Answered step by step

Verified Expert Solution

Question

1 Approved Answer

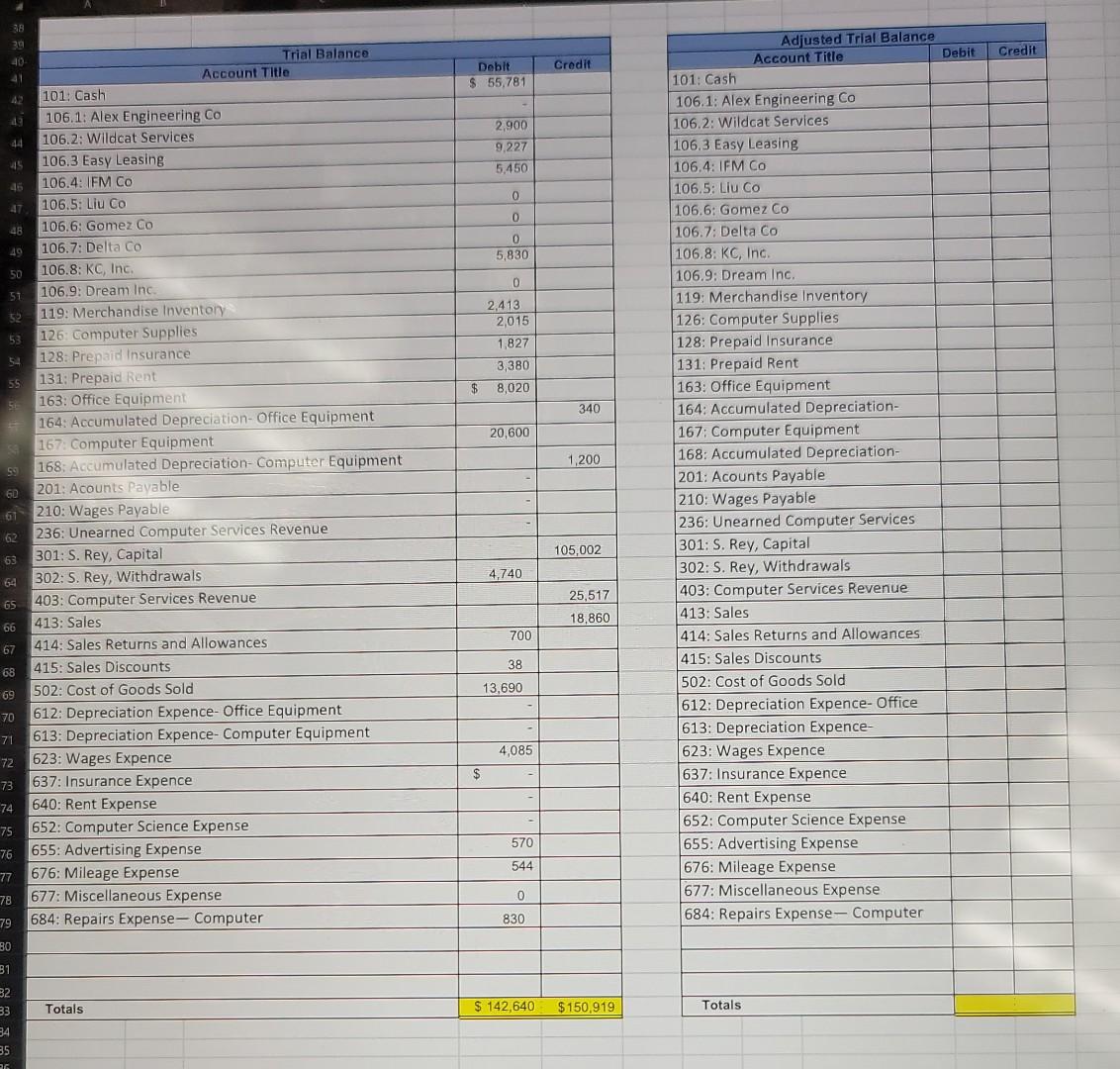

I'm having trouble finding where I messed up since my trial balance obviously isn't adding up. I know no entries from March 31 except the

I'm having trouble finding where I messed up since my trial balance obviously isn't adding up. I know no entries from March 31 except the mileage expense should be included here but I can't seem to di d where I made a mistake. I'd appreciate help. Thanks in advance!

