Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I'm not understanding this explanation. Please help me do it on a financial calculator. How much will a person need to make to buy a

I'm not understanding this explanation. Please help me do it on a financial calculator.

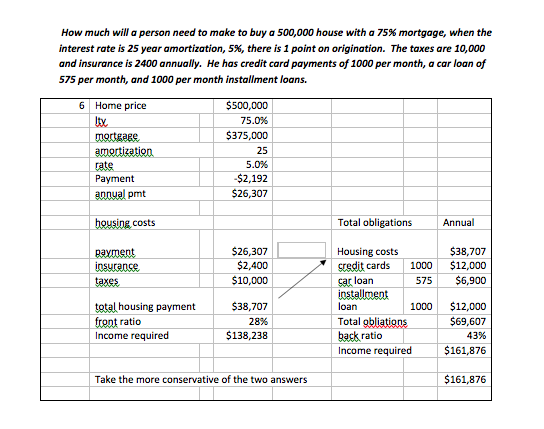

How much will a person need to make to buy a 500,000 house with a 75% mortgage, when the interest rate is 25 year amortization, 5%, there is 1 point on origination. The taxes are 10,000 and insurance is 2400 annually. He has credit card payments of 1000 per month, a car loan of 575 per month, and 1000 per month installment loans. $500,000 75.0% $375,000 25 5.0% 2,192 $26,307 6 Home price rate Payment pmt costs Total obligations Annual $26,307 $2,400 $10,000 $38,707 Housing costs credit cards 1000$12,000 ar loan loan Total back ratio Income required $161,876 nsurance 575 $6,900 538,707 28% $138,238 total housing payment 1000 $12,000 $69,607 43% ratio Income required Take the more conservative of the two answers $161,876Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started