I'm not confident with my entries nor know what to do for 2021. I would appreciate the help and will rate! Chapman Company obtains 100 percent of Abernethy Companys stock on January 1, 2020. As of that date, Abernethy has the following trial balance

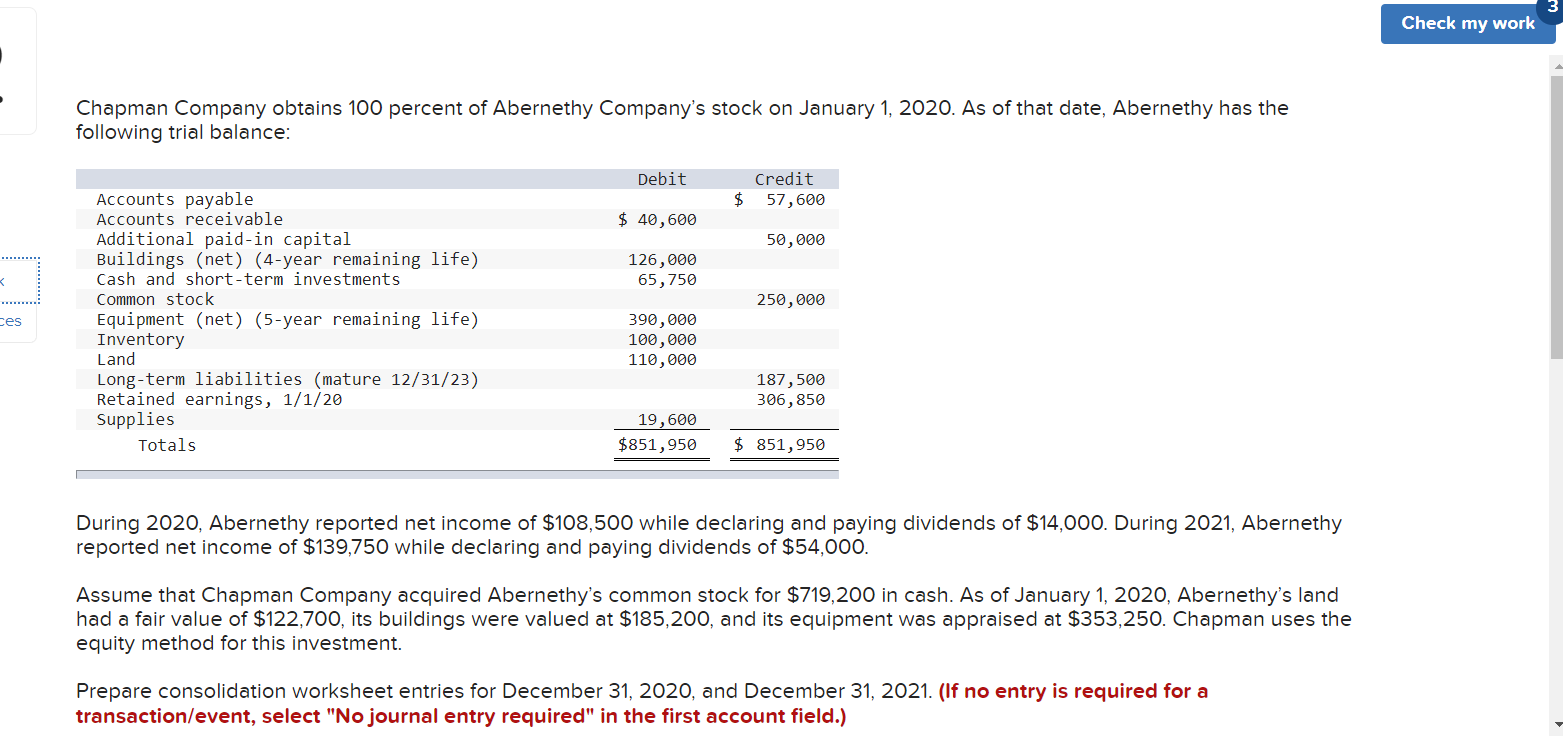

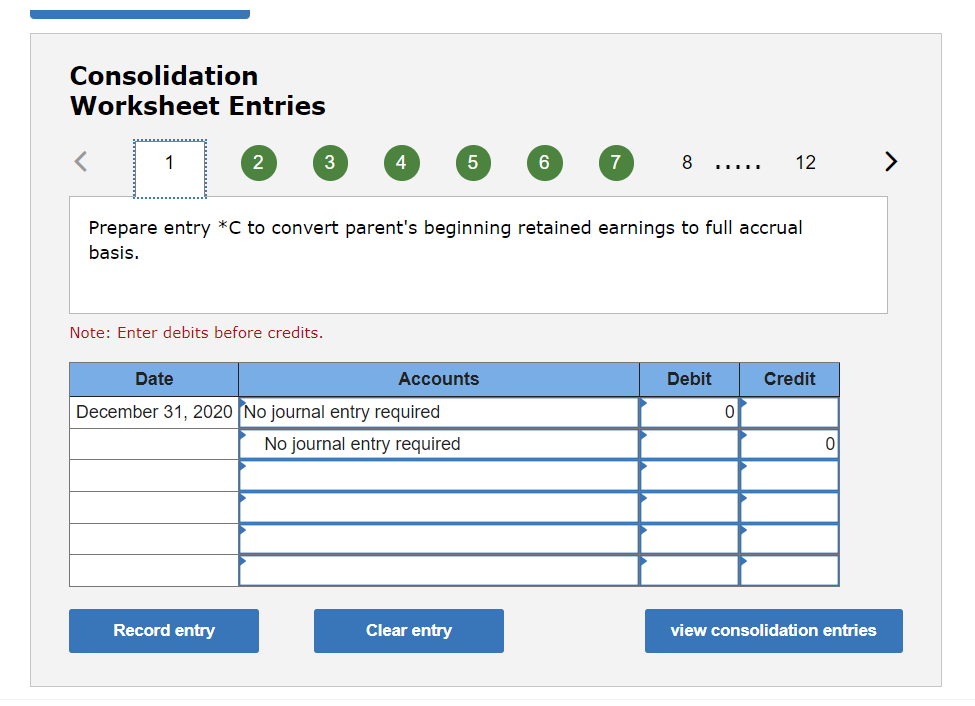

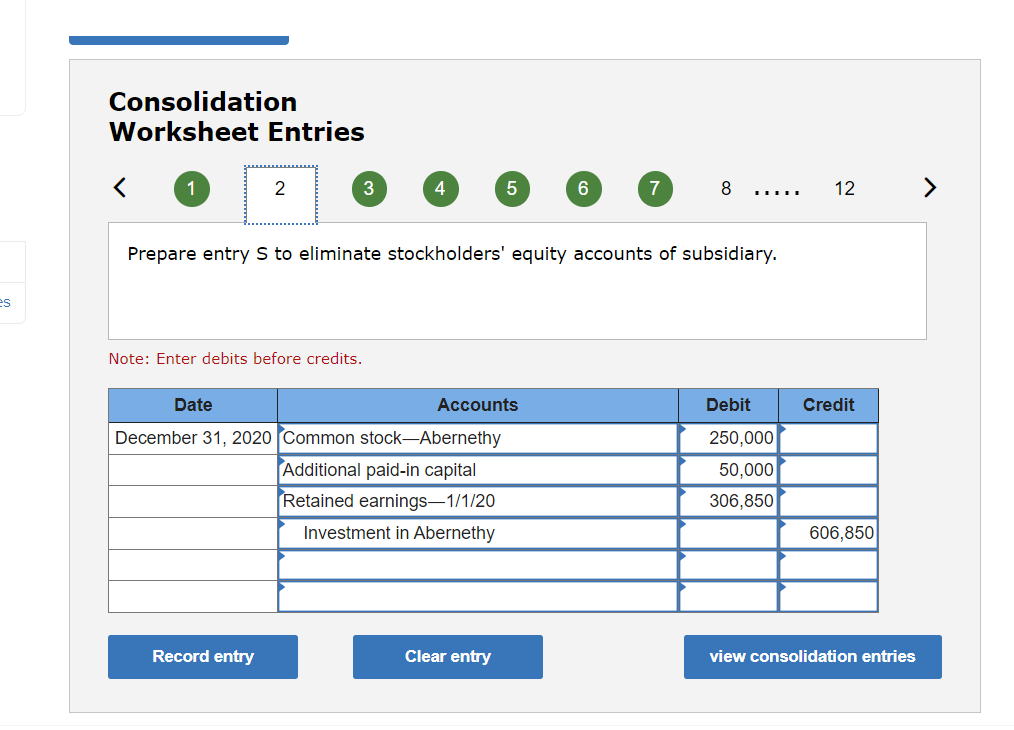

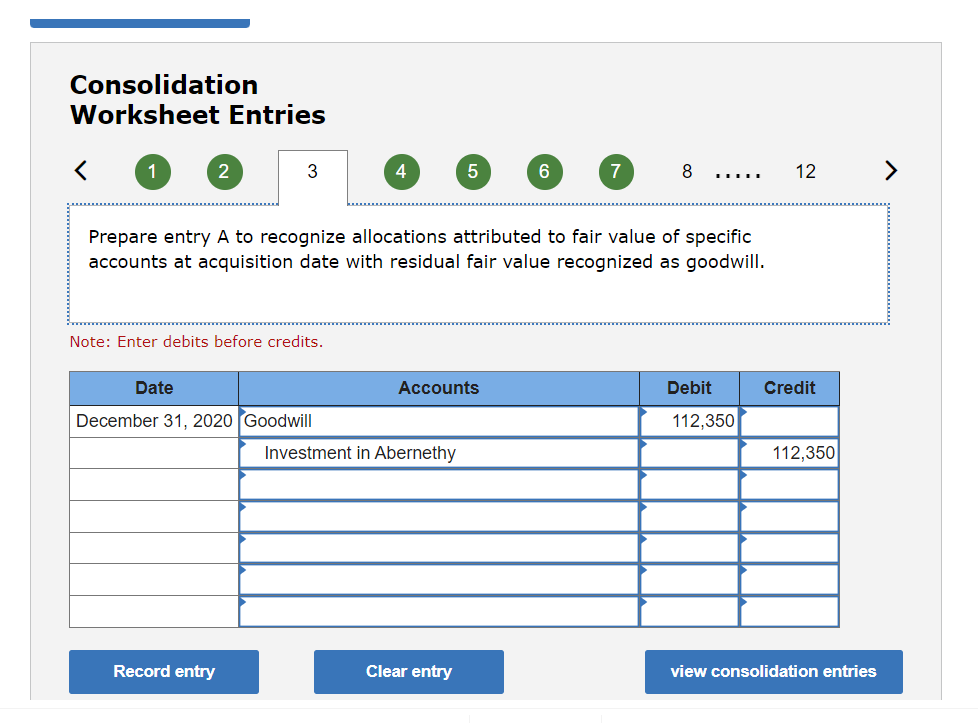

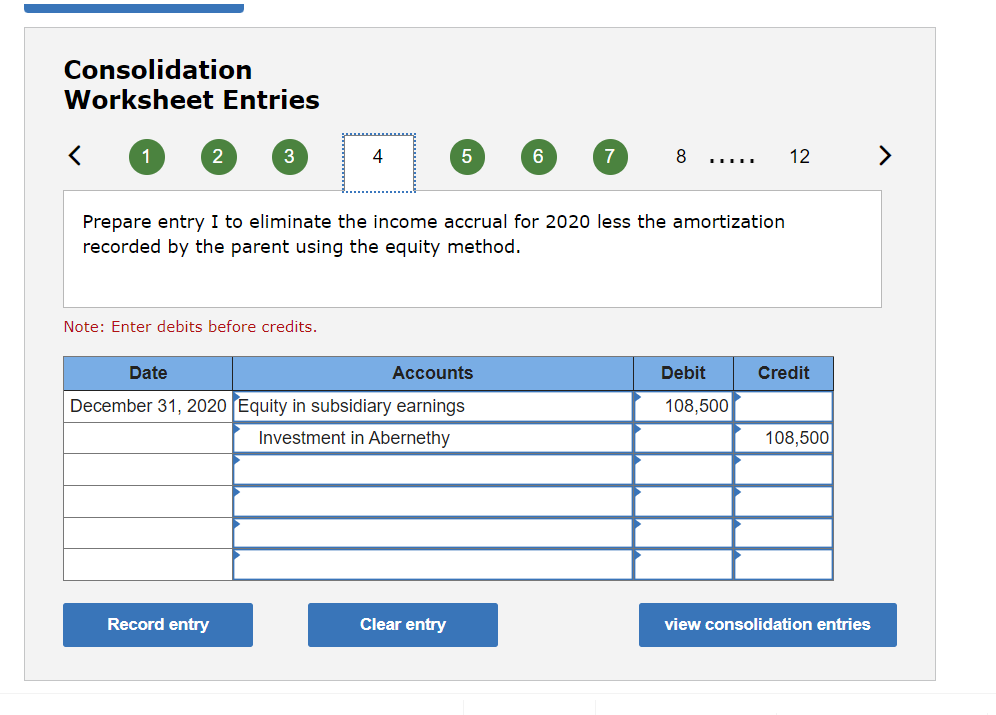

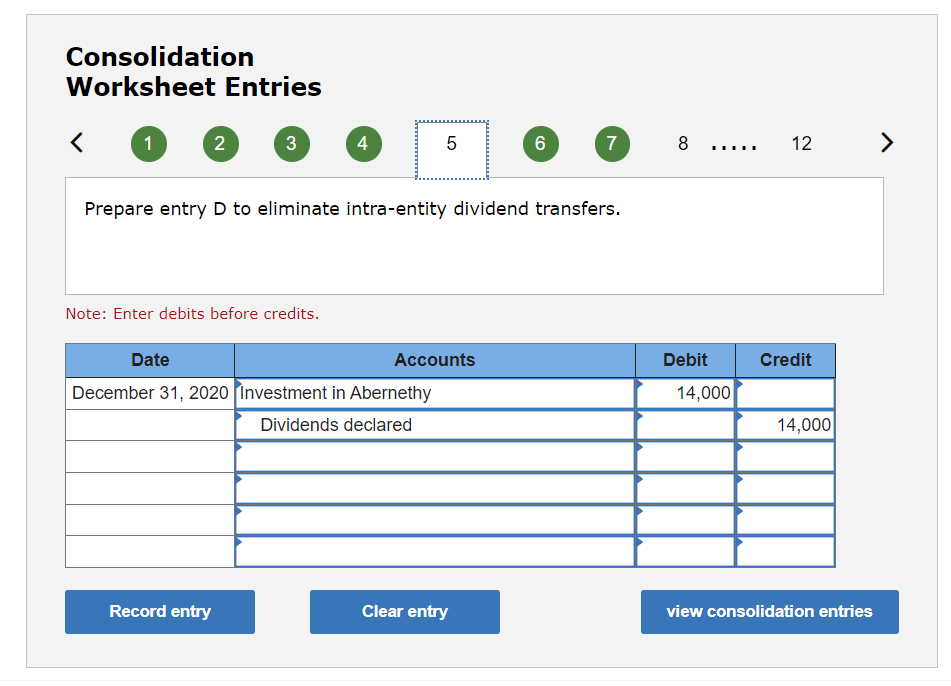

