Answered step by step

Verified Expert Solution

Question

1 Approved Answer

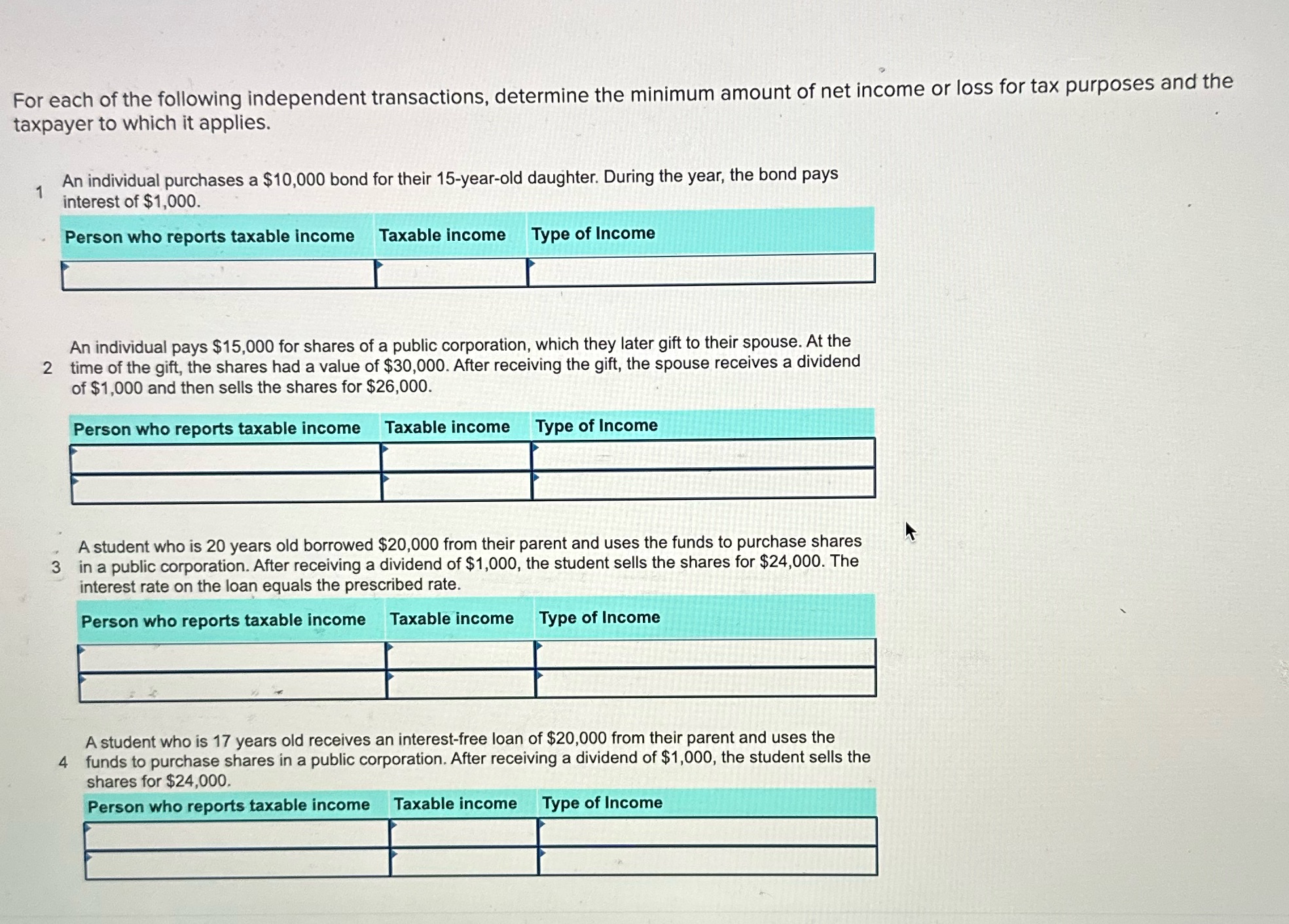

For each of the following independent transactions, determine the minimum amount of net income or loss for tax purposes and the taxpayer to which

For each of the following independent transactions, determine the minimum amount of net income or loss for tax purposes and the taxpayer to which it applies. 1 An individual purchases a $10,000 bond for their 15-year-old daughter. During the year, the bond pays interest of $1,000. Person who reports taxable income Taxable income Type of Income An individual pays $15,000 for shares of a public corporation, which they later gift to their spouse. At the 2 time of the gift, the shares had a value of $30,000. After receiving the gift, the spouse receives a dividend of $1,000 and then sells the shares for $26,000. Person who reports taxable income Taxable income Type of Income A student who is 20 years old borrowed $20,000 from their parent and uses the funds to purchase shares 3 in a public corporation. After receiving a dividend of $1,000, the student sells the shares for $24,000. The interest rate on the loan equals the prescribed rate. Person who reports taxable income Taxable income Type of Income A student who is 17 years old receives an interest-free loan of $20,000 from their parent and uses the 4 funds to purchase shares in a public corporation. After receiving a dividend of $1,000, the student sells the shares for $24,000. Person who reports taxable income Taxable income Type of Income

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer Transaction 1 Bond Investment for Minor Taxpayer Individual Parent Taxable Income Interest in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started