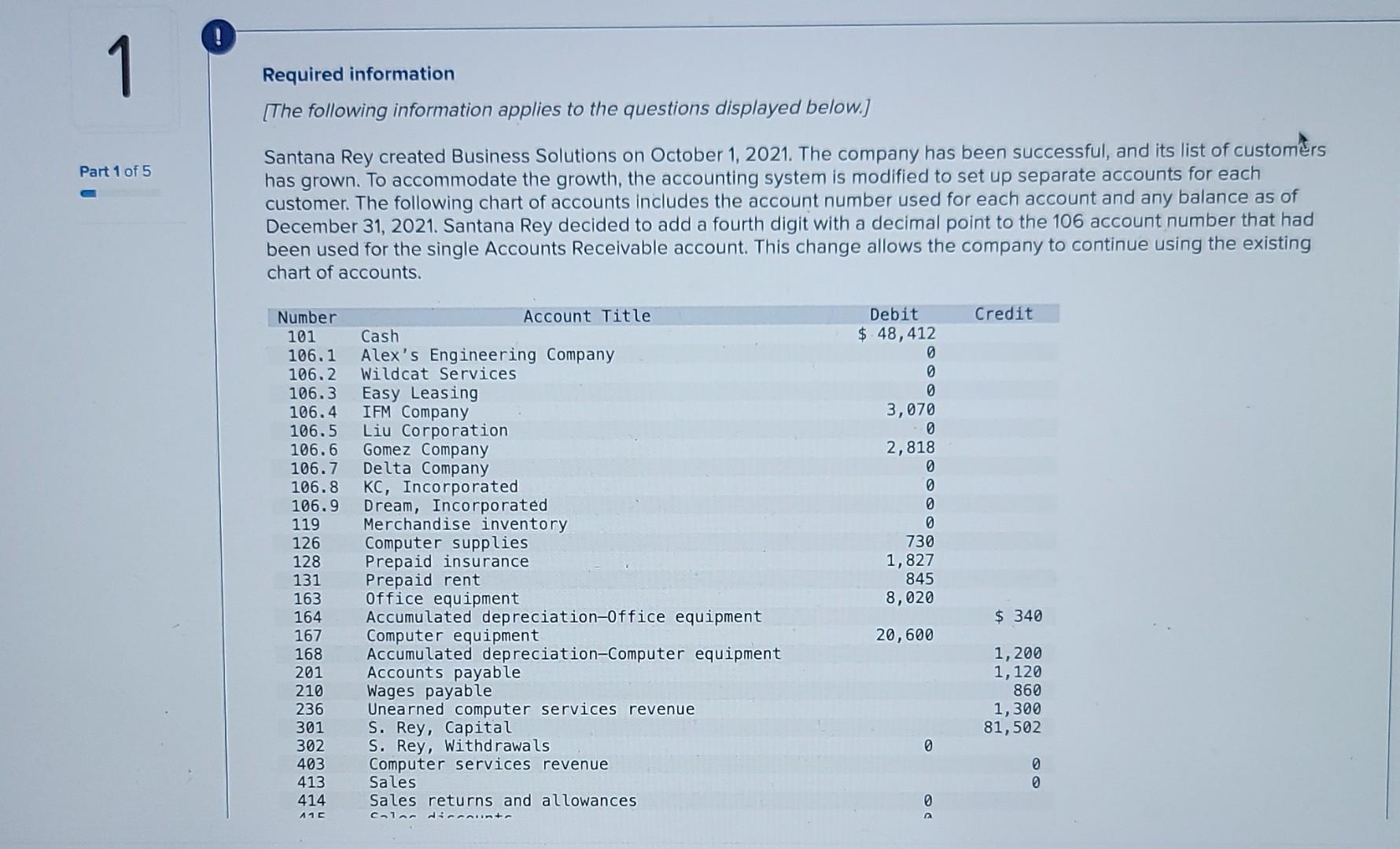

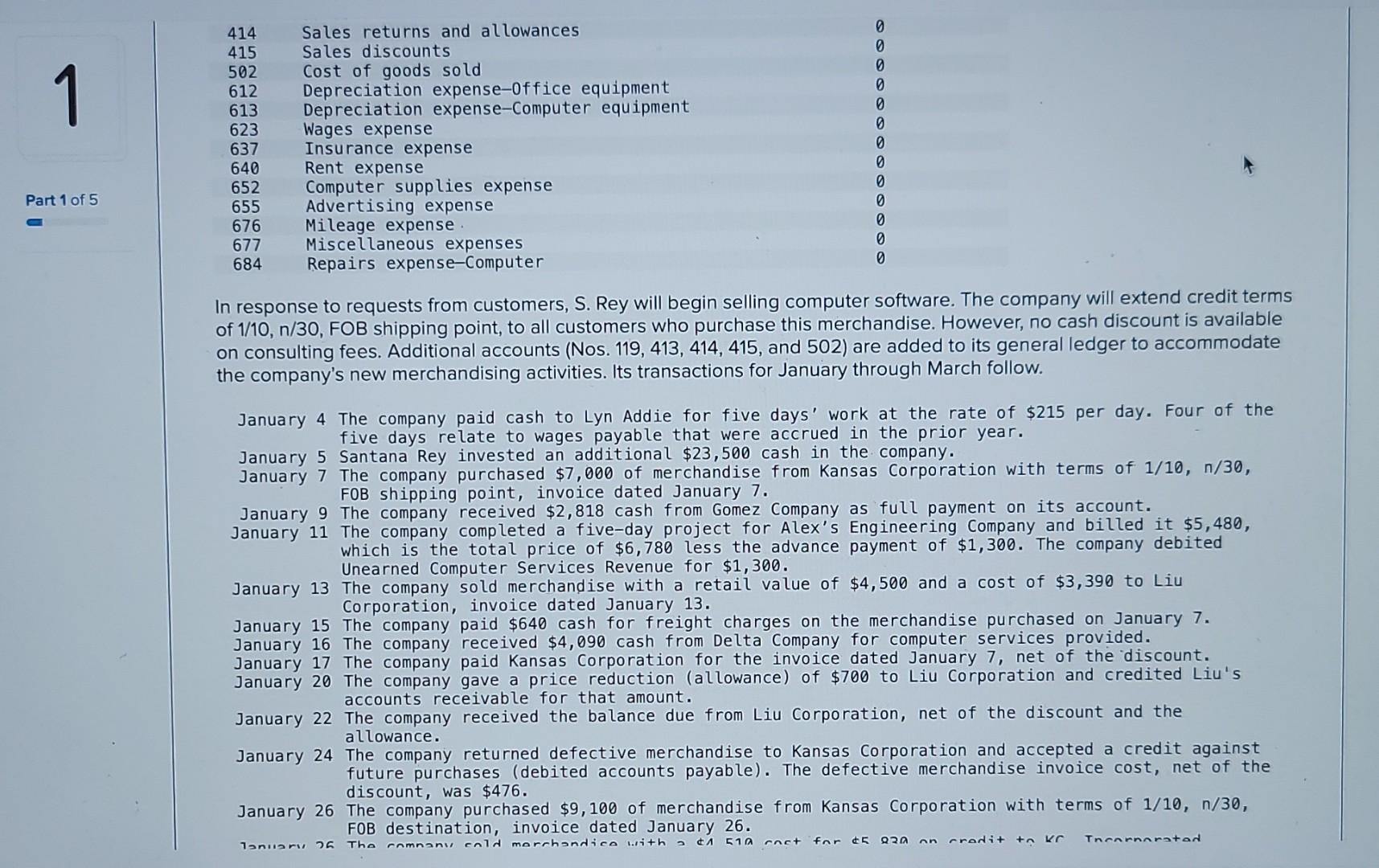

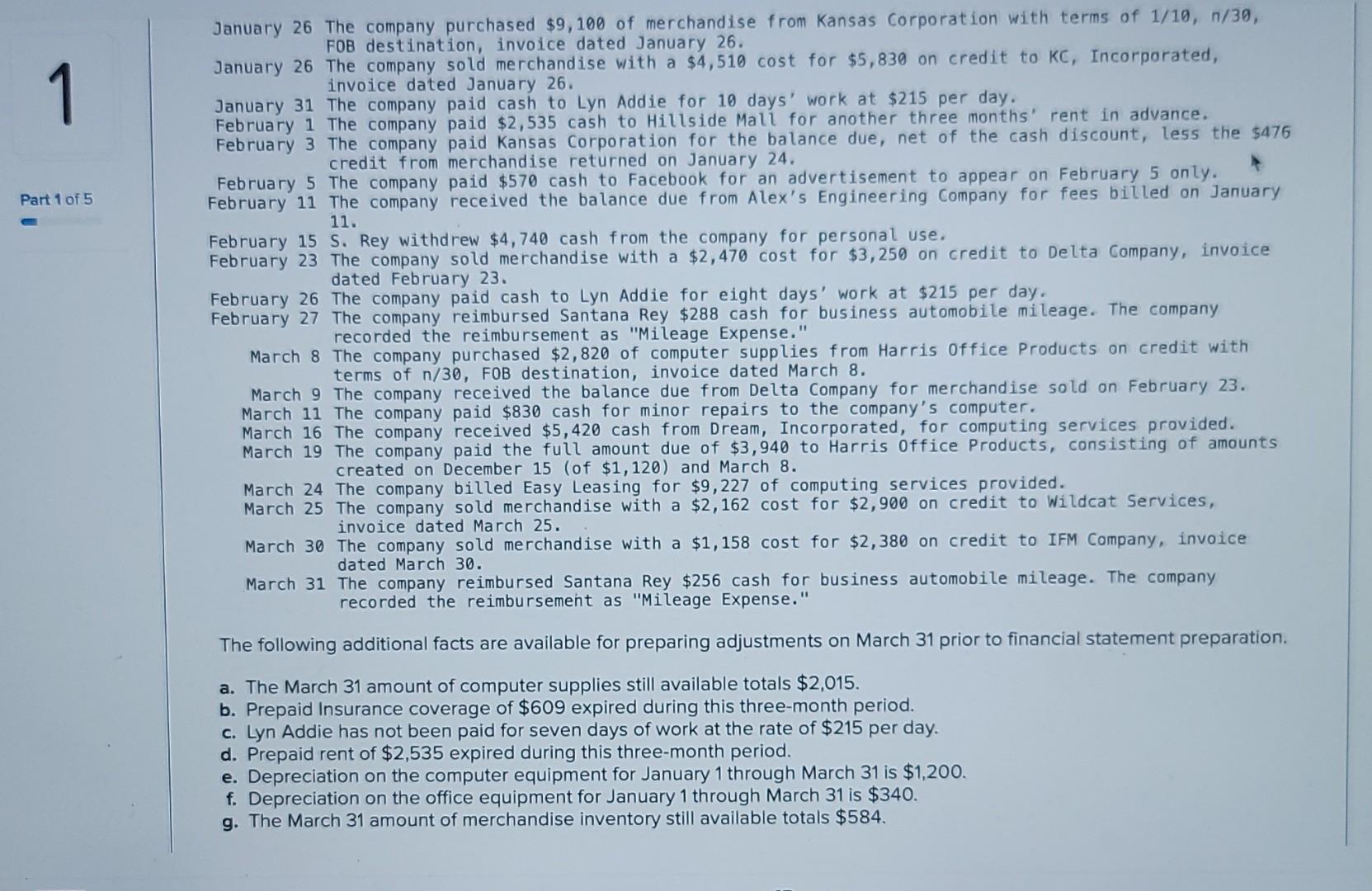

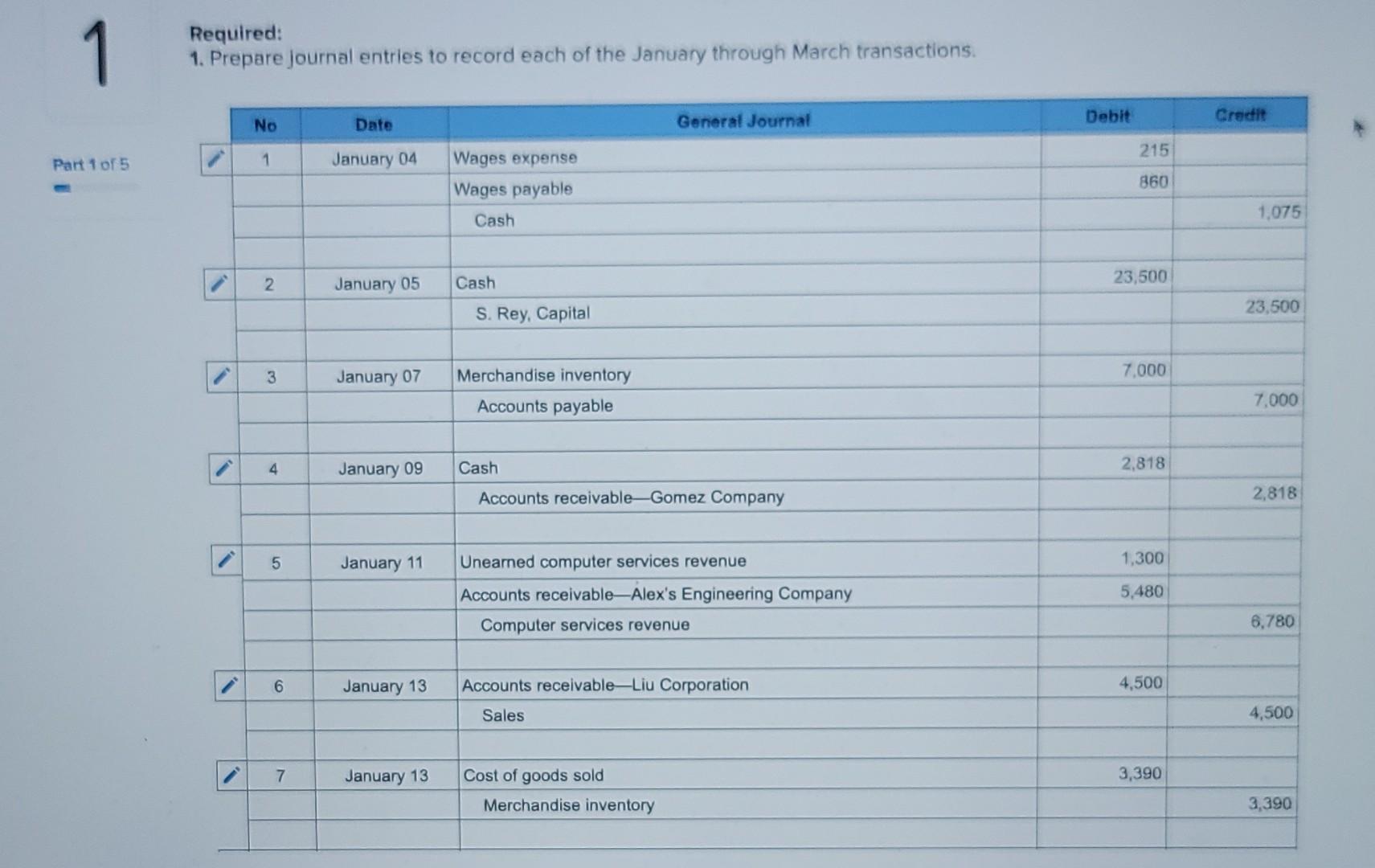

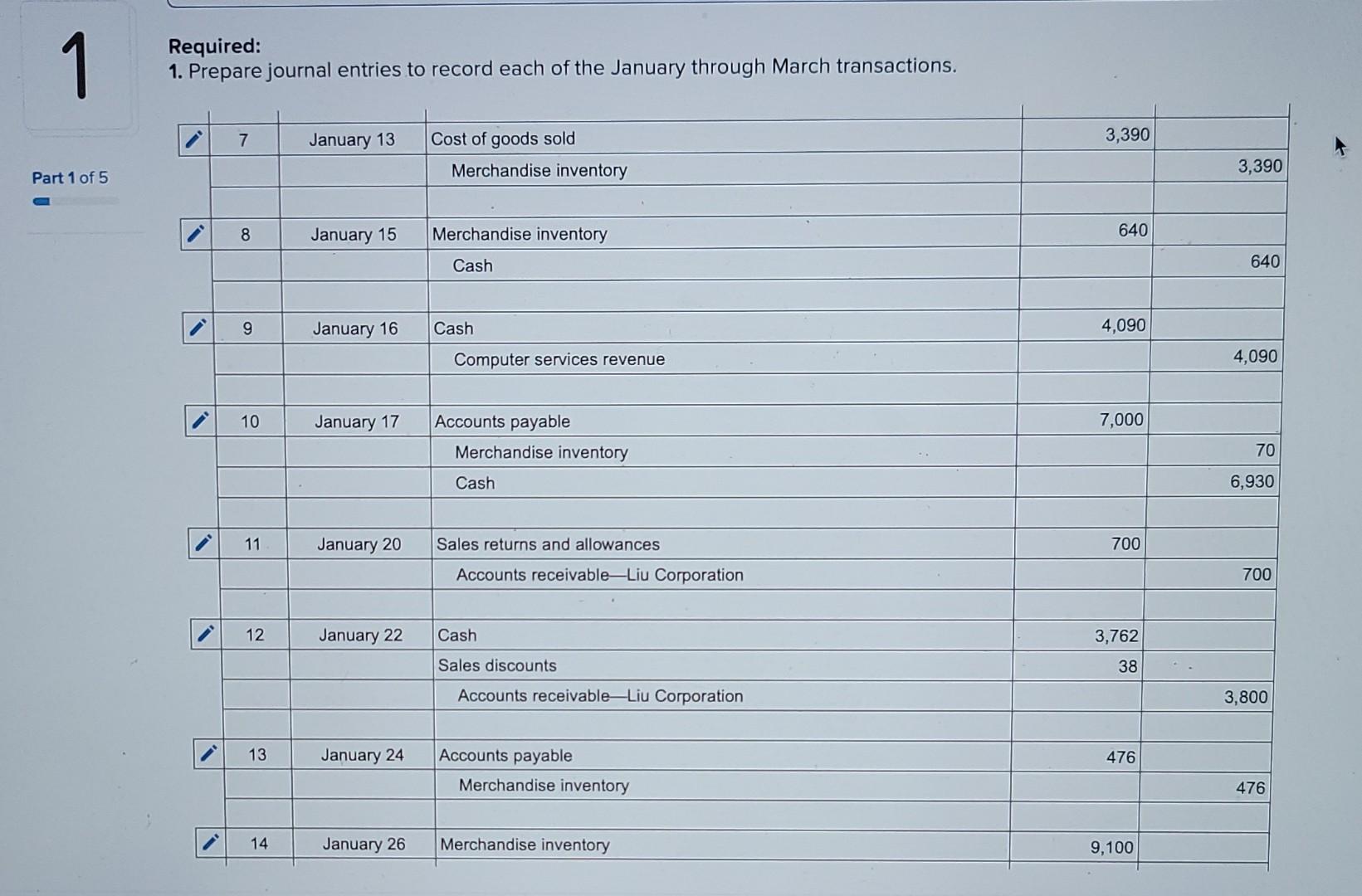

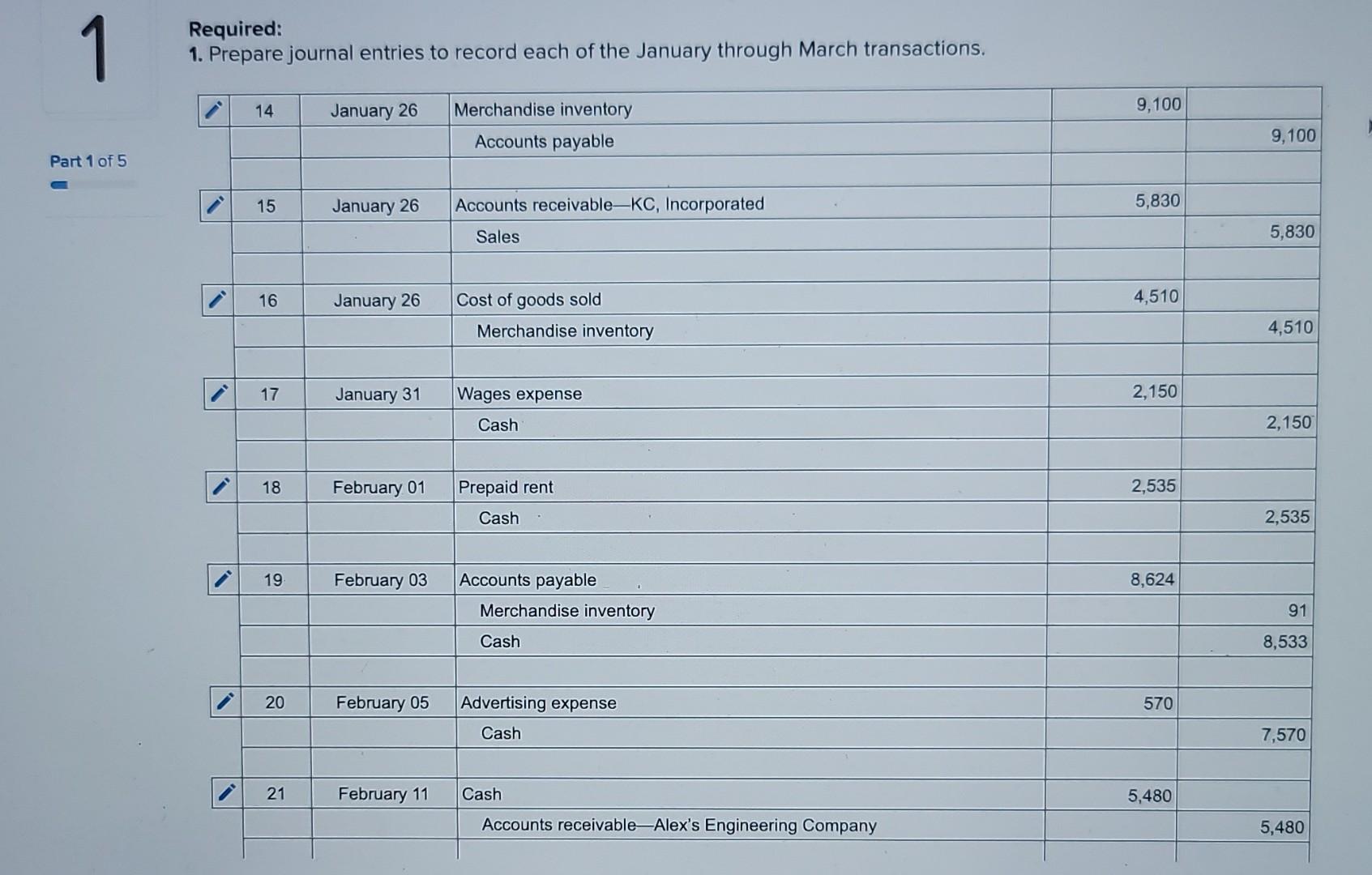

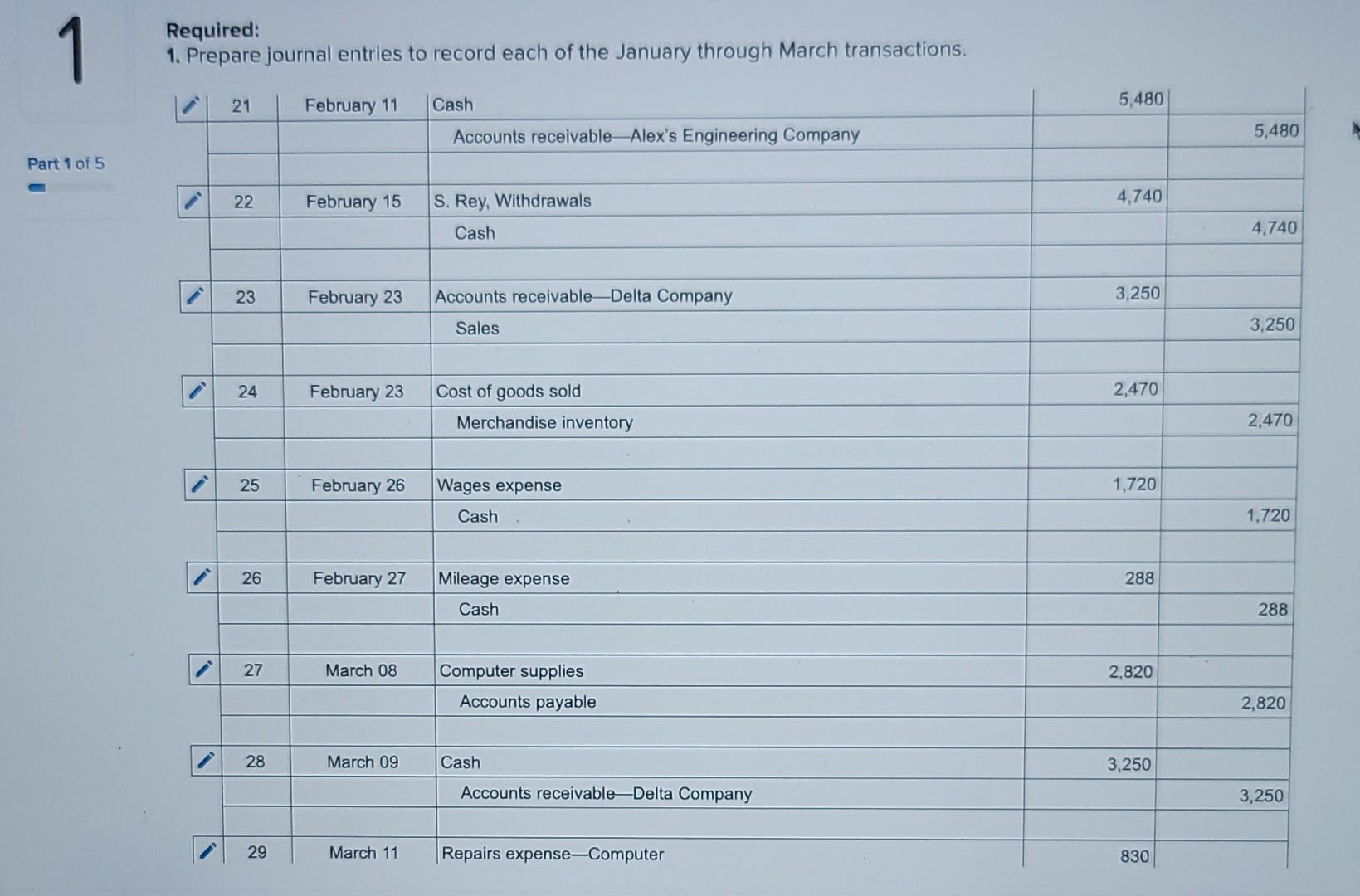

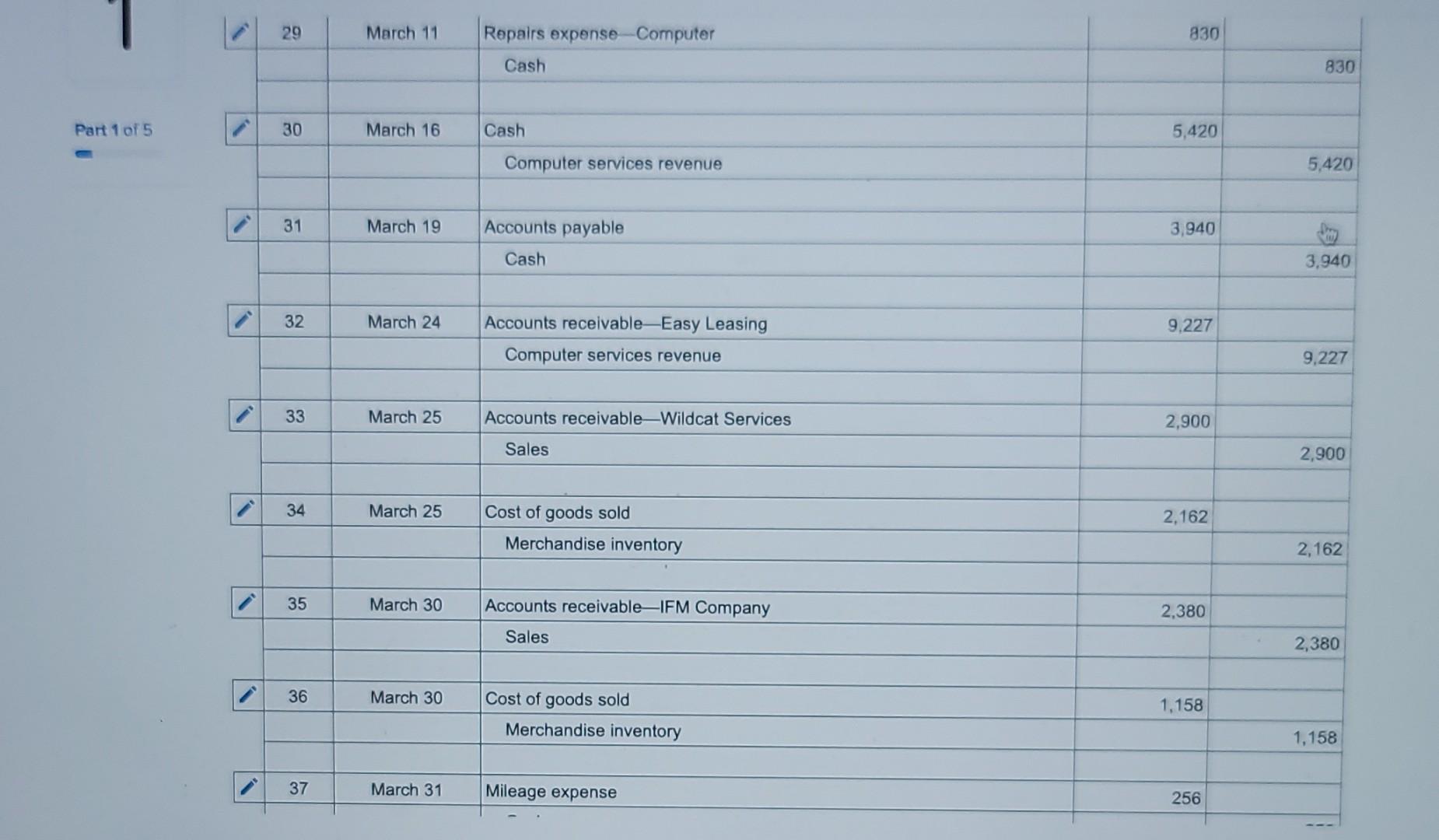

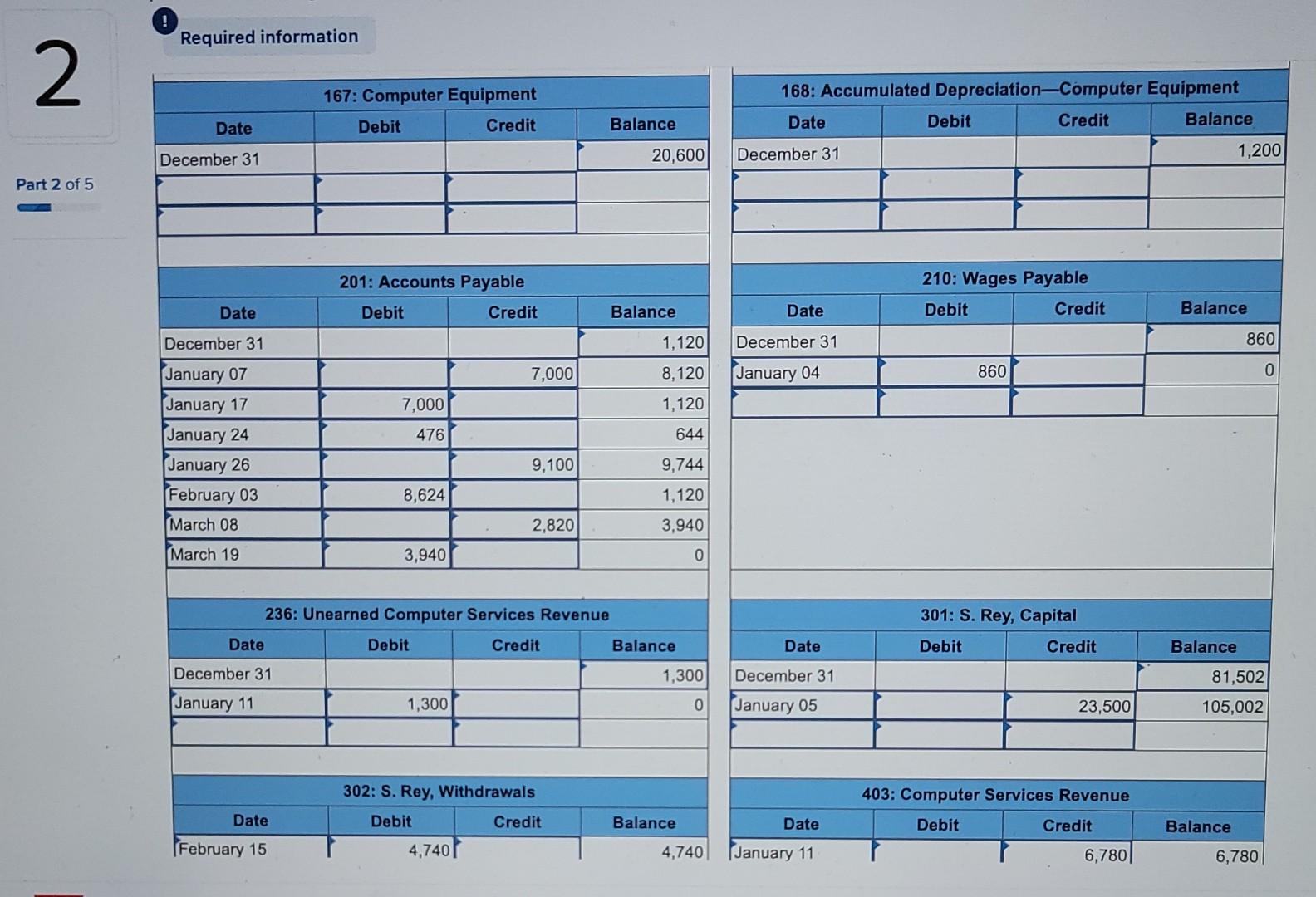

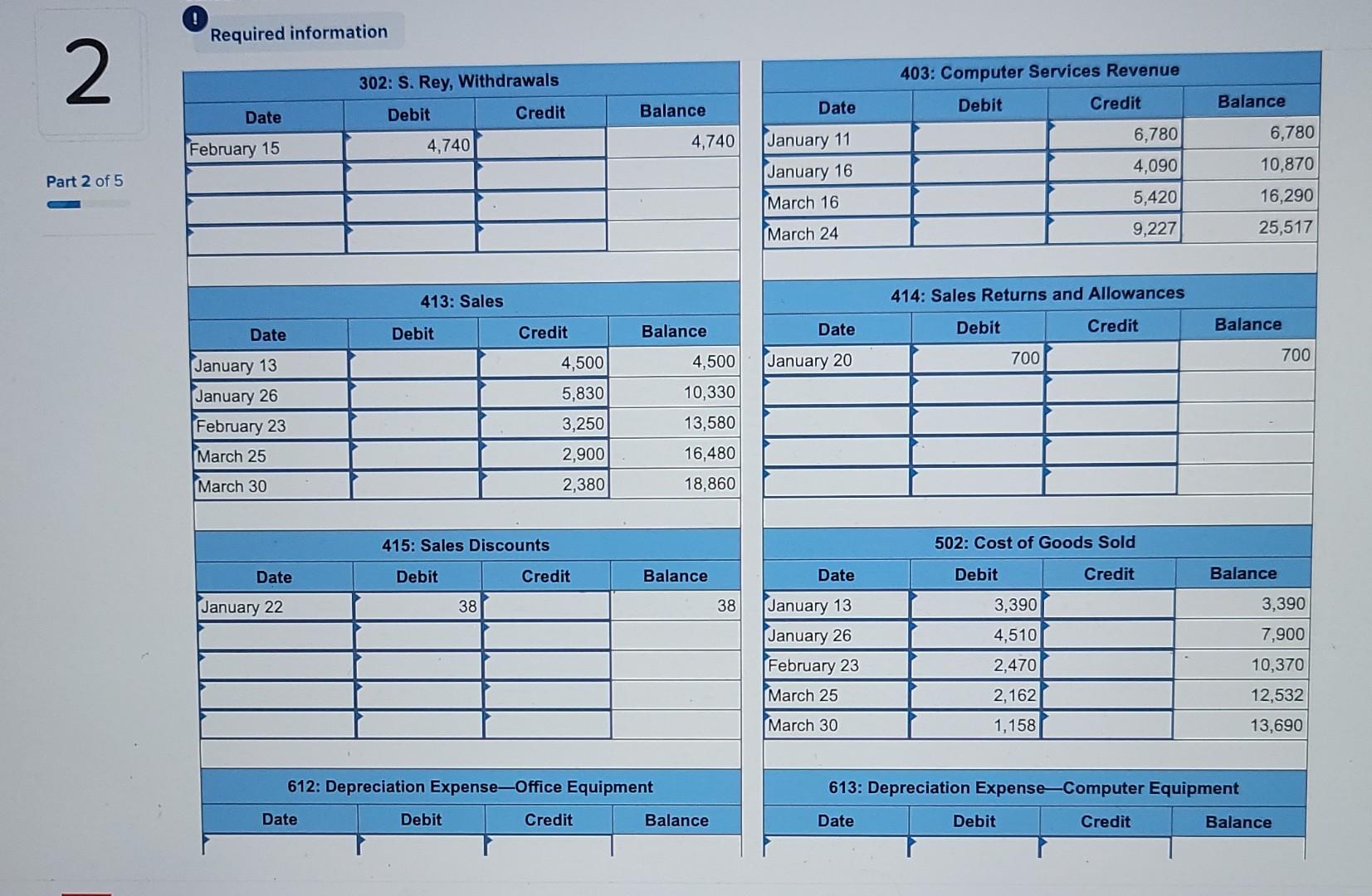

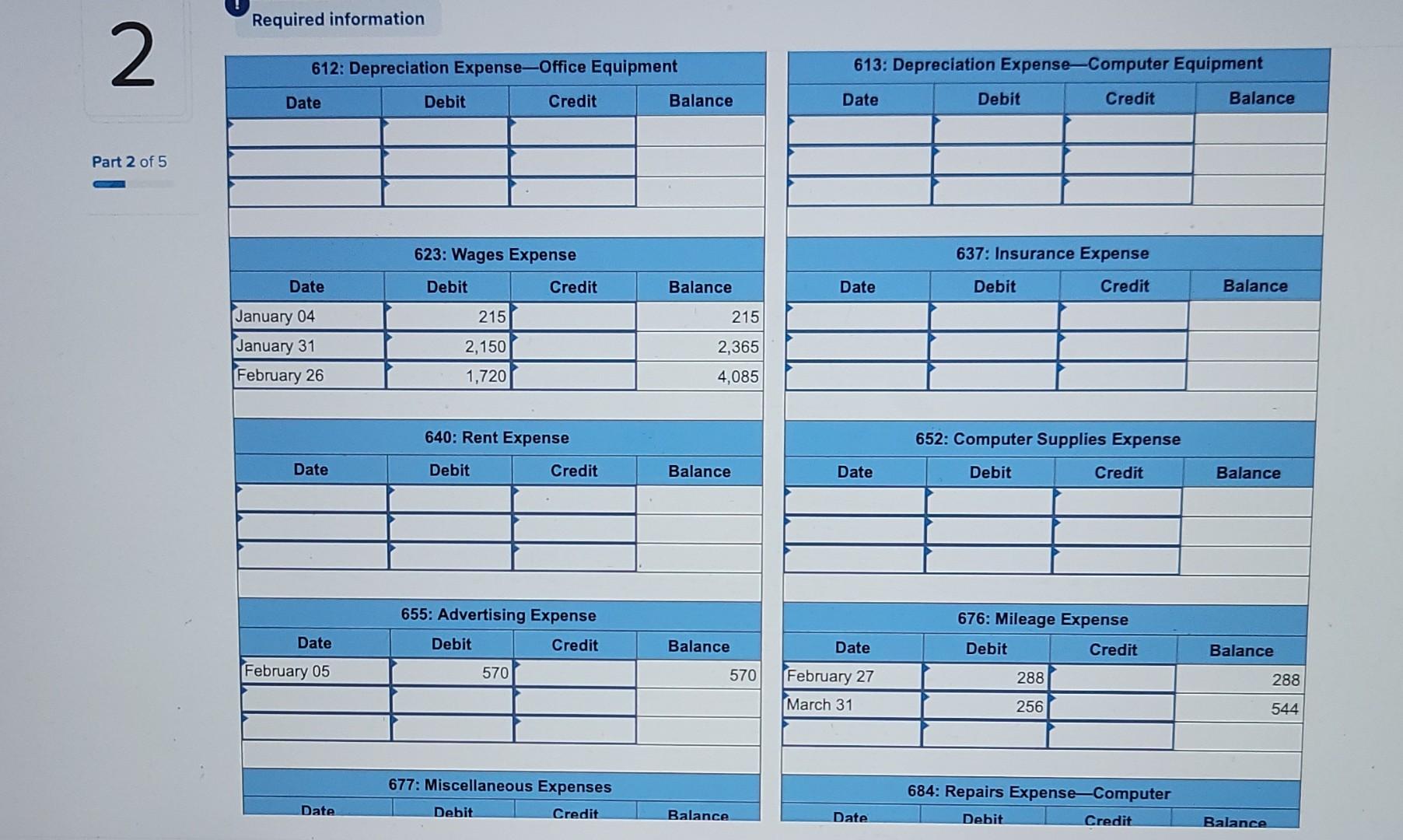

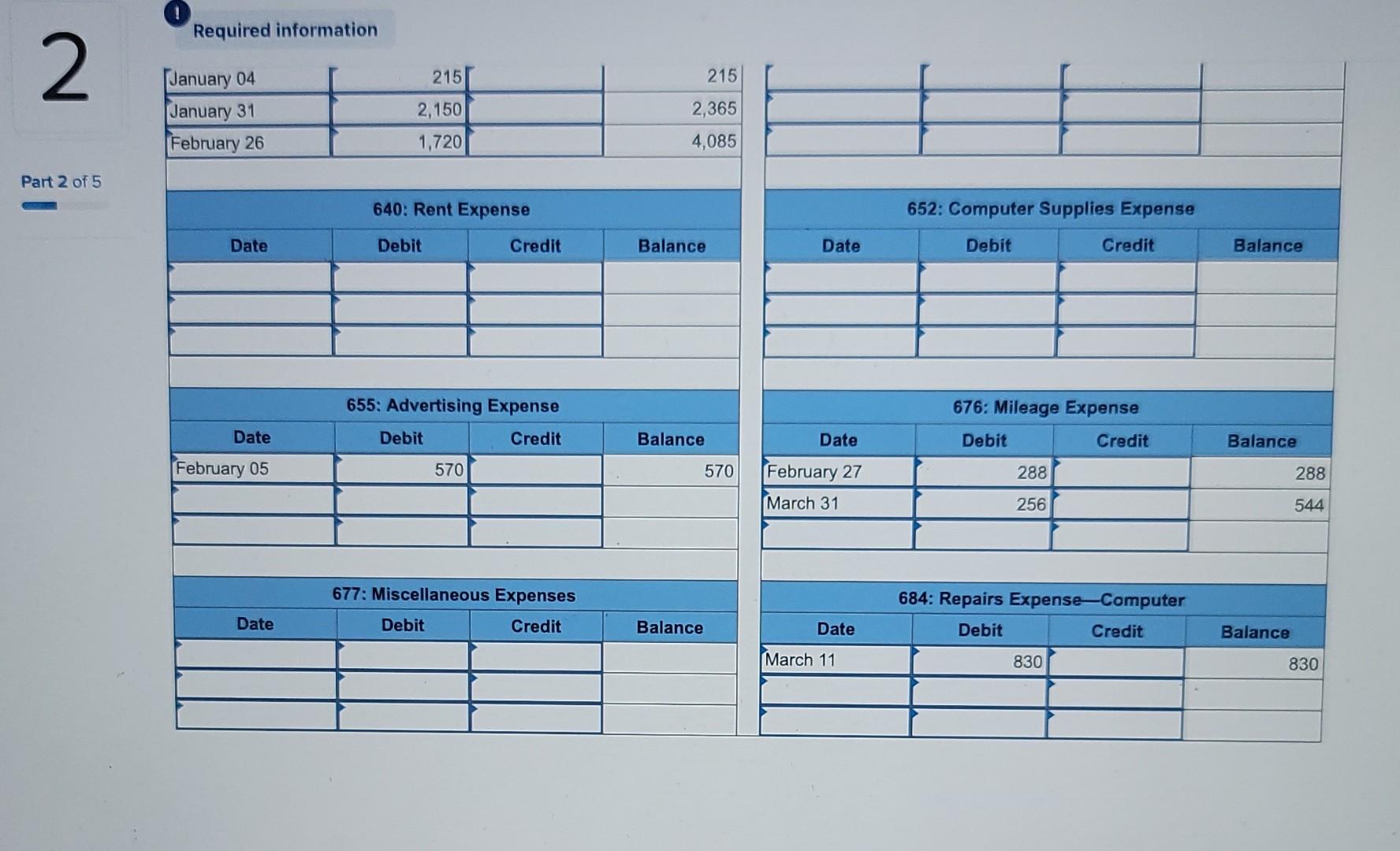

1 Required information [The following information applies to the questions displayed below.] Part 1 of 5 Santana Rey created Business Solutions on October 1, 2021. The company has been successful, and its list of customers has grown. To accommodate the growth, the accounting system is modified to set up separate accounts for each customer. The following chart of accounts includes the account number used for each account and any balance as of December 31, 2021. Santana Rey decided to add a fourth digit with a decimal point to the 106 account number that had been used for the single Accounts Receivable account. This change allows the company to continue using the existing chart of accounts. Credit Number Account Title 101 Cash 106.1 Alex's Engineering Company 106.2 Wildcat Services 106.3 Easy Leasing 106.4 IFM Company 106.5 Liu Corporation 106.6 Gomez Company 106.7 Delta Company 106.8 KC, Incorporated 106.9 Dream, Incorporated 119 Merchandise inventory 126 Computer supplies 128 Prepaid insurance 131 Prepaid rent 163 Office equipment 164 Accumulated depreciation-office equipment 167 Computer equipment 168 Accumulated depreciation-Computer equipment 201 Accounts payable 210 Wages payable 236 Unearned computer services revenue 301 S. Rey, Capital 302 S. Rey, Withdrawals 403 Computer services revenue 413 Sales 414 Sales returns and allowances Colar diraiinta Debit $ 48,412 0 0 0 3,070 0 2,818 0 0 0 0 730 1,827 845 8,020 $ 340 20,600 1,200 1,120 860 1,300 81,502 0 0 0 115 1 414 415 502 612 613 623 637 640 652 655 676 677 684 Sales returns and allowances Sales discounts Cost of goods sold Depreciation expense-Office equipment Depreciation expense-Computer equipment Wages expense Insurance expense Rent expense Computer supplies expense Advertising expense Mileage expense Miscellaneous expenses Repairs expense-Computer 0 0 0 0 0 0 0 0 0 0 0 0 0 Part 1 of 5 In response to requests from customers, S. Rey will begin selling computer software. The company will extend credit terms of 1/10, n/30, FOB shipping point, to all customers who purchase this merchandise. However, no cash discount is available on consulting fees. Additional accounts (Nos. 119, 413, 414, 415, and 502) are added to its general ledger to accommodate the company's new merchandising activities. Its transactions for January through March follow. January 4 The company paid cash to Lyn Addie for five days' work at the rate of $215 per day. Four of the five days relate to wages payable that were accrued in the prior year. January 5 Santana Rey invested an additional $23,500 cash in the company. January 7 The company purchased $7,000 of merchandise from Kansas Corporation with terms of 