Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Image caption Calculate the net income of the trust. You are required to present a complete analysis, briefly explaining the treatment of all items

Image caption

Image caption Calculate the net income of the trust.

You are required to present a complete analysis, briefly explaining the treatment of all items and/or elements in this question, including references to appropriate legislation, case law and/or tax rulings. Disregard GST and disregard full expensing/immediate write off provisions.

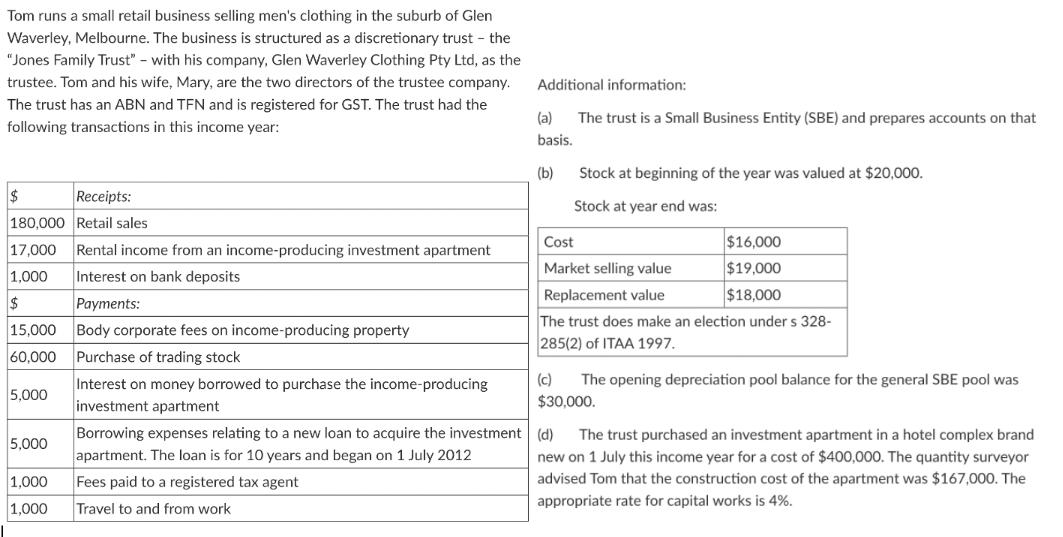

Tom runs a small retail business selling men's clothing in the suburb of Glen Waverley, Melbourne. The business is structured as a discretionary trust - the "Jones Family Trust" - with his company, Glen Waverley Clothing Pty Ltd, as the trustee. Tom and his wife, Mary, are the two directors of the trustee company. The trust has an ABN and TFN and is registered for GST. The trust had the following transactions in this income year: $ 180,000 17,000 1,000 $ 15,000 60,000 5,000 5,000 1,000 1,000 Receipts: Retail sales Rental income from an income-producing investment apartment Interest on bank deposits Payments: Body corporate fees on income-producing property Purchase of trading stock Interest on money borrowed to purchase the income-producing investment apartment Borrowing expenses relating to a new loan to acquire the investment apartment. The loan is for 10 years and began on 1 July 2012 Fees paid to a registered tax agent Travel to and from work Additional information: (a) The trust is a Small Business Entity (SBE) and prepares accounts on that basis. (b) Stock at beginning of the year was valued at $20,000. Stock at year end was: $16,000 $19,000 $18,000 Cost Market selling value Replacement value The trust does make an election under s 328- 285(2) of ITAA 1997. (c) The opening depreciation pool balance for the general SBE pool was $30,000. (d) The trust purchased an investment apartment in a hotel complex brand new on 1 July this income year for a cost of $400,000. The quantity surveyor advised Tom that the construction cost of the apartment was $167,000. The appropriate rate for capital works is 4%.

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

I can provide a general overview of how you can calculate the net income of the trust based on the i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started