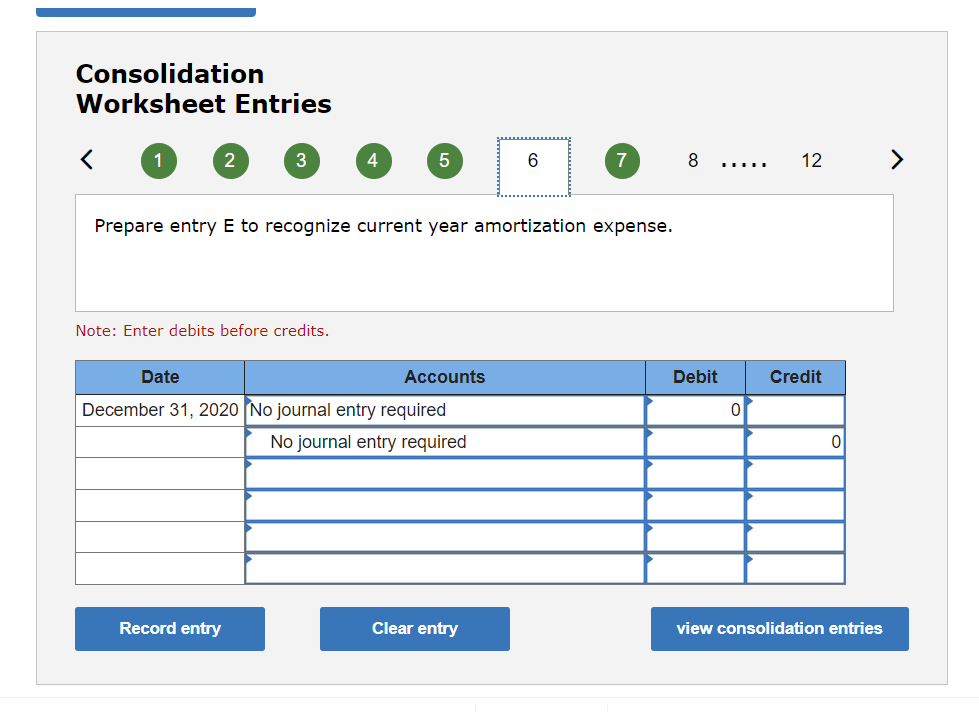

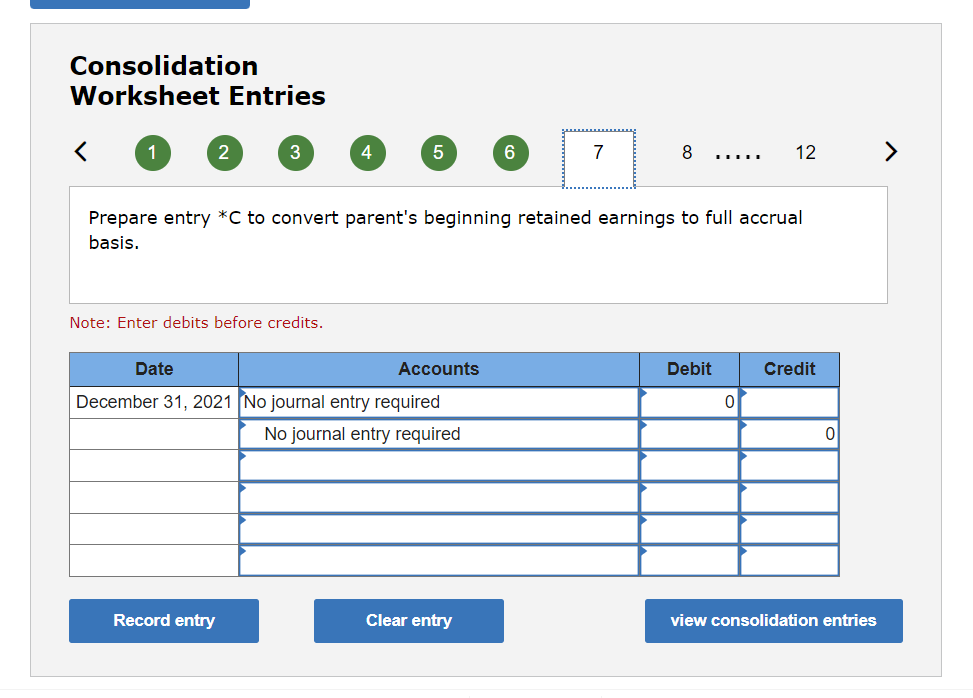

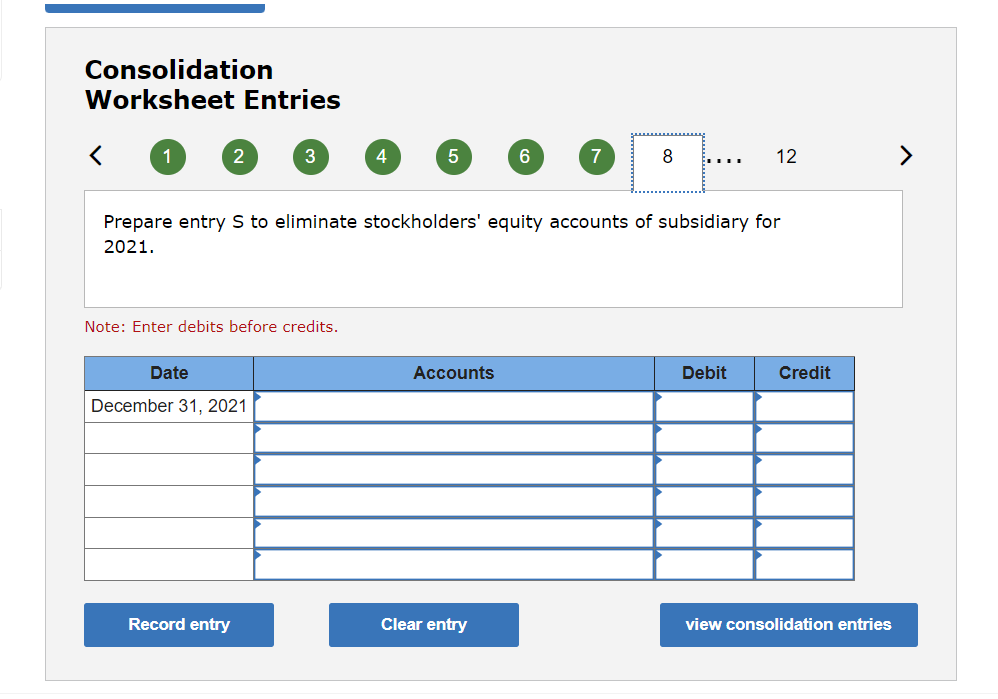

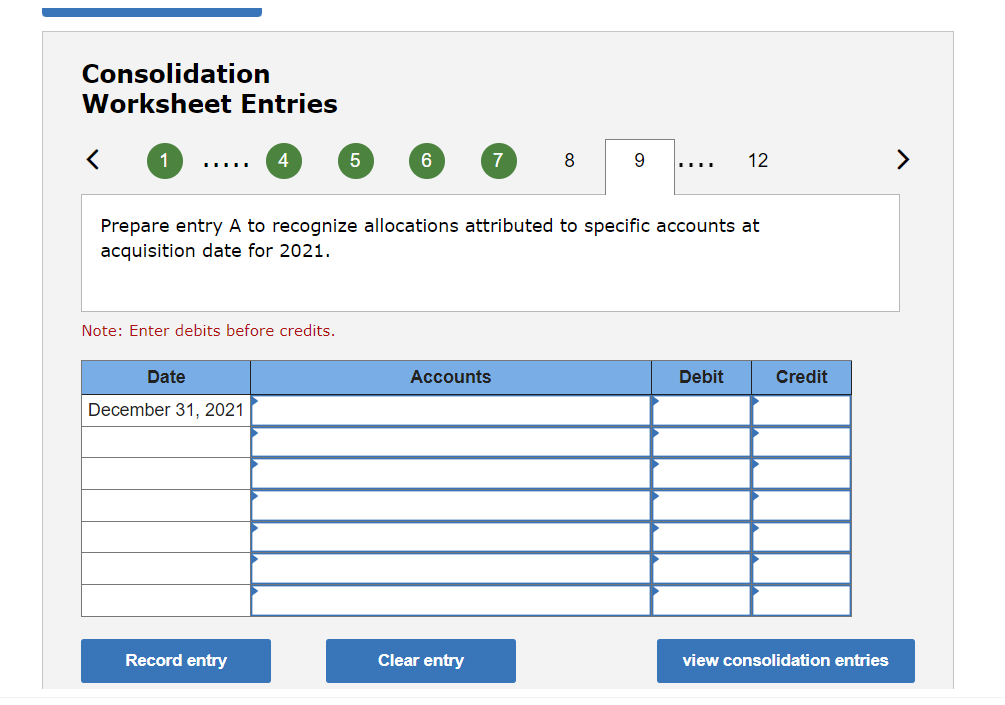

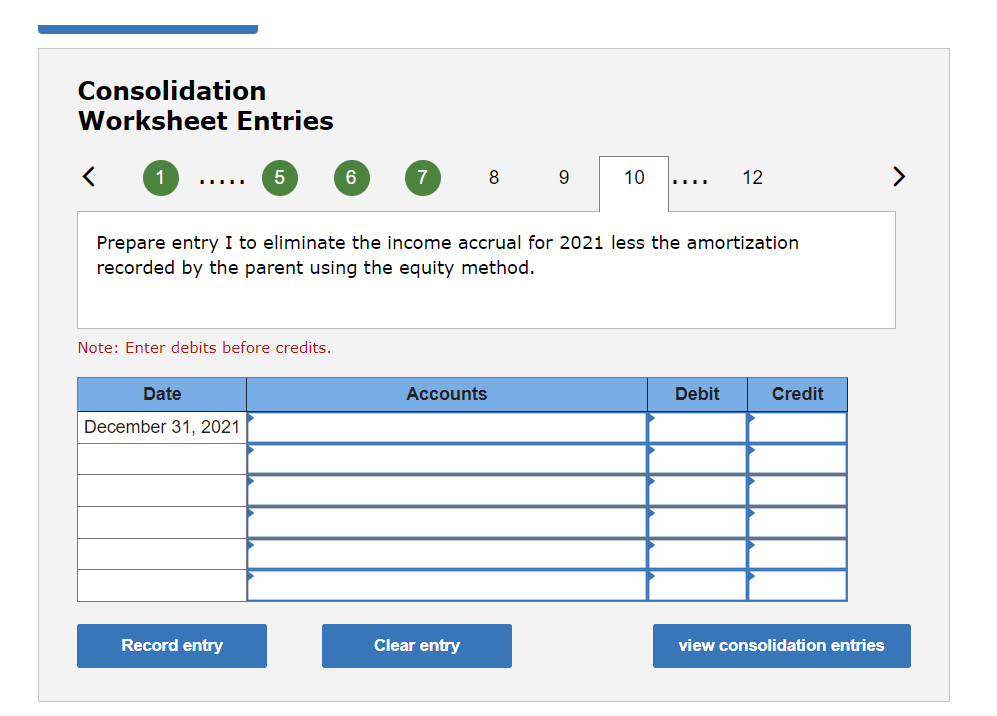

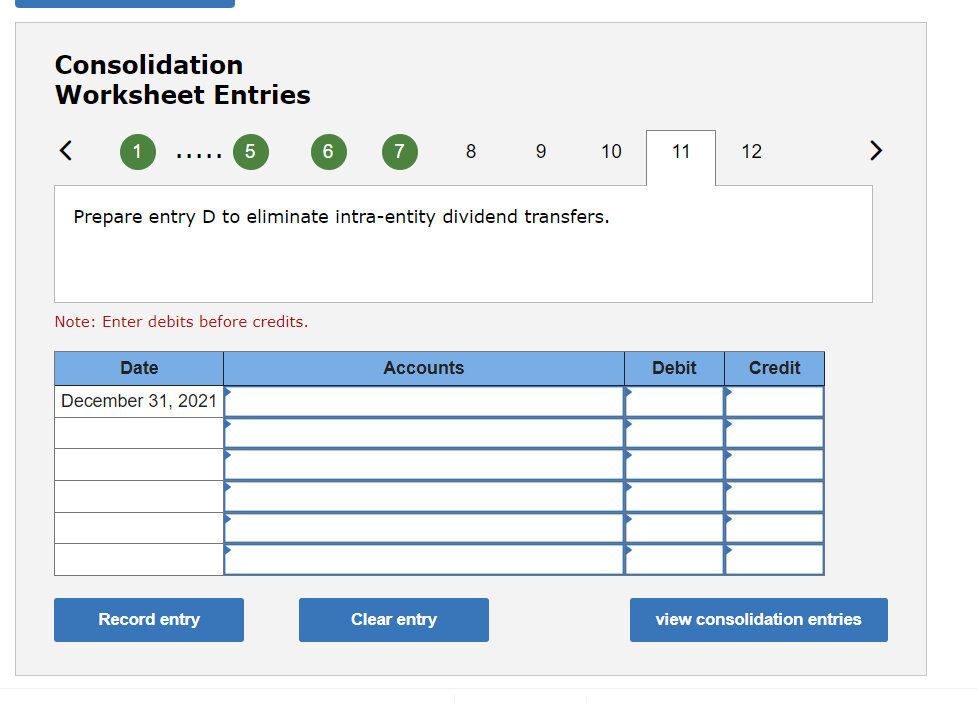

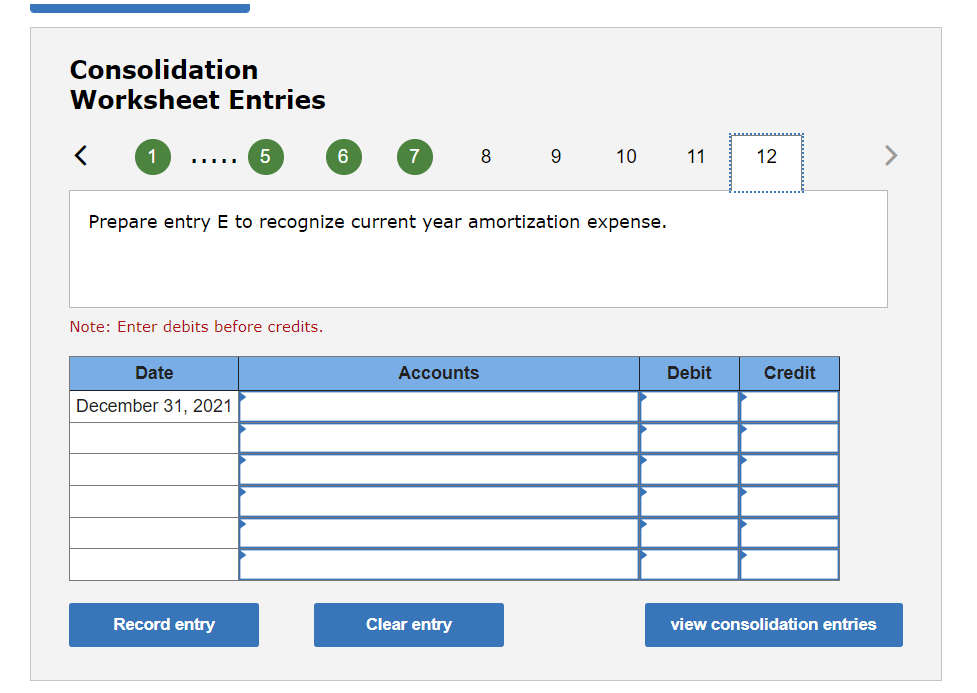

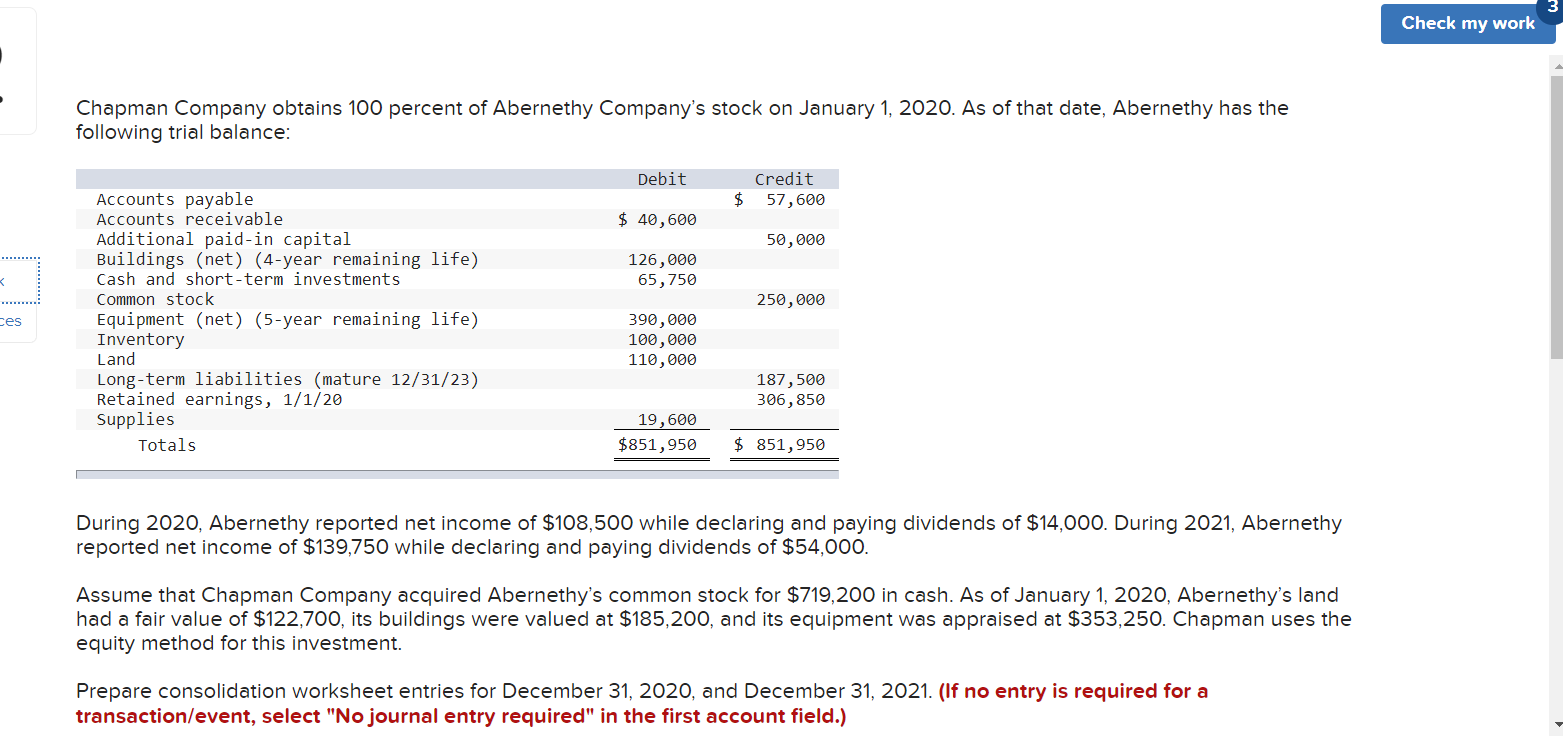

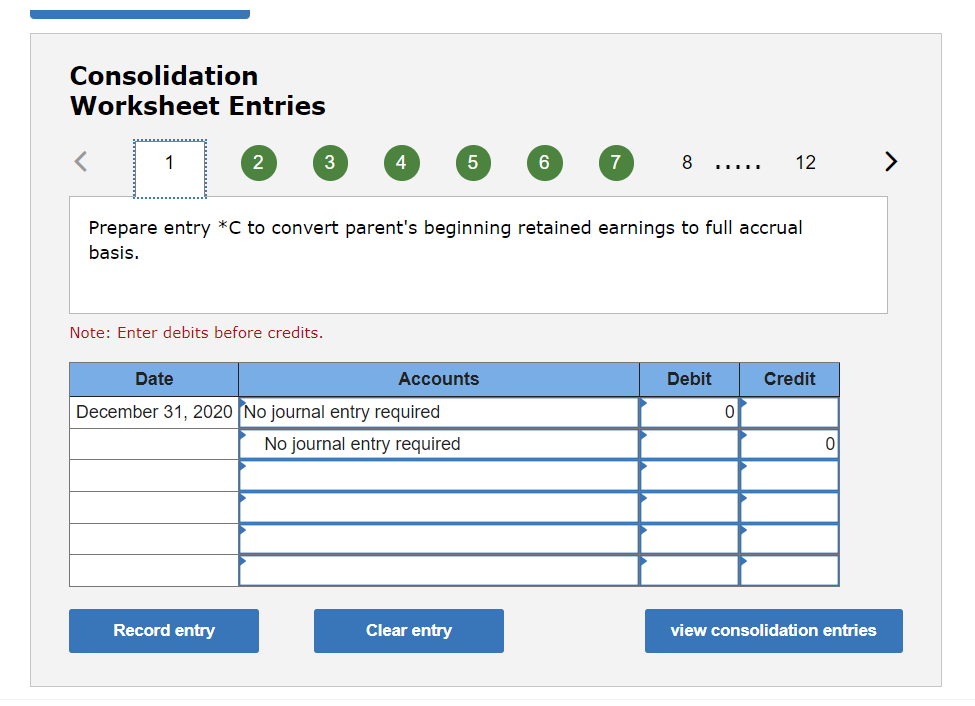

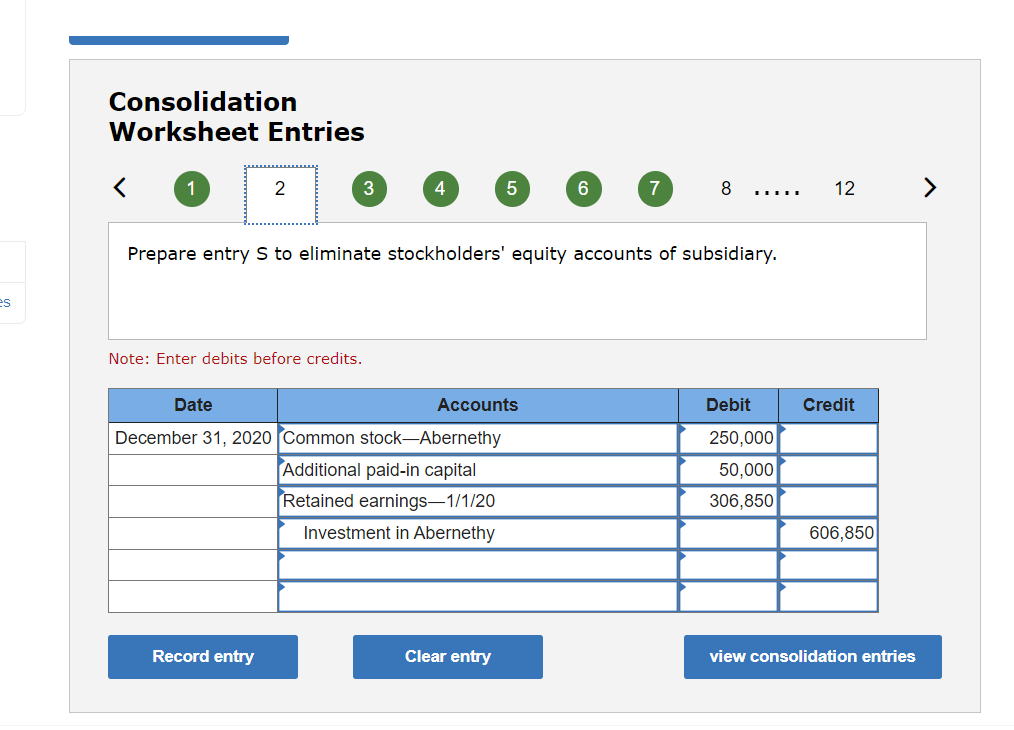

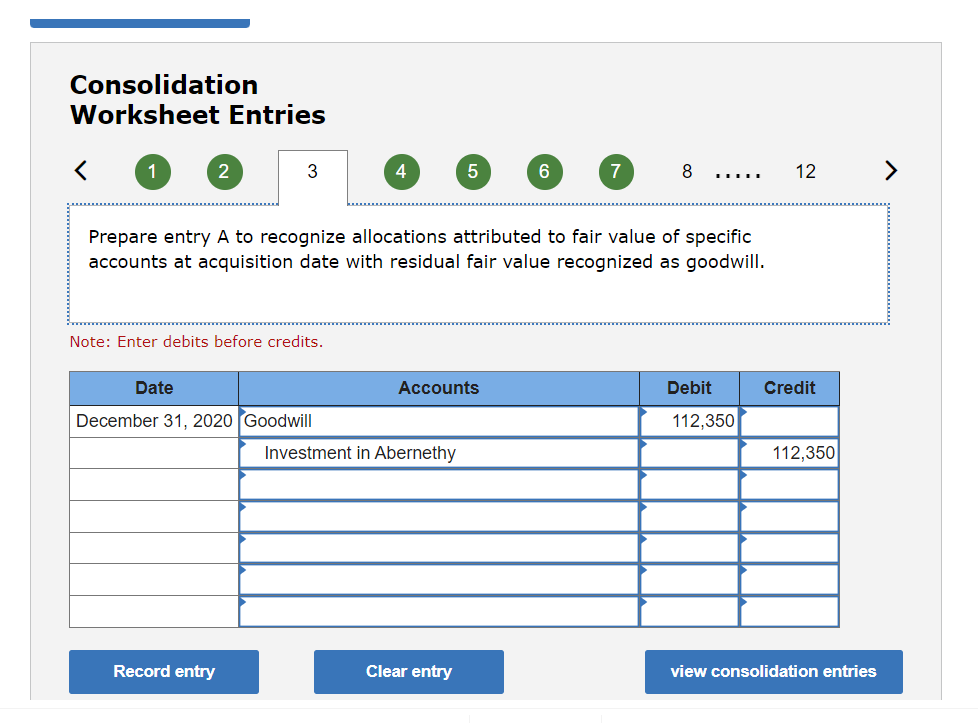

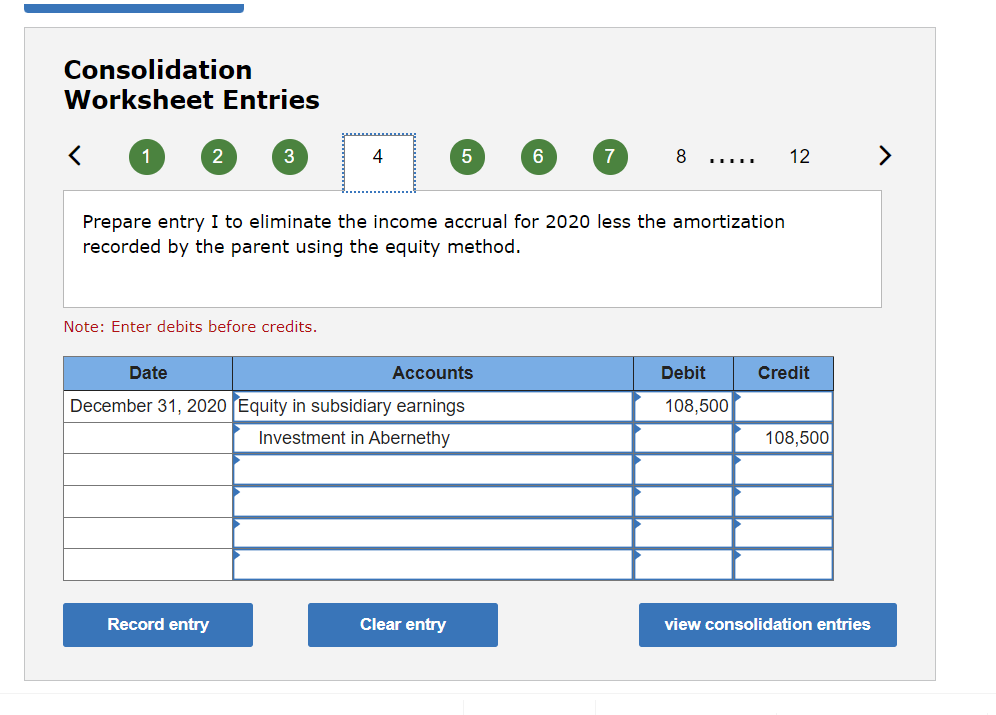

