Answered step by step

Verified Expert Solution

Question

1 Approved Answer

if you zoom into the first and second picture, you'll see the question asks for one to develop a multi-step income statement. Question 12 GOOD

if you zoom into the first and second picture, you'll see the question asks for one to develop a multi-step income statement.

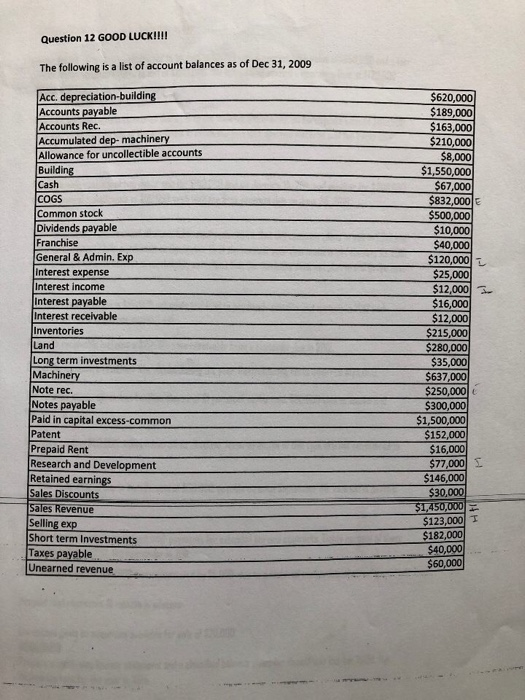

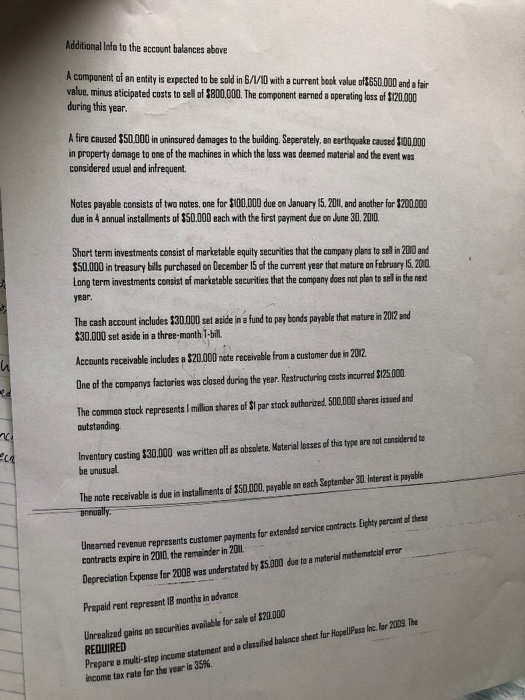

Question 12 GOOD LUCK!!!! The following is a list of account balances as of Dec 31, 2009 Acc. depreciation-building Accounts payable Accounts Rec. Accumulated dep-machinery Allowance for uncollectible accounts Building Cash COGS Common stock Dividends payable Franchise General & Admin. Exp interest expense Interest income Interest payable Interest receivable Inventories Land Long term investments Machinery Note rec. Notes payable Pald in capital excess-common Patent Prepaid Rent Research and Development Retained earnings Sales Discounts Sales Revenue Selling exp Short term Investments Taxes payable Unearned revenue $620,000 $189,000 $163,000 $210,000 $8,000 $1,550,000 $67,000 $832,000 $500,000 $10,000 $40,000 $120,000 $25,000 $12,000 $16,000 $12,000 $215,000 $280,000 $35,000 $637,000 $250,000 $300.000 $1,500,000 $152,000 $16,000 $77,000 I $146.000 $30,000 $1,450,000 $123,000 I $182,000 $40,000 $60,000 Additional Inta to the account balances above A component of an entity is expected to be sold in B//10 with a current book value of$650.000 and a fair value, minus aticipated costs to sell of $800.000. The component earned a operating loss of $120.000 during this year. A fire caused $50,000 in uninsured damages to the building. Seperately, an earthquake caused $100,000 in property damage to one of the machines in which the loss was deemed material and the event was considered usual and infrequent. Notes payable consists of two notes, one for $100.000 due on January 15, 2011, and another for $200.000 due in 4 annual installments of $50.000 each with the first payment due on June 30, 2010. Short term investments consist of marketable equity securities that the company plans to sell in 2010 and $50,000 in treasury Bills purchased on December 15 of the current year that mature on February 15,200. Long term investments consist of marketable securities that the company does not plan to sell in the next year. The cash account includes $30.000 set aside in a fund to pay bonds payable that mature in 2012 and $30,000 set aside in a three-month T-bill Accounts receivable includes a $20.000 note receivable from a customer due in 2012. One of the companys factories was closed during the year. Restructuring costs incurred $125.000 The common stock represents I million shares of SI par stock authorized, 500.000 shares issued and outstanding Inventory costing $30.000 was written off as obsolete. Material losses of this type are not considered to be unusual. The note receivable is due in installments of $50.000. payable on each September 30. Interest is payable annually. Uneamed revenue represents customer savments for extended service contracts Fighly percent of these contracts expire in 2010 the remainder in 2011. - Depreciation Expense for 2008 was understated by $5.000 due to a material mathematial error Prepaid rent represent 18 months in advance Unrealized gains on securities available for sale of $20,000 REQUIRED Prepare a multi-step income statement and a classified balance sheet for HopelPuss Inc. for 2008 The income tax rate for the year is 35% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started