Answered step by step

Verified Expert Solution

Question

1 Approved Answer

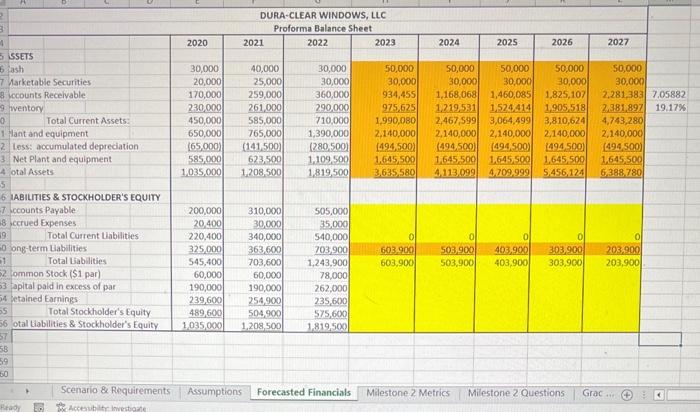

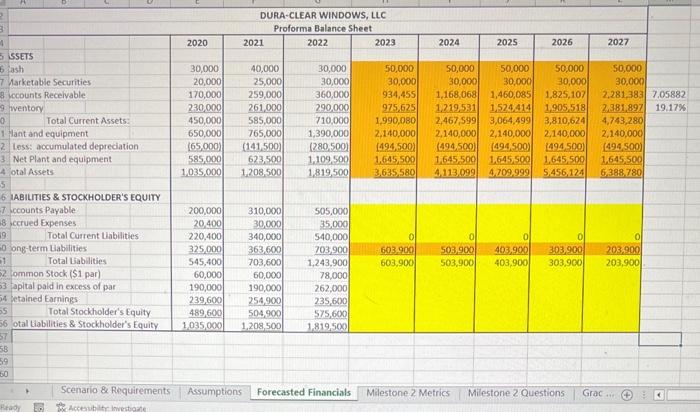

im needing help with everything under liabilities and stockholders equity i keep being told information is missing but not real sure what is needed. whats

im needing help with everything under liabilities and stockholders equity

i keep being told information is missing but not real sure what is needed. whats posted here is what i have the assumptions are there...

