I'm not what other information you are are asking for exactly. Would you be able to specify?

Question 2a & 2B

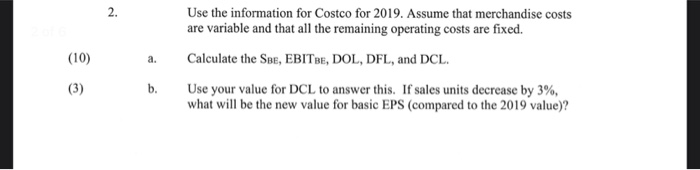

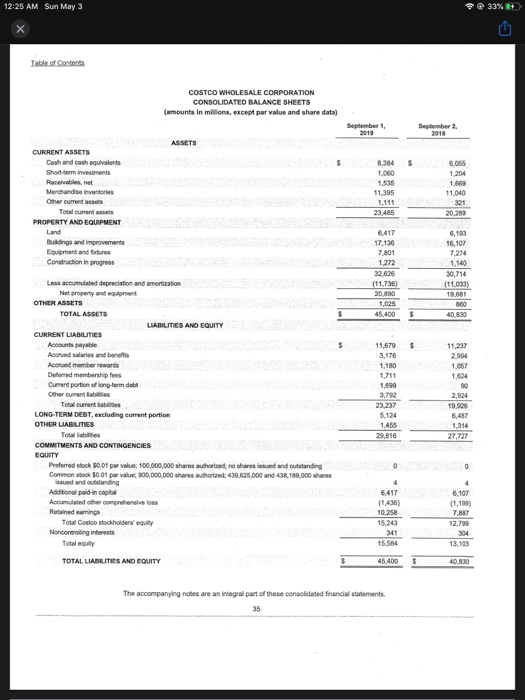

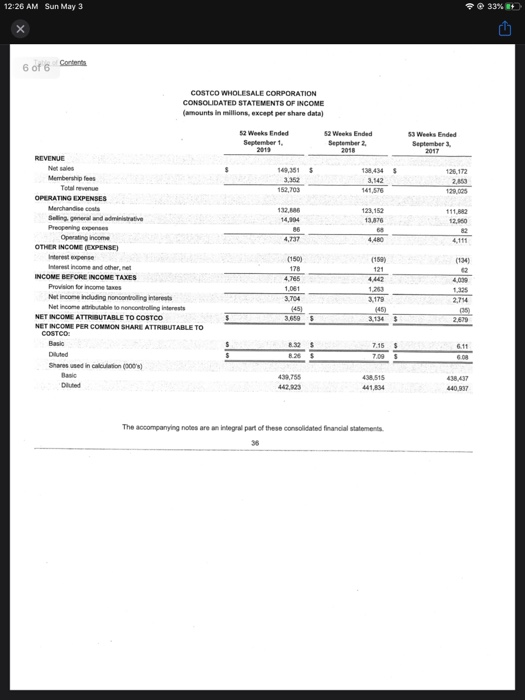

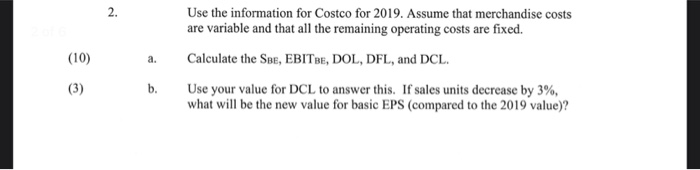

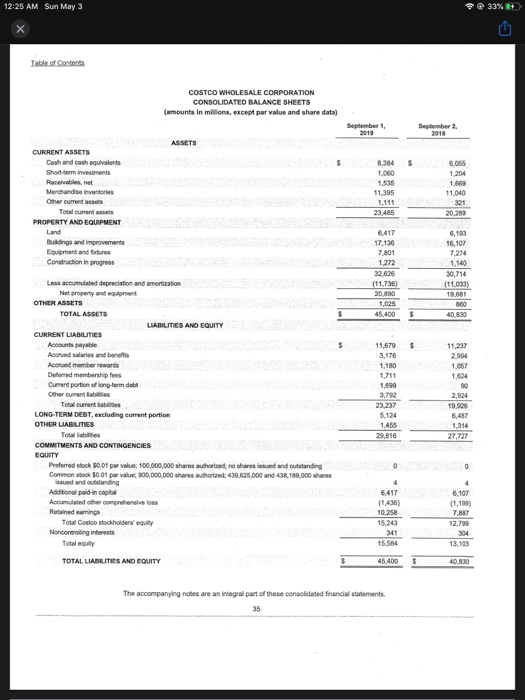

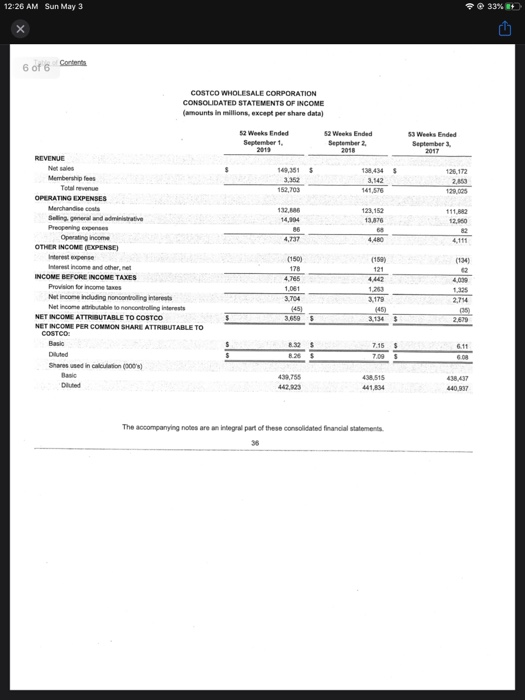

2. Use the information for Costco for 2019. Assume that merchandise costs are variable and that all the remaining operating costs are fixed. (10) a. Calculate the SBE, EBITBE, DOL, DFL, and DCL b. Use your value for DCL to answer this. If sales units decrease by 3%, what will be the new value for basic EPS (compared to the 2019 value)? 12:25 AM Sun May 3 33% + Table of Contents COSTCO WHOLESALE CORPORATION CONSOLIDATED BALANCE SHEETS (amounts in millions, except par value and share data) September 1, September 2. ASSETS 8.384 5055 1060 CURRENT ASSETS Cash and cash equivalents Short term Investments Receivables.net Merchandisinventores Other current assets Total current PROPERTY AND EQUIPMENT 1,595 11,395 23.485 20 29 Buildings and improvements Equipment and futures Construction in progress 6.417 17,138 7.801 1.272 16.107 7274 1,140 (11,736) 20.800 1127 Les accumulated depreciation and amortization Net property and equipment OTHER ASSETS TOTAL ASSETS LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable Acorud saries and benefits Accrund member words Deferred membership fees Current portion of long-term debit Other current abilities Tocumentai LONG-TERM DEBT, excluding current portion OTHER LIABILITIES 11,679 3.175 1.699 3.792 23.237 6,487 1455 29,816 27.727 0 COMMITMENTS AND CONTINGENCIES EQUITY Preferred stock 50.01 par value 100,000,000 shares authorized, no share d and outstanding Common stock 30.01 par value 100,000,000 shares authorized: 430.625.000 and 438,189,000 shares ud and outstanding Additional paid in capital Accumulated other comprehensive loss Retained carings Total Costco stockholders' equity Noncontrolling interests Total