I'm confused on the last part of the cash budget and I'm not sure if my income statement or my balance sheet are correct.

I'm confused on the last part of the cash budget and I'm not sure if my income statement or my balance sheet are correct.

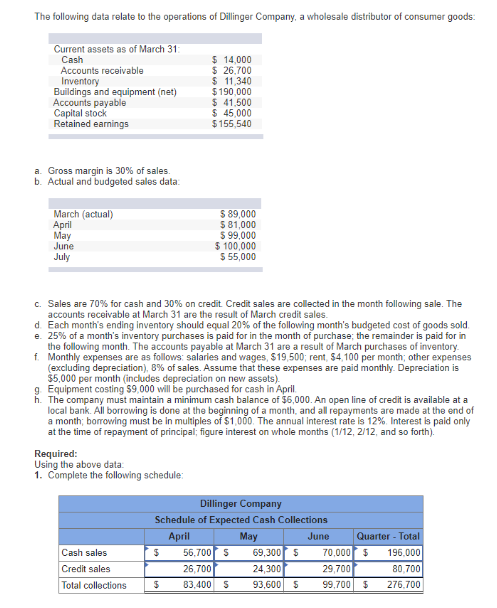

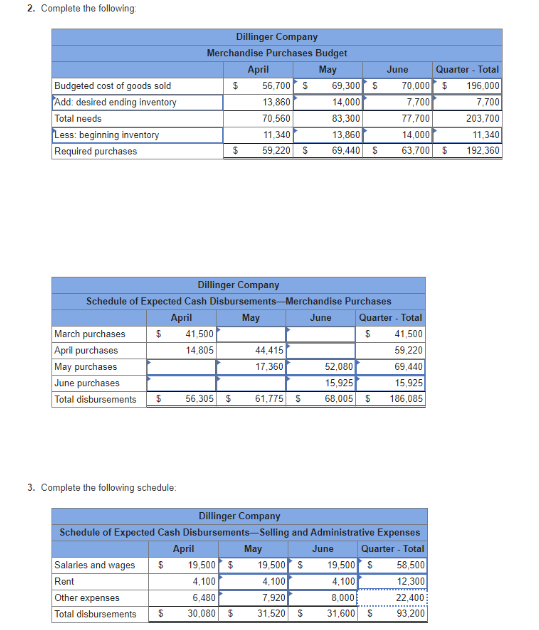

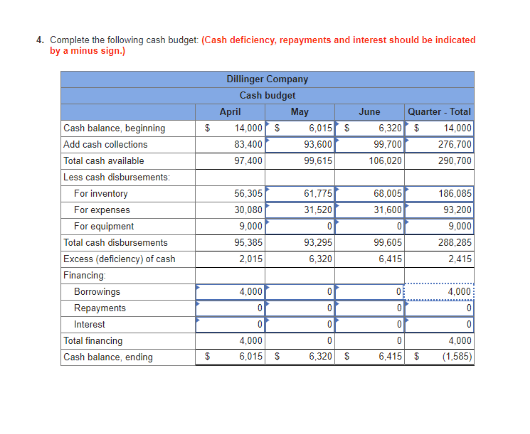

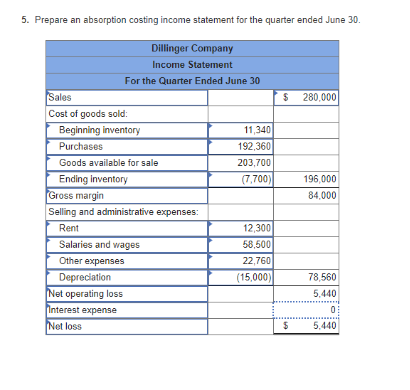

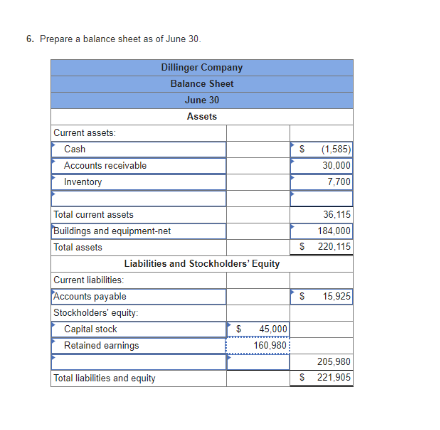

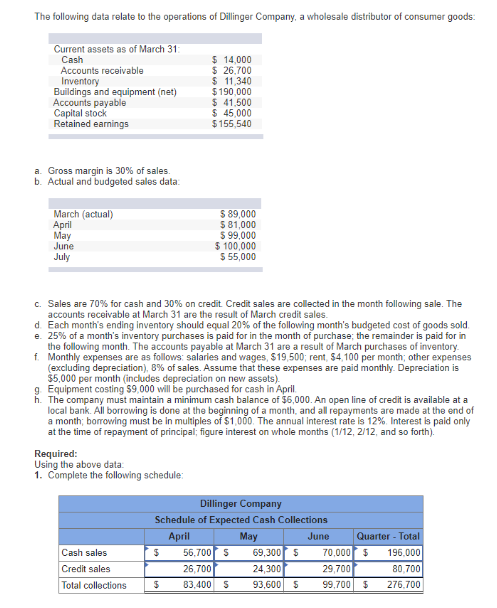

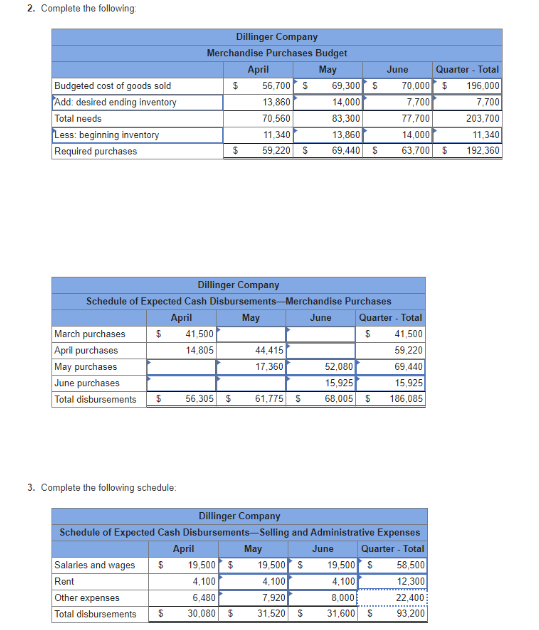

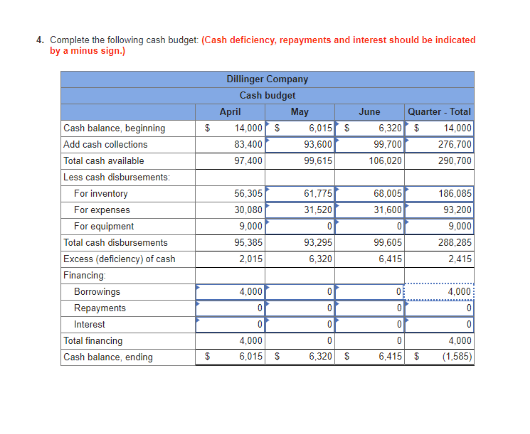

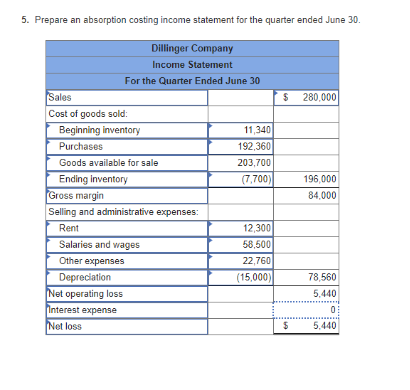

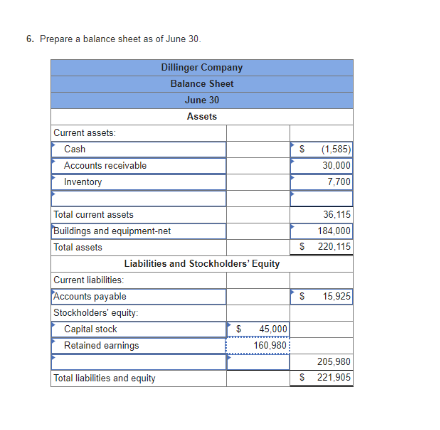

The following data relate to the operations of Dillinger Company, a wholesale distributor of consumer goods Current assets as of March 31 Cash Accounts receivable Inventory Buildings and equipment (net) Accounts payable Capital stock Retained earnings $ 14,000 $ 26.700 $ 11 340 $ 190,000 $ 41.500 $ 45.000 $155.540 a. Gross margin is 30% of sales b. Actual and budgeted sales data March (actual) April May June July $ 89,000 $ 81,000 $ 99,000 $ 100,000 $ 55,000 c. Sales are 70% for cash and 30% on credit. Credit sales are collected in the month following sale. The accounts receivable at March 31 are the result of March credit sales. d. Each month's ending inventory should equal 20% of the following month's budgeted cost of goods sold e 25% of a month's inventory purchases is paid for in the month of purchase the remainder is paid for in the following month. The accounts payable at March 31 are a result of March purchases of inventory 1 Monthly expenses are as follows: salaries and wages, $19,500; rent, $4 100 per month; other expenses (excluding depreciation), 8% of sales. Assume that these expenses are paid monthly. Depreciation is $5,000 per month (includes depreciation