Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If you could show your calculator strokes so that I can see how you did the problem and know how to do future problems that

If you could show your calculator strokes so that I can see how you did the problem and know how to do future problems that may be similar that would be wonderful!

thank you!!!

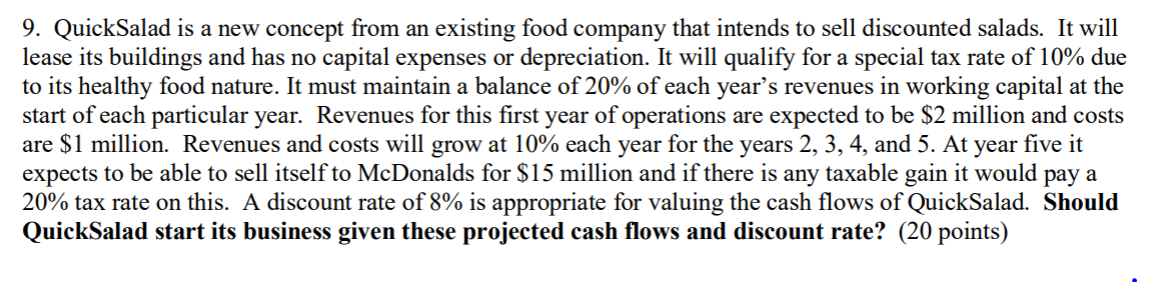

9. QuickSalad is a new concept from an existing food company that intends to sell discounted salads. It will lease its buildings and has no capital expenses or depreciation. It will qualify for a special tax rate of 10% due to its healthy food nature. It must maintain a balance of 20% of each year's revenues in working capital at the start of each particular year. Revenues for this first year of operations are expected to be $2 million and costs are $1 million. Revenues and costs will grow at 10% each year for the years 2, 3, 4, and 5. At year five it expects to be able to sell itself to McDonalds for $15 million and if there is any taxable gain it would pay a 20% tax rate on this. A discount rate of 8% is appropriate for valuing the cash flows of QuickSalad. Should QuickSalad start its business given these projected cash flows and discount rate? (20 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started