Question

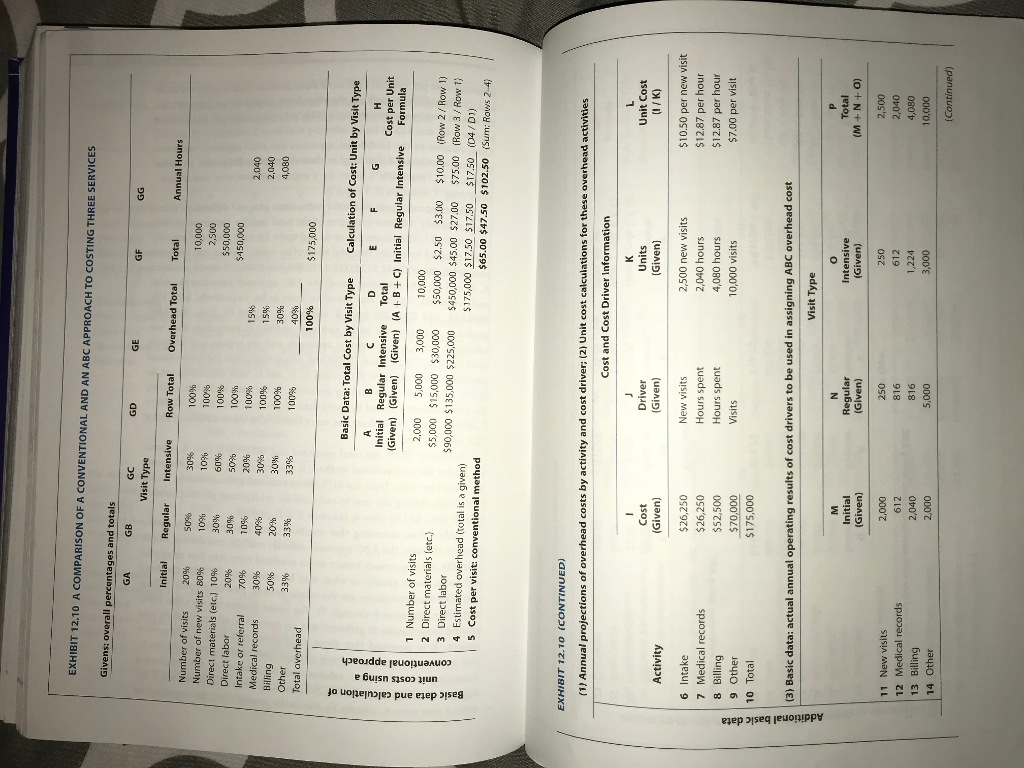

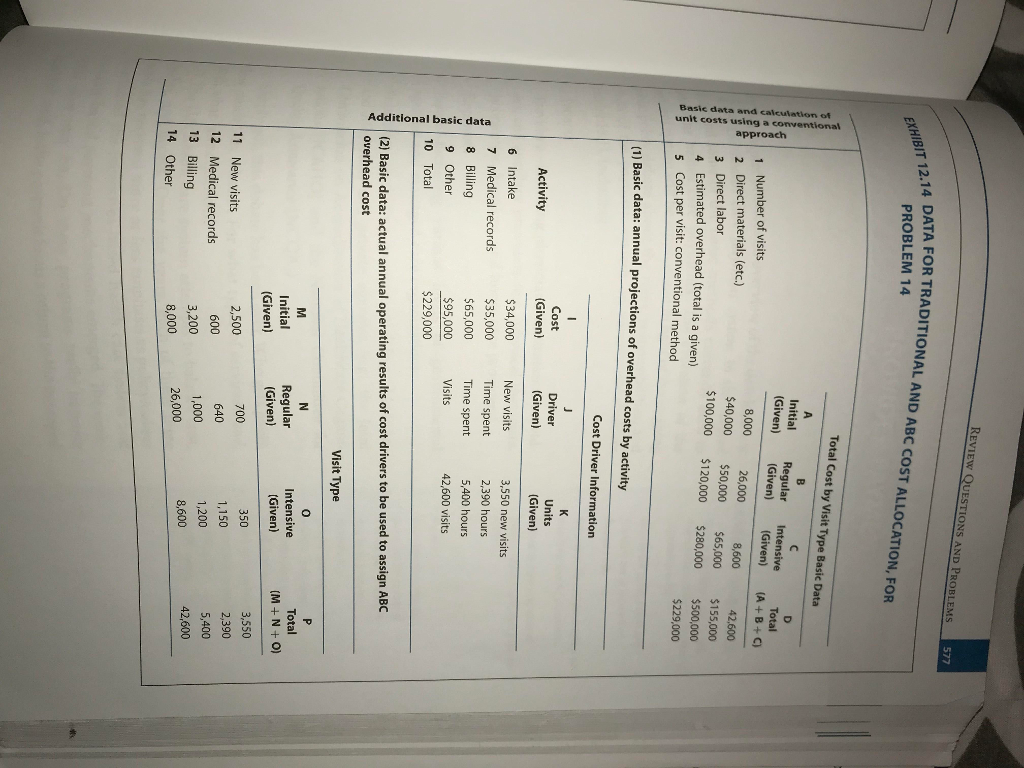

Images 12.10, 12.12, and 12.14 are all there. 10) Activity based costing. Referring to exhibit 12.10, suppose that instead of 2000, 5000, and 3000 for

Images 12.10, 12.12, and 12.14 are all there.

10) Activity based costing. Referring to exhibit 12.10, suppose that instead of 2000, 5000, and 3000 for an initial, regular and intensive visit, respectively, the number of visits was 2500, 6000, and 