1/10, n/30, FOB shipping point, invoice dated January 7. January 9 The company received $2,818 cash from Gomez Company as full payment on its account. January 11 The company completed a five-day project for Alex's Engineering Company and billed it $5,480, which is the total price of $6,780 less the advance payment of $1,300. The company debited Unearned Computer Services Revenue for $1,300. January 13 The company sold merchandise with a retail value of $4,500 and a cost of $3,390 to Liu Corporation, invoice dated January 13. January 15 The company paid $640 cash for freight charges on the merchandise purchased on January 7. January 16 The company received $4,090 cash from Delta Company for computer services provided. January 17 The company paid Kansas Corporation for the invoice dated January 7, net of the discount. January 20 The company gave a price reduction (allowance) of $700 to Liu Corporation and credited Liu's accounts receivable for that amount. January 22 The company received the balance due from Liu Corporation, net of the discount and the allowance. January 24 The company returned defective merchandise to Kansas Corporation and accepted a credit against future purchases (debited accounts payable). The defective merchandise invoice cost, net of the discount, was $476. January 26 The company purchased $9,100 of merchandise from Kansas Corporation with terms of 1/10, n/30, FOB destination, invoice dated January 26. comnany cold merchandice with 241 510 nct for 15 20 on credit KO Tncnrnratad Tonnaru 26 Tha 1 Part 1 of 5 January 26 The company purchased $9,100 of merchandise from Kansas Corporation with terms of 1/10, n/30, FOB destination, invoice dated January 26. January 26 The company sold merchandise with a $4,510 cost for $5,830 on credit to KC, Incorporated, invoice dated January 26. January 31 The company paid cash to Lyn Addie for 10 days' work at $215 per day. February 1 The company paid $2,535 cash to Hillside Mal for another three months' rent in advance. February 3 The company paid Kansas Corporation for the balance due, net of the cash discount, less the $476 credit from merchandise returned on January 24. February 5 The company paid $570 cash to Facebook for an advertisement to appear on February 5 only. February 11 The company received the balance due from Alex's Engineering Company for fees bitled on January 11. February 15 S. Rey withdrew $4,740 cash from the company for personal use. February 23 The company sold merchandise with a $2,470 cost for $3,250 on credit to Delta Company, invoice dated February 23. February 26 The company paid cash to Lyn Addie for eight days' work at $215 per day. February 27 The company reimbursed Santana Rey $288 cash for business automobile mileage. The company recorded the reimbursement as "Mileage Expense." March 8 The company purchased $2,820 of computer supplies from Harris Office Products on credit with terms of n/30, FOB destination, invoice dated March 8. March 9 The company received the balance due from Delta Company for merchandise sold on February 23. March 11 The company paid $830 cash for minor repairs to the company's computer. March 16 The company received $5,420 cash from Dream, Incorporated, for computing services provided. March 19 The company paid the full amount due of $3,940 to Harris Office Products, consisting of amounts created on December 15 (of $1,120) and March 8. March 24 The company billed Easy Leasing for $9,227 of computing services provided. March 25 The company sold merchandise with a $2,162 cost for $2,900 on credit to Wildcat Services, invoice dated March 25. March 30 The company sold merchandise with a $1,158 cost for $2,380 on credit to IFM Company, invoice dated March 30. March 31 The company reimbursed Santana Rey $256 cash for business automobile mileage. The company recorded the reimbursement as "Mileage Expense." The following additional facts are available for preparing adjustments on March 31 prior to financial statement preparation. a. The March 31 amount of computer supplies still available totals $2,015. b. Prepaid Insurance coverage of $609 expired during this three-month period. c. Lyn Addie has not been paid for seven days of work at the rate of $215 per day. d. Prepaid rent of $2,535 expired during this three-month period. e. Depreciation on the computer equipment for January 1 through March 31 is $1,200. f. Depreciation on the office equipment for January 1 through March 31 is $340. g. The March 31 amount of merchandise inventory still available totals $584. 1 Required: 1. Prepare journal entries to record each of the January through March transactions. Debit No Credit General Journal Date 215 Part 1 of 5 1 January 04 860 Wages expense Wages payable Cash 1,075 2 January 05 Cash 23,500 23,500 S. Rey, Capital 3 7,000 January 07 Merchandise inventory Accounts payable 7.000 4 January 09 Cash 2,818 Accounts receivable-Gomez Company 2,818 5 January 11 1,300 Unearned computer services revenue Accounts receivable-Alex's Engineering Company Computer services revenue 5,480 6,780 6 January 13 Accounts receivable Liu Corporation 4,500 Sales 4,500 7 January 13 3,390 Cost of goods sold Merchandise inventory 3,390 1 Required: 1. Prepare journal entries to record each of the January through March transactions. 7 January 13 3,390 Cost of goods sold Merchandise inventory 3,390 Part 1 of 5 8 January 15 Merchandise inventory 640 Cash 640 9 January 16 Cash 4,090 Computer services revenue 4,090 10 January 17 7,000 Accounts payable Merchandise inventory Cash 70 6,930 11 January 20 Sales returns and allowances 700 Accounts receivable Liu Corporation 700 12 January 22 Cash 3,762 Sales discounts 38 Accounts receivable Liu Corporation 3,800 13 January 24 476 Accounts payable Merchandise inventory 476 14 January 26 Merchandise inventory 9,100 1 Required: 1. Prepare journal entries to record each of the January through March transactions. 14 January 26 9,100 Merchandise inventory Accounts payable 9,100 Part 1 of 5 15 January 26 Accounts receivable-KC, Incorporated 5,830 Sales 5,830 16 January 26 4,510 Cost of goods sold Merchandise inventory 4,510 17 January 31 Wages expense 2,150 Cash 2,150 18 February 01 Prepaid rent 2,535 Cash 2,535 19 February 03 8,624 Accounts payable Merchandise inventory 91 Cash 8,533 20 February 05 570 Advertising expense Cash 7,570 21 February 11 Cash 5,480 Accounts receivable-Alex's Engineering Company 5,480 1 Required: 1. Prepare journal entries to record each of the January through March transactions. 