on new assets) 9 Equipment costing $9.000 will be purchased for cash in April h. The company must maintain a minimum cash balance of $6,000. An open line of credit is available at a local bank. All borrowing is done at the beginning of a month, and alrepayments are made at the end of a month borrowing must be in multiples of $1,000. The annual interest rate is 12% Interest is paid only at the time of repayment of principal figure interest on whole months (1/12, 2/12, and so forth) Required: Using the above data 1. Complete the following schedule: Dillinger Company Schedule of Expected Cash Collections April May June Quarter - Total $ 56.700 5 69,300 $ 70,000 $ 196,000 26,700 24 3007 29,700 80.700 S 83.400 S 93.600 $ 99.700 5 276.700 Credit sales Total collections 2. Complete the following $ Budgeted cost of goods sold Add: desired ending inventory Total needs Less: beginning inventory Required purchases Dillinger Company Merchandise Purchases Budget April May $ 56.700 $ 69,300 13 860 13,860 14,000 70.560 83,300 11,340 13,860 $ 59.220 S 69.440 June 70,000 7,700 7 7.700 14.000 63.700 Quarter - Total $ 196,000 7700 203.700 11.340 $ 192,360 S Dillinger Company Schedule of Expected Cash Disbursements Merchandise Purchases April May June Quarter - Total March purchases $ 41,500 $ 41,500 April purchases 14.805 44.415 59,220 May purchases 17.360 52.080 69.440 June purchases 15,9251 15,925 Total disbursements $ 56,305 $ 61,775 5 6 8,005 5 186,085 3. Complete the following schedule Dillinger Company Schedule of Expected Cash Disbursements-Selling and Administrative Expenses April May June Quarter - Total Salaries and wages S 19.500 $ 19,500 $ 19,500 $ 58.500 Rent 4.100 4.100 4.100_. 