equity 6,107 6,417 (1,436) 10,258 15.243 (1,199) 7 BAT 12,799 304 13.103 341 15.54 TOTAL LIABILITIES AND EQUITY 45.400 The accompanying notes are an integral part of these consolidated financial statements 12:26 AM Sun May 3 33% + 6 of 6 Contents COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF INCOME (amounts in millions, except per share data) 53 Weeks Ended 52 Weeks Ended September 1 52 Weeks Ended September 2, 59,361 $ 3.362 138,434 3,142 141,575 125,172 2.1 129,005 152,703 14.004 123,152 13,876 12,50 REVENUE Net sales Membership fees Total revenue OPERATING EXPENSES Merchandise Selling general and administrative Preopening expenses Operating income OTHER INCOME EXPENSE) Interest pense Interest income and other.net INCOME BEFORE INCOME TAXES Provision for income taxes Net income including noncontrolling interest Net income table to noncontrolling interests NET INCOME ATTROUTABLE TO COSTCO NET INCOME PER COMMON SHARE ATTRIBUTABLE TO 4.480 (150) (150) 4,786 1,081 3.704 1203 3.179 2,714 3.659 3.134 2.679 7.15 $ Diluted Shares used in calculation (000) 608 439,755 438,515 48437 Diluted The accompanying notes are an integral part of these consolidated financial statements 2. Use the information for Costco for 2019. Assume that merchandise costs are variable and that all the remaining operating costs are fixed. (10) a. Calculate the SBE, EBITBE, DOL, DFL, and DCL b. Use your value for DCL to answer this. If sales units decrease by 3%, what will be the new value for basic EPS (compared to the 2019 value)? 12:25 AM Sun May 3 33% + Table of Contents COSTCO WHOLESALE CORPORATION CONSOLIDATED BALANCE SHEETS (amounts in millions, except par value and share data) September 1, September 2. ASSETS 8.384 5055 1060 CURRENT ASSETS Cash and cash equivalents Short term Investments Receivables.net Merchandisinventores Other current assets Total current PROPERTY AND EQUIPMENT 1,595 11,395 23.485 20 29 Buildings and improvements Equipment and futures Construction in progress 6.417 17,138 7.801 1.272 16.107 