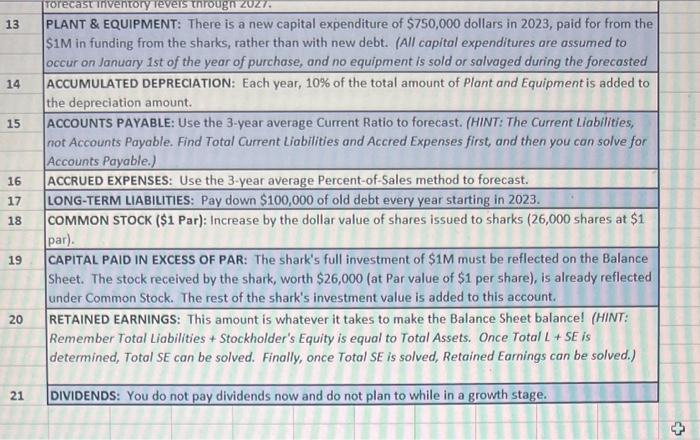

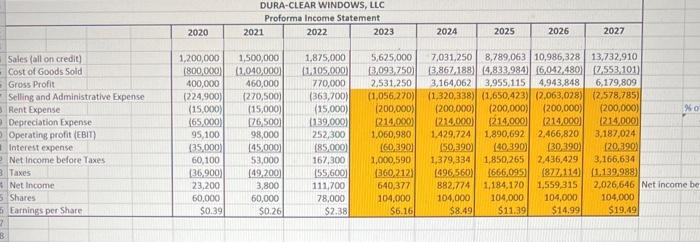

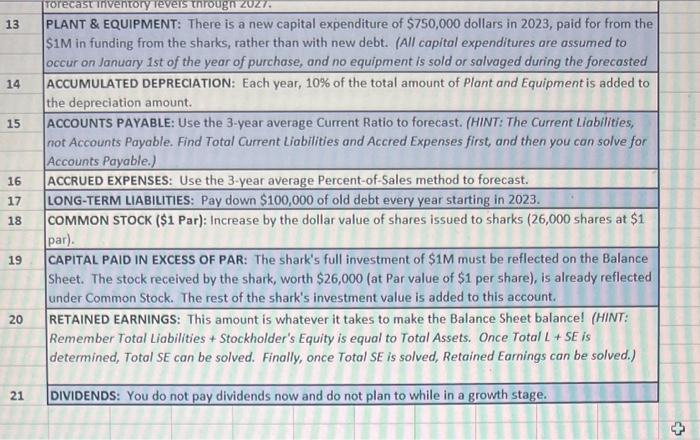

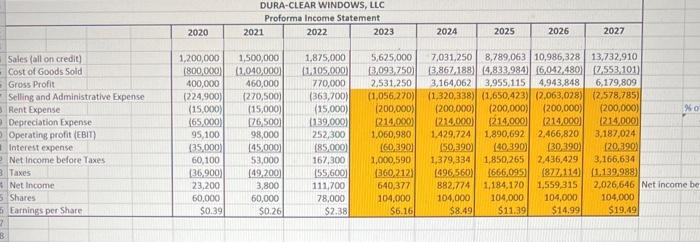

DURA-CLEAR WINDOWS, LLC Proforma Balance Sheet PLANT \& EQUIPMENT: There is a new capital expenditure of $750,000 dollars in 2023, paid for from the $1M in funding from the sharks, rather than with new debt. (All capital expenditures are assumed to occur on January 1 st of the year of purchase, and no equipment is sold or salvaged during the forecasted ACCUMULATED DEPRECIATION: Each year, 10% of the total amount of Plant and Equipment is added to the depreciation amount. ACCOUNTS PAYABLE: Use the 3-year average Current Ratio to forecast. (HINT: The Current Liabilities, not Accounts Payable. Find Total Current Liabilities and Accred Expenses first, and then you can solve for Accounts Payable.) ACCRUED EXPENSES: USe the 3-year average Percent-of-Sales method to forecast. LONG-TERM LIABILITIES: Pay down $100,000 of old debt every year starting in 2023. COMMON STOCK (\$1 Par): Increase by the dollar value of shares issued to sharks (26,000 shares at $1 par). CAPITAL PAID IN EXCESS OF PAR: The shark's full investment of $1M must be reflected on the Balance Sheet. The stock received by the shark, worth $26,000 (at Par value of $1 per share), is already reflected under Common Stock. The rest of the shark's investment value is added to this account. 20 RETAINED EARNINGS: This amount is whatever it takes to make the Balance Sheet balance! (HINT: Remember Total Liabilities + Stockholder's Equity is equal to Total Assets. Once Total L + SE is determined, Total SE can be solved. Finally, once Total SE is solved, Retained Earnings can be solved.) 21 DIVIDENDS: You do not pay dividends now and do not plan to while in a growth stage. DURA-CLEAR WINDOWS, LLC Proforma Income Statement DURA-CLEAR WINDOWS, LLC Proforma Balance Sheet PLANT \& EQUIPMENT: There is a new capital expenditure of $750,000 dollars in 2023, paid for from the $1M in funding from the sharks, rather than with new debt. (All capital expenditures are assumed to occur on January 1 st of the year of purchase, and no equipment is sold or salvaged during the forecasted ACCUMULATED DEPRECIATION: Each year, 10% of the total amount of Plant and Equipment is added to the depreciation amount. ACCOUNTS PAYABLE: Use the 3-year average Current Ratio to forecast. (HINT: The Current Liabilities, not Accounts Payable. Find Total Current Liabilities and Accred Expenses first, and then you can solve for Accounts Payable.) ACCRUED EXPENSES: USe the 3-year average Percent-of-Sales method to forecast. LONG-TERM LIABILITIES: Pay down $100,000 of old debt every year starting in 2023. COMMON STOCK (\$1 Par): Increase by the dollar value of shares issued to sharks (26,000 shares at $1 par). CAPITAL PAID IN EXCESS OF PAR: The shark's full investment of $1M must be reflected on the Balance Sheet. The stock received by the shark, worth $26,000 (at Par value of $1 per share), is already reflected under Common Stock. The rest of the shark's investment value is added to this account. 20 RETAINED EARNINGS: This amount is whatever it takes to make the Balance Sheet balance! (HINT: Remember Total Liabilities + Stockholder's Equity is equal to Total Assets. Once Total L + SE is determined, Total SE can be solved. Finally, once Total SE is solved, Retained Earnings can be solved.) 21 DIVIDENDS: You do not pay dividends now and do not plan to while in a growth stage. DURA-CLEAR WINDOWS, LLC Proforma Income Statement Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started