Answered step by step

Verified Expert Solution

Question

1 Approved Answer

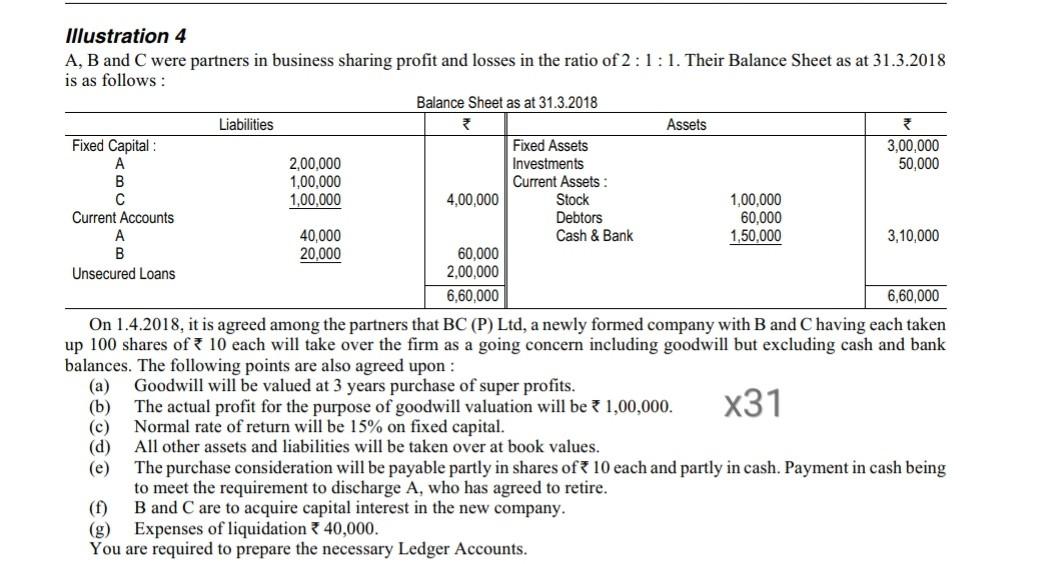

Illustration 4 A, B and C were partners in business sharing profit and losses in the ratio of 2:1:1. Their Balance Sheet as at 31.3.2018

Illustration 4 A, B and C were partners in business sharing profit and losses in the ratio of 2:1:1. Their Balance Sheet as at 31.3.2018 is as follows: Balance Sheet as at 31.3.2018 Liabilities Assets Fixed Capital Fixed Assets 3,00,000 2,00.000 Investments 50,000 B 1,00,000 Current Assets : 1,00,000 4,00,000 Stock 1,00.000 Current Accounts Debtors 60,000 A 40,000 Cash & Bank 1,50,000 3,10,000 B 20,000 60,000 Unsecured Loans 2,00.000 6,60,000 6,60,000 On 1.4.2018, it is agreed among the partners that BC (P) Ltd, a newly formed company with B and Chaving each taken up 100 shares of 3 10 each will take over the firm as a going concern including goodwill but excluding cash and bank balances. The following points are also agreed upon : (a) Goodwill will be valued at 3 years purchase of super profits. (b) The actual profit for the purpose of goodwill valuation will be 1,00,000. x31 (c) Normal rate of return will be 15% on fixed capital. (d) All other assets and liabilities will be taken over at book values. (e) The purchase consideration will be payable partly in shares of 10 each and partly in cash. Payment in cash being to meet the requirement to discharge A, who has agreed to retire. (f) B and C are to acquire capital interest in the new company. (g) Expenses of liquidation 40,000. You are required to prepare the necessary Ledger Accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started