1500. Assume that the costs associated with intake, new visits, medical records and billing do not change in number or distribution.

a) Would there be a change in the overhead cost per visit of an initial visit using either the conventional or ABC methods?

b) Would there be a change in the total overhead cost of initial visits using either the conventional or ABC methods.

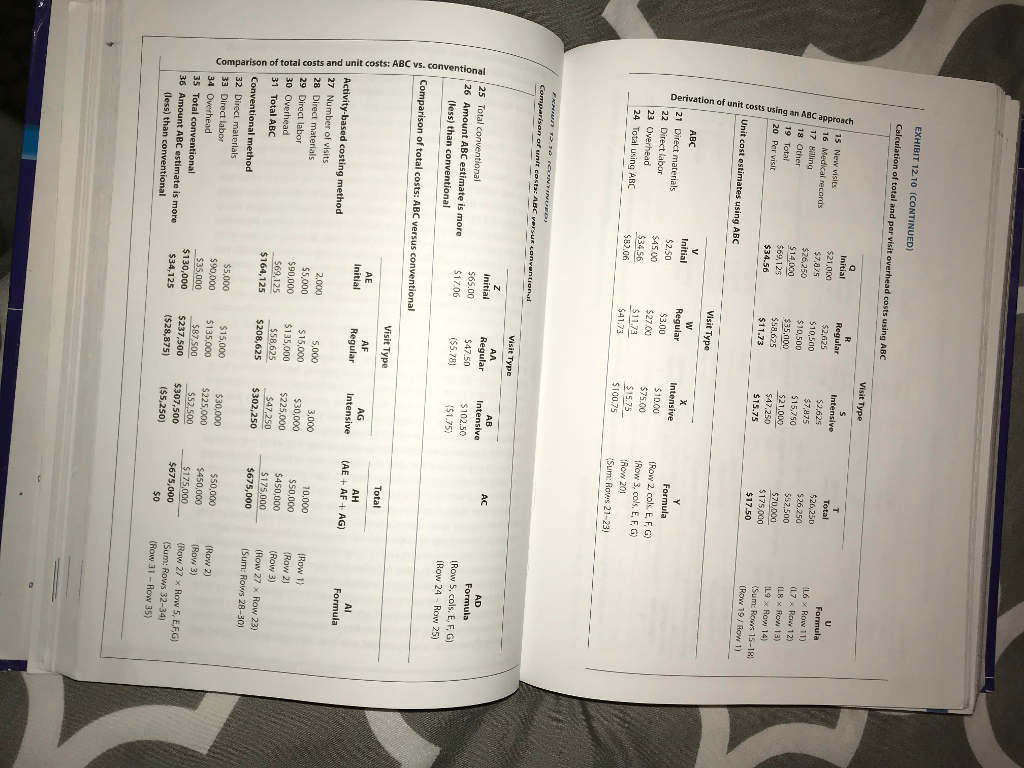

12) Use the information in exhibit 12.12 to answer these questions.