21 February 11 Cash 5,480 Accounts receivable-Alex's Engineering Company 5,480 Part 1 of 5 22 February 15 4,740 S. Rey, Withdrawals Cash 4,740 23 February 23 Accounts receivable-Delta Company 3,250 Sales 3,250 24 February 23 2,470 Cost of goods sold Merchandise inventory 2,470 25 February 26 Wages expense 1,720 Cash 1,720 26 February 27 Mileage expense 288 Cash 288 27 March 08 2,820 Computer supplies Accounts payable 2,820 28 March 09 Cash 3,250 Accounts receivable-Delta Company 3,250 29 March 11 Repairs expense -Computer 830 29 March 11 830 Repairs expense Computer Cash 830 Part 1 of 5 30 March 16 Cash 5,420 Computer services revenue 5,420 31 March 19 Accounts payable 3,940 Cash 3,940 32 March 24 9,227 Accounts receivable-Easy Leasing Computer services revenue 9,227 33 March 25 Accounts receivable-Wildcat Services 2,900 Sales 2.900 34 March 25 2,162 Cost of goods sold Merchandise inventory 2,162 35 March 30 Accounts receivableIFM Company 2,380 Sales 2,380 36 March 30 Cost of goods sold Merchandise inventory 1,158 1,158 37 March 31 Mileage expense 256 Required information 830 1 Cash 5,420 30 March 16 Cash 5,420 Computer services revenue Part 1 of 5 3,940 31 March 19 Accounts payable Cash 3.940 9,227 32 March 24 Accounts receivable-Easy Leasing Computer services revenue 9,227 33 2,900 March 25 Accounts receivable Wildcat Services 2,900 Sales 2,162 34 March 25 Cost of goods sold Merchandise inventory 2,162 35 March 30 Accounts receivable-IFM Company 2,380 Sales 2,380 36 March 30 1,158 Cost of goods sold Merchandise inventory 1,158 37 March 31 256 Mileage expense Cash 256 2. Post the journal entries in part 1 to the accounts in the company's general ledger. Note: Begin with the ledger's post-closing adjusted balances as of December 31, 2021. 2 101: Cash 106.1: Accounts Receivable-Alex's Engineering Company Date Debit Credit Balance Date Debit Credit Balance December 31 December 31 0 Part 2 of 5 1,075 5,480 5,480 January 11 February 11 5,480 0 23,500 2,818 640 4,090 6,930 3,762 January 04 January 05 January 09 January 15 January 16 January 17 January 22 January 31 February 01 February 03 February 05 February 11 February 15 February 26 February 27 2,150 2,535 8,533 7,570 48,412 47,337 70,837 73,655 73,015 77,105 70,175 73,937 71,787 69,252 60,719 53,149 58,629 53,889 52,169 51,881 55,131 54,301 5,480 4,740 1,720 288 March 09 3,250 March 11 830 March 16 5,420 59,721 55,781 March 19 3,940 106.2: Accounts Receivable-Wildcat Services 106.3: Accounts Receivable-Easy Leasing Date Debit Credit Balance Date Debit Credit Balance 2 106.2: Accounts Receivable-Wildcat Services Date Debit Credit Balance 106.3: Accounts Receivable-Easy Leasing Date Debit Credit Balance 0 0 December 31 December 31 Part 2 of 5 9,227 2,900 March 24 2,900 9,227 March 25 106.5: Accounts Receivable-Liu Corporation Date Debit Credit Balance 106.4: Accounts Receivable-IFM Company Date Debit Credit Balance December 31 3,070 March 30 2,380 5,450 December 31 0 4,500 4,500 3,800 700 January 13 January 20 January 22 3,800 