ignore the pic with nestle info***

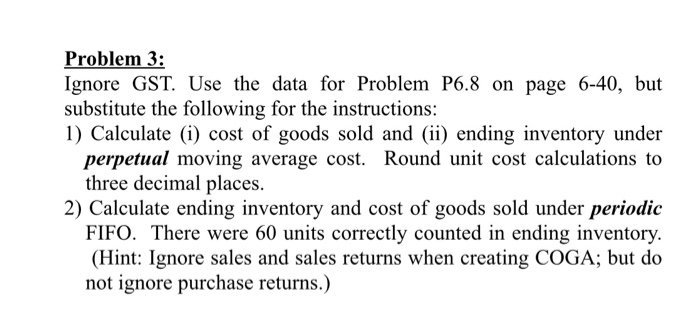

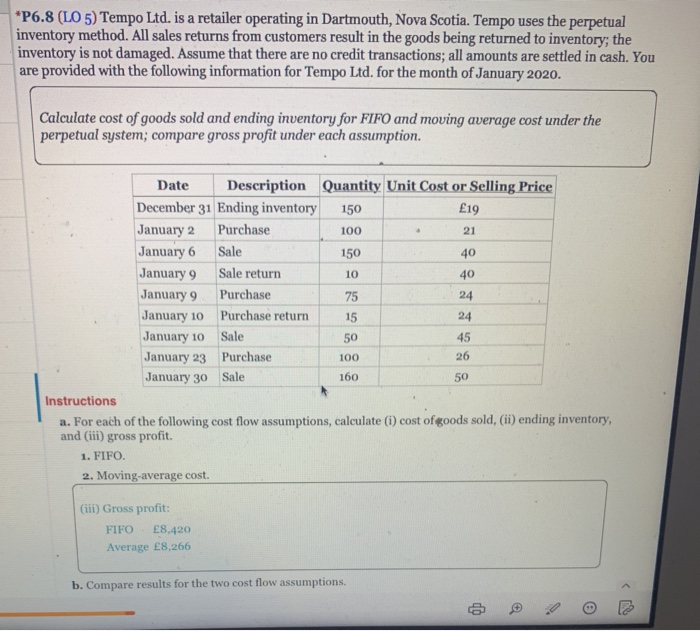

Problem 3: Ignore GST. Use the data for Problem P6.8 on page 6-40, but substitute the following for the instructions: 1) Calculate (i) cost of goods sold and (ii) ending inventory under perpetual moving average cost. Round unit cost calculations to three decimal places. 2) Calculate ending inventory and cost of goods sold under periodic FIFO. There were 60 units correctly counted in ending inventory. (Hi: Ignore sales and sales returns when creating COGA; but do not ignore purchase returns.) Comparative Analysis Problem: Nestl SA (CHE) vs. Delfi.Limited (SGP) CT6.2 Nestl's financial statements are presented in Appendix B. Financial statements of Delfi Limited are presented in Appendix C. Instructions a. Based on the information contained in these financial statements, compute the following ratios for each company for the most recent year shown. 1. Inventory turnover. (Round to one decimal.) 2. Days in inventory. (Round to nearest day.) b. What conclusions concerning the management of the inventory can you draw from these data? Real-World Focus P6.8 (LO 5) Tempo Ltd. is a retailer operating in Dartmouth, Nova Scotia. Tempo uses the perpetual inventory method. All sales returns from customers result in the goods being returned to inventory; the inventory is not damaged. Assume that there are no credit transactions; all amounts are settled in cash. You are provided with the following information for Tempo Ltd. for the month of January 2020. Calculate cost of goods sold and ending inventory for FIFO and moving average cost under the perpetual system; compare gross profit under each assumption. Quantity Unit Cost or Selling Price Description Date December 31 Ending inventory January 2Purchase January 6 Sale January 9 Sale return January 9 Purchase January 10 Purchase return January 10 Sale January 23 Purchase January 30 Sale 19 21 40 40 24 24 45 26 50 150 100 150 10 75 15 50 100 160 Instructions l a. For each of the following cost flow assumptions, calculate () cost of goods sold, (ii) ending inventory and (iii) gross profit. 1. FIFO 2. Moving-average cost. (iii) Gross profit: FIFO 8,420 Average 8,266 b. Compare results for the two cost flow assumptions