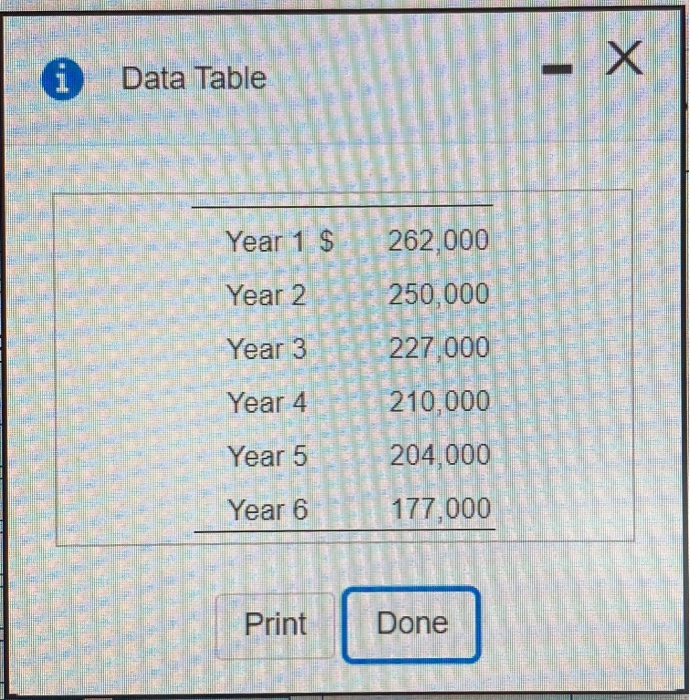

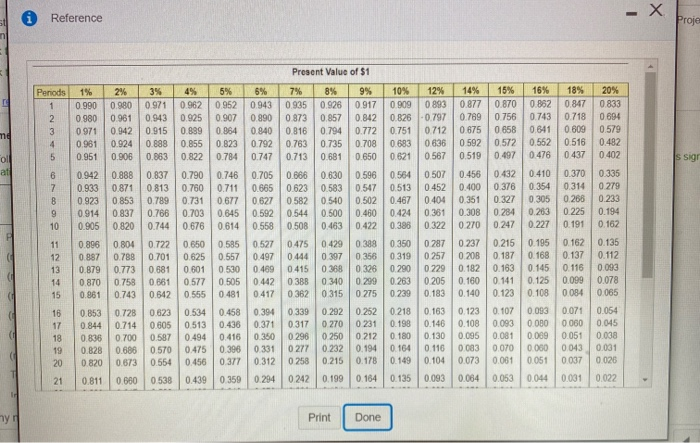

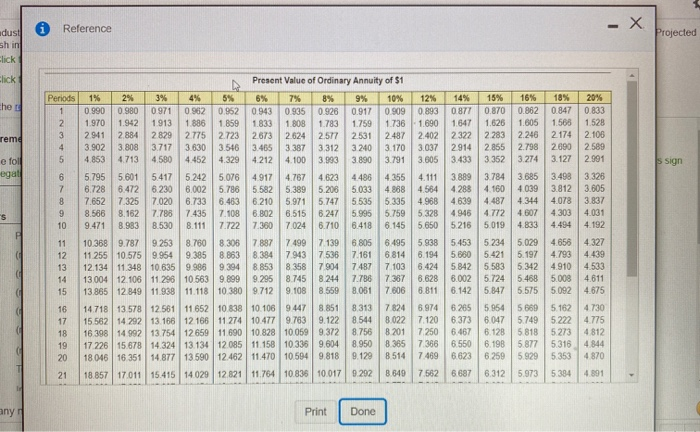

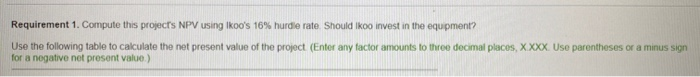

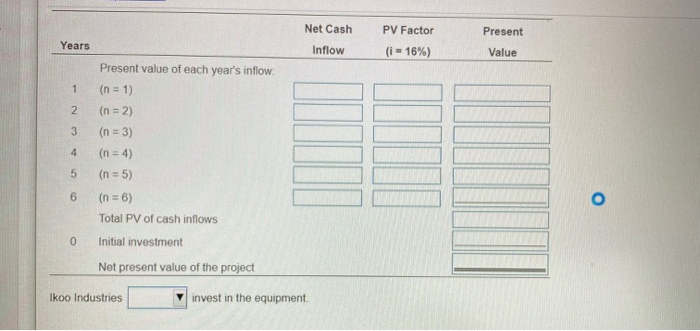

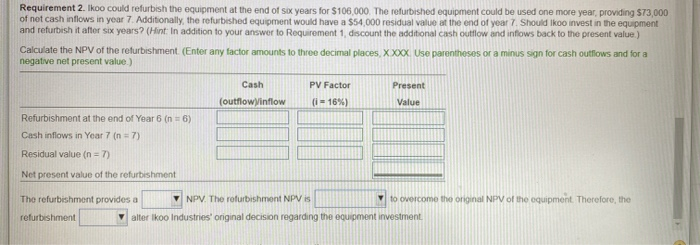

Ikoo Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a sx-year ite and will cost $925,000. Projected net cash inflows are as follows Click the icon to view the projected not cash inflows.) (Click the icon to view Present Value of $1 table) (Click the icon to view Present Value of Ordinary Annuity of S1 table.) Read the requirements X Data Table Year 1 $ Year 2 262,000 250,000 227,000 Year 3 Year 4 210,000 Year 5 204.000 Year 6 177,000 Print Done -X Reference Proje Periods 1% O. 1 2 3 4 5 10% 0 909 0826 0.751 0.683 0.621 0.990 0.980 0971 0961 0.951 nd 20% 0.833 0694 0.579 0.482 0.402 s sign ol at 6 7 8 9 10 0.942 0.933 0.923 0.914 0.905 Present Value of $1 2% 3% 4% 5% 6% 7% 8% 9% 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.961 0.943 0.925 0.907 0.990 0.873 0.857 0.842 0.942 0915 0.899 0.864 0.840 0 816 0.794 0.772 0.924 0.888 0.855 0823 0.792 0.763 0.735 0.708 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0853 0.789 0.731 0.677 0 627 0582 0.540 0.502 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.804 0.722 0.650 0.585 0.527 0.475 0429 0.388 0.788 0.701 0.625 0.557 0.497 0.444 0 397 0.356 0.773 0.681 0.601 0.530 0.489 0.415 0 368 0 326 0.758 0.661 0.577 0.505 0442 0.388 0340 0.299 0.743 0.642 0.555 0.481 0.417 0362 0315 0 275 0.728 0.623 0.534 0.458 0.394 0339 0.292 0.252 0.714 0.605 0513 0.436 0.371 0.317 0270 0 231 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0 212 0.686 0570 0.475 0.396 0.331 0277 0.232 0.194 0.673 0.554 0.456 0377 0.312 0 258 0.215 0.178 0.680 0.538 0.439 0.359 0.294 0.242 0.199 0.164 0.564 0.513 0.467 0424 0.388 12% 14% 15% 16% 18% 0 893 0.877 0.870 0.862 0.847 -0.797 0.769 0 756 0.743 0.718 0712 0.675 0658 0.641 0.609 0.636 0592 0.572 0.552 0.516 0 567 0.519 0.497 0476 0.437 0507 0.456 0.432 0.410 0.370 0.452 0.400 0.376 0.354 0.314 0.404 0 351 0.327 0.305 0.268 0361 0.308 0.284 0.263 0.225 0.322 0.270 0.247 0.227 0.191 0287 0.237 0.215 0.195 