Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Illustration #5a Pepper Company, which is a calendar-year-reporting company, purchased 65% of the common stock of Salt Company, on December 31, 2019, for 20,000

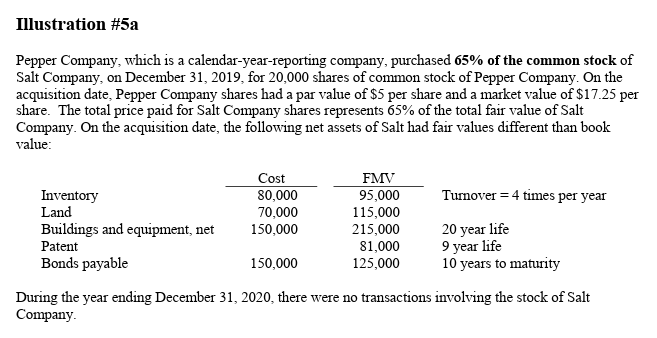

Illustration #5a Pepper Company, which is a calendar-year-reporting company, purchased 65% of the common stock of Salt Company, on December 31, 2019, for 20,000 shares of common stock of Pepper Company. On the acquisition date, Pepper Company shares had a par value of $5 per share and a market value of $17.25 per share. The total price paid for Salt Company shares represents 65% of the total fair value of Salt Company. On the acquisition date, the following net assets of Salt had fair values different than book value: Cost FMV Inventory Land 80,000 95,000 Turnover 4 times per year 70,000 115,000 Buildings and equipment, net 150,000 215,000 20 year life Patent 81,000 9 year life Bonds payable 150,000 125,000 10 years to maturity During the year ending December 31, 2020, there were no transactions involving the stock of Salt Company.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to calculate the purchase price of Salt Company the fair value of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started