Answered step by step

Verified Expert Solution

Question

1 Approved Answer

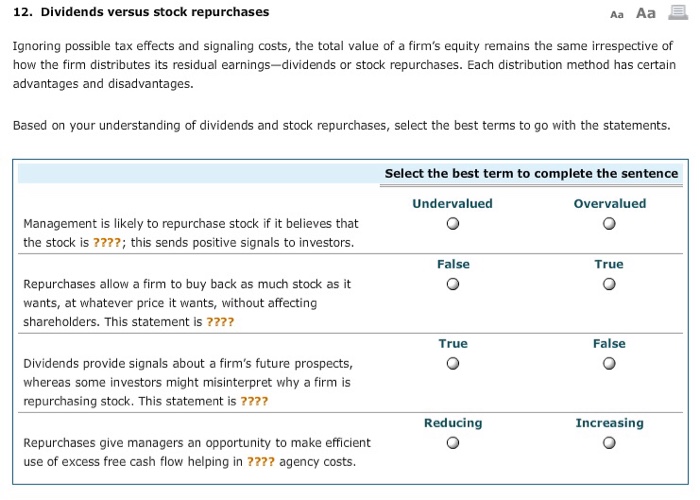

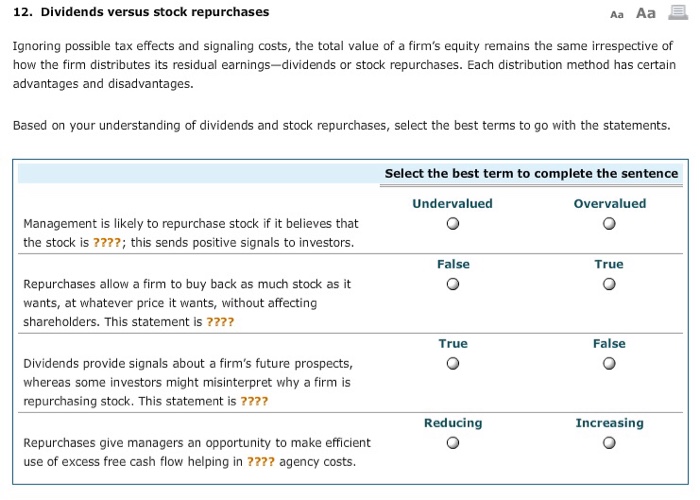

Ignoring possible tax effects and signaling costs, the total value of a firm's equity remains the same irrespective of how the firm distributes its residual

Ignoring possible tax effects and signaling costs, the total value of a firm's equity remains the same irrespective of how the firm distributes its residual earnings-dividends or stock repurchases. Each distribution method has certain advantages and disadvantages. Based on your understanding of dividends and stock repurchases, select the best terms to go with the statements. Management is likely to repurchase stock if it believes that the stock is ????; this sends positive signals to investors. Undervalued Overvalued Repurchases allow a firm to buy back as much stock as it wants, at whatever price it wants, without affecting shareholders. This statement is ???? True False Dividends provide signals about a firm's future prospects, whereas some investors might misinterpret why a firm is repurchasing stock. This statement is ???? True False Repurchases give managers an opportunity to make efficient use of excess free cash flow helping in ???? agency costs. Reducing Increasing

Ignoring possible tax effects and signaling costs, the total value of a firm's equity remains the same irrespective of how the firm distributes its residual earnings-dividends or stock repurchases. Each distribution method has certain advantages and disadvantages. Based on your understanding of dividends and stock repurchases, select the best terms to go with the statements. Management is likely to repurchase stock if it believes that the stock is ????; this sends positive signals to investors. Undervalued Overvalued Repurchases allow a firm to buy back as much stock as it wants, at whatever price it wants, without affecting shareholders. This statement is ???? True False Dividends provide signals about a firm's future prospects, whereas some investors might misinterpret why a firm is repurchasing stock. This statement is ???? True False Repurchases give managers an opportunity to make efficient use of excess free cash flow helping in ???? agency costs. Reducing Increasing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started