Answered step by step

Verified Expert Solution

Question

1 Approved Answer

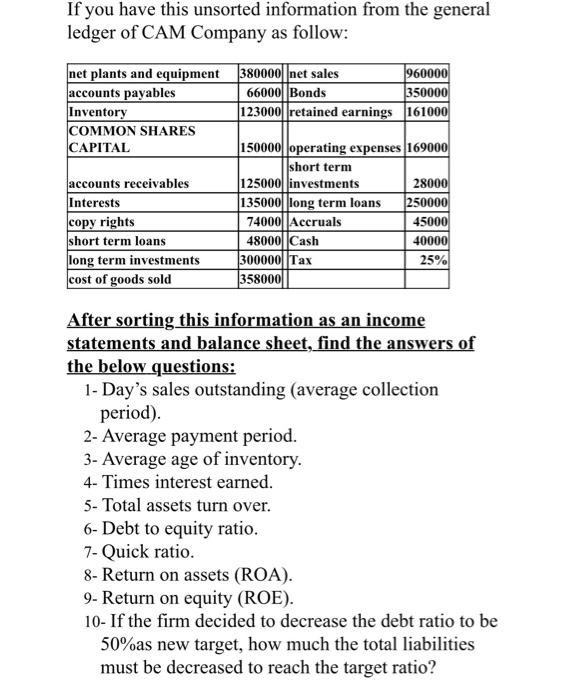

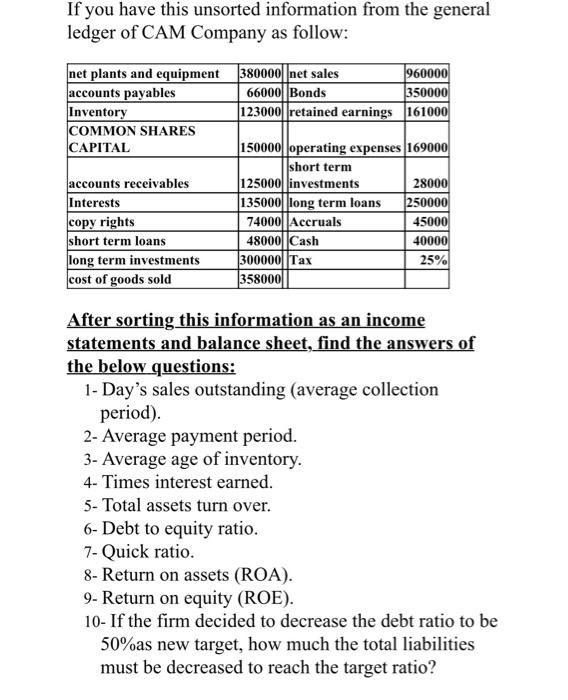

If you have this unsorted information from the general ledger of CAM Company as follow: net plants and equipment 380000 net sales 960000 accounts payables

If you have this unsorted information from the general ledger of CAM Company as follow:

net plants and equipment

380000

net sales

960000

accounts payables

66000

Bonds

350000

Inventory

123000

retained earnings

161000

COMMON SHARES CAPITAL

150000

operating expenses

169000

accounts receivables

125000

short term investments

28000

Interests

135000

long term loans

250000

copy rights

74000

Accruals

45000

short term loans

48000

Cash

40000

long term investments

300000

Tax

25%

cost of goods sold

358000

After sorting this information as an income statements and balance sheet, find the answers of the below questions:

1- Days sales outstanding (average collection period).

2- Average payment period.

3- Average age of inventory.

4- Times interest earned.

5- Total assets turn over.

6- Debt to equity ratio.

7- Quick ratio.

8- Return on assets (ROA).

9- Return on equity (ROE).

10- If the firm decided to decrease the debt ratio to be 50%as new target, how much the total liabilities must be decreased to reach the target ratio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started