a) D Clark, the new administrator for the surgical clinic, was trying to figure out how to allocate the overhead expenses. He decided to try to allocate utilities based on square footage of each department, to allocate administration based on direct costs, and to allocate laboratory based on tests. How would indirect costs be distributed as a result?

b) Joe Ryan, the director of laboratories, was given approval to add 250 square to the lab by expanding into the day op suite which lost the space. What will his new fully allocated expenses be? Assume there are no additional costs incurred by adding the 250 square feet.

c) Mary Jones, the manager of the endoscopy suite, is concerned about adding more space. She contends that if the cystoscopy and endoscopy units were combined, fewer staff would be needed, and direct costs could reduced by $40,000 ($20,000) in each unit. She also feels that the day op area is underutilized and that 200 square feet could be used by a combined unit when excess capacity was needed. Assuming that the 200 square feet were to be allocated weekly between endoscopy and cystoscopy suites in addition to renovations as described in part B, what would the total allocated costs for each of these two services be under this scenario?

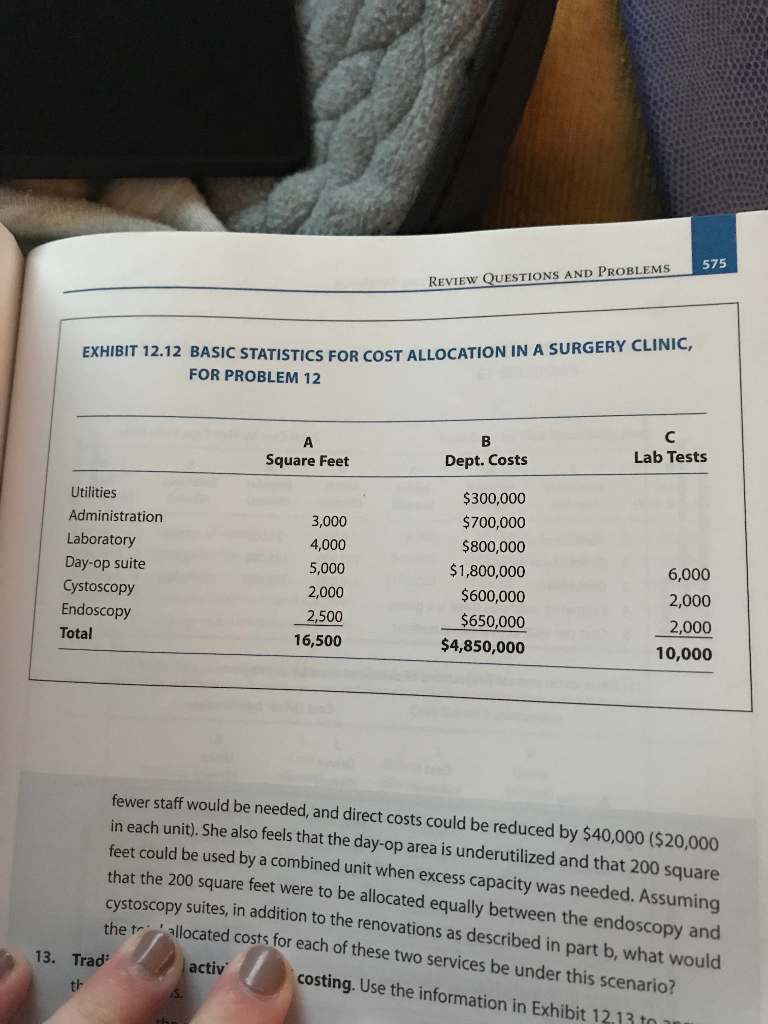

14) Use the information in Exhibit 12.14 to answer these questions

a) What is the per unit cost of an initial, regular, and intensive visit using the conventional and ABC approaches?

b) What is the total cost of initial, regular, and intensive visits using the conventional and ABC approaches?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started