0 106.7: Accounts Receivable-Delta Company Date Debit Credit Balance 106.6: Accounts Receivable-Gomez Company Date Debit Credit Balance December 31 2,818 January 09 2,818 0 December 31 0 February 23 3,250 3,250 March 09 3,250 0 106.8: Accounts Receivable-KC, Incorporated Date Debit Credit Balance 106.9: Accounts Receivable-Dream, Incorporated Date Debit Credit Balance December 31 0 December 31 0 January 26 5,830 5,830 119: Merchandise Inventory 126: Computer Supplies Required information 119: Merchandise Inventory Debit Credit 126: Computer Supplies Debit Credit Date Balance Date Balance December 31 0 December 31 730 7,000 7,000 March 08 2,820 3,550 2,015 3,390 March 31 1,535 3,610 4,250 640 70 4,180 January 07 January 13 January 15 January 17 January 24 January 26 January 26 February 03 February 23 476 3,704 12,804 9,100 4,5 8,294 8,203 91 2,470 5,733 March 25 2,162 3,571 March 30 1.158 2,413 128: Prepaid Insurance Debit Credit 131: Prepaid Rent Debit Credit Date Balance Date Balance December 31 1,827 December 31 845 February 01 2,535 3,380 163: Office Equipment Debit Credit 164: Accumulated Depreciation Office Equipment Date Debit Credit Balance Date Balance December 31 8,020 December 31 340 ! Required information 2 167: Computer Equipment Debit Date Credit Balance 168: Accumulated Depreciation-Computer Equipment Date Debit Credit Balance December 31 1,200 December 31 20,600 Part 2 of 5 201: Accounts Payable Debit Credit 210: Wages Payable Debit Credit Date Balance Date Balance December 31 1,120 December 31 860 7,000 8,120 January 04 860 0 7,000 1,120 January 07 January 17 January 24 January 26 February 03 476 644 9,100 9,744 1,120 8,624 March 08 2,820 3,940 March 19 3,940 0 301: S. Rey, Capital 236: Unearned Computer Services Revenue Date Debit Credit Balance Date Debit Credit Balance December 31 1,300 December 31 81,502 January 11 1,300 0 January 05 23,500 105,002 302: S. Rey, Withdrawals 403: Computer Services Revenue Date Debit Credit Balance Date Debit Credit Balance [February 15 4,740 4,740 January 11 6,780 6,780 ! Required information 2 302: S. Rey, Withdrawals 403: Computer Services Revenue Date Debit Credit Balance Date Credit Balance Debit February 15 4,740 4,740 January 11 January 16 March 16 6,780 4,090 5,420 6,780 10,870 16,290 Part 2 of 5 March 24 9,227 25,517 413: Sales 414: Sales Returns and Allowances Date Debit Credit Balance Date Balance Debit Credit 700 4,500 700 January 20 January 13 January 26 February 23 4,500 5,830 10,330 3,250 13,580 March 25 16,480 2,900 2,380 March 30 18,860 415: Sales Discounts 502: Cost of Goods Sold Date Debit Credit Balance Date Debit Credit Balance January 22 38 38 3,390 3,390 January 13 January 26 February 23 4,510 2,470 2,162 1,158 7,900 10,370 12,532 March 25 March 30 13,690 612: Depreciation Expense-Office Equipment 613: Depreciation Expense-Computer Equipment Date Debit Credit Balance Date Debit Credit Balance Required information 2 612: Depreciation Expense-Office Equipment 613: Depreciation Expense-Computer Equipment Date Debit Credit Balance Date Debit Credit Balance Part 2 of 5 623: Wages Expense 637: Insurance Expense Date Debit Credit Balance Date Debit Credit Balance 