12.300 Other expenses 6.480 7.920 8.000 22 400 Total disbursements $ 30.080 $ 31.520 S 31.600 S 93.200 4. Complete the following cash budget: (Cash deficiency, repayments and interest should be indicated by a minus sign.) Dillinger Company Cash budget April May 14000 $ 6,0157 $ 83.400 93,6001 97.400 99,615 $ June 6,320 99,700 1 06,020 Quarter - Total $ 14,000 276.700 290 700 61,7751 31,520 68,005 31,600 Cash balance, beginning Add cash collections Total cash available Less cash disbursements: For inventory For expenses For equipment Total cash disbursements Excess deficiency) of cash Financing Borrowings Repayments Interest Total financing Cash balance, ending 56.305 30.080 9,000 95,385 2015 186,085 93 200 9.000 288,285 2.415 93,295 6,320 99,605 6,415 or 0 4.000 4,0001 01 0 00 0 0 4.000 4. 0000 6,015 S 6 $ ,320 S 6.415S (1.585) 5. Prepare an absorption costing income statement for the quarter ended June 30. $ 280,000 Dillinger Company Income Statement For the Quarter Ended June 30 Sales Cost of goods sold: Beginning inventory 11,340 Purchases 192,360 Goods available for sale 203,700 Ending Inventory (7.700) Gross margin Selling and administrative expenses: Rent 12,300 Salaries and wages 58,500 Other expenses 22.7601 Depreciation (15,000) Net operating loss Interest expense Net loss 196,000 84,000 78.560 $ 5440 6. Prepare a balance sheet as of June 30 Dillinger Company Balance Sheet June 30 Assets (1.585) Current assets Cash Accounts receivable Inventory 30.000 7.700 36,115 184 000 220,115 $ Total current assets Buildings and equipment-net Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Stockholders' equity Capital stock R$ 45000 Retained earnings 160 980 $ 15.925 205.980 221,905 Total liabilities and equity $

I'm confused on the last part of the cash budget and I'm not sure if my income statement or my balance sheet are correct.

I'm confused on the last part of the cash budget and I'm not sure if my income statement or my balance sheet are correct.