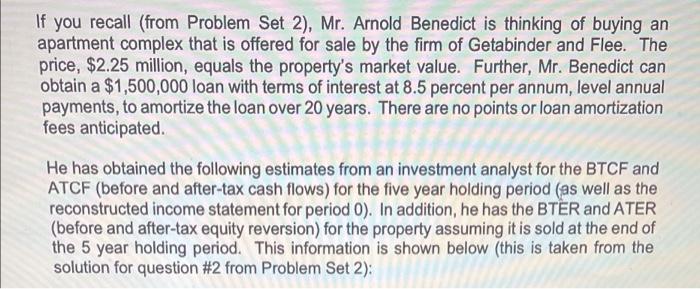

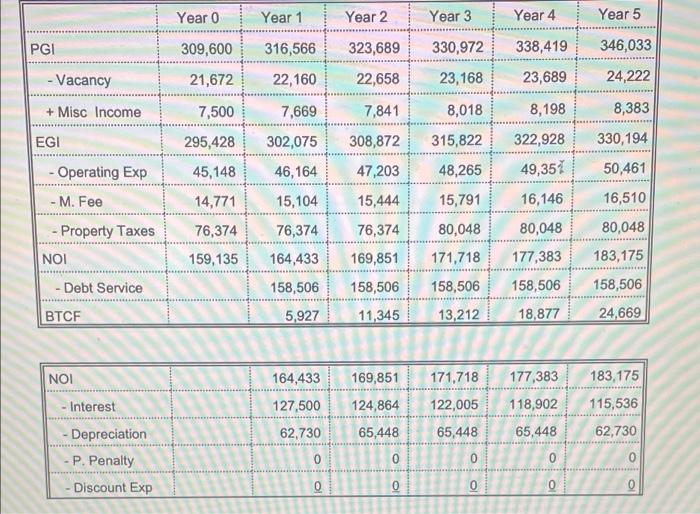

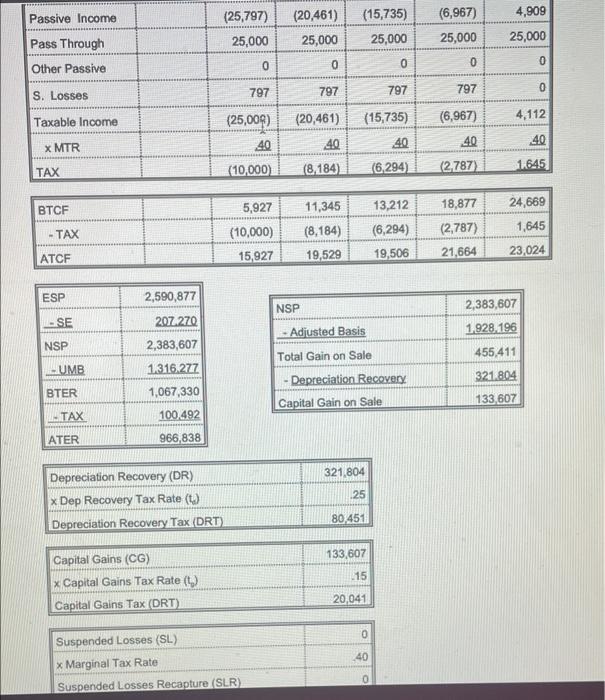

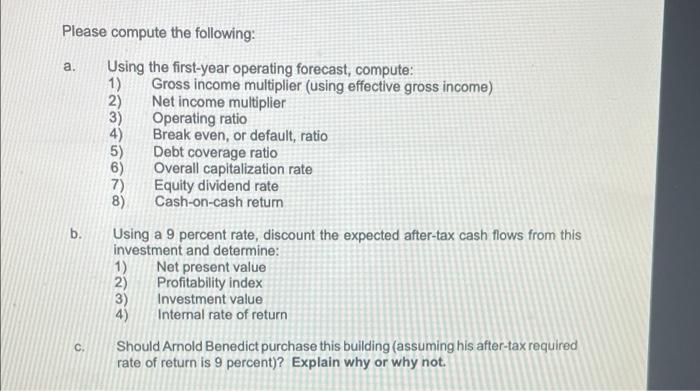

If you recall (from Problem Set 2), Mr. Arnold Benedict is thinking of buying an apartment complex that is offered for sale by the firm of Getabinder and Flee. The price, $2.25 million, equals the property's market value. Further, Mr. Benedict can obtain a $1,500,000 loan with terms of interest at 8.5 percent per annum, level annual payments, to amortize the loan over 20 years. There are no points or loan amortization fees anticipated He has obtained the following estimates from an investment analyst for the BTCF and ATCF (before and after-tax cash flows) for the five year holding period (as well as the reconstructed income statement for period 0). In addition, he has the BTER and ATER (before and after-tax equity reversion) for the property assuming it is sold at the end of the 5 year holding period. This information is shown below (this is taken from the solution for question #2 from Problem Set 2): Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 PGI 323,689 330,972 338,419 346,033 309,600 21,672 7,500 316,566 22,160 - Vacancy 22,658 23,168 23,689 24,222 + Misc Income 7,841 8,018 8,198 8,383 7,669 302,075 EGI 295,428 308,872 315,822 330,194 322,928 49,357 45,148 47,203 48,265 50,461 46,164 15,104 15,444 15,791 16,146 16,510 - Operating Exp - M. Fee - Property Taxes NOI 14,771 76,374 159,135 76,374 80,048 80,048 76,374 164,433 80,048 183,175 169,851 177,383 171,718 158,506 - Debt Service 158,506 158,506 158,506 158,506 5,927 BTCF 11,345 13,212 18,877 24,669 NOI 164,433 169,851 171.718 183,175 