215 215 January 04 January 31 February 26 2,150 2,365 1,720 4,085 640: Rent Expense 652: Computer Supplies Expense Date Debit Credit Balance Date Debit Credit Balance 676: Mileage Expense 655: Advertising Expense Debit Credit Date Balance Date Debit Credit Balance February 05 570 570 288 288 February 27 March 31 256 544 677: Miscellaneous Expenses 684: Repairs Expense Computer Date Debit Credit Balance Date Debit Credit Balance Required information 2 215 215 January 04 January 31 February 26 2,150 1,720 2,365 4,085 Part 2 of 5 640: Rent Expense 652: Computer Supplies Expense Date Debit Credit Balance Date Debit Credit Balance 676: Mileage Expense 655: Advertising Expense Debit Credit Date Balance Date Debit Credit Balance February 05 570 570 February 27 288 288 March 31 256 544 677: Miscellaneous Expenses 684: Repairs Expense-Computer Debit Credit Date Debit Credit Balance Date Balance March 11 830 830 Credit Credit Debit $ 55,781 2,900 9.227 5.450 0 0 0 5,830 0 2,413 2,015 1,827 3,380 $ 8,020 340 20,600 1,200 38 39 40 Trial Balance 41 Account Title 142 101: Cash 19 106.1: Alex Engineering Co 106.2: Wildcat Services 45 106.3 Easy Leasing 45 106.4: IFM CO 47. 106.5: Liu Co 48 106.6: Gomez Co 49 106.7: Delta Co 50 106.8: KC, Inc 51 106.9: Dream Inc. 52 119: Merchandise Inventory 53 126 Computer Supplies 54 128: Prepaid Insurance 55 131: Prepaid Rent 163: Office Equipment 164: Accumulated Depreciation - Office Equipment 167: Computer Equipment 50 168: Accumulated Depreciation- Computer Equipment 201: Acounts Payable 61 210: Wages Payable 62 236: Unearned Computer Services Revenue 63 301: S. Rey, Capital 302: S. Rey, Withdrawals 65 403: Computer Services Revenue 66 413: Sales 67 414: Sales Returns and Allowances 68 415: Sales Discounts 69 502: Cost of Goods Sold 70 612: Depreciation Expence- Office Equipment 71 613: Depreciation Expence- Computer Equipment 72 623: Wages Expence 73 637: Insurance Expence 74 640: Rent Expense 75 652: Computer Science Expense 76 655: Advertising Expense 77 676: Mileage Expense 78 677: Miscellaneous Expense 79 684: Repairs Expense - Computer BO Adjusted Trial Balance Account Title Debit 101: Cash 106.1: Alex Engineering Co 106.2: Wildcat Services 106.3 Easy Leasing 106.4: IFM CO 106.5: Liu Co 106.6: Gomez Co 106.7: Delta CO 106.8: KC, Inc 106.9: Dream Inc. 119: Merchandise Inventory 126: Computer Supplies 128: Prepaid Insurance 131: Prepaid Rent 163: Office Equipment 164: Accumulated Depreciation- 167: Computer Equipment 168: Accumulated Depreciation- 201: Acounts Payable 210: Wages Payable 236: Unearned Computer Services 301: S. Rey, Capital 302: S. Rey, Withdrawals 403: Computer Services Revenue 413: Sales 414: Sales Returns and Allowances 415: Sales Discounts 502: Cost of Goods Sold 612: Depreciation Expence-Office 613: Depreciation Expence- 623: Wages Expence 637: Insurance Expence 640: Rent Expense 652: Computer Science Expense 655: Advertising Expense 676: Mileage Expense 677: Miscellaneous Expense 684: Repairs Expense - Computer 60 105,002 4,740 25,517 18,860 700 38 13,690 4,085 $ 570 544 0 830 31 82 33 Totals $ 142,640 $150.919 Totals 34 35Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

