Answered step by step

Verified Expert Solution

Question

1 Approved Answer

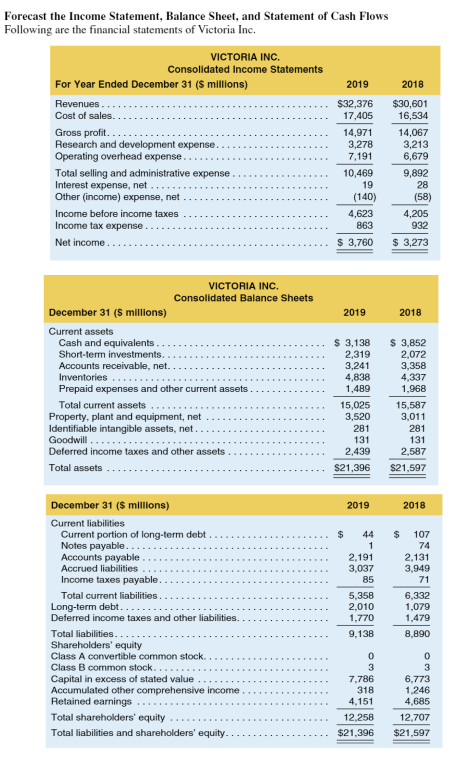

Forecast the Income Statement, Balance Sheet, and Statement of Cash Flows Following are the financial statements of Victoria Inc. VICTORIA INC. Consolidated Income Statements

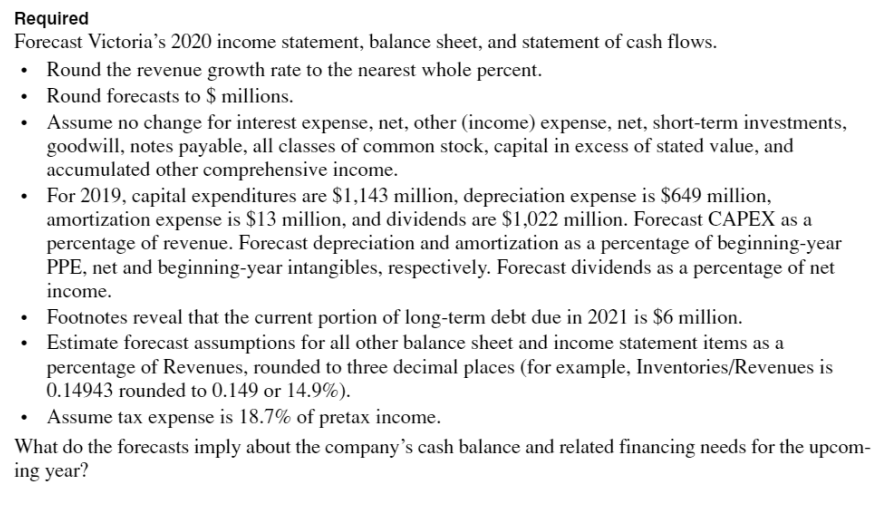

Forecast the Income Statement, Balance Sheet, and Statement of Cash Flows Following are the financial statements of Victoria Inc. VICTORIA INC. Consolidated Income Statements For Year Ended December 31 ($ millions) 2019 2018 Revenues. $32,376 $30,601 Cost of sales. 17,405 16,534 Gross profit.. 14,971 14,067 Research and development expense. 3,278 3,213 Operating overhead expense.. 7,191 6,679 Total selling and administrative expense 10,469 9,892 Interest expense, net... 19 28 Other (income) expense, net (140) (58) Income before income taxes 4,623 4,205 Income tax expense.. 863 932 Net income... $ 3,760 $ 3,273 VICTORIA INC. Consolidated Balance Sheets December 31 ($ millions) 2019 2018 Current assets Cash and equivalents. $ 3,138 $ 3,852 Short-term investments. 2,319 2,072 Accounts receivable, net. 3,241 3,358 Inventories.... 4,838 4,337 Prepaid expenses and other current assets. 1,489 1,968 Total current assets 15,025 15,587 Property, plant and equipment, net 3,520 3,011 Identifiable intangible assets, net.. 281 281 Goodwill. 131 131 Deferred income taxes and other assets 2,439 2,587 Total assets $21,396 $21,597 December 31 ($ millions) 2019 2018 Current liabilities Current portion of long-term debt $ 44 $ 107 Notes payable... 1 Accounts payable. 2,191 Accrued liabilities 3,037 74 2,131 3,949 Income taxes payable.. 85 71 Total current liabilities.. 5,358 6,332 Long-term debt.. 2,010 1,079 Deferred income taxes and other liabilities. 1,770 1,479 Total liabilities.. 9,138 8,890 Shareholders' equity Class A convertible common stock. 0 0 Class B common stock. 3 3 Capital in excess of stated value 7,786 6,773 Accumulated other comprehensive income. 318 1,246 Retained earnings... 4,151 4,685 Total shareholders' equity 12,258 12,707 Total liabilities and shareholders' equity.. $21,396 $21,597 Required Forecast Victoria's 2020 income statement, balance sheet, and statement of cash flows. Round the revenue growth rate to the nearest whole percent. Round forecasts to $ millions. Assume no change for interest expense, net, other (income) expense, net, short-term investments, goodwill, notes payable, all classes of common stock, capital in excess of stated value, and accumulated other comprehensive income. For 2019, capital expenditures are $1,143 million, depreciation expense is $649 million, amortization expense is $13 million, and dividends are $1,022 million. Forecast CAPEX as a percentage of revenue. Forecast depreciation and amortization as a percentage of beginning-year PPE, net and beginning-year intangibles, respectively. Forecast dividends as a percentage of net income. Footnotes reveal that the current portion of long-term debt due in 2021 is $6 million. Estimate forecast assumptions for all other balance sheet and income statement items as a percentage of Revenues, rounded to three decimal places (for example, Inventories/Revenues is 0.14943 rounded to 0.149 or 14.9%). Assume tax expense is 18.7% of pretax income. What do the forecasts imply about the company's cash balance and related financing needs for the upcom- ing year?

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here are the forecasts for Victoria Inc for 2020 Income Statement Revenues 33184 2 growth from 2019 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started