Answered step by step

Verified Expert Solution

Question

1 Approved Answer

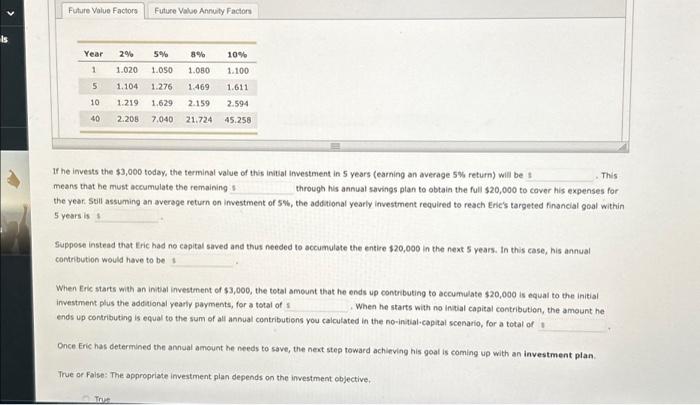

ils Future Value Factors Future Value Annuity Factors Year 1 5 10 40 2% 5% 8% 1.020 1.050 1.080 1.104 1.276 1.469 1.611 1.219 1.629

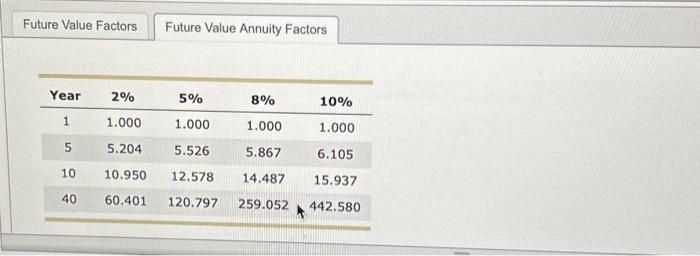

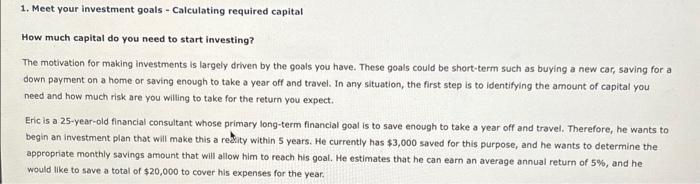

ils Future Value Factors Future Value Annuity Factors Year 1 5 10 40 2% 5% 8% 1.020 1.050 1.080 1.104 1.276 1.469 1.611 1.219 1.629 2.159 2.594 2.208 7.040 21.724 45.258 10% 1.100 This If he invests the $3,000 today, the terminal value of this initial investment in 5 years (earning an average 5% return) will be $ means that he must accumulate the remaining $ through his annual savings plan to obtain the full $20,000 to cover his expenses for the year. Still assuming an average return on investment of 5%, the additional yearly investment required to reach Eric's targeted financial goal within 5 years is $ Suppose instead that Eric had no capital saved and thus needed to accumulate the entire $20,000 in the next 5 years. In this case, his annual contribution would have to be $ When Eric starts with an initial investment of $3,000, the total amount that he ends up contributing to accumulate $20,000 is equal to the initial investment plus the additional yearly payments, for a total of $ When he starts with no initial capital contribution, the amount he ends up contributing is equal to the sum of all annual contributions you calculated in the no-initial-capital scenario, for a total of $ True Once Eric has determined the annual amount he needs to save, the next step toward achieving his goal is coming up with an investment plan. True or False: The appropriate investment plan depends on the investment objective.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started