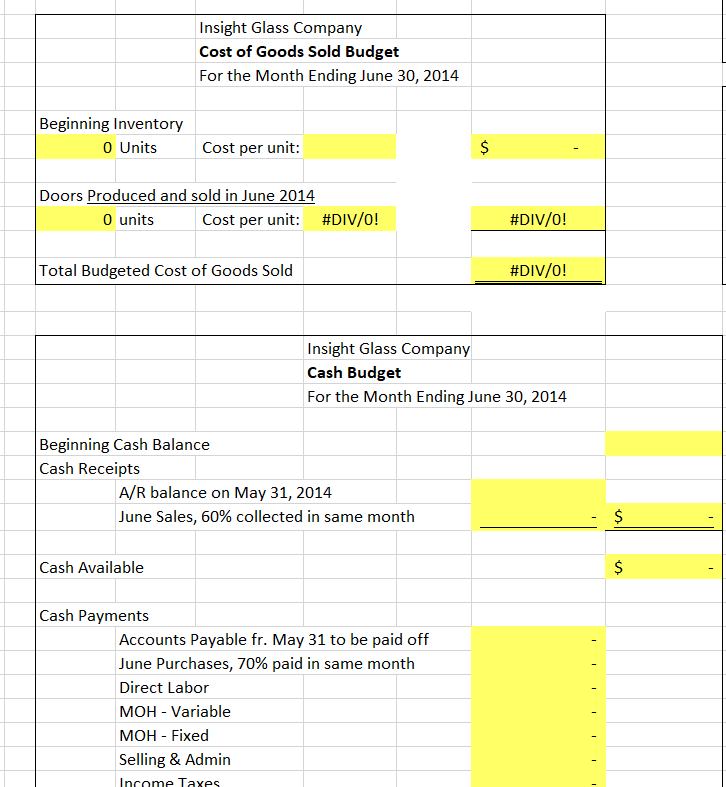

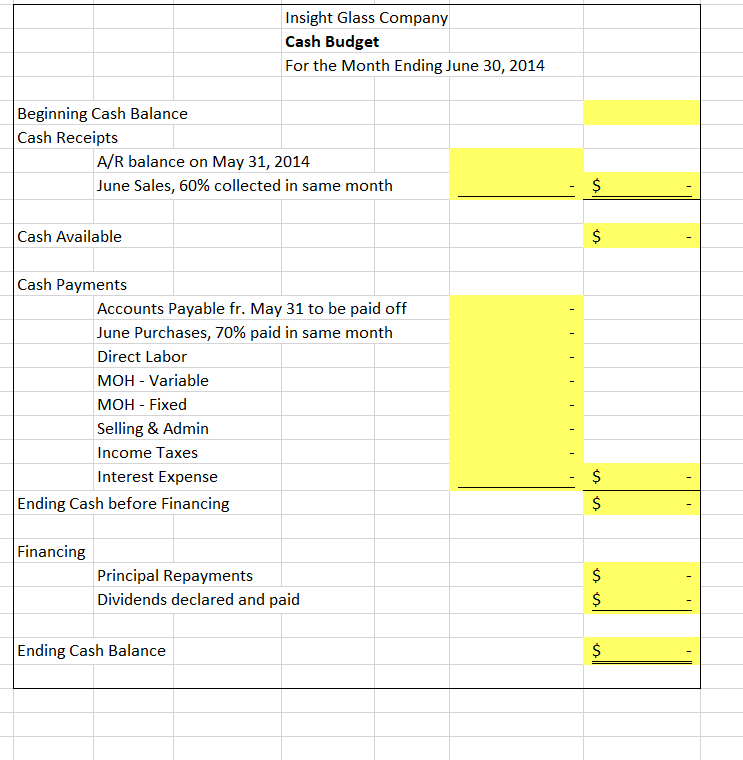

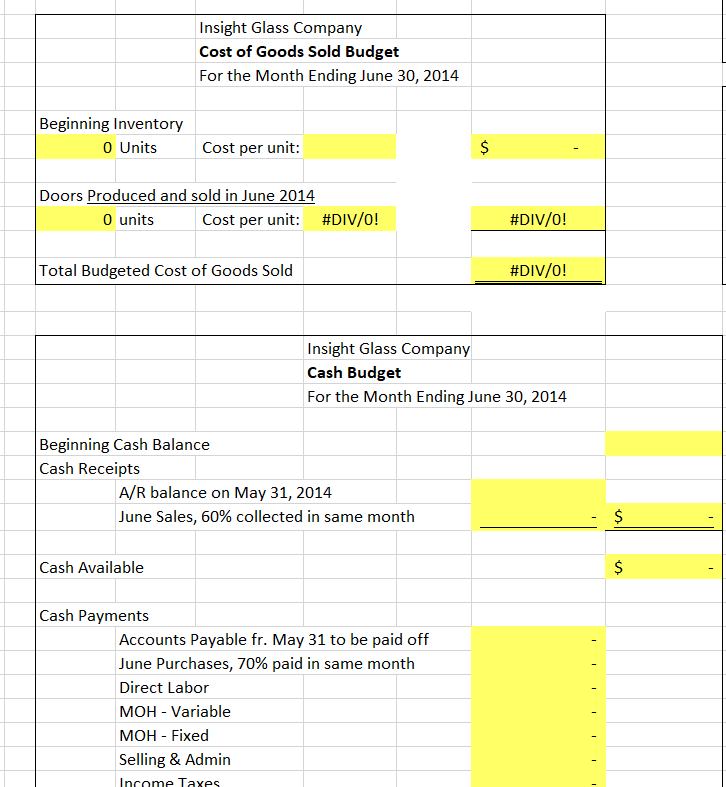

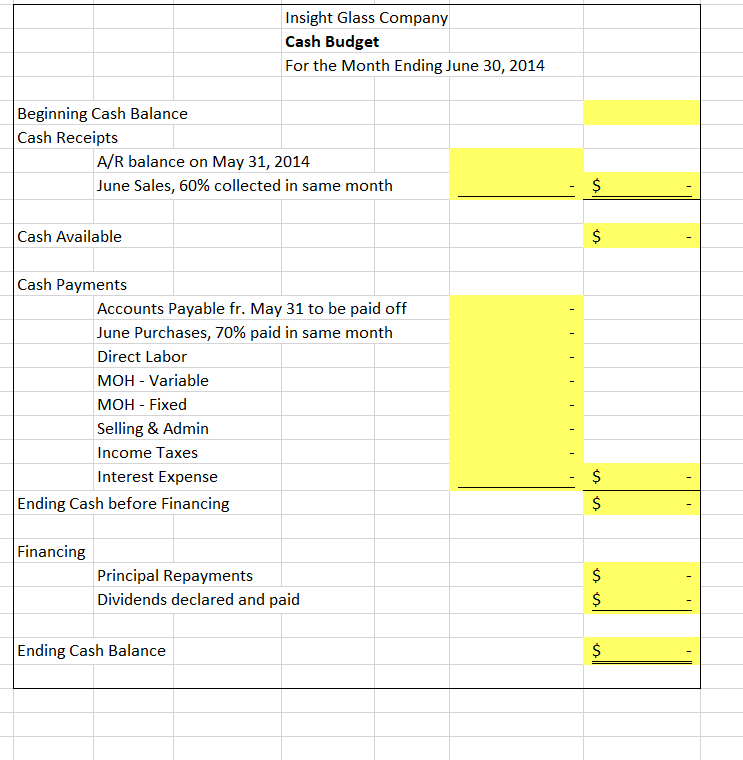

Insight Glass Company Insight Glass makes sliding glass doors for two local construction companies and wants to prepare a master budget for the next month of operation, June 2014. The sales department estimates that it can sell 180 doors in June. Each door retails for $1,100. In order to avoid delays in shipping, management wants to maintain ending inventory each month equal to 10% of the estimated unit sales in that month. Beginning inventory of finished doors is expected to be 20 units as of June 1, 2014 with a per unit cost of $624. Note: The per unit cost of doors produced during June may vary slightly from the per unit cost of June's beginning Finished Goods Inventory (given as $624). In other words, you will need to arrive at a new per unit cost for the month of June. Each door takes 36 square feet of glass and 4 hours of direct labor. Glass purchases are estimated at $10 per square foot and direct labor averages $16 an hour, including benefits. As of June 1s, Insight Glass estimates it will have 1500 square feet of glass in raw materials inventory and would like to have ending inventory of 1000 feet. Variable overhead costs are estimated at $100 per door. Fixed overhead for the month is estimated to be $17,010. Insight Glass anticipates selling and administrative costs of $18,750 monthly and the monthly interest cost on its long-term debt is 1% of the outstanding balance, paid on the 30th of each month. The principal payment on the debt is $25,000 per month. Insight Glass, as a corporation, expects to pay 40% of its net income in income taxes. Monthly estimates are sent to the appropriate taxing authority by the 10th of the next month (therefore, income taxes payable as of 5/31/14 will be paid on 6/10). Monthly depreciation of the building and the equipment is $8,000 and $10,000 respectively (this is the sales/administrative portion of depreciation and not a part of overhead production costs). All sales are on account. However, in estimating cash flows, Insight Glass expects 60% of the current month sales to be received by the end of the month and the balance to be collected in the next month. Therefore, all the Accounts Receivable owing at June 1st (which represents 40% of May sales) is expected to be received in June. ending inventory each month equal to 10% of the estimated unit sales in that month. Beginning inventory of finished doors is expected to be 20 units as of June 1, 2014 with a per unit cost of $624. Note: The per unit cost of doors produced during June may vary slightly from the per unit cost of June's beginning Finished Goods Inventory (given as $624). In other words, you will need to arrive at a new per unit cost for the month of June. Each door takes 36 square