177,383 118,902 Interest 127,500 124,864 122,005 115,536 62,730 65,448 65,448 65,448 62,730 - Depreciation P. Penalty Discount Exp 0 o 0 0 0 0 0 0 0 Passive Income (15,735) 4,909 (25,797) 25,000 (20,461) 25,000 (6,967) 25,000 Pass Through 25,000 25,000 0 0 0 0 0 Other Passive 797 797 S. Losses 797 797 0 Taxable income (15,735) 4,112 (6,967) (25,000) 40 (10,000 (20,461) 40 X MTR 40 40 40 (8,184) TAX (6294) (2.787) 1645 24,669 BTCF 5,927 (10,000) 15,927 TAX 11,345 (8,184) 19,529 13,212 (6,294) 19,506 18,877 (2,787) 21,664 1,645 23,024 ATCF ESP 2,590,877 NSP - SE 207270 2,383,607 1,928.196 - Adjusted Basis NSP 2,383,607 Total Gain on Sale 455,411 -UMB 1.316.277 1,067,330 321.804 BTER - Depreciation Recovery Capital Gain on Sale 133,607 TAX 100,492 ATER 966,838 321,804 25 Depreciation Recovery (DR) x Dep Recovery Tax Rate () Depreciation Recovery Tax (DRT) 80,4511 133,607 15 Capital Gains (CG) x Capital Gains Tax Rate (t) Capital Gains Tax (DRT) 20.041 0 40 Suspended Losses (SL) x Marginal Tax Rate Suspended Losses Recapture (SLR) 0 Please compute the following: a. Using the first-year operating forecast, compute: 1) Gross income multiplier (using effective gross income) 2) Net income multiplier 3) Operating ratio Break even, or default, ratio 5) Debt coverage ratio 6) Overall capitalization rate 7) Equity dividend rate 8) Cash-on-cash return Using a 9 percent rate, discount the expected after-tax cash flows from this investment and determine: 1) Net present value 2) Profitability index 3) Investment value 4) Internal rate of return Should Arnold Benedict purchase this building (assuming his after-tax required rate of return is 9 percent)? Explain why or why not. b. eeee c