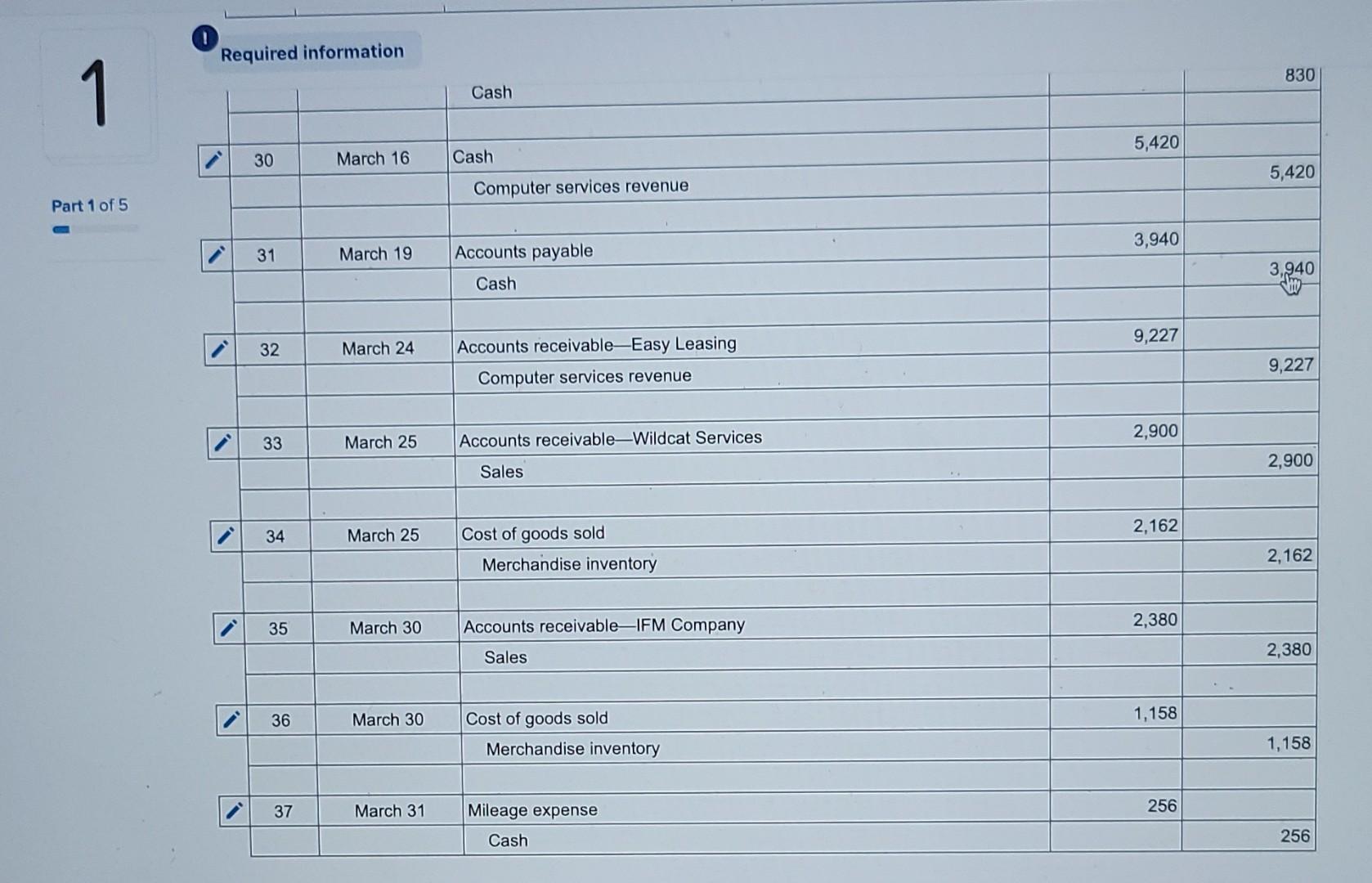

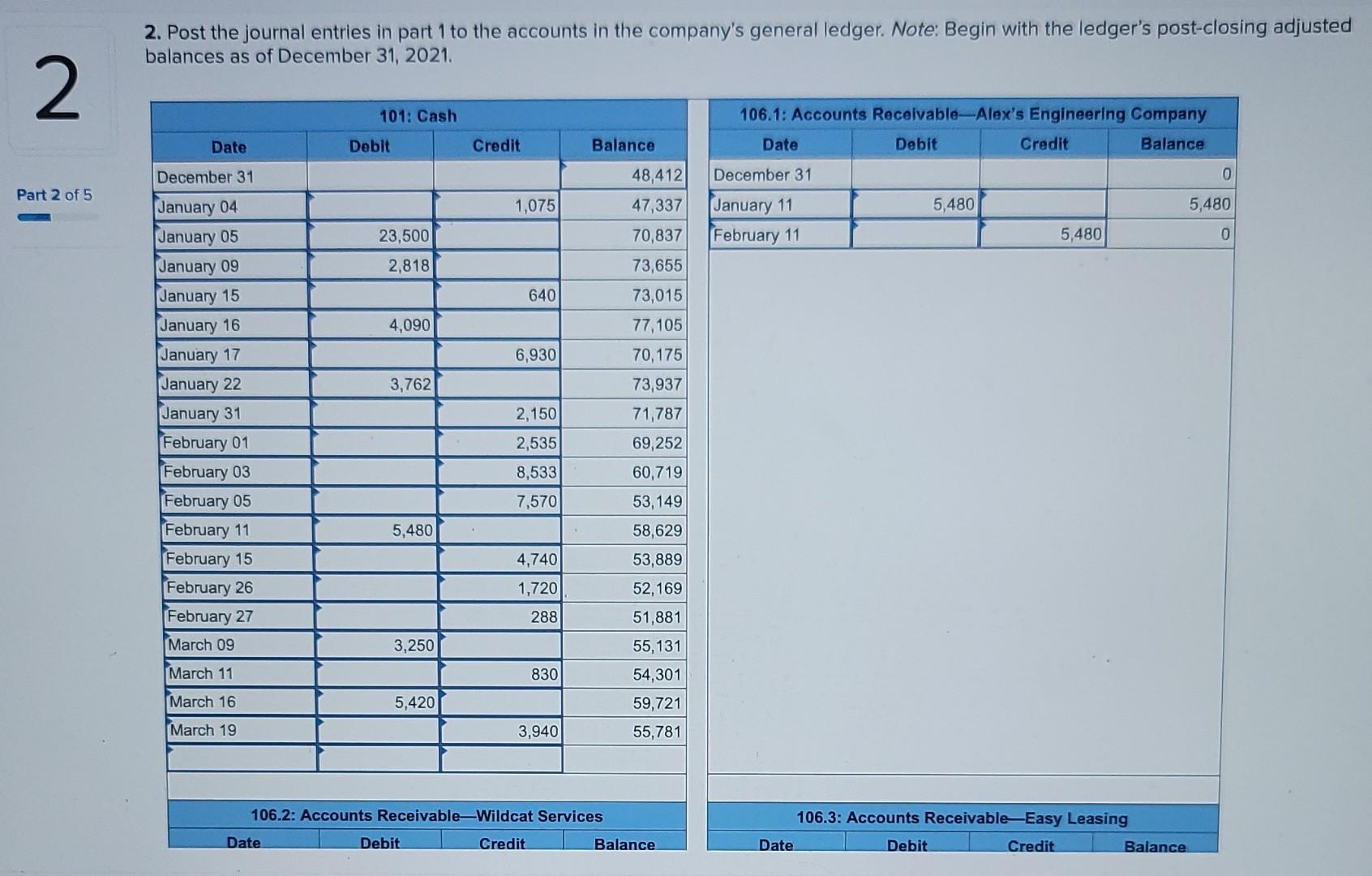

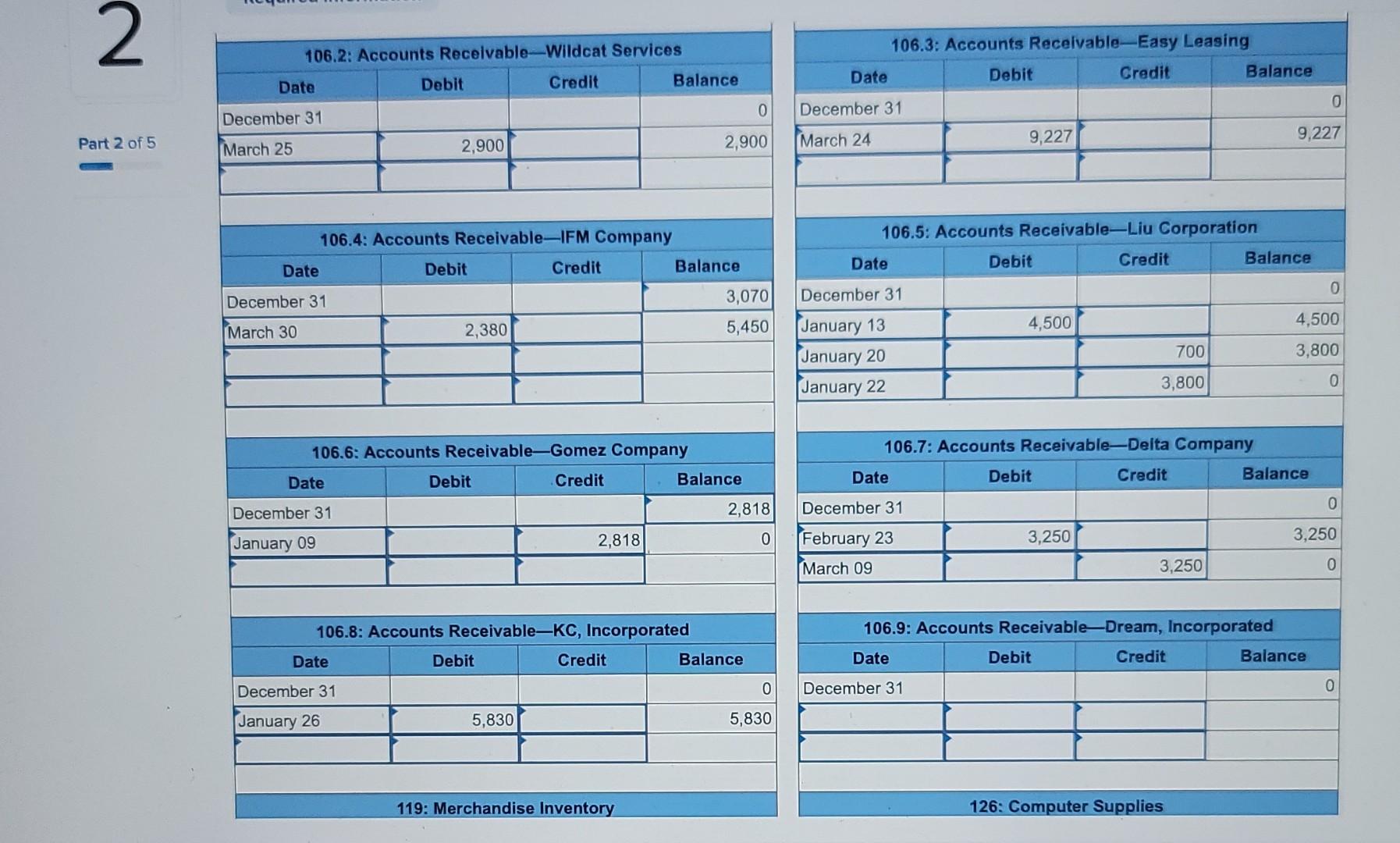

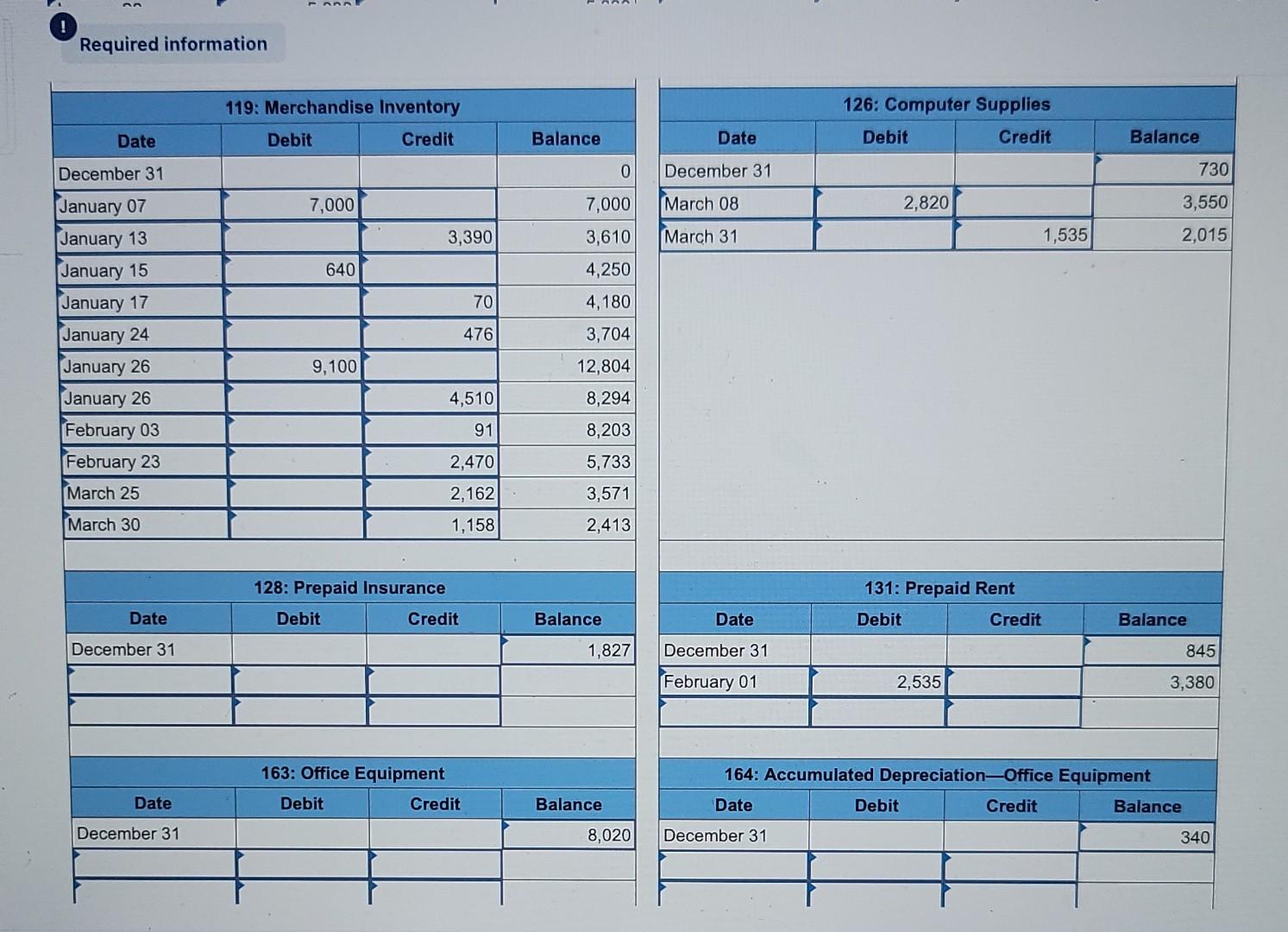

Get Started