feet of glass and 4 hours of direct labor. Glass purchases are estimated at $10 per square foot and direct labor averages $16 an hour, including benefits. As of June 1st, Insight Glass estimates it will have 1500 square feet of glass in raw materials inventory and would like to have ending inventory of 1000 feet. Variable overhead costs are estimated at $100 per door. Fixed overhead for the month is estimated to be $17,010. Insight Glass anticipates selling and administrative costs of $18,750 monthly and the monthly interest cost on its long-term debt is 1% of the outstanding balance, paid on the 30th of each month. The principal payment on the debt is $25,000 per month. Insight Glass, as a corporation, expects to pay 40% of its net income in income taxes. Monthly estimates are sent to the appropriate taxing authority by the 10th of the next month (therefore, income taxes payable as of 5/31/14 will be paid on 6/10). Monthly depreciation of the building and the equipment is $8,000 and $10,000 respectively (this is the sales/administrative portion of depreciation and not a part of overhead production costs). All sales are on account. However, in estimating cash flows, Insight Glass expects 60% of the current month sales to be received by the end of the month and the balance to be collected in the next month. Therefore, all the Accounts Receivable owing at June 1st (which represents 40% of May sales) is expected to be received in June. Glass is purchased on account. Exactly 70% of the purchases are paid in the current month and the balance is paid early in the next month. The balance of Accounts Payable owing at June 1st, will be paid in June. Assume all other expenses (both production and administrative) are paid in the month incurred. The Board of Directors for the company plans to declare and pay a $.50 per share cash dividend during the month of June. Insight Glass Company Cost of Goods Sold Budget For the Month Ending June 30, 2014 Beginning Inventory O Units Cost per unit: $ Doors Produced and sold in June 2014 0 units Cost per unit: #DIV/0! #DIV/0! Total Budgeted Cost of Goods Sold #DIV/0! Insight Glass Company Cash Budget For the Month Ending June 30, 2014 Beginning Cash Balance Cash Receipts A/R balance on May 31, 2014 June Sales, 60% collected in same month $ Cash Available $ Cash Payments Accounts Payable fr. May 31 to be paid off June Purchases, 70% paid in same month Direct Labor MOH - Variable MOH - Fixed Selling & Admin Income Taxes - Insight Glass Company Cash Budget For the Month Ending June 30, 2014 Beginning Cash Balance Cash Receipts A/R balance on May 31, 2014 June Sales, 60% collected in same month $ Cash Available $ Cash Payments Accounts Payable fr. May 31 to be paid off June Purchases, 70% paid in same month Direct Labor MOH - Variable MOH - Fixed Selling & Admin Income Taxes Interest Expense Ending Cash before Financing $ $ - Financing Principal Repayments Dividends declared and paid $ $ Ending Cash Balance $ Insight Glass Company Insight Glass makes sliding glass doors for two local construction companies and wants to prepare a master budget for the next month of operation, June 2014. The sales department estimates that it can sell 180 doors in June. Each door retails for $1,100. In order to avoid delays in shipping, management wants to maintain ending inventory each month equal to 10% of the estimated unit sales in that month. Beginning inventory of finished doors is expected to be 20 units as of June 1, 2014 with a per unit cost of $624. Note: The per unit cost of doors produced during June may vary slightly from the per unit cost of June's beginning Finished Goods Inventory (given as $624). In other words, you will need to arrive at a new per unit cost for the month of June. Each door takes 36 square feet of glass and 4 hours of direct labor. Glass purchases are estimated at $10 per square foot and direct labor averages $16 an hour, including benefits. As of June 1s, Insight Glass estimates it will have 1500 square feet of glass in raw materials inventory and would like to have ending inventory of 1000 feet. Variable overhead costs are estimated at $100 per door. Fixed overhead for the month is estimated to be $17,010. Insight Glass anticipates selling and administrative costs of $18,750 monthly and the monthly interest cost on its long-term debt is 1% of the outstanding balance, paid on the 30th of each month. The principal payment on the debt is $25,000 per month. Insight Glass, as a corporation, expects to pay 40% of its net income in income taxes. Monthly estimates are sent to the appropriate taxing authority by the 10th of the next month (therefore, income taxes payable as of 5/31/14 will be paid on 6/10). Monthly depreciation of the building and the equipment is $8,000 and $10,000 respectively (this is the sales/administrative portion of depreciation and not a part of overhead production costs). All sales are on account. However, in estimating cash flows, Insight Glass expects 60% of the current month sales to be received by the end of the month and the balance to be collected in the next month. Therefore, all the Accounts Receivable owing at June 1st (which represents 40% of May sales) is expected to be received in June. ending inventory each month equal to 10% of the estimated unit sales in that month. Beginning inventory of finished doors is expected to be 20 units as of June 1, 2014 with a per unit cost of $624. Note: The per unit cost of doors produced during June may vary slightly from the per unit cost of June's beginning Finished Goods Inventory (given as $624). In other words, you will need to arrive at a new per unit cost for the month of June. Each door takes 36 square feet of glass and 4 hours of direct labor. Glass purchases are estimated at $10 per