Question

Im visiting Acmes impressive new corporate HQ to speak to the management team. Acmes share price has been falling consistently for a while now, despite

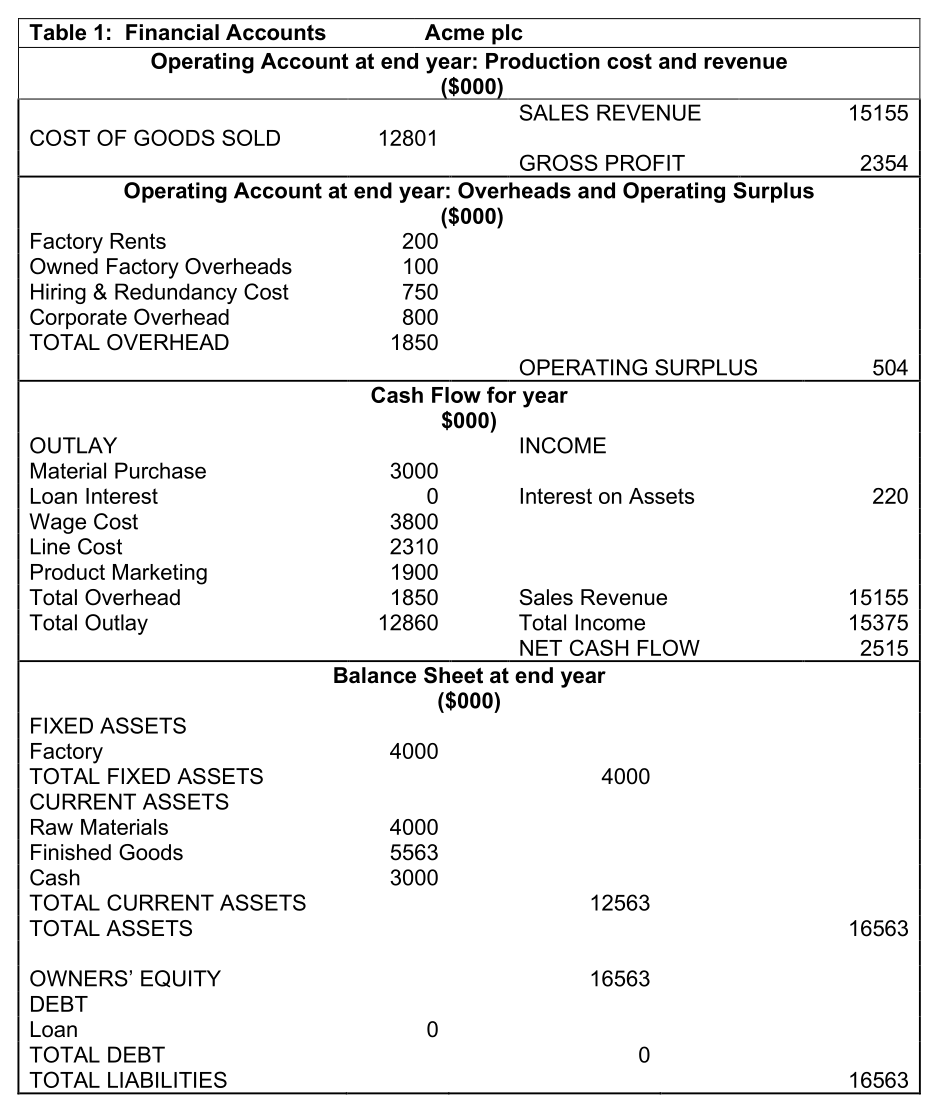

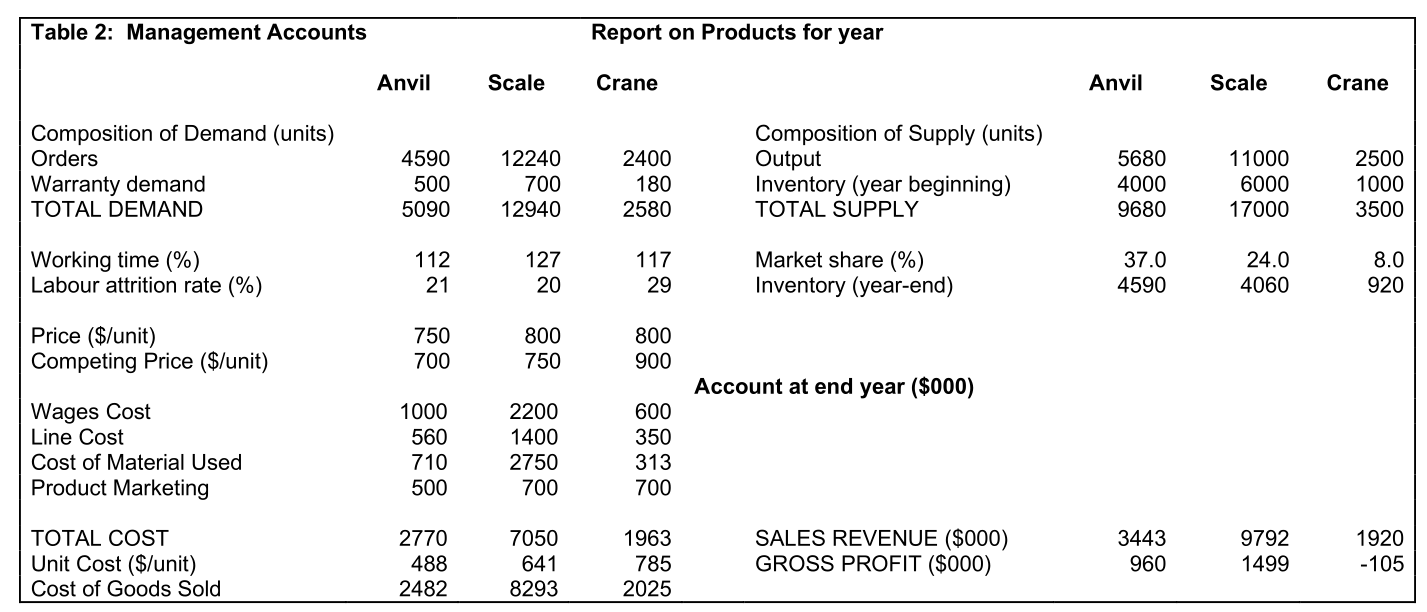

Im visiting Acmes impressive new corporate HQ to speak to the management team. Acmes share price has been falling consistently for a while now, despite the fact that the economy is booming and stock market indices have never been higher. I want to see what those on the ground think. Acme is a key player in producing components for automotive vehicle assembly lines. Its Anvil and Scale products have been successful and well thought of by customers for many years. The lack of growth in these markets, however, encouraged Acme to look for other opportunities three years ago. As a result the company launched the mini Crane for use in the construction trade. The market for cranes is dominated by LiftTech, a global leader in industrial lifting solutions, and Acme has found it hard to transfer its previous success into this fast-growing and competitive market. I spoke to the Operations Director, who told me that the recent economic recovery has resulted in increasing difficulty in attracting and keeping good employees at current pay rates. She also expects the attrition rate to worsen dramatically in the near future and that this could have an impact on quality of output. The Finance Director was more sanguine, noting that Acme has a high Gross Profit, healthy Cash Flow and plenty of inventories. He said, We have kept to our objective of never having to borrow. The recent share price fall is due to short-term investors and unjustified reports in the financial press. The CEO was fairly optimistic. He said, The Crane is taking time to respond to changes I implemented last year. The price increase was designed to increase profits, but market share has fallen from 10% to 8% already. I have every confidence in this product and we will achieve the synergies we were looking for soon. I have just today introduced a no firing policy to rectify our labour problems. Required: 1) Assess the situation using financial and strategic analysis. Is the no firing policy likely to be the solution to Acmes problems? 2) Analyse Acmes strategic position and suggest a set of options for the short run and the long run.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started