Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There are three (3) types of textbook based homework items located at the end of each chapter. These include Discussion Questions (DQ), Exercises (E),

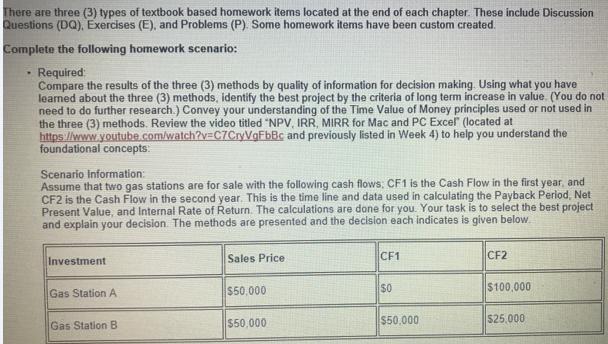

There are three (3) types of textbook based homework items located at the end of each chapter. These include Discussion Questions (DQ), Exercises (E), and Problems (P). Some homework items have been custom created. Complete the following homework scenario: Required: Compare the results of the three (3) methods by quality of information for decision making. Using what you have leaned about the three (3) methods, identify the best project by the criteria of long term increase in value. (You do not need to do further research.) Convey your understanding of the Time Value of Money principles used or not used in the three (3) methods. Review the video titled "NPV, IRR, MIRR for Mac and PC Excel (located at https //www.youtube.com/watch?v=C7CryVgFbBc and previously listed in Week 4) to help you understand the foundational concepts: Scenario Information: Assume that two gas stations are for sale with the following cash flows; CF1 is the Cash Flow in the first year, and CF2 is the Cash Flow in the second year. This is the time line and data used in calculating the Payback Period, Net Present Value, and Internal Rate of Return. The calculations are done for you. Your task is to select the best project and explain your decision. The methods are presented and the decision each indicates is given below. Investment Sales Price CF1 CF2 Gas Station A $50,000 $0 $100,000 $50,000 $50,000 $25,000 Gas Station B

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Among the three methods the method of payback period does not use time value of money principle in a quantitative manner and uses a thumbrule criteria This is actually a accounting method and should n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started