Answered step by step

Verified Expert Solution

Question

1 Approved Answer

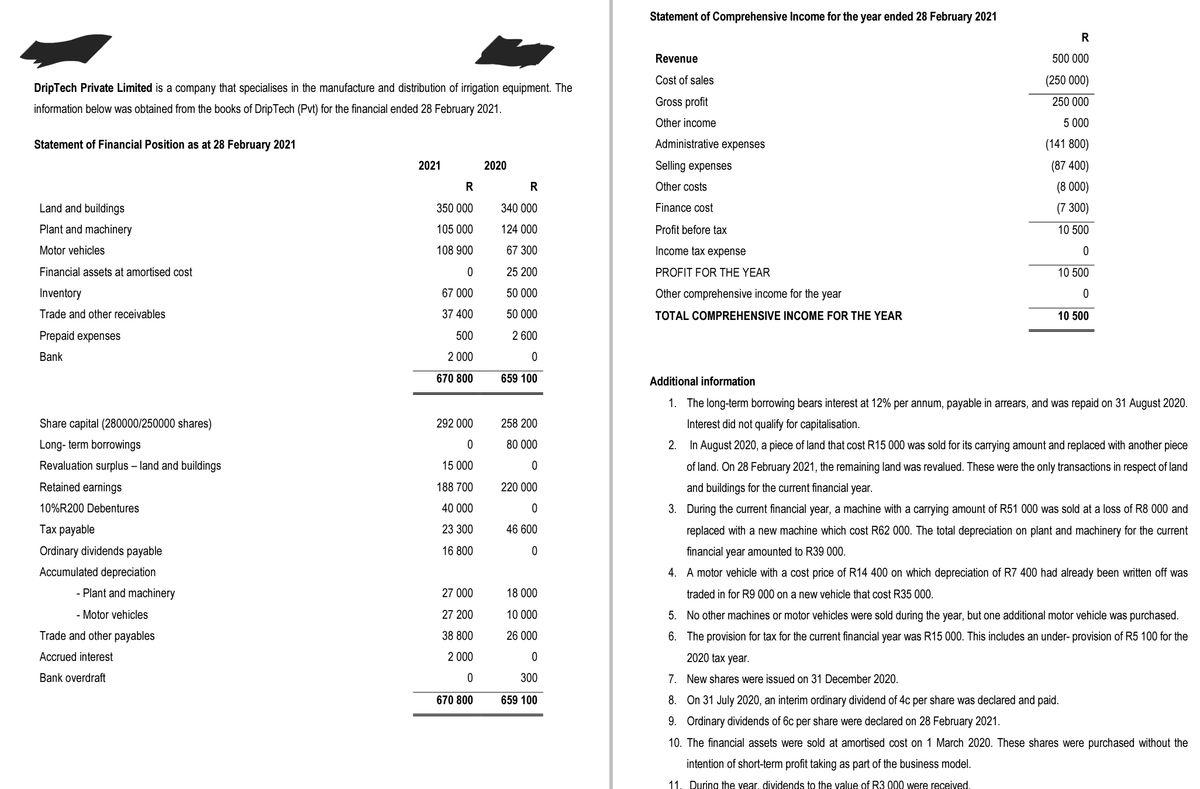

Prepare the Statement of Cashflow using the INDIRECT METHOD as at 29 February 2021. Show all the necessary workings. Statement of Comprehensive Income for the

Prepare the Statement of Cashflow using the INDIRECT METHOD as at 29 February 2021. Show all the necessary workings.

Statement of Comprehensive Income for the year ended 28 February 2021 R Revenue 500 000 Cost of sales (250 000) DripTech Private Limited is a company that specialises in the manufacture and distribution of irrigation equipment. The Gross profit 250 000 information below was obtained from the books of DripTech (Pvt) for the financial ended 28 February 2021. Other income 5 000 Statement of Financial Position as at 28 February 2021 Administrative expenses (141 800) 2021 2020 Selling expenses (87 400) R R Other costs (8 000) Land and buildings 350 000 340 000 Finance cost (7 300) Plant and machinery 105 000 124 000 Profit before tax 10 500 Motor vehicles 108 900 67 300 Income tax expense Financial assets at amortised cost 25 200 PROFIT FOR THE YEAR 10 500 Inventory 67 000 50 000 Other comprehensive income for the year Trade and other receivables 37 400 50 000 TOTAL COMPREHENSIVE INCOME FOR THE YEAR 10 500 Prepaid expenses 500 2 600 Bank 2 000 670 800 659 100 Additional information 1. The long-term borrowing bears interest at 12% per annum, payable in arrears, and was repaid on 31 August 2020. Share capital (280000/250000 shares) 292 000 258 200 Interest did not qualify for capitalisation. Long- term borrowings 80 000 2. In August 2020, a piece of land that cost R15 000 was sold for its carrying amount and replaced with another piece Revaluation surplus - land and buildings 15 000 of land. On 28 February 2021, the remaining land was revalued. These were the only transactions in respect of land Retained earnings 188 700 220 000 and buildings for the current financial year. 10%R200 Debentures 40 000 3. During the current financial year, a machine with a carrying amount of R51 000 was sold at a loss of R8 000 and ayable 23 300 46 600 replaced with a new machine which cost R62 000. The total depreciation on plant and machinery for the current Ordinary dividends payable 16 800 financial year amounted to R39 000. Accumulated depreciation 4. A motor vehicle with a cost price of R14 400 on which depreciation of R7 400 had already been written off was - Plant and machinery 27 000 18 000 traded in for R9 000 on a new vehicle that cost R35 000. - Motor vehicles 27 200 10 000 5. No other machines or motor vehicles were sold during the year, but one additional motor vehicle was purchased. Trade and other payables 38 800 26 000 6. The provision for tax for the current financial year was R15 000. This includes an under- provision of R5 100 for the Accrued interest 2 000 2020 tax year. Bank overdraft 300 7. New shares were issued on 31 December 2020. 659 100 8. On 31 July 2020, an interim ordinary dividend of 4c per share was declared and paid. 9. Ordinary dividends of 6c per share were declared on 28 February 2021. 670 800 10. The financial assets were sold at amortised cost on 1 March 2020. These shares were purchased without the intention of short-term profit taking as part of the business model. 11. During the vear, dividends to the value of R3 000 were received.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer Step 1 c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started