance $ Asset Management This Year Last Year 1430.000 AED S Earnings per Share Average Collection period This Year Last Year ROE This Year Last Year lase Year Dividend Yield Ratia Gross Margin Ave, Collect period Average Sales period This Year Last Year Jay Co Ltd Comparative Income Statement This Year Sales (Al on account) $5,000,000 Cost of Goods Sold 38250g 1,125 poo Seling and Administrative Expenses 6522 Net Operating Income 472.000 Interest Expense 22.000 Net income before taxes 400.000 Income taxes (30%) 270000 Net Income 280 poo Common Dividends 310000 Net Income retained 170.000 Beginning Retained Earnings Ending Retained Earnings SABO This Year Last Year $4350,000 2450 900,000 549.004 352,000 22.000 280,000 84.000 196,000 95.000 101,000 579.000 $690.00 Dividend Yield Ratio Dividend Payout Ratio This Year Last Year Avg. Sales period Operating Cycle Operating Cycle = Avg. Sales+ ARturn This Year Last Year Dividend Payout Ratio Price Earnings Ratio Other Information Operating Cycle This Year Last Year Tax Rate Common Stock Par Value 30% $50 Total Awet Turnover Industry Ratios 2.5 This Year Last Year P-E Ratio Book Vale per Share Current Ratio Acid-test ratio Average collection period Average sale period Debt-to-equity ratio Times interest earned ratio Price-eamingsratio 1.3 18 days 60 days 0.90 6.0 Total Asset Turn. This Year Last Year Book Value $2,420,000 $1,420.000 Total Assets beginning of last year Stockholders Equity beginning of last year No change in common stock last two years Stock price end of year Accounts Receivable beginning of last year inventory beginning of last year SSS $65 $250,000 $500,000

If you could include the formulas that would be great:)

If you could include the formulas that would be great:)