Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If you see it, please help me solve this problem in time, special thanks Question 1 (a) The financial performance of QQ is rapidly declining,

If you see it, please help me solve this problem in time, special thanks

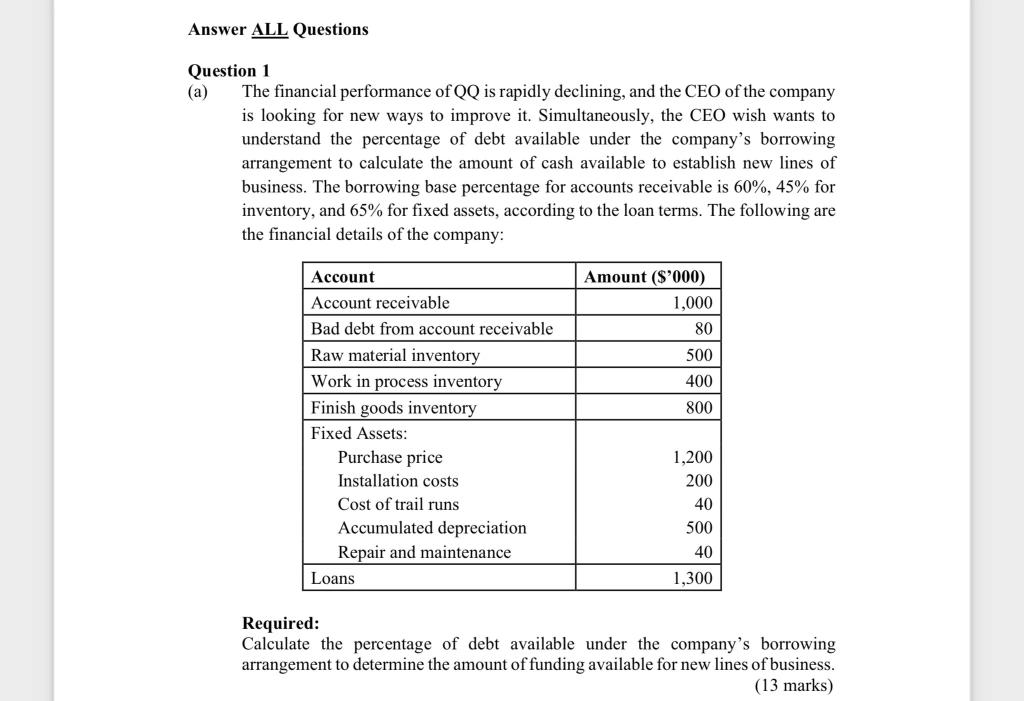

Question 1 (a) The financial performance of QQ is rapidly declining, and the CEO of the company is looking for new ways to improve it. Simultaneously, the CEO wish wants to understand the percentage of debt available under the company's borrowing arrangement to calculate the amount of cash available to establish new lines of business. The borrowing base percentage for accounts receivable is 60%,45% for inventory, and 65% for fixed assets, according to the loan terms. The following are the financial details of the company: Required: Calculate the percentage of debt available under the company's borrowing arrangement to determine the amount of funding available for new lines of business. (13 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started