7274 1,140 (11,736) 20.800 1127 Les accumulated depreciation and amortization Net property and equipment OTHER ASSETS TOTAL ASSETS LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable Acorud saries and benefits Accrund member words Deferred membership fees Current portion of long-term debit Other current abilities Tocumentai LONG-TERM DEBT, excluding current portion OTHER LIABILITIES 11,679 3.175 1.699 3.792 23.237 6,487 1455 29,816 27.727 0 COMMITMENTS AND CONTINGENCIES EQUITY Preferred stock 50.01 par value 100,000,000 shares authorized, no share d and outstanding Common stock 30.01 par value 100,000,000 shares authorized: 430.625.000 and 438,189,000 shares ud and outstanding Additional paid in capital Accumulated other comprehensive loss Retained carings Total Costco stockholders' equity Noncontrolling interests Total equity 6,107 6,417 (1,436) 10,258 15.243 (1,199) 7 BAT 12,799 304 13.103 341 15.54 TOTAL LIABILITIES AND EQUITY 45.400 The accompanying notes are an integral part of these consolidated financial statements 12:26 AM Sun May 3 33% + 6 of 6 Contents COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF INCOME (amounts in millions, except per share data) 53 Weeks Ended 52 Weeks Ended September 1 52 Weeks Ended September 2, 59,361 $ 3.362 138,434 3,142 141,575 125,172 2.1 129,005 152,703 14.004 123,152 13,876 12,50 REVENUE Net sales Membership fees Total revenue OPERATING EXPENSES Merchandise Selling general and administrative Preopening expenses Operating income OTHER INCOME EXPENSE) Interest pense Interest income and other.net INCOME BEFORE INCOME TAXES Provision for income taxes Net income including noncontrolling interest Net income table to noncontrolling interests NET INCOME ATTROUTABLE TO COSTCO NET INCOME PER COMMON SHARE ATTRIBUTABLE TO 4.480 (150) (150) 4,786 1,081 3.704 1203 3.179 2,714 3.659 3.134 2.679 7.15 $ Diluted Shares used in calculation (000) 608 439,755 438,515 48437 Diluted The accompanying notes are an integral part of these consolidated financial statements