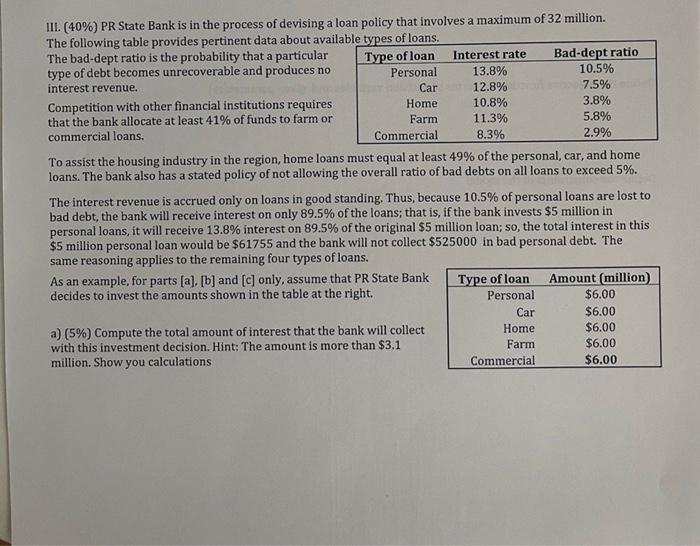

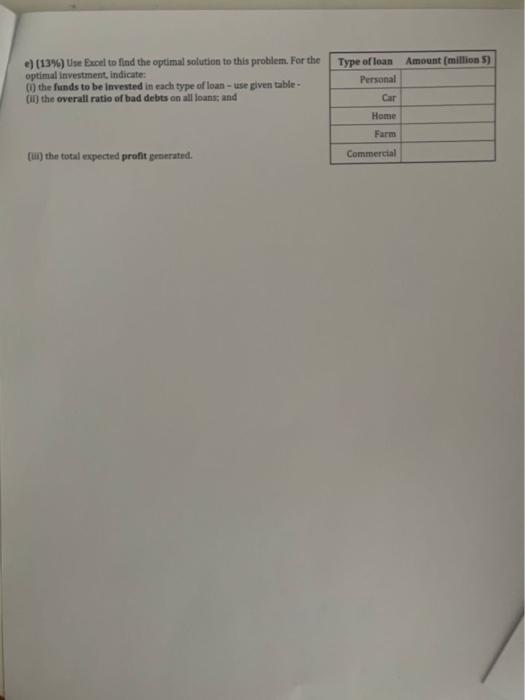

III. (40%) PR State Bank is in the process of devising a loan policy that involves a maximum of 32 million. The following table provides pertinent data about availabla timee nflnane The bad-dept ratio is the probability that a particular type of debt becomes unrecoverable and produces no interest revenue. Competition with other financial institutions requires that the bank allocate at least 41% of funds to farm or commercial loans. To assist the housing industry in the region, home loans must equal at least 49% of the personal, car, and home loans. The bank also has a stated policy of not allowing the overall ratio of bad debts on all loans to exceed 5%. The interest revenue is accrued only on loans in good standing. Thus, because 10.5% of personal loans are lost to bad debt, the bank will receive interest on only 89.5% of the loans; that is, if the bank invests $5 million in personal loans, it will receive 13.8% interest on 89.5% of the original $5 million loan; so, the total interest in this $5 million personal loan would be $61755 and the bank will not collect $525000 in bad personal debt. The same reasoning applies to the remaining four types of loans. As an example, for parts [a], [b] and [c] only, assume that PR State Bank decides to invest the amounts shown in the table at the right. a) 5%) Compute the total amount of interest that the bank will collect with this investment decision. Hint: The amount is more than $3,1 million. Show you calculations b) (S\%) Compute the total expected amount of bad debt generated by this investment decision. (Hint: This amount is more than $1.8 million.) Show that the profit generated by this investment is more than $1.3 million. Show you calculations c) (S\%) Is this investment decision feasible? Why or not? Clearly justify your answer. d) (12%) Develop a linear programming model to determine the amounts of loans in each category that maximize the total profit for the bank. Define clearly your decision varlables: Define the objective function (in terms of decision variables and given parameters) Define the constraints of the model e) (13\%) Use Escel to find the optimal solution to this problem. For the optimal investment, indicate: (i) the funds to be invested in each type of loan - use given table - (ii) the overall ratio of bad debts on all foans; and (iii) the total expectied profit grtierated. III. (40%) PR State Bank is in the process of devising a loan policy that involves a maximum of 32 million. The following table provides pertinent data about availabla timee nflnane The bad-dept ratio is the probability that a particular type of debt becomes unrecoverable and produces no interest revenue. Competition with other financial institutions requires that the bank allocate at least 41% of funds to farm or commercial loans. To assist the housing industry in the region, home loans must equal at least 49% of the personal, car, and home loans. The bank also has a stated policy of not allowing the overall ratio of bad debts on all loans to exceed 5%. The interest revenue is accrued only on loans in good standing. Thus, because 10.5% of personal loans are lost to bad debt, the bank will receive interest on only 89.5% of the loans; that is, if the bank invests $5 million in personal loans, it will receive 13.8% interest on 89.5% of the original $5 million loan; so, the total interest in this $5 million personal loan would be $61755 and the bank will not collect $525000 in bad personal debt. The same reasoning applies to the remaining four types of loans. As an example, for parts [a], [b] and [c] only, assume that PR State Bank decides to invest the amounts shown in the table at the right. a) 5%) Compute the total amount of interest that the bank will collect with this investment decision. Hint: The amount is more than $3,1 million. Show you calculations b) (S\%) Compute the total expected amount of bad debt generated by this investment decision. (Hint: This amount is more than $1.8 million.) Show that the profit generated by this investment is more than $1.3 million. Show you calculations c) (S\%) Is this investment decision feasible? Why or not? Clearly justify your answer. d) (12%) Develop a linear programming model to determine the amounts of loans in each category that maximize the total profit for the bank. Define clearly your decision varlables: Define the objective function (in terms of decision variables and given parameters) Define the constraints of the model e) (13\%) Use Escel to find the optimal solution to this problem. For the optimal investment, indicate: (i) the funds to be invested in each type of loan - use given table - (ii) the overall ratio of bad debts on all foans; and (iii) the total expectied profit grtierated