Answered step by step

Verified Expert Solution

Question

1 Approved Answer

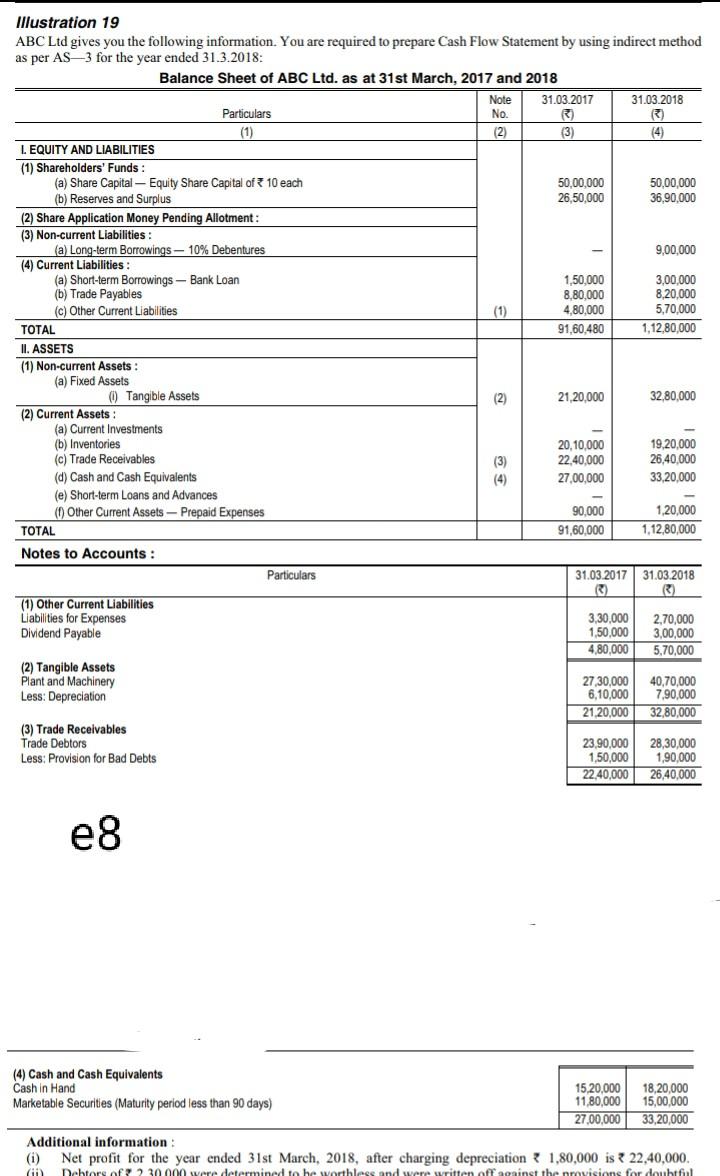

Illustration 19 ABC Ltd gives you the following information. You are required to prepare Cash Flow Statement by using indirect method as per AS-3 for

Illustration 19 ABC Ltd gives you the following information. You are required to prepare Cash Flow Statement by using indirect method as per AS-3 for the year ended 31.3.2018: Balance Sheet of ABC Ltd. as at 31st March, 2017 and 2018 Note 31.03.2017 31.03.2018 Particulars No. () () (1) (2) (3) (4) L EQUITY AND LIABILITIES (1) Shareholders' Funds: (a) Share Capital - Equity Share Capital of 10 each 50,00,000 50,00,000 (b) Reserves and Surplus 26,50,000 36,90,000 (2) Share Application Money Pending Allotment: (3) Non-current Liabilities: (a) Long-term Borrowings - 10% Debentures 9,00,000 (4) Current Liabilities: (a) Short-term Borrowings - Bank Loan 1,50,000 3,00,000 (b) Trade Payables 8,80,000 8.20,000 (c) Other Current Liabilities (1) 4,80,000 5,70,000 TOTAL 91,60,480 1,12,80,000 II. ASSETS (1) Non-current Assets (a) Fixed Assets ( Tangible Assets (2) 21,20,000 32.80,000 (2) Current Assets (a) Current Investments (b) Inventories 20.10,000 19,20,000 (c) Trade Receivables (3) 22,40,000 26,40,000 (d) Cash and Cash Equivalents (4) 27,00,000 33,20,000 (e) Short-term Loans and Advances (1) Other Current Assets-Prepaid Expenses 90,000 1.20,000 TOTAL 91,60,000 1,12,80,000 Notes to Accounts: Particulars 31.03.2017 31.03.2018 3) (1) Other Current Liabilities Liabilities for Expenses 3,30,000 2,70,000 Dividend Payable 1,50,000 3.00.000 4,80,000 5.70,000 (2) Tangible Assets Plant and Machinery 27 30,000 40,70,000 Less: Depreciation 6,10,000 7,90,000 21,20,000 32.80,000 (3) Trade Receivables Trade Debtors 23,90,000 28,30,000 Less: Provision for Bad Debts 1,50,000 1,90,000 22,40,000 26,40,000 e 8 (4) Cash and Cash Equivalents Cash in Hand 15.20,000 18,20,000 Marketable Securities (Maturity period less than 90 days) 11,80,000 15,00,000 27,00,000 33.20,000 Additional information: (i) Net profit for the year ended 31st March, 2018, after charging depreciation 1,80,000 is 22,40,000. Debtors of 230.000 were determined to be worthless and were written off against the provisions for doubtful Cii

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started