0.162 0.257 0 208 0.187 0.168 0.137 0229 0.182 0.163 0.145 0.116 0.205 0.160 0.141 0.125 0.099 0.183 0.140 0.123 0.108 0.084 0.163 0.123 0.107 0.093 0.071 0.146 0.108 0.093 0.080 0060 0.130 0.095 0.081 0.009 0.051 0.116 0.083 0.070 0 000 0.043 0.104 0.073 0.061 0.051 0.037 0.093 0.084 0.053 0.044 0.031 11 12 13 14 15 0.896 0.887 0.879 0.870 0.861 0.335 0279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 16 17 18 19 20 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0 180 0 164 0.149 0.135 0.853 0.844 0.836 0.828 0.820 21 0.811 0.022 1 Print Done Reference - X Projected dust sh in lick Flick! che 1 18% 20% 0.847 0.833 1.566 1.528 2.174 2.105 28902.589 3.127 2.991 remd s sign e foll egal 8 7 652 "S Present Value of Ordinary Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 0990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0877 0.870 0.862 2. 1.970 1.942 1913 1.886 1859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.626 1.605 3 2941 2 884 2829 2.775 2.723 2673 2.624 2.577 2.531 2.487 2.4022322 2.283 2.246 4 3.902 3.808 3.717 3.630 3.546 3.465 3387 3.312 3 240 3.170 3.037 2914 2855 2.798 5 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.352 3.274 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.111 3889 3.784 3.685 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.888 4.564 4.288 4.160 4.039 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4639 4.487 4.344 9 8.586 8.162 7.788 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.328 4946 4.7724.607 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 5019 4.833 11 10.368 9.787 9253 8.760 8.308 7887 7 499 7 139 6805 6.495 5.938 5453 5 234 5.029 12 11 255 10.575 9.954 9.385 8.883 8.384 7.943 7536 7.161 6.814 6.194 5.860 5.421 5.197 13 12.134 11.348 10 635 9988 9.394 8.853 83587904 7.487 7.103 6.424 5.842 5.583 5.342 14 13.004 12 106 11 296 10.563 9.899 9.295 8.745 8 244 7.786 7.367 6.628 6.002 5.724 5.468 15 13.865 12 849 11.938 11.118 10 380 9.712 9.108 8.559 8.051 7.606 6.811 6.142 5.8475.575 16 14.718 13.578 12.561 11652 10 838 10.106 9447 8.851 8.313 7824 6.974 6.265 5.954 5 669 17 15.56214 292 13.166 12 166 11 274 10.4779.783 9.122 8.544 8.022 7.120 