Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I'm having issues with part d of this question. I'm currently using the following formula to solve it: Return on invested capital from a margin

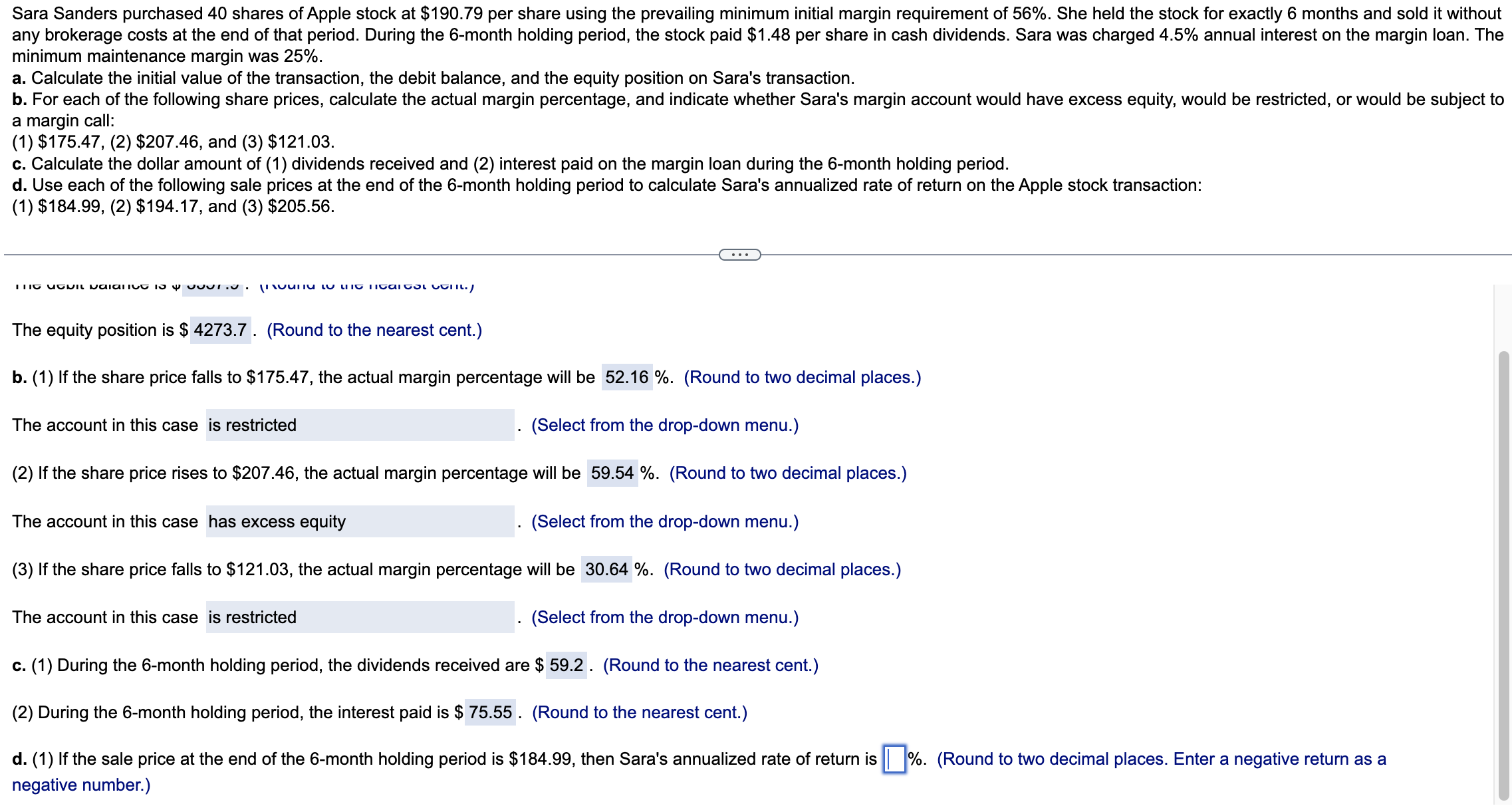

I'm having issues with part d of this question. I'm currently using the following formula to solve it: Return on invested capital from a margin transaction = (total current income received - total interest paid on loan margin + Market Value of securities at sale - market value of securities at purchase) / amount of equity at purchase.

minimum maintenance margin was 25%. a. Calculate the initial value of the transaction, the debit balance, and the equity position on Sara's transaction. a margin call: (1) $175.47, (2) $207.46, and (3) $121.03. c. Calculate the dollar amount of (1) dividends received and (2) interest paid on the margin loan during the 6-month holding period. d. Use each of the following sale prices at the end of the 6-month holding period to calculate Sara's annualized rate of return on the Apple stock transaction: (1) $184.99, (2) $194.17, and (3) $205.56. The equity position is $ (Round to the nearest cent.) b. (1) If the share price falls to $175.47, the actual margin percentage will be \%. (Round to two decimal places.) The account in this case (Select from the drop-down menu.) (2) If the share price rises to $207.46, the actual margin percentage will be \%. (Round to two decimal places.) The account in this case (Select from the drop-down menu.) (3) If the share price falls to $121.03, the actual margin percentage will be \%. (Round to two decimal places.) The account in this case (Select from the drop-down menu.) c. (1) During the 6-month holding period, the dividends received are $59.2. (Round to the nearest cent.) (2) During the 6-month holding period, the interest paid is $75.55. (Round to the nearest cent.) d. (1) If the sale price at the end of the 6 -month holding period is $184.99, then Sara's annualized rate of return is \%. (Round to two decimal places. Enter a negative return as a negative number.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started