Question

c) [12 marks] An investor can invest in a riskless asset and two portfolios with returns given by: r=+r++ Bi(rm -rf), where i=1, 2,

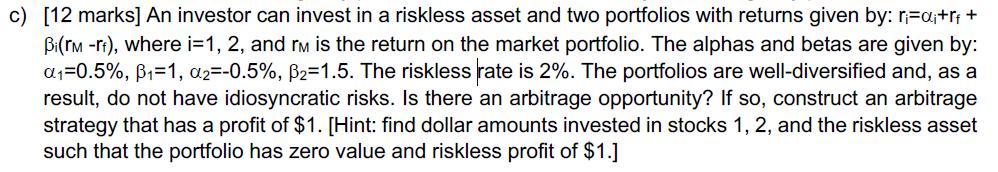

c) [12 marks] An investor can invest in a riskless asset and two portfolios with returns given by: r=+r++ Bi(rm -rf), where i=1, 2, and M is the return on the market portfolio. The alphas and betas are given by: 1=0.5%, 1=1, a2=-0.5%, 2=1.5. The riskless rate is 2%. The portfolios are well-diversified and, as a result, do not have idiosyncratic risks. Is there an arbitrage opportunity? If so, construct an arbitrage strategy that has a profit of $1. [Hint: find dollar amounts invested in stocks 1, 2, and the riskless asset such that the portfolio has zero value and riskless profit of $1.]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the steps to solve this problem 1 Given 1 05 1 1 2 05 2 15 rf 2 2 L...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Statistics Data Analysis And Decision Modeling

Authors: James R. Evans

5th Edition

132744287, 978-0132744287

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App