square foot and direct labor averages $16 an hour, including benefits. As of June 1st, Insight Glass estimates it will have 1500 square feet of glass in raw materials inventory and would like to have ending inventory of 1000 feet. Variable overhead costs are estimated at $100 per door. Fixed overhead for the month is estimated to be $17,010. Insight Glass anticipates selling and administrative costs of $18,750 monthly and the monthly interest cost on its long-term debt is 1% of the outstanding balance, paid on the 30th of each month. The principal payment on the debt is $25,000 per month. Insight Glass, as a corporation, expects to pay 40% of its net income in income taxes. Monthly estimates are sent to the appropriate taxing authority by the 10th of the next month (therefore, income taxes payable as of 5/31/14 will be paid on 6/10). Monthly depreciation of the building and the equipment is $8,000 and $10,000 respectively (this is the sales/administrative portion of depreciation and not a part of overhead production costs). All sales are on account. However, in estimating cash flows, Insight Glass expects 60% of the current month sales to be received by the end of the month and the balance to be collected in the next month. Therefore, all the Accounts Receivable owing at June 1st (which represents 40% of May sales) is expected to be received in June. Glass is purchased on account. Exactly 70% of the purchases are paid in the current month and the balance is paid early in the next month. The balance of Accounts Payable owing at June 1st, will be paid in June. Assume all other expenses (both production and administrative) are paid in the month incurred. The Board of Directors for the company plans to declare and pay a $.50 per share cash dividend during the month of June. Insight Glass Company Cost of Goods Sold Budget For the Month Ending June 30, 2014 Beginning Inventory O Units Cost per unit: $ Doors Produced and sold in June 2014 0 units Cost per unit: #DIV/0! #DIV/0! Total Budgeted Cost of Goods Sold #DIV/0! Insight Glass Company Cash Budget For the Month Ending June 30, 2014 Beginning Cash Balance Cash Receipts A/R balance on May 31, 2014 June Sales, 60% collected in same month $ Cash Available $ Cash Payments Accounts Payable fr. May 31 to be paid off June Purchases, 70% paid in same month Direct Labor MOH - Variable MOH - Fixed Selling & Admin Income Taxes - Insight Glass Company Cash Budget For the Month Ending June 30, 2014 Beginning Cash Balance Cash Receipts A/R balance on May 31, 2014 June Sales, 60% collected in same month $ Cash Available $ Cash Payments Accounts Payable fr. May 31 to be paid off June Purchases, 70% paid in same month Direct Labor MOH - Variable MOH - Fixed Selling & Admin Income Taxes Interest Expense Ending Cash before Financing $ $ - Financing Principal Repayments Dividends declared and paid $ $ Ending Cash Balance $