Answered step by step

Verified Expert Solution

Question

1 Approved Answer

III. In this question, we consider policy choices when the real exchange rate is too high and the nominal exchange rate is fixed. An

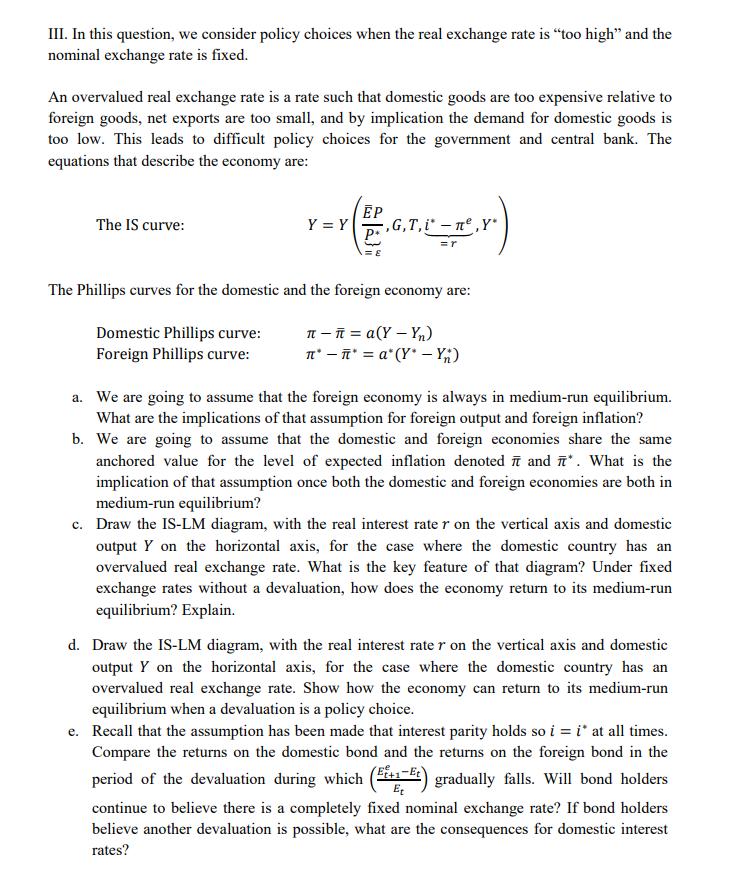

III. In this question, we consider policy choices when the real exchange rate is "too high" and the nominal exchange rate is fixed. An overvalued real exchange rate is a rate such that domestic goods are too expensive relative to foreign goods, net exports are too small, and by implication the demand for domestic goods is too low. This leads to difficult policy choices for the government and central bank. The equations that describe the economy are: EP The IS curve: Y = Y x( ,G,T,i-ne,Y* P+ The Phillips curves for the domestic and the foreign economy are: Domestic Phillips curve: t - = a(Y - Y) ** = a* (Y* - Y) Foreign Phillips curve: a. We are going to assume that the foreign economy is always in medium-run equilibrium. What are the implications of that assumption for foreign output and foreign inflation? b. We are going to assume that the domestic and foreign economies share the same anchored value for the level of expected inflation denoted and *. What is the implication of that assumption once both the domestic and foreign economies are both in medium-run equilibrium? c. Draw the IS-LM diagram, with the real interest rate r on the vertical axis and domestic output Y on the horizontal axis, for the case where the domestic country has an overvalued real exchange rate. What is the key feature of that diagram? Under fixed exchange rates without a devaluation, how does the economy return to its medium-run equilibrium? Explain. d. Draw the IS-LM diagram, with the real interest rate r on the vertical axis and domestic output Y on the horizontal axis, for the case where the domestic country has an overvalued real exchange rate. Show how the economy can return to its medium-run equilibrium when a devaluation is a policy choice. e. Recall that the assumption has been made that interest parity holds so i = i* at all times. Compare the returns on the domestic bond and the returns on the foreign bond in the (Et+1-Et) period of the devaluation during which gradually falls. Will bond holders Et continue to believe there is a completely fixed nominal exchange rate? If bond holders believe another devaluation is possible, what are the consequences for domestic interest rates?

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Implications b T T a YYn 77 ate y yit TI a YYn TI a yy Eu medium ruin e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started