Answered step by step

Verified Expert Solution

Question

1 Approved Answer

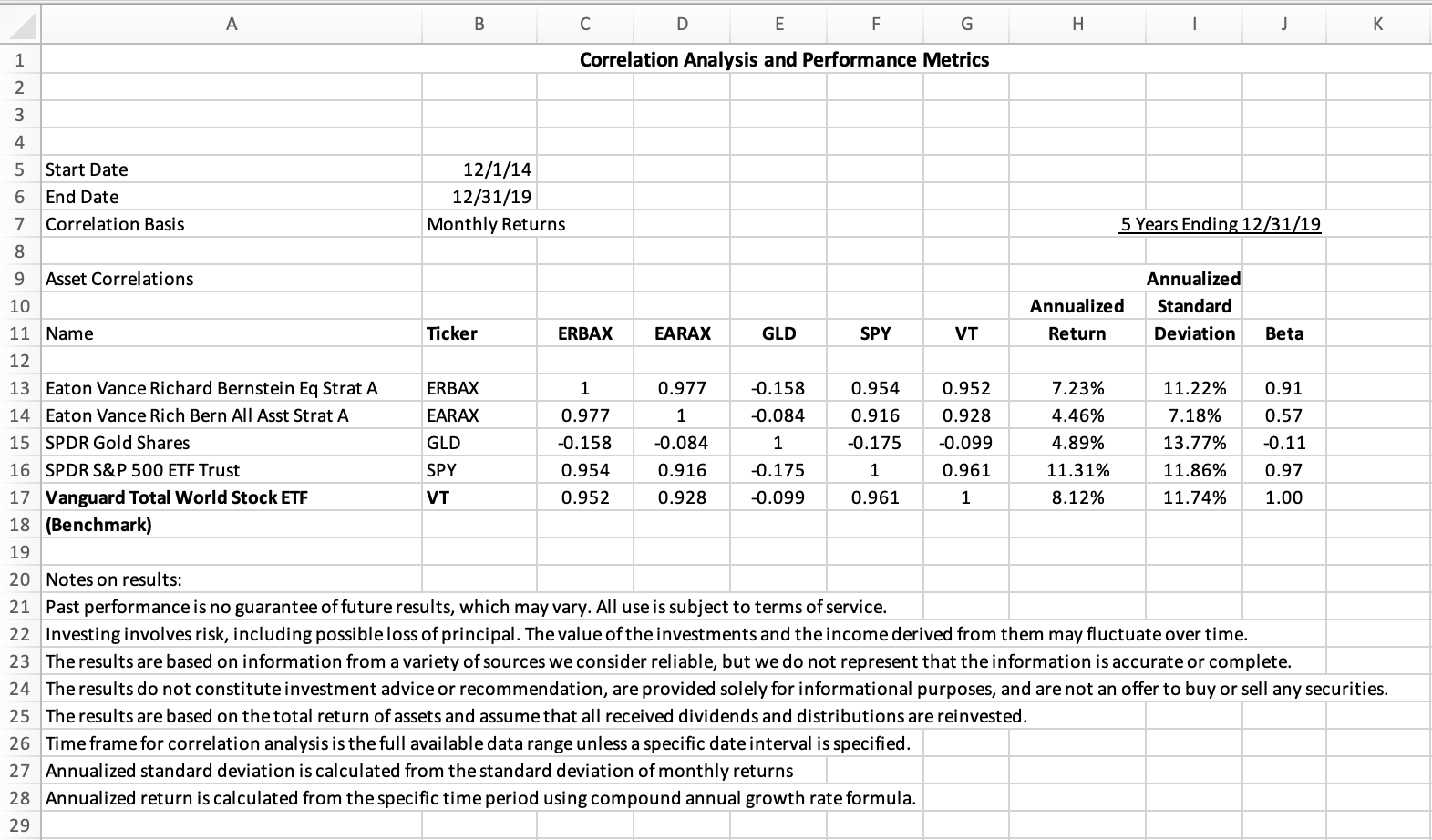

If you were given $1,000,000 to buy into any combination of the 5 funds in the spreadsheet, which allocation would you choose, based on your

- If you were given $1,000,000 to buy into any combination of the 5 funds in the spreadsheet, which allocation would you choose, based on your risk/return preferences? Calculate your weighted average portfolio return and portfolio beta based on the historical 5-year annualized returns.

I was thinking of going with either the EARAX or ERBAX, in addition to the SPDR Gold Shares and SPDR S&P 500 STF Trust. Just need to calculate the weighted average and beta for the three together. Please explain why EARAX or ERBAX is better. Also, why the combination of the three together would make for the risk/return preferences.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started