Question

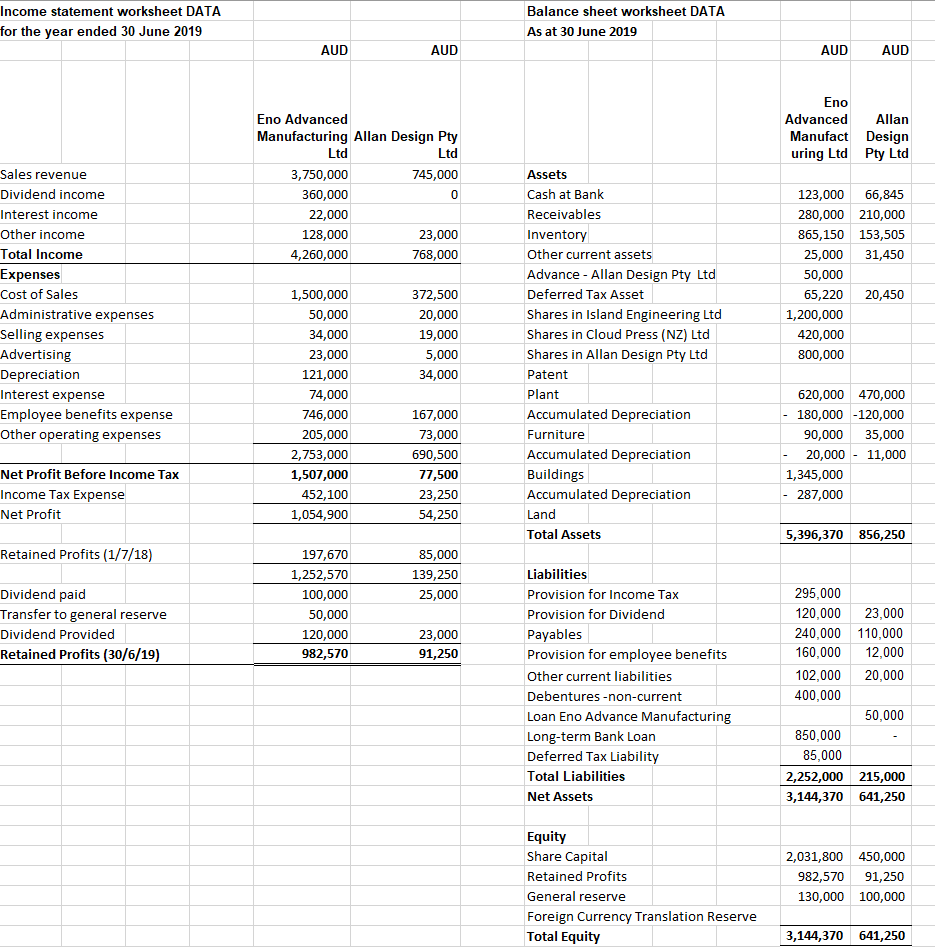

I'm currently doing an accounting unit for business combinations and have come across this question - At the time of investment, the liabilities of Allan

I'm currently doing an accounting unit for business combinations and have come across this question - At the time of investment, the liabilities of Allan Design Pty Ltd were all recorded at fair value, except for a contingent liability relating to a warranty claim for an amount of $25 000 and a contingent liability was disclosed in the notes of Allan Design Pty Ltd. Six months after acquisition Eno Advanced Manufacturing Ltd intervened and negotiated a $10,000 payment to settle the case and Allan Design Pty Ltd recorded an expense for the $10,000 for the period ending 30 June 2017.

Australian tax rate is 30%

I'm a bit stumped for the elimination journal entry and wondering if it's as simple as the following: Dr Business combination valuation reserve 17,500 Cr Contingent liability 17,500 Calculation - (25,000*(1-0.30)) I'm not sure if this is right and if there is a deferred tax amount needed to be factored in. I've attached an im,age of the accounts of the two entities parent - Eno Advanced Manufacturing Ltd and subsidiary - Allan Design Pty Ltd

Income statement worksheet DATA for the year ended 30 June 2019 Balance sheet worksheet DATA As at 30 June 2019 AUD AUD AUD AUD Eno Advanced Allan Manufact Design uring Ltd Pty Ltd Eno Advanced Manufacturing Allan Design Pty Ltd Ltd 3,750,000 745,000 360,000 0 22,000 128,000 23,000 4,260,000 768,000 Sales revenue Dividend income Interest income Other income Total Income Expenses Cost of Sales Administrative expenses Selling expenses Advertising Depreciation Interest expense Employee benefits expense Other operating expenses 123,000 66,845 280,000 210,000 865,150 153,505 25,000 31,450 50,000 65,220 20,450 1,200,000 420,000 800,000 372,500 20,000 19,000 5,000 34,000 Assets Cash at Bank Receivables Inventory Other current assets Advance - Allan Design Pty Ltd Deferred Tax Asset Shares in Island Engineering Ltd Shares in Cloud Press (NZ) Ltd Shares in Allan Design Pty Ltd Patent Plant Accumulated Depreciation Furniture Accumulated Depreciation Buildings Accumulated Depreciation Land Total Assets 1,500,000 50,000 34,000 23,000 121,000 74,000 746,000 205,000 2,753,000 1,507,000 452,100 1,054,900 167,000 73,000 690,500 77,500 23,250 54,250 620,000 470,000 180,000 -120,000 90,000 35,000 20,000 11,000 1,345,000 - 287,000 Net Profit Before Income Tax Income Tax Expense Net Profit 5,396,370 856,250 Retained Profits (1/7/18) 85,000 139,250 25,000 Dividend paid Transfer to general reserve Dividend Provided Retained Profits (30/6/19) 197,670 1,252,570 100,000 50,000 120,000 982,570 23,000 91,250 Liabilities Provision for Income Tax Provision for Dividend Payables Provision for employee benefits Other current liabilities Debentures -non-current Loan Eno Advance Manufacturing Long-term Bank Loan Deferred Tax Liability Total Liabilities Net Assets 295,000 120,000 23,000 240,000 110,000 160,000 12,000 102,000 20,000 400,000 50,000 850,000 85,000 2,252,000 215,000 3,144,370 641,250 Equity Share Capital Retained Profits General reserve Foreign Currency Translation Reserve Total Equity 2,031,800 450,000 982,570 91,250 130,000 100,000 3,144,370 641,250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started