6.373 6047 5.749 18 16 398 1499213.754 12 659 11.690 10.828 10.059 9.372 8.756 8201 7250 6.467 6.128 5 818 19 17 226 15.678 14 32413.134 12.085 11.158 10336 9.604 8.950 8 365 7366 6.550 6.198 5 877 20 18.046 16 351 14.87713 590 12.462 11.470 10.5949.818 9.129 8514 7.469 6.623 6.259 5.929 21 18.857 17 011 15.415 14.029 1282111.764 10.836 10.017 9292 8.849 7.562 6 687 6.312 5.973 3.498 3.328 3.812 3.605 4.078 3.837 4.303 4.031 4.494 4.192 4.656 4.327 4.793 4.439 4.910 4.533 5.008 4.611 5.092 4.675 5. 162 4730 5.222 4.775 5273 4812 5.316 4.844 5353 4870 5.384 4.891 any Print Done Requirement 1. Compute this projects NPV using Ikoo's 16% hurdle rate Should Ikoo invest in the equipment? Use the following table to calculate the net present value of the project (Enter any factor amounts to three decimal places, XXXX. Use parentheses or a minus sign for a negative net present value) Net Cash PV Factor Years Present Value Inflow (i - 16%) 1 N 3 4 Present value of each year's inflow (n = 1) (n = 2) (n = 3) (n = 4) (n = 5) (n = 6) Total PV of cash inflows Initial investment Net present value of the project 5 6 0 Ikoo Industries invest in the equipment. Requirement 2. Ikoo could refurbish the equipment at the end of six years for $106,000. The refurbished equipment could be used one more year, providing S73,000 of net cash inflows in year 7. Additionally, the refurbished equipment would have a $54,000 residual value at the end of year 7. Should Ikoo invest in the equipment and refurbish it after six years? (Hint: In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the present value.) Calculate the NPV of the returbishment (Enter any factor amounts to three decimal places, Xxx Use parentheses or a minus sign for cash outflows and for a negative net present value.) Cash (outflow inflow PV Factor (i = 16%) Present Value Refurbishment at the end of Year 6 in 6) Cash inflows in Year 7 (n = 7) Residual value (n = 7) Net present value of the refurbishment The refurbishment provides a NPV. The refurbishment NPV is to overcome the original NPV of the equipment. Therefore, the refurbishment alter Ikoo Industries' original decision regarding the equipment investment