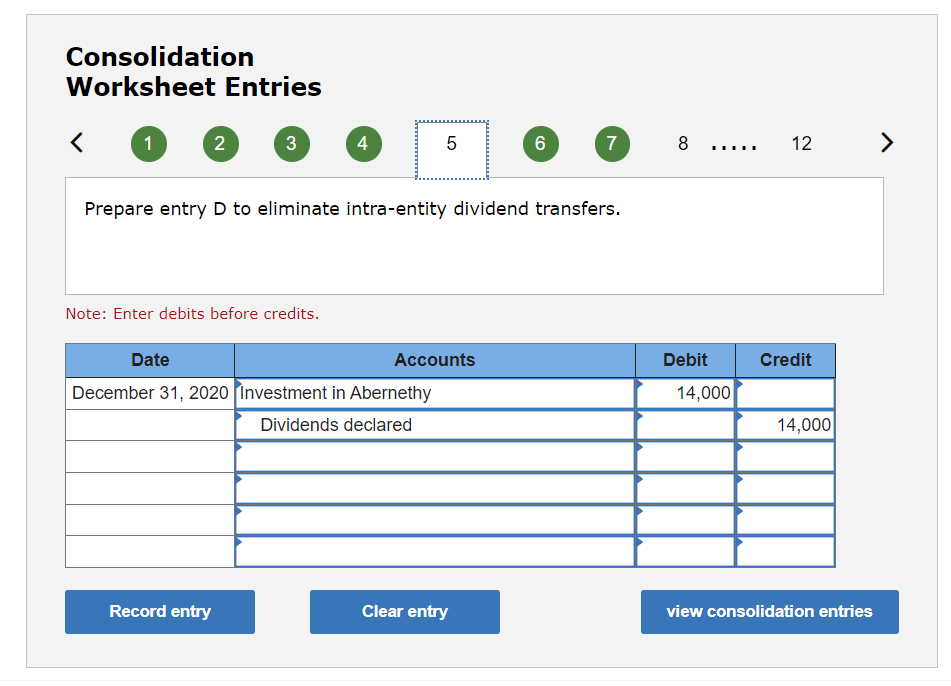

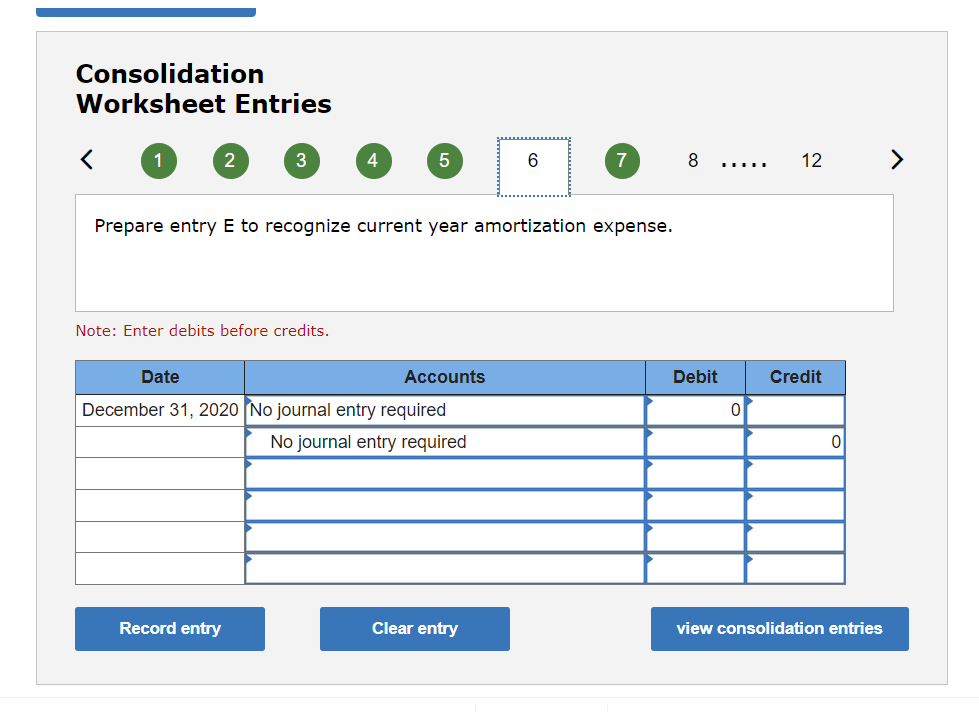

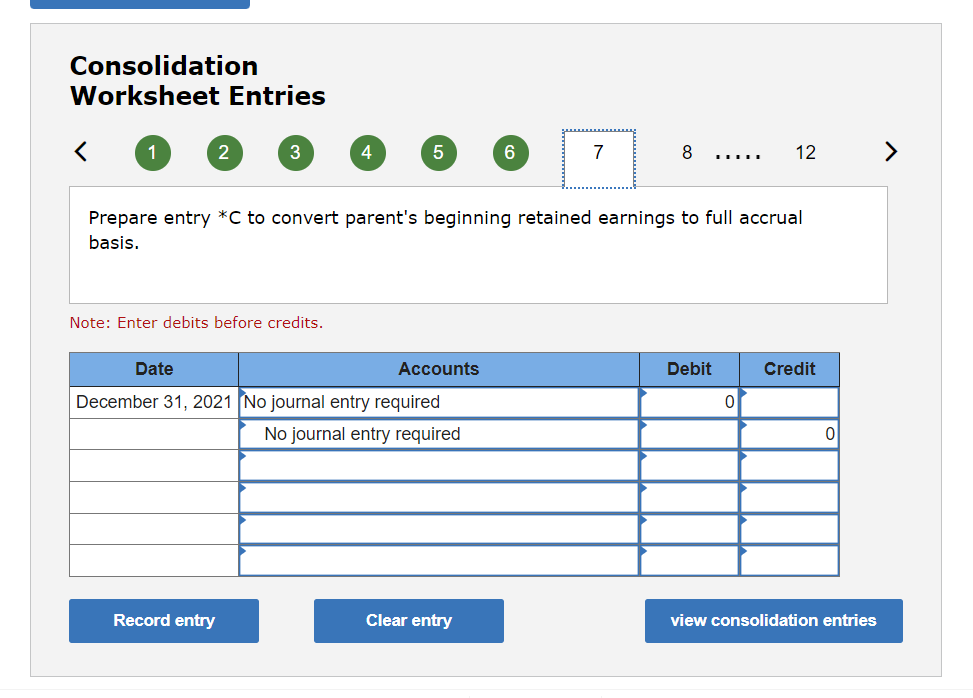

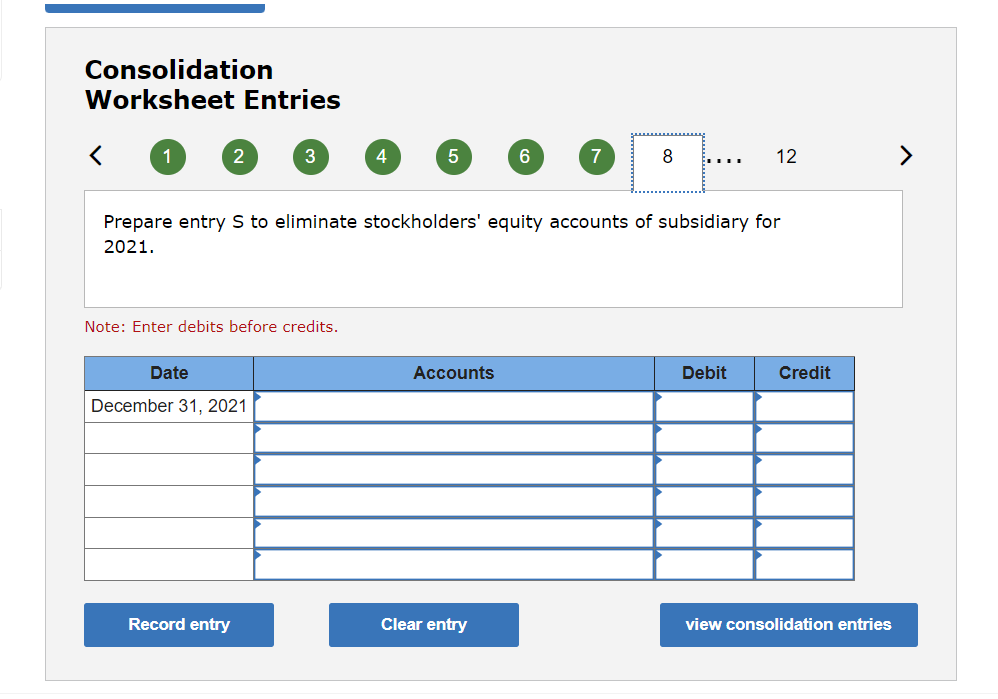

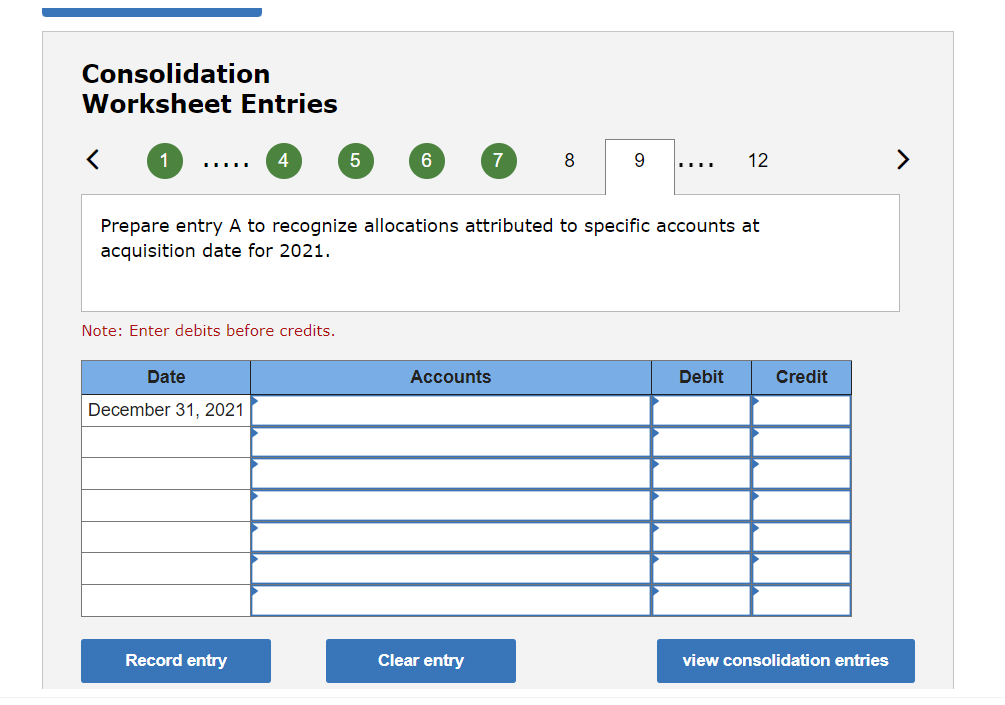

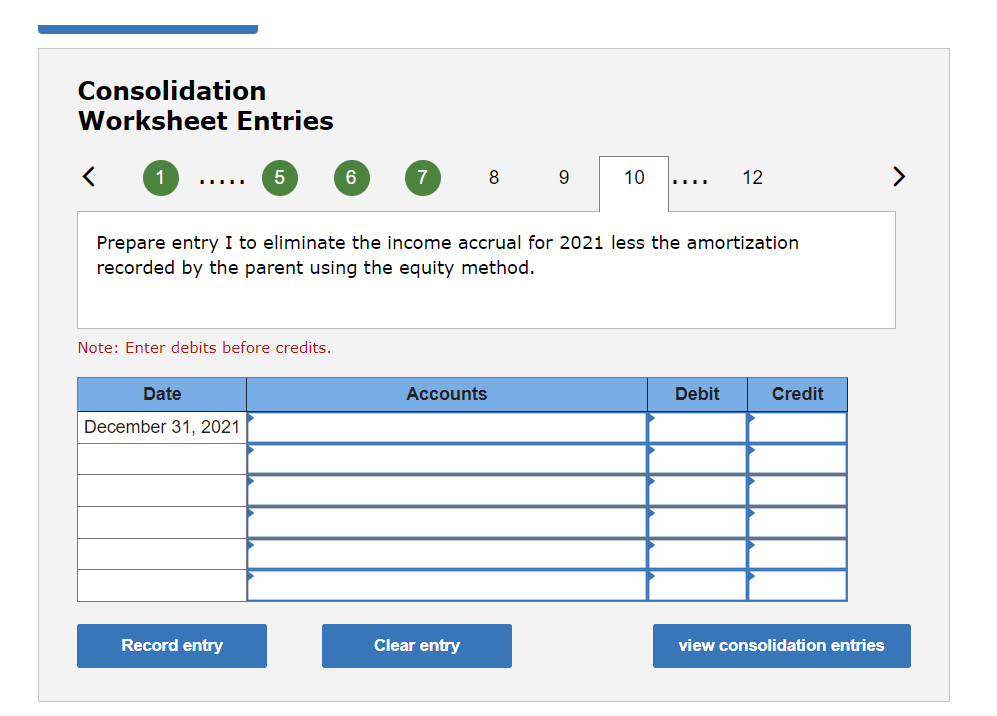

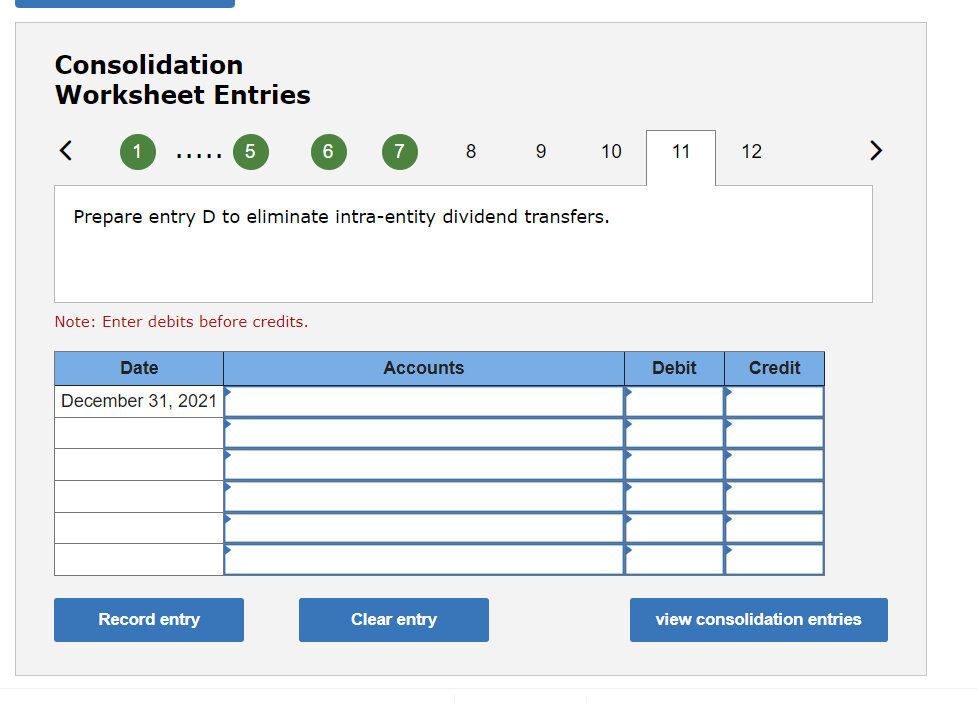

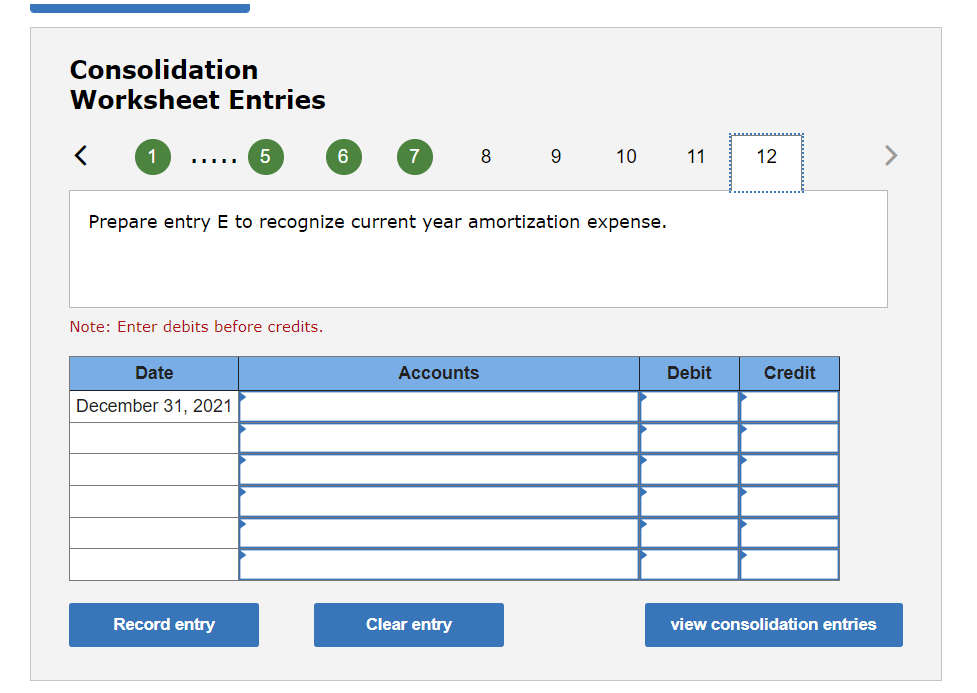

Chapman Company obtains 100 percent of Abernethy Company's stock on January 1, 2020. As of that date, Abernethy has the following trial balance: During 2020, Abernethy reported net income of $108,500 while declaring and paying dividends of $14,000. During 2021, Abernethy reported net income of $139,750 while declaring and paying dividends of $54,000. Assume that Chapman Company acquired Abernethy's common stock for $719,200 in cash. As of January 1, 2020, Abernethy's land had a fair value of $122,700, its buildings were valued at $185,200, and its equipment was appraised at $353,250. Chapman uses the equity method for this investment. Prepare consolidation worksheet entries for December 31, 2020, and December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Consolidation Worksheet Entries Prepare entry C to convert parent's beginning retained earnings to full accrual basis. Note: Enter debits before credits. Consolidation Worksheet Entries Prepare entry S to eliminate stockholders' equity accounts of subsidiary. Note: Enter debits before credits. Consolidation Worksheet Entries (5) 6 ( 6 8 , Prepare entry A to recognize allocations attributed to fair value of specific accounts at acquisition date with residual fair value recognized as goodwill. Note: Enter debits before credits. Consolidation Worksheet Entries 1 6 ( 6 ,... Prepare entry I to eliminate the income accrual for 2020 less the amortization recorded by the parent using the equity method. Note: Enter debits before credits. Consolidation Worksheet Entries 2 7 Prepare entry D to eliminate intra-entity dividend transfers. Note: Enter debits before credits. Consolidation Worksheet Entries 1 2 3 Prepare entry E to recognize current year amortization expense. Note: Enter debits before credits. Consolidation Worksheet Entries 1 2 3 8.12 Prepare entry C to convert parent's beginning retained earnings to full accrual basis. Note: Enter debits before credits. Consolidation Worksheet Entries Prepare entry S to eliminate stockholders' equity accounts of subsidiary for 2021. Note: Enter debits before credits. Consolidation Worksheet Entries Prepare entry A to recognize allocations attributed to specific accounts at acquisition date for 2021. Note: Enter debits before credits. Consolidation Worksheet Entries (1) ( 7 ( 8 Prepare entry I to eliminate the income accrual for 2021 less the amortization recorded by the parent using the equity method. Note: Enter debits before credits. Consolidation Worksheet Entries 1 m. 5 6 78 9 10 Prepare entry D to eliminate intra-entity dividend transfers. Note: Enter debits before credits. Consolidation Worksheet Entries 1 . ,5 8 Prepare entry E to recognize current year amortization expense. Note: Enter debits before credits