Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I'm confused on the second part.. thank you! On January 1,2018 , a machine was purchased for $125,000. The machine has an estimated salvage value

I'm confused on the second part.. thank you!

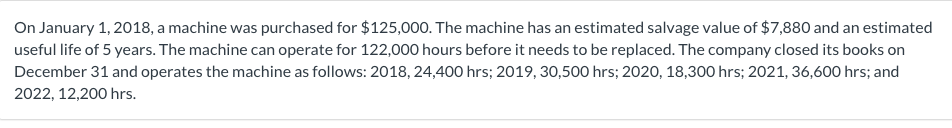

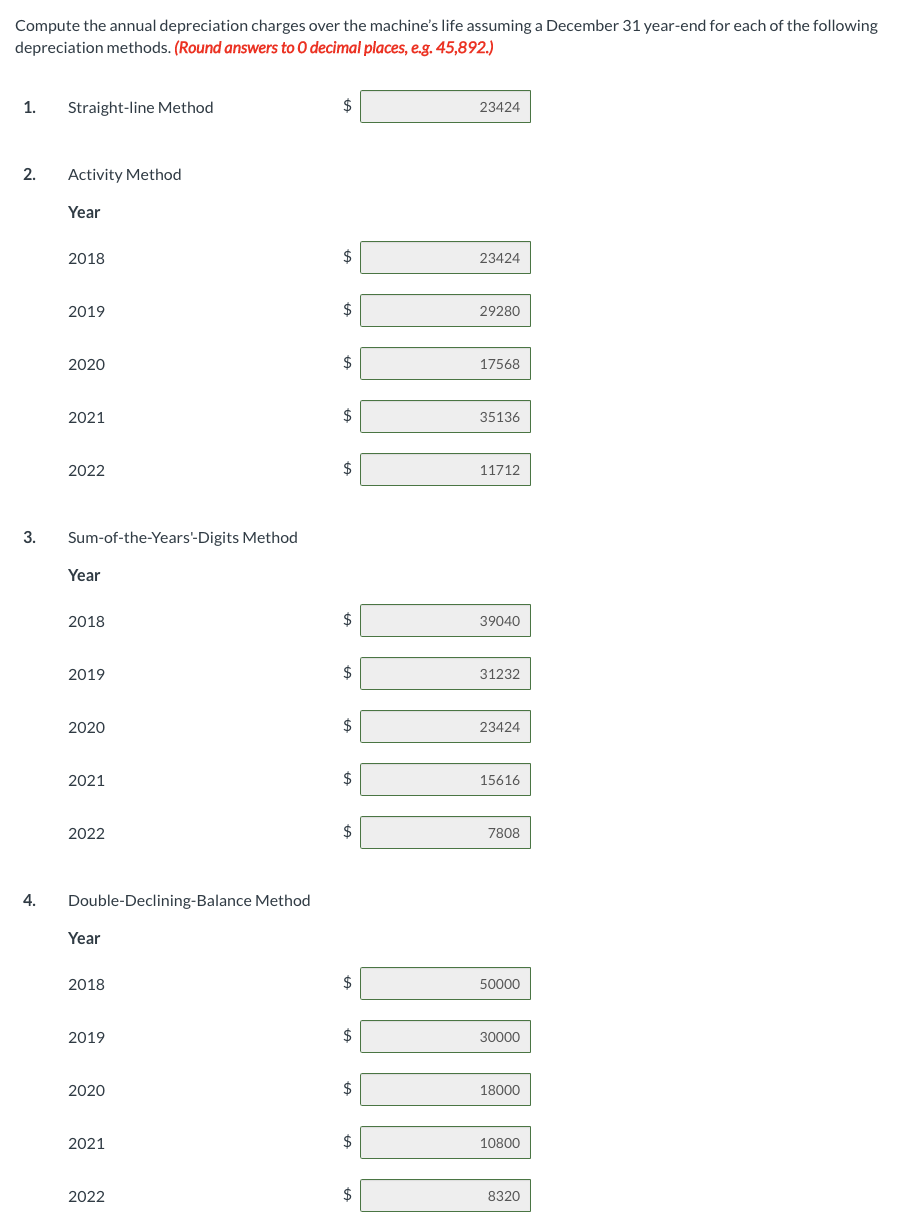

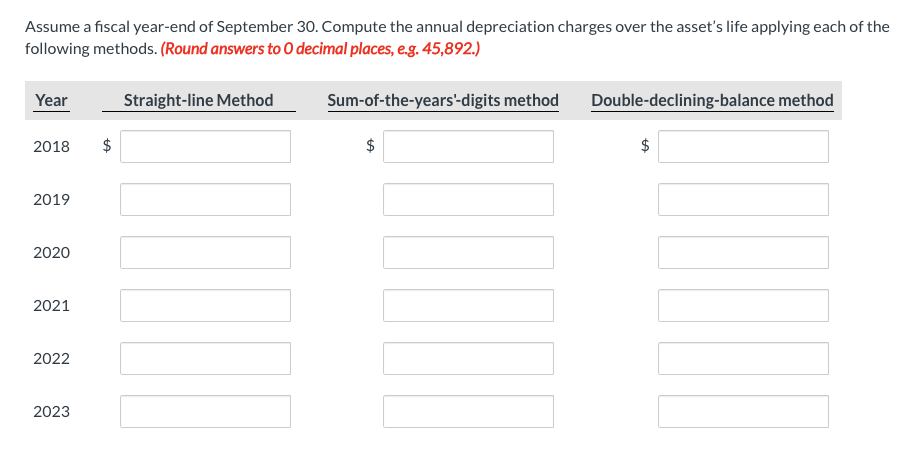

On January 1,2018 , a machine was purchased for $125,000. The machine has an estimated salvage value of $7,880 and an estimated useful life of 5 years. The machine can operate for 122,000 hours before it needs to be replaced. The company closed its books on December 31 and operates the machine as follows: 2018,24,400hrs;2019,30,500hrs;2020,18,300hrs;2021,36,600hrs; and 2022,12,200 hrs. Compute the annual depreciation charges over the machine's life assuming a December 31 year-end for each of the following depreciation methods. (Round answers to 0 decimal places, e.g. 45,892.) Assume a fiscal year-end of September 30. Compute the annual depreciation charges over the asset's life applying each of the following methods. (Round answers to